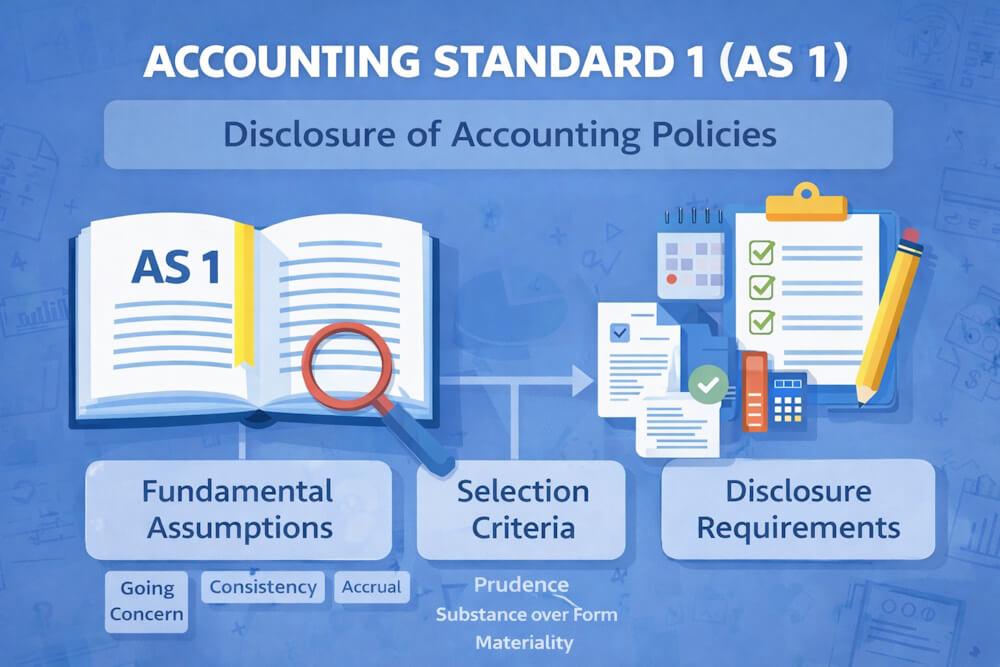

Accounting Standard 1 (AS-1) forms the foundation of financial reporting by focusing on one crucial aspect: disclosure of accounting policies. While accounting standards provide rules and principles, AS-1 ensures that users of financial statements clearly understand how those principles have been applied in practice.

This pillar page provides a complete, structured explanation of AS-1, covering its meaning, objectives, fundamental assumptions, accounting policies, selection criteria, and disclosure requirements—supported by illustrations. It also links to detailed sub-blogs for in-depth study.

What Is Accounting Standard 1 (AS-1)?

Accounting Standard 1, titled “Disclosure of Accounting Policies”, requires enterprises to disclose the significant accounting policies adopted in preparing and presenting financial statements.

Accounting policies directly affect reported profits, assets, and liabilities. Since accounting standards often allow more than one acceptable method, AS-1 ensures transparency by mandating disclosure of the methods actually used.

“Detailed explanation: – Accounting Standard 1 (AS-1): Meaning, Objective & Applicability”

Objectives of AS-1

AS-1 aims to:

- Promote better understanding of financial statements

- Improve comparability between enterprises

- Enable comparison of financial statements across periods

- Ensure transparency where alternative accounting treatments exist

By requiring disclosure, AS-1 bridges the gap between accounting numbers and their interpretation.

Applicability of Accounting Standard 1

AS-1 applies to all enterprises, regardless of:

- Size

- Nature of business

- Form of ownership

There are no exemptions under AS-1.

Fundamental Accounting Assumptions under AS-1

AS-1 recognises three fundamental accounting assumptions that underlie the preparation of financial statements:

- Going Concern

- Consistency

- Accrual Basis of Accounting

These assumptions are normally assumed to be followed. Therefore:

- If followed → no disclosure required

- If not followed → disclosure is mandatory

“In-depth coverage: Blog – Fundamental Accounting Assumptions under AS-1”

Why These Assumptions Matter

These assumptions ensure:

- Logical profit measurement

- Reliable valuation of assets and liabilities

- Comparability of financial information

Without them, financial statements lose credibility.

