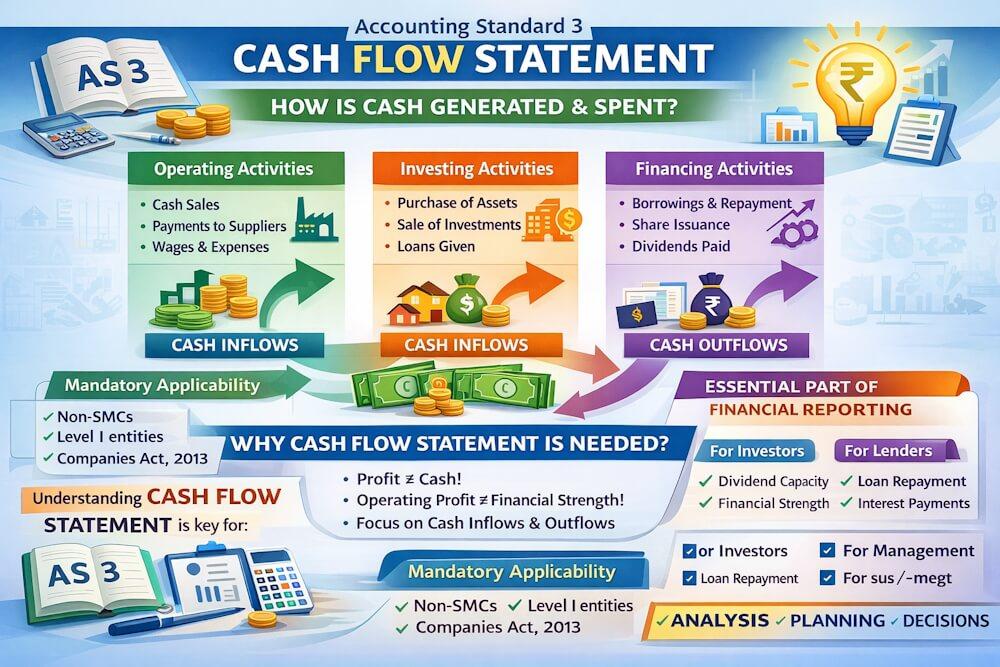

Financial statements are meant to communicate the financial story of an enterprise. The Balance Sheet shows the financial position on a particular date, and the Profit and Loss Account shows whether the enterprise earned profit or incurred loss during a period. However, neither of these statements clearly explains how cash moved during the year. An enterprise may report high profits and still face cash shortages. This gap is filled by the Cash Flow Statement, governed by Accounting Standard 3 (AS 3).

Accounting Standard 3 deals with the preparation and presentation of the Cash Flow Statement and explains why it is an essential part of financial reporting.

Meaning of Accounting Standard 3 (AS 3)

