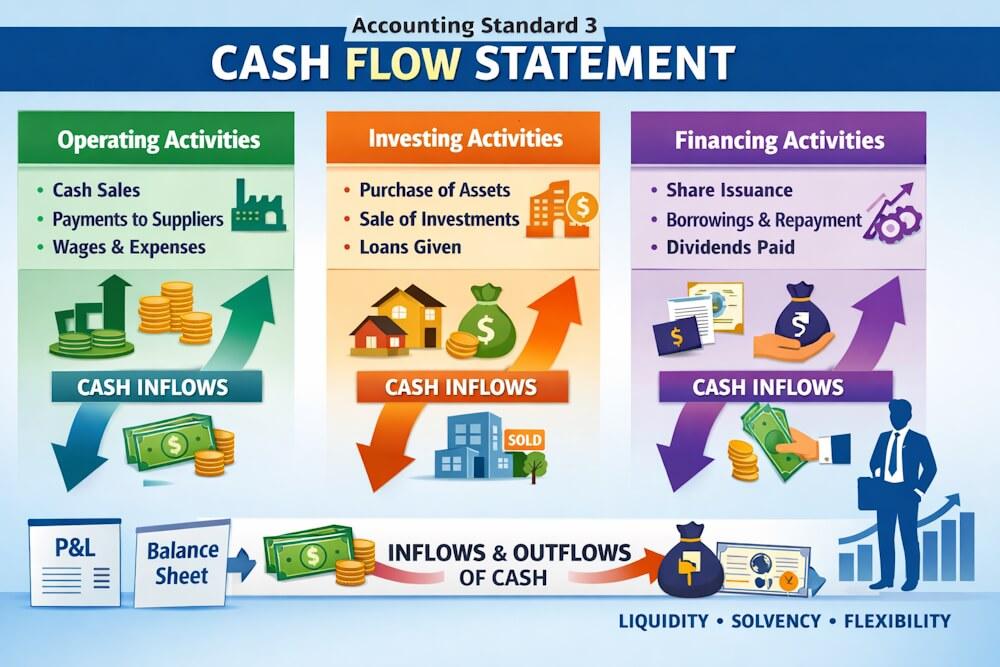

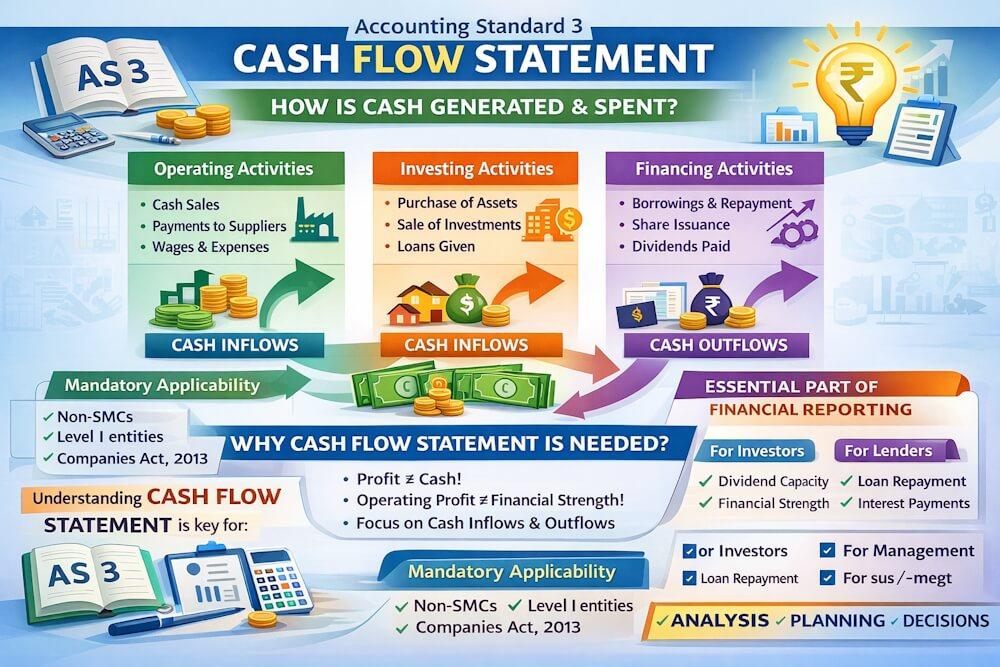

Accounting Standard 3 (AS-3) deals with the Cash Flow Statement, one of the most important financial statements used to analyse the liquidity, solvency, and financial flexibility of an enterprise. While the Profit and Loss Statement shows profitability and the Balance Sheet shows financial position, the Cash Flow Statement explains how cash is generated and how it is used.

This pillar page provides a complete, structured explanation of AS-3, covering its meaning, objectives, applicability, cash and cash equivalents, types of cash flows, methods of preparation, special situations, disclosures, and illustrations. It also serves as a hub linking all detailed AS-3 blogs.

What Is Accounting Standard 3 (AS-3)?

Accounting Standard 3, titled “Cash Flow Statement”, requires enterprises to prepare and present a statement showing inflows and outflows of cash and cash equivalents during an accounting period, classified into:

- Operating activities

- Investing activities

- Financing activities

AS-3 helps users understand changes in cash position, which cannot be derived merely from the Profit and Loss Account or Balance Sheet.

Applicability of Accounting Standard 3

AS-3 is:

Mandatory for:

- Non-SMCs

- Level I enterprises (non-corporate entities)

Encouraged for other enterprises

However, as per the Companies Act, 2013, preparation of a Cash Flow Statement is mandatory for all companies, except:

- One Person Company

- Small Company

- Dormant Company

- Certain startup private companies (as notified)

Thus, AS-3 plays a vital role in statutory financial reporting.

