One of the most important foundations of the Cash Flow Statement is a clear understanding of what constitutes “cash” and “cash equivalents.” Many students and even practitioners assume that any bank balance or investment automatically qualifies, but Accounting Standard 3 (AS-3) lays down specific rules and conditions for this classification.

Without correctly identifying cash and cash equivalents, a Cash Flow Statement can become misleading. AS-3 therefore provides precise definitions and explanations to ensure uniformity and comparability.

Meaning of Cash under AS-3

Under Accounting Standard 3, cash includes:

- Cash in hand, and

- Deposits repayable on demand with banks or other financial institutions

These are amounts that are readily available for use by the enterprise without any restriction.

Examples of cash:

- Physical cash held by the business

- Current account balance with banks

- Demand deposits that can be withdrawn at any time

Cash represents the most liquid asset of an enterprise and forms the core of cash flow reporting.

Meaning of Cash Equivalents under AS-3

Cash equivalents are short-term, highly liquid investments that:

- Are readily convertible into known amounts of cash, and

- Are subject to insignificant risk of change in value

AS-3 further clarifies that a short-term investment is one which has a maturity of three months or less from the date of acquisition.

Thus, not every investment qualifies as a cash equivalent. Only those investments that meet all the above conditions can be treated as cash equivalents.

Why Cash Equivalents Are Included with Cash

The objective of the Cash Flow Statement is to explain changes in liquid resources of an enterprise. Some investments are so liquid and so close to cash in nature that excluding them would distort the analysis.

By grouping cash and cash equivalents together, AS-3 ensures that the Cash Flow Statement reflects the enterprise’s true liquidity position.

Examples of Cash Equivalents

Common examples of cash equivalents (subject to conditions) include:

- Short-term bank deposits with maturity of three months or less

- Treasury bills with short maturity

- Highly liquid debt instruments with negligible risk

However, merely being short-term is not sufficient. The investment must also be highly liquid and free from significant risk of value changes.

Investments That Are Normally NOT Cash Equivalents

AS-3 clearly states that investments in shares are not normally treated as cash equivalents, even if they are short-term.

The reason is:

- Share prices fluctuate

- There is uncertainty regarding realisable value

Because of this risk, equity shares generally fail the “insignificant risk” condition.

Three Balance Sheet Items Covered by Cash & Cash Equivalents

For the purpose of Cash Flow Statement, AS-3 notes that cash and cash equivalents consist of at least three balance sheet items:

- Cash in hand

- Demand deposits with banks

- Investments regarded as cash equivalents

Due to this, AS-3 requires enterprises to disclose a break-up of opening and closing cash and cash equivalents as a note to the Cash Flow Statement.

This disclosure improves clarity and transparency.

Break-Up of Opening and Closing Cash Balances

The Cash Flow Statement shows net increase or decrease in cash and cash equivalents during the period. However, users also need to know:

- What cash consisted of at the beginning

- What cash consists of at the end

Therefore, AS-3 mandates a reconciliation between:

- Cash and cash equivalents as per Cash Flow Statement, and

- Corresponding figures in the Balance Sheet

This reconciliation is provided through notes.

Meaning of Cash Flows in Relation to Cash & Cash Equivalents

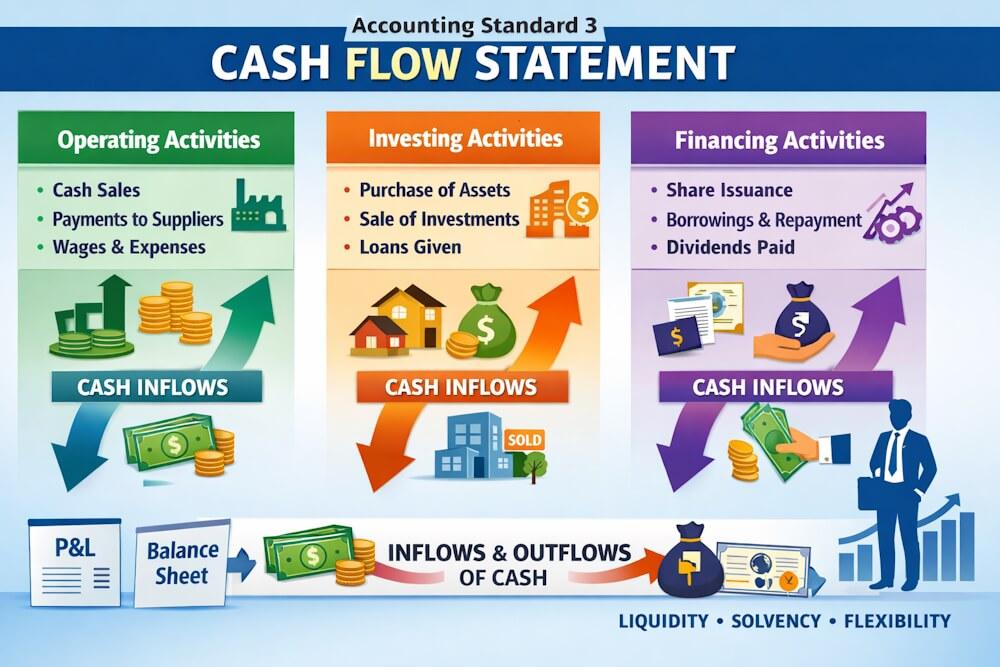

AS-3 defines cash flows as inflows and outflows of cash and cash equivalents.

Important clarifications:

- Any transaction that does not result in cash movement is not a cash flow

- Movements within cash or cash equivalents are not cash flows

For example:

- Transferring money from cash to bank is not a cash flow

- Purchasing a cash-equivalent investment using cash is not a cash flow

Such transactions do not change total cash and cash equivalents.

Change in Cash Does Not Always Mean Cash Flow

AS-3 highlights an important concept: A change in cash balance does not necessarily imply a cash flow.

Illustration (Foreign Currency Balance)

Suppose:

- An enterprise has USD 10,000 in a foreign bank account

- At the time of receipt, exchange rate was ₹49/USD → recorded at ₹4,90,000

- At year end, exchange rate becomes ₹50/USD → balance restated at ₹5,00,000

The increase of ₹10,000 is not a cash inflow. There is:

- No receipt of cash

- No payment of cash

It is only an exchange difference, not a cash flow.

Treatment of Exchange Differences under AS-3

Exchange gains and losses relating to:

- Cash, and

- Cash equivalents

are not treated as cash flows.

AS-3 requires that:

- Net increase/decrease in cash and cash equivalents in the Cash Flow Statement should be shown exclusive of exchange differences

- The difference between cash balance in Balance Sheet and Cash Flow Statement should be reconciled through notes

This ensures accurate reporting.

Why Strict Definition of Cash & Cash Equivalents Is Important

Incorrect classification may lead to:

- Overstatement of liquidity

- Misinterpretation of cash position

- Incorrect operating, investing, or financing cash flows

AS-3’s strict definition prevents manipulation and promotes consistency.

Cash Equivalents vs Short-Term Investments