Financial statements are prepared to communicate the financial position and performance of an enterprise to users such as investors, lenders, management, regulators, and other stakeholders. However, simply presenting numbers is not enough. To correctly understand those numbers, users must also understand how those numbers have been arrived at. This is where Accounting Standard 1 (AS 1) – Disclosure of Accounting Policies becomes extremely important.

Accounting Standard 1 deals with the disclosure of significant accounting policies followed by an enterprise while preparing its financial statements. It ensures transparency, comparability, and better interpretation of financial information.

Meaning of Accounting Standard 1 (AS 1)

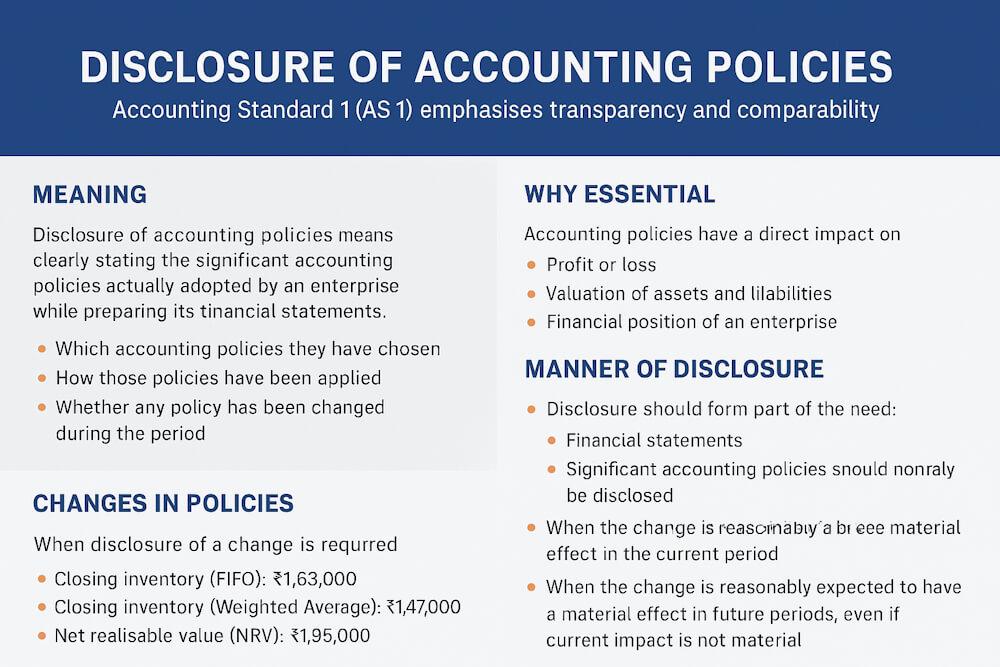

Accounting Standard 1, titled “Disclosure of Accounting Policies”, requires enterprises to disclose the significant accounting policies actually adopted in the preparation and presentation of their financial statements.

Accounting policies refer to the specific principles, bases, conventions, rules, and practices applied by an enterprise while recording and presenting financial information. Since accounting standards do not prescribe a single method for every situation, enterprises often have a choice among different acceptable accounting treatments. AS 1 ensures that such choices are clearly disclosed to users of financial statements.

In simple words, AS 1 answers this question for the reader:

“Which accounting rules and methods has the company used while preparing these financial statements?”

Why Is AS 1 Needed?

Even though accounting standards exist, diversity in accounting policies is unavoidable. This happens mainly for two reasons:

1. Accounting standards cannot cover all situations

Accounting standards do not deal with every possible accounting situation. In areas not specifically covered, enterprises are free to adopt any reasonable accounting policy.

2. Enterprises operate in different circumstances

Businesses differ in size, nature, industry, geographical location, and operating environment. Because of this, a single uniform accounting policy cannot suit all enterprises for all time.

As a result, even when two enterprises enter into identical transactions, the reported financial results may differ due to differences in accounting policies. This affects the comparability of financial statements, which is an important qualitative characteristic.

Merely stating that “all accounting standards have been followed” is not enough. Users must know which accounting policies were selected among the alternatives allowed by standards. AS 1 addresses this problem by making disclosure mandatory.

