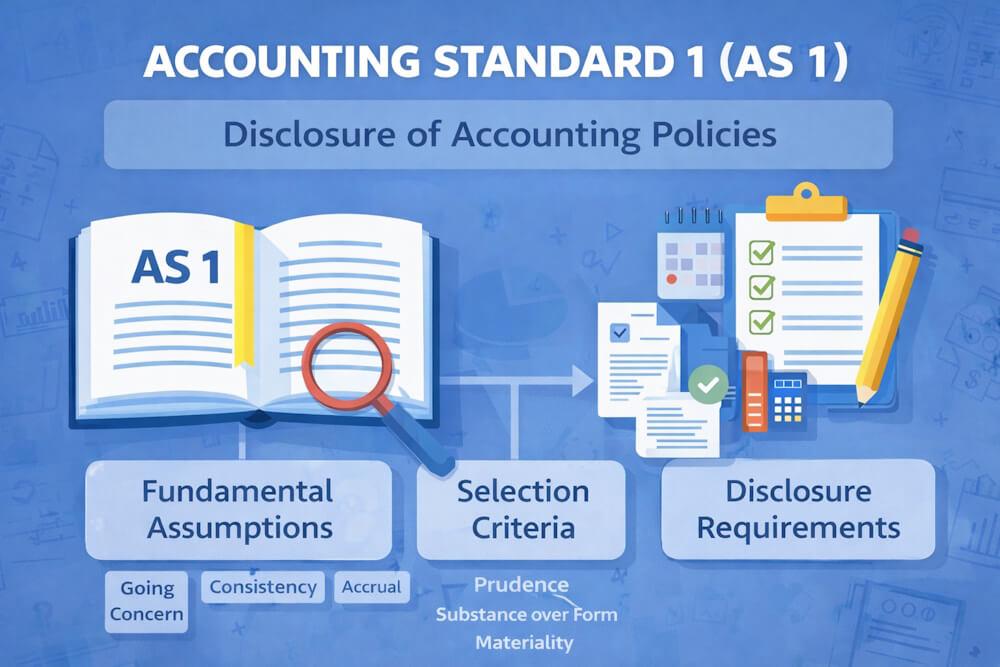

Accounting does not operate on rigid rules alone. While accounting standards provide a framework, they also allow flexibility so that financial statements can reflect the true nature of a business. This flexibility is exercised through accounting policies. Accounting Standard 1 (AS 1) focuses heavily on accounting policies because they have a direct impact on reported profits, assets, and liabilities.

Understanding accounting policies is essential for students, professionals, and users of financial statements, as differences in policies can significantly change how financial results appear, even when underlying transactions are the same.

Meaning of Accounting Policies

Accounting policies refer to the specific accounting principles and the methods of applying those principles adopted by an enterprise in the preparation and presentation of financial statements.

In simple words, accounting policies explain how accounting principles are actually put into practice by an enterprise.

Every time an accountant records, measures, or discloses a transaction, a choice is involved. These choices together form the accounting policies of an enterprise.

Why Do Accounting Policies Exist?

Accounting standards do not prescribe a single method for every accounting situation. Instead, they often permit more than one acceptable alternative. This is because:

- Businesses operate under different conditions

- A single method cannot suit all enterprises

- Accounting requires professional judgment

As a result, accounting policies exist to bridge the gap between general accounting principles and practical business situations.

Examples of Accounting Policy Choices

AS 1 provides clear illustrations showing how accounting policies differ across enterprises.

Some common examples include:

| Item | Alternative Accounting Policies |

| Inventory valuation | FIFO, Weighted Average |

| Cash Flow Statement | Direct Method, Indirect Method |

This list is not exhaustive. From valuation of assets and liabilities to recognition of income and provision for losses, accounting policies exist at every stage of financial reporting.

Nature of Accounting Policies

The nature of accounting policies can be understood through the following key characteristics:

1. Accounting Policies Are Based on Judgment

Accounting policies involve professional judgment. Two accountants may adopt different policies for the same transaction, even while complying with accounting standards.