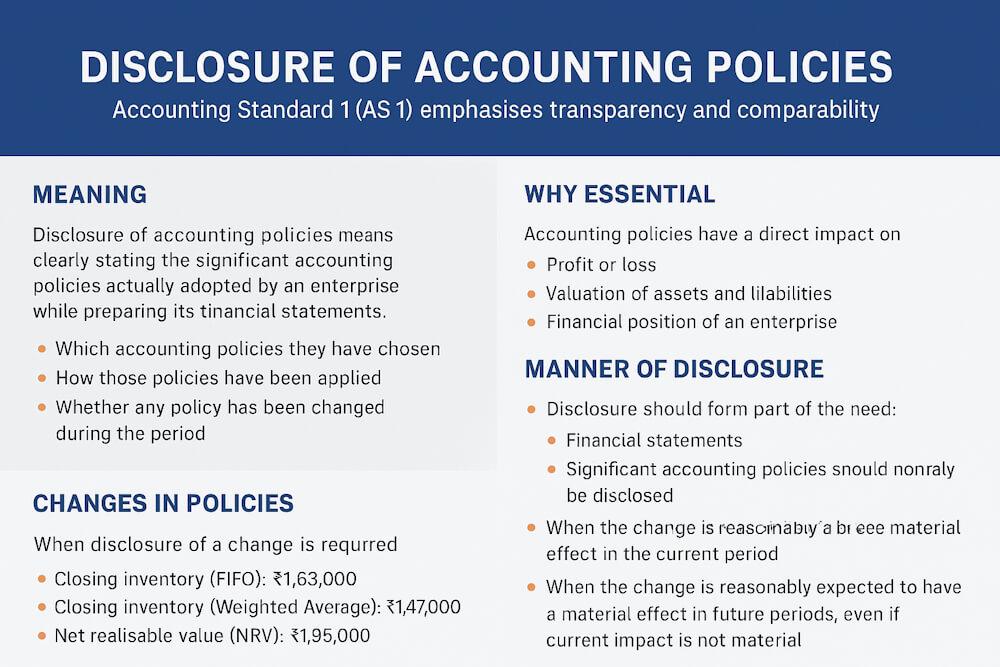

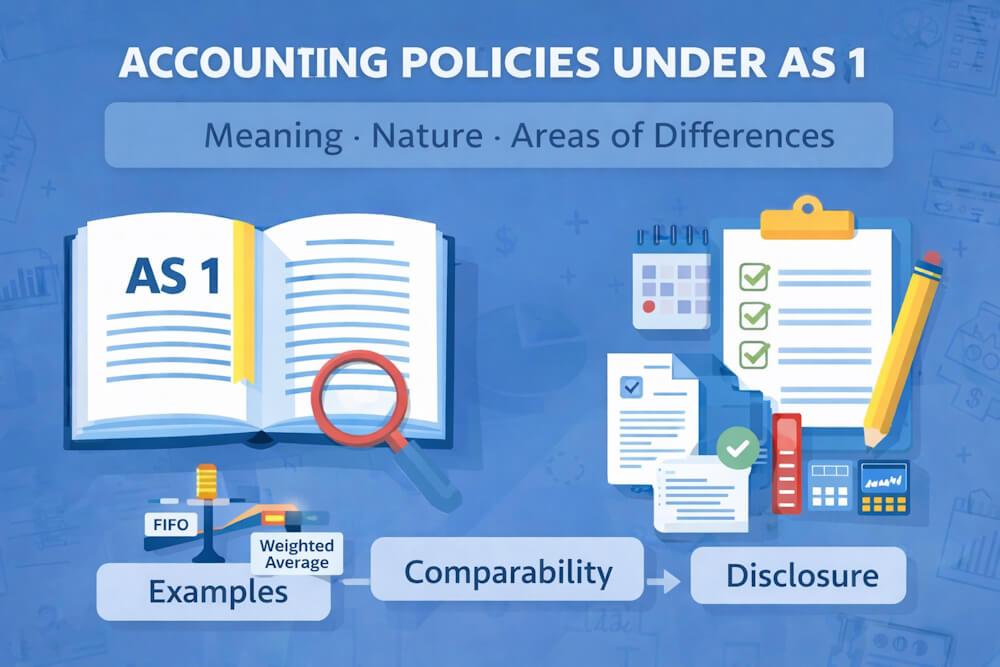

Accounting Policies: Meaning and Nature

Accounting policies refer to the specific accounting principles and methods adopted by an enterprise while preparing financial statements.

Examples include:

- Inventory valuation methods (FIFO / Weighted Average)

- Cash Flow Statement methods (Direct / Indirect)

Accounting is both:

- A science (based on principles)

- An art (based on professional judgment)

“Detailed explanation: Blog – Accounting Policies: Meaning, Nature & Areas of Differences”

Why Accounting Policies Differ

Differences in accounting policies arise because:

- Accounting standards cannot cover every situation

- Enterprises operate in different environments

- Standards often permit more than one method

Such differences affect comparability, which AS-1 addresses through disclosure.