Objectives of Cash Flow Statement (AS-3)

The Cash Flow Statement aims to:

- Identify historical changes in cash and cash equivalents

- Assess the ability to generate cash

- Evaluate liquidity and solvency

- Determine future cash requirements

- Compare operating efficiency of enterprises

- Analyse the relationship between profitability and cash flows

It acts as a decision-making tool for investors, lenders, and management.

“Detailed coverage: – Accounting Standard 3 (AS-3): Meaning, Objective & Applicability”

Meaning of Cash and Cash Equivalents

Under AS-3, cash and cash equivalents include:

- Cash in hand

- Demand deposits with banks

- Short-term, highly liquid investments

- Readily convertible into known amounts of cash

- Subject to insignificant risk of change in value

- Maturity of three months or less

Investments in equity shares are normally not treated as cash equivalents due to valuation uncertainty.

AS-3 also requires disclosure of the break-up of opening and closing cash and cash equivalents.

“Detailed coverage: – Cash & Cash Equivalents under AS-3: Meaning and Treatment”

Meaning of Cash Flows

Cash flows refer to inflows and outflows of cash and cash equivalents.

Important points:

- Non-cash transactions are excluded

- Movements within cash or cash equivalents are not cash flows

- Exchange differences on foreign currency cash balances are not cash flows

Thus, not every change in cash balance represents a cash flow.

Types of Cash Flows under AS-3

AS-3 classifies cash flows into three categories to improve usefulness and clarity.

1. Operating Cash Flows

Cash flows arising from principal revenue-producing activities, such as:

- Cash sales

- Payments to suppliers

- Salaries and wages

- Operating expenses

2. Investing Cash Flows

Cash flows related to acquisition and disposal of long-term assets and investments, such as:

- Purchase or sale of fixed assets

- Loans given or recovered

- Interest and dividends received (for non-financial enterprises)

3. Financing Cash Flows

Cash flows that result in changes in capital structure, such as:

- Issue or redemption of shares

- Borrowings and repayments

- Dividends paid

“Detailed coverage: Blog – Types of Cash Flows under AS-3: Operating, Investing & Financing”

Classification of Cash Flows: Special Rules

AS-3 provides detailed classification rules for items like:

- Loans and advances

- Interest paid and received

- Dividends paid and received

- Income tax

- Insurance claims

- Financial vs non-financial enterprises

These rules ensure uniformity and consistency in reporting.

“Detailed coverage: Blog – Classification of Cash Flows under AS-3 (With Rules & Examples)”

Cash Flow from Operating Activities

Cash flows from operating activities can be reported using:

1. Direct Method

Shows:

- Gross cash receipts

- Gross cash payments

It provides a clear picture of cash sources and uses.

2. Indirect Method

Starts with net profit and adjusts for:

- Non-cash items

- Non-operating items

- Changes in working capital

AS-3 prefers the direct method, though both are permitted.

“Detailed coverage: Blog – Cash Flow from Operating Activities: Direct vs Indirect Method”

Reporting Cash Flows on Net Basis

AS-3 generally prohibits netting of cash flows from investing and financing activities.

However, net reporting is allowed in limited cases such as:

- Cash flows on behalf of customers

- Items with quick turnover and short maturity

- Certain financial enterprise transactions

Interest, Dividends, Taxes & Extraordinary Items

AS-3 provides specific treatment for:

- Interest paid and received

- Dividends paid and received

- Income tax

- Extraordinary items

Classification differs between financial and non-financial enterprises, ensuring clarity and consistency.

“Detailed coverage: Blog – Net Basis Reporting, Interest, Dividends & Taxes under AS-3”

Special Situations under AS-3

AS-3 deals with special and complex situations such as:

- Business purchase and disposal

- Foreign currency cash flows

- Exchange gains and losses

- Non-cash investing and financing transactions

These transactions are either disclosed separately or excluded from cash flow statements, as required.

“Detailed coverage: Blog – Business Purchase, Foreign Currency & Non-Cash Transactions (AS-3)”

Disclosures under AS-3

AS-3 requires disclosure of:

- Significant cash balances not available for use

- Undrawn borrowing facilities

- Cash required to maintain operating capacity

Such disclosures improve understanding of liquidity and financial flexibility.

Practical Illustrations & Exam Orientation

The standard includes:

- Classification illustrations

- Full Cash Flow Statement preparation problems

- MCQs

- Scenario-based and theoretical questions

These are extremely important for CA / B.Com / MBA examinations.

“Detailed coverage: Blog – AS-3 Practical Illustrations, MCQs & Exam-Based Problems”

Complete AS-3 Blog Series

For detailed learning, explore the full AS-3 series:

1. AS-3: Meaning, Objective & Applicability

2. Cash & Cash Equivalents under AS-3

3. Types of Cash Flows under AS-3

4. Classification of Cash Flows under AS-3

5. Operating Cash Flows – Direct vs Indirect Method

6. Net Basis Reporting, Interest, Dividends & Taxes

7. Business Purchase, Foreign Currency & Non-Cash Transactions

8. AS-3 Practical Illustrations & Exam Questions

Conclusion

Accounting Standard 3 plays a crucial role in financial reporting by explaining how cash moves within an enterprise. By classifying cash flows into operating, investing, and financing activities, AS-3 enhances transparency, comparability, and decision usefulness.

For students, AS-3 is a high-weightage examination topic. For professionals, it is an essential tool for analysing liquidity and financial health. Understanding AS-3 through a structured approach ensures both conceptual clarity and practical competence.