This is why accounting is often described as both a science and an art:

- Science, because it follows established principles

- Art, because it involves judgment in applying those principles

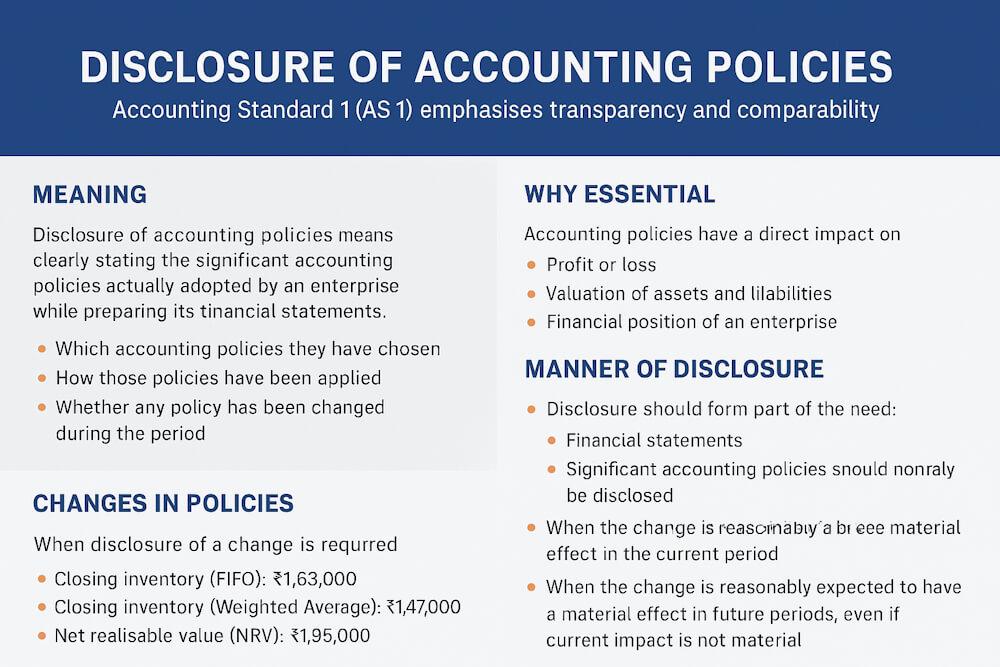

2. Accounting Policies Affect Financial Results

Accounting policies have a direct impact on profits, asset values, and liabilities.

For example:

- Different inventory valuation methods result in different closing stock values

- Different recognition policies affect profit timing

Because of this, accounting policies can make comparison between enterprises difficult if not disclosed properly.

3. Accounting Policies Vary Between Enterprises

Even enterprises operating in the same industry may follow different accounting policies. This happens due to:

- Management preferences

- Business size

- Nature of operations

- Accounting judgment

Although efforts are made by regulatory authorities to reduce diversity, accounting policies cannot be reduced to a single uniform approach.

Areas Where Accounting Policies Are Commonly Encountered

Accounting policies are encountered in almost every area of accounting. Some important areas highlighted in AS 1 include:

1. Valuation of Inventories

Inventory can be valued using different methods such as:

- FIFO (First In, First Out)

- Weighted Average

The choice of method affects:

- Cost of goods sold

- Closing inventory

- Reported profit

2. Recognition of Revenue

Revenue recognition policies determine:

- When revenue is recognised

- Whether revenue is recognised on delivery, completion, or billing

Differences in recognition timing can lead to differences in reported profits.

3. Provision for Expected Losses

Enterprises may adopt different policies for:

- Creating provisions

- Estimating losses

- Recognising contingent liabilities

These policies influence profit measurement and financial position.

4. Valuation of Assets and Liabilities

Policies differ in:

- Depreciation methods

- Estimation techniques

- Valuation bases

All these choices affect balance sheet figures.

Why Diversity in Accounting Policies Is Unavoidable

AS 1 clearly acknowledges that diversity in accounting policies is unavoidable. This is because:

- Accounting standards cannot cover all possible situations

- Enterprises operate in diverse environments

- Business conditions change over time

Even when accounting standards cover an area, they may allow more than one method. Therefore, differences in accounting policies are inevitable.

Impact of Different Accounting Policies on Financial Statements

Differences in accounting policies lead to differences in reported information, even when transactions are identical.

This directly affects the comparability of financial statements, which is an important qualitative characteristic.