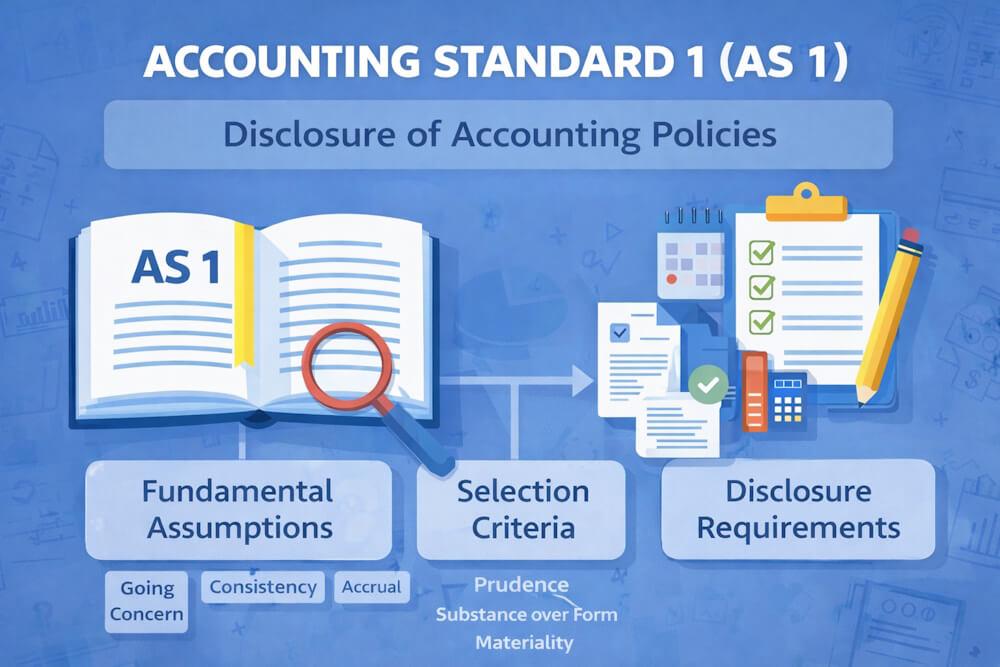

Objective of Accounting Standard 1

The main objective of AS 1 is to promote better understanding of financial statements by requiring disclosure of significant accounting policies in an orderly and meaningful manner.

The objectives can be summarized as follows:

- Enhancing transparency - Disclosure of accounting policies allows users to see how figures have been calculated and presented.

- Improving comparability - Users can compare financial statements of different enterprises for the same accounting period when accounting policies are disclosed.

- Ensuring consistency across periods - Disclosure of changes in accounting policies enables users to compare financial statements of the same enterprise across different accounting periods.

- Supporting informed decision-making - Investors, analysts, and creditors can make better decisions when they understand the accounting assumptions and methods used.

Applicability of Accounting Standard 1

Accounting Standard 1 applies to all enterprises, irrespective of their size, nature, or form of ownership.

This means AS 1 is applicable to:

- Companies

- Partnership firms

- Sole proprietorships

- Manufacturing and service enterprises

- Profit-making and non-profit organizations

There are no exemptions provided under AS 1 based on turnover or type of business.

What Are Accounting Policies?

Accounting policies are the specific accounting principles and methods adopted by an enterprise while preparing financial statements.

Every accountant faces choices while recording transactions, such as:

- How should inventories be valued?

- Which method should be used for cash flow statements?

- When should revenue be recognized?

For example:

| Item | Alternative Accounting Policies |

| Inventory valuation | FIFO, Weighted Average |

| Cash Flow Statement | Direct Method, Indirect Method |

This list is not exhaustive. From valuation of assets and liabilities to recognition of revenue and provision for expected losses, accountants must select appropriate principles and apply suitable methods. This process is known as formulation of accounting policies.

Accounting Is Both Science and Art

Accounting is often described as both a science and an art.

- It is a science because it is based on tested principles and standards.

- It is an art because the application of these principles depends on the professional judgment of the accountant.

Different accountants may interpret and apply the same principles differently. As a result, even enterprises operating in the same industry may follow different accounting policies. Though efforts are made by regulatory bodies to reduce diversity, it cannot be completely eliminated.