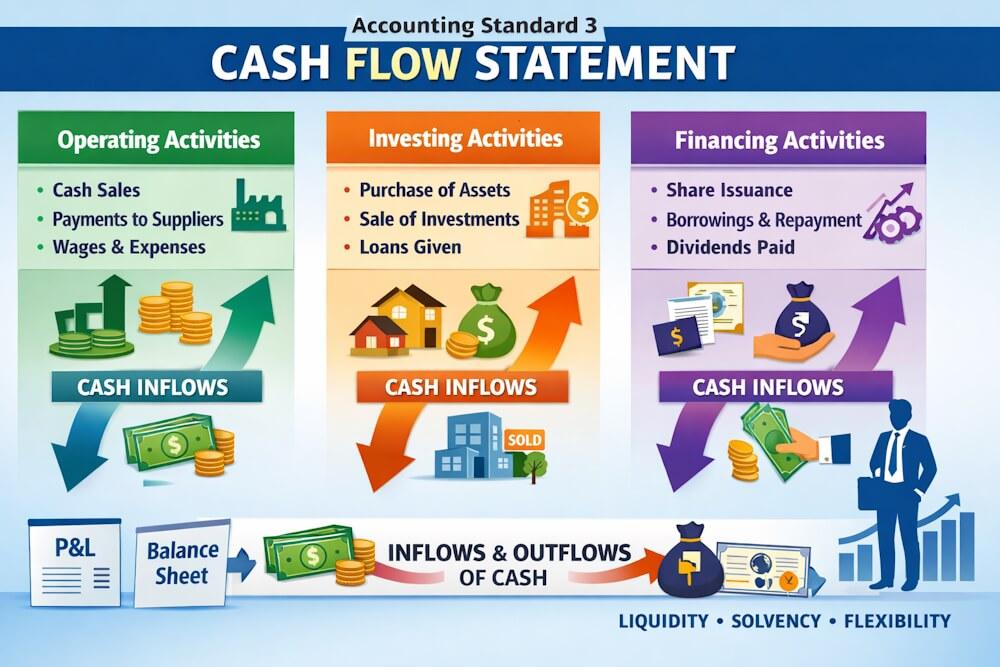

Accounting Standard 3, titled “Cash Flow Statement”, requires enterprises to prepare a statement that shows inflows and outflows of cash and cash equivalents during an accounting period. These cash flows are classified into three categories:

- Operating activities

- Investing activities

- Financing activities

The Cash Flow Statement explains where cash came from and how it was used, something that cannot be fully understood from the Profit and Loss Account or Balance Sheet alone.

In simple words, AS 3 answers the question: “How did the enterprise generate cash and where was it spent?”

Why Cash Flow Statement Is Needed

Profit does not necessarily mean availability of cash. An enterprise may earn profits but still be unable to pay salaries, suppliers, or loan instalments due to poor cash management.

For example:

- Sales made on credit increase profit but not cash

- Purchase of fixed assets may not affect profit immediately but reduces cash

- Repayment of loans does not affect profit but causes cash outflow

Because of such situations, users of financial statements need a separate statement that focuses only on cash movements. AS 3 fulfils this need.

Nature of Cash Flow Statement

A Cash Flow Statement is a summary of cash receipts and payments of an enterprise during a particular accounting period. It focuses only on cash and cash equivalents.

Important characteristics:

- Non-cash transactions are excluded

- Movements within cash or cash equivalents are ignored

- Cash flows are classified based on the nature of activities

This classification improves clarity and usefulness of information.

Applicability of Accounting Standard 3

AS 3 applies differently depending on the type of enterprise.

Mandatory Applicability

AS 3 is mandatory for:

- Non-SMCs (Non-Small and Medium Companies)

- Enterprises falling under Level I category (for non-corporate entities) at the end of the accounting period

Encouraged Applicability

For other enterprises, preparation of a Cash Flow Statement is not compulsory, but it is strongly encouraged.

Applicability under the Companies Act, 2013

The Companies Act, 2013 has significantly widened the scope of Cash Flow Statement preparation.

As per the Act:

- All companies are required to prepare a Cash Flow Statement, except:

- One Person Company

- Small Company

- Dormant Company

- Certain startup private companies (as notified)

Thus, even if AS 3 does not mandate preparation in some cases, the Companies Act may still require it.

Special Case of Applicability Changes

AS 3 also clarifies how to deal with changes in applicability:

- If an enterprise was not covered earlier but qualifies in the current year, it need not present comparative figures for previous years.

- If an enterprise was covered earlier but ceases to qualify, it must continue preparing Cash Flow Statements for two more consecutive years.

This ensures consistency and comparability.

Objective of Cash Flow Statement (AS 3)

The primary objective of the Cash Flow Statement is to provide information about the historical changes in cash and cash equivalents of an enterprise.

Specifically, it helps users:

- Identify sources of cash inflows

- Understand how cash has been utilised

- Assess liquidity position

- Evaluate solvency of the enterprise

- Determine ability to generate cash in future

- Compare operational efficiency of different enterprises

Thus, AS 3 plays a critical role in decision-making.

Importance of Cash Flow Statement for Users

1. For Investors

Investors use the Cash Flow Statement to assess:

- Ability to pay dividends

- Sustainability of operations

- Financial strength beyond reported profits

2. For Lenders and Creditors

Lenders evaluate:

- Ability to repay loans

- Timeliness of interest payments

- Short-term liquidity

3. For Management

Management uses cash flow information to:

- Plan working capital

- Manage cash shortages

- Make investment decisions

Relationship between Profit and Cash Flow

Profit and cash flow are related but not the same.

Key differences:

- Profit includes non-cash items like depreciation

- Cash flow ignores non-cash expenses and incomes

- Timing differences affect profit and cash differently

AS 3 helps users understand this relationship clearly.