Example: Impact on Comparability

Two enterprises purchase the same goods at the same price and sell the same quantity. However:

- One uses FIFO

- The other uses Weighted Average

The closing stock and profit figures will differ. Without disclosure of accounting policies, users may draw incorrect conclusions about performance.

Role of AS 1 in Addressing Policy Differences

AS 1 does not aim to eliminate differences in accounting policies. Instead, it ensures that differences are clearly disclosed.

This allows users to:

- Understand how figures are computed

- Adjust comparisons mentally

- Make informed decisions

Thus, AS 1 balances flexibility with transparency.

Disclosure of Accounting Policies

AS 1 requires that all significant accounting policies adopted in the preparation and presentation of financial statements must be disclosed.

Key Points Regarding Disclosure

- Disclosure should form part of the financial statements

- Significant accounting policies should normally be disclosed in one place

- Scattered disclosure across notes should be avoided

This ensures clarity and ease of understanding for users.

Why Disclosure in One Place Is Important

When accounting policies are disclosed in one consolidated section:

- Users can easily locate and read them

- Comparisons become simpler

- Interpretation of financial statements improves

Scattered disclosure may confuse users and reduce the usefulness of information.

Relationship Between Accounting Policies and True & Fair View

Financial statements are prepared to present a true and fair view of the financial position and performance of an enterprise.

Accounting policies play a crucial role in achieving this objective. While selecting accounting policies, management must ensure that:

- Policies are appropriate

- Financial statements reflect reality

- Information is not misleading

Thus, selection and disclosure of accounting policies are closely linked to true and fair presentation.

Example Explaining the Effect of Accounting Policies

Inventory Valuation Example

A trader purchases 500 units at 10 per unit and sells 400 units at 15 per unit.

If the net realisable value of unsold stock is:

- 15 → inventory is valued at cost

- 8 → inventory is valued at 8 per unit

This accounting policy directly affects:

- Closing stock value

- Profit for the period

Such examples show why accounting policies must be disclosed clearly.

Importance of Accounting Policies for Users

Accounting policies help users:

- Understand financial results correctly

- Compare financial statements of different enterprises

- Analyse performance across periods

- Avoid misinterpretation of figures

Without disclosure of accounting policies, financial statements would lose much of their analytical value.

Conclusion

Accounting policies form the practical backbone of financial reporting. While accounting standards provide the framework, accounting policies determine how that framework is applied in real-life situations.

Accounting Standard 1 recognises the inevitability of differences in accounting policies and addresses this challenge through mandatory disclosure. By requiring enterprises to disclose significant accounting policies in a clear and consolidated manner, AS 1 enhances transparency, comparability, and reliability of financial statements.

For students and professionals alike, understanding the meaning, nature, and impact of accounting policies is essential to correctly interpret financial statements and apply accounting standards effectively.

“Accounting policies operate within the framework laid down by Accounting Standard 1. To understand the purpose and scope of AS 1, refer to Accounting Standard 1 (AS 1): Meaning, Objective & Applicability.

These policies are applied on the basis of certain basic premises, which are explained in Fundamental Accounting Assumptions under AS 1.

”

FAQs -

1: What are accounting policies as per AS 1?

Answer: Accounting policies are the specific accounting principles and methods adopted by an enterprise in the preparation and presentation of its financial statements.

2: Why do accounting policies differ between enterprises?

Answer: Accounting policies differ because enterprises operate under different conditions and accounting standards often permit more than one acceptable method.

3: Give examples of accounting policy differences.

Answer: Common examples include inventory valuation methods such as FIFO or Weighted Average and cash flow statement preparation using direct or indirect methods.

4: How do accounting policies affect financial statements?

Answer: Accounting policies directly affect profit, asset valuation, and liabilities, which may lead to differences in reported financial results.

5: Why is disclosure of accounting policies important?

Answer: Disclosure helps users understand how financial figures are calculated and improves comparability between financial statements of different enterprises.

6: Does AS 1 restrict the choice of accounting policies?

Answer: No, AS 1 does not restrict the selection of accounting policies. It only requires disclosure of the significant policies adopted.

7: Where should accounting policies be disclosed?

Answer: AS 1 requires that significant accounting policies should normally be disclosed in one place as part of the financial statements.