Because accounting policies significantly affect reported profits, assets, and liabilities, disclosure becomes essential.

Importance of Disclosure of Accounting Policies

Disclosure of accounting policies is important for the following reasons:

- True and fair view - Financial statements can present a true and fair view only when users know the accounting policies behind the numbers.

- Understanding financial results - Without disclosure, users may misinterpret profits or financial position.

- Comparability between enterprises - Disclosure allows users to adjust figures mentally while comparing two enterprises.

- Comparability over time - Disclosure of changes helps in trend analysis of the same enterprise.

Example Explaining the Need for AS 1

Example: Inventory Valuation

Suppose two companies purchase the same goods at the same prices and sell the same quantity during the year. However:

- Company A values inventory using FIFO

- Company B values inventory using Weighted Average

Even though the transactions are identical, the closing inventory value and profit figures will differ. If accounting policies are not disclosed, users may wrongly assume that one company performed better than the other.

AS 1 ensures that such differences are clearly disclosed, allowing users to interpret financial statements correctly.

Disclosure of Changes in Accounting Policies

AS 1 also requires enterprises to disclose any change in accounting policies that has a material effect on the financial statements.

If a change:

- Has a material effect in the current period, the amount of impact should be disclosed.

- Has no material effect currently but is expected to affect future periods, the fact of change should still be disclosed.

Example -

A company changes its method of inventory valuation from FIFO to Weighted Average.

- Closing inventory under FIFO: 2,00,000

- Closing inventory under Weighted Average: 1,80,000

This change reduces profit and inventory value by 20,000. AS 1 requires the company to disclose:

- The nature of change

- The reason for change

- The financial impact of the change

A simple statement that “the accounting policy has changed” is not sufficient.

Why Simple Disclosure Is Not Enough

Merely stating that a policy has been changed does not help users understand the impact. AS 1 emphasizes that the effect of the change should be disclosed wherever ascertainable. This ensures meaningful disclosure rather than formal compliance.

Conclusion

Accounting Standard 1 plays a foundational role in financial reporting. It recognizes that diversity in accounting policies is unavoidable, but ensures that such diversity does not mislead users of financial statements. By mandating disclosure of significant accounting policies and changes therein, AS 1 enhances transparency, comparability, and reliability of financial information.

In practical terms, AS 1 does not restrict enterprises from choosing accounting policies. Instead, it ensures that whatever policies are chosen are clearly communicated to stakeholders. This balance between flexibility and disclosure makes AS 1 one of the most important accounting standards in practice.

FAQs

1: What is Accounting Standard 1 (AS 1)?

Answer: Accounting Standard 1 (AS 1) deals with the disclosure of significant accounting policies followed by an enterprise in preparing its financial statements. It helps users understand how financial results have been derived.

2: Why is disclosure of accounting policies important?

Answer: Disclosure of accounting policies is important because different accounting methods can lead to different financial results. Disclosure ensures transparency, comparability, and correct interpretation of financial statements.

3: To whom is Accounting Standard 1 applicable?

Answer: Accounting Standard 1 is applicable to all enterprises, regardless of their size, nature, or form of ownership. There are no exemptions under AS 1.

4: What are accounting policies?

Answer: Accounting policies are the specific principles and methods adopted by an enterprise for recording and presenting financial information, such as inventory valuation methods or cash flow statement methods.

5: Is it mandatory to disclose changes in accounting policies?

Answer: Yes, any change in accounting policy that has a material effect in the current or future periods must be disclosed. The financial impact of the change should also be disclosed if it can be determined.

6: Can two companies follow different accounting policies?

Answer: Yes, companies may follow different accounting policies due to differences in business conditions. However, Accounting Standard 1 requires such policies to be disclosed to maintain comparability.

7: Is stating “accounting standards are followed” sufficient?

Answer: No, merely stating that accounting standards are followed is not sufficient. AS 1 requires disclosure of specific accounting policies actually adopted by the enterprise.

8: Does AS 1 restrict the choice of accounting policies?

Answer: No, AS 1 does not restrict the selection of accounting policies. It only requires that the selected policies and any changes in them are properly disclosed.