Meaning of Cash and Cash Equivalents (Brief Overview)

For the purpose of AS 3:

- Cash includes cash in hand and demand deposits with banks

- Cash equivalents are short-term, highly liquid investments:

- Readily convertible into known amounts of cash

- Subject to insignificant risk of change in value

- Maturity of three months or less from date of acquisition

Equity shares are generally not considered cash equivalents due to valuation uncertainty.

Meaning of Cash Flows

Cash flows refer to inflows and outflows of cash and cash equivalents.

Important clarifications:

- Non-cash transactions are excluded

- Exchange differences on foreign currency balances are not cash flows

- Transfer of cash between bank and cash equivalents is not a cash flow

Thus, every change in cash balance does not represent a cash flow.

Classification of Cash Flows under AS 3

AS 3 classifies cash flows into three categories to improve usefulness of information.

1. Operating Activities

These are the principal revenue-producing activities of the enterprise.

Examples:

- Cash received from customers

- Payments to suppliers

- Salaries and wages

- Operating expenses

Operating cash flows indicate whether the enterprise can generate sufficient cash from its core business.

2. Investing Activities

These relate to acquisition and disposal of long-term assets and investments.

Examples:

- Purchase or sale of fixed assets

- Loans given or recovered

- Interest and dividends received (for non-financial enterprises)

Investing cash flows show how an enterprise uses cash for growth and expansion.

3. Financing Activities

These result in changes in capital and borrowings.

Examples:

- Issue or redemption of shares

- Borrowings and repayments

- Dividends paid

Financing cash flows indicate how an enterprise funds its operations.

Why Separate Classification Is Important

Each type of cash flow has different implications:

- Operating cash flows reflect sustainability

- Investing cash flows reflect future growth

- Financing cash flows reflect capital structure

Separate disclosure helps users analyse these aspects independently.

Practical Importance of AS 3 in Real Life

In practice, AS 3 helps:

- Detect liquidity problems early

- Avoid over-reliance on profits

- Improve cash planning

- Strengthen financial transparency

For this reason, AS 3 is widely used by analysts, bankers, and regulators.

AS 3 from Examination Perspective

From an exam point of view, AS 3 is highly important because:

- Questions are asked on objectives and applicability

- Classification of cash flows is frequently tested

- Practical problems carry high weightage

A clear conceptual understanding of AS 3 is essential for scoring well.

“This article introduces the basics of Accounting Standard 3. For a complete and structured explanation covering cash and cash equivalents, types of cash flows, classification rules, preparation methods, disclosures, and practical illustrations, refer to our Accounting Standard 3 (AS-3): Cash Flow Statement – Complete Guide.”

Conclusion

Accounting Standard 3 plays a crucial role in financial reporting by focusing on cash movements, which are vital for survival and growth of an enterprise. By requiring classification of cash flows into operating, investing, and financing activities, AS 3 improves transparency and decision usefulness.

Understanding the meaning, objectives, and applicability of AS 3 is the first step toward mastering Cash Flow Statements. Once these basics are clear, preparation methods and practical problems become much easier to handle.

FAQs

1: What is Accounting Standard 3 (AS 3)?

Answer: Accounting Standard 3 deals with the preparation and presentation of the Cash Flow Statement, which shows inflows and outflows of cash and cash equivalents during an accounting period.

2: What is the objective of AS 3?

Answer: The objective of AS 3 is to provide information about historical changes in cash and cash equivalents and help users assess liquidity, solvency, and cash-generating ability of an enterprise.

3: To whom is Accounting Standard 3 applicable?

Answer: AS 3 is mandatory for Non-SMCs and Level I enterprises. As per the Companies Act, 2013, most companies are required to prepare a Cash Flow Statement.

4: Why is a Cash Flow Statement important?

Answer: A Cash Flow Statement helps users understand how cash is generated and used, which cannot be clearly seen from the Profit and Loss Account or Balance Sheet.

5: What are the main types of cash flows under AS 3?

Answer: AS 3 classifies cash flows into operating, investing, and financing activities to improve clarity and usefulness of financial information.

6: Is profit the same as cash flow?

Answer: No, profit includes non-cash items and accruals, whereas cash flow focuses only on actual cash movements during the period.

7: Does AS 3 apply to all companies?

Answer: Most companies are required to prepare a Cash Flow Statement, except One Person Companies, small companies, dormant companies, and certain startup private companies.