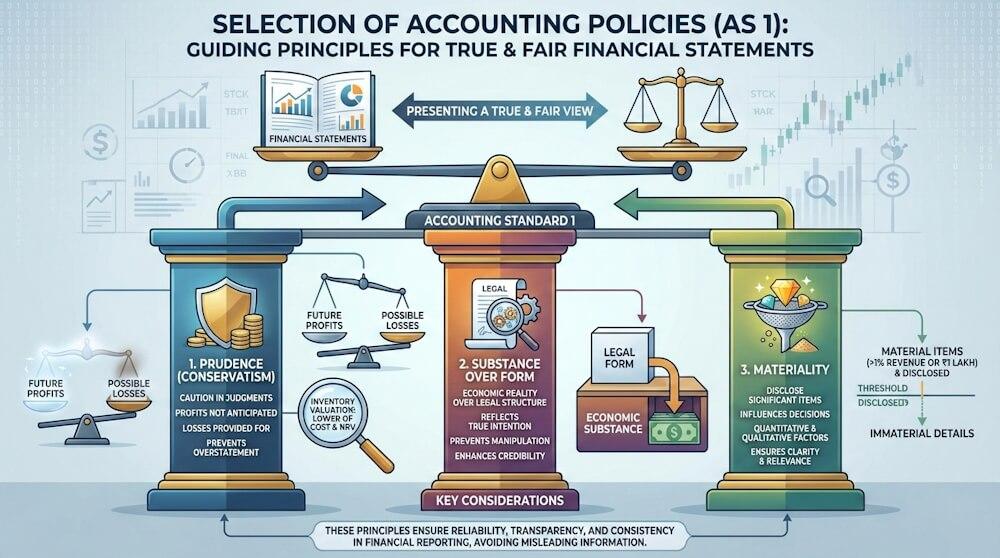

Selection of Accounting Policies under AS-1

While enterprises have flexibility in choosing accounting policies, AS-1 lays down three guiding considerations for selecting appropriate policies:

- Prudence

- Substance over Form

- Materiality

These principles ensure that accounting policies are not chosen arbitrarily.

“Detailed explanation: Blog – Selection of Accounting Policies (Prudence, Substance over Form & Materiality)”

Brief Overview of the Three Principles

- Prudence: - Profits are not anticipated, but losses are recognised when expected.

- Substance over Form: - Transactions should be accounted for according to their economic reality, not merely their legal form.

- Materiality: - All material items that may influence users’ decisions must be disclosed.

Together, these principles support true and fair presentation.

Disclosure of Accounting Policies under AS-1

AS-1 requires disclosure of all significant accounting policies adopted in preparing financial statements.

Manner of Disclosure

- Disclosure must form part of financial statements

- Significant policies should normally be disclosed in one place

- Disclosure should not be scattered

This improves clarity and usability.

Disclosure of Changes in Accounting Policies

AS-1 also mandates disclosure when accounting policies are changed.

Disclosure is required when:

- The change has a material effect in the current period, or

- The change is expected to have a material effect in future periods

What must be disclosed:

- Nature of change

- Reason for change

- Financial impact, if ascertainable

If the impact cannot be determined, the fact must be stated.

“Detailed explanation with illustrations: Blog – Disclosure of Accounting Policies & Changes (With Illustrations)”

Disclosure of Deviations from Fundamental Assumptions

If any fundamental accounting assumption is not followed, AS-1 requires disclosure of the fact.

| Assumption | If Followed | If Not Followed |

| Going Concern | No disclosure | Disclosure required |

| Consistency | No disclosure | Disclosure required |

| Accrual Basis | No disclosure | Disclosure required |

This prevents users from making incorrect assumptions about financial statements.

Importance of AS-1 for Users of Financial Statements

AS-1 helps:

- Investors assess performance correctly

- Analysts compare enterprises meaningfully

- Management maintain transparency

- Students understand real-world accounting practice

It strengthens trust in financial reporting.

AS-1 for Exams and Practical Application

From an exam perspective, AS-1 is important for:

- Theoretical questions

- Scenario-based questions

- Practical illustrations

- MCQs on disclosure and assumptions

From a practical perspective, AS-1 governs how financial statements communicate accounting choices.

Conclusion

Accounting Standard 1 plays a foundational role in financial reporting by ensuring that accounting policies and their changes are clearly disclosed and properly understood. While it allows flexibility in choosing accounting policies, it prevents misuse of that flexibility through mandatory disclosure.

By understanding AS-1 in a structured manner—from assumptions to policies, selection criteria, and disclosure—students and professionals gain a complete and practical view of financial reporting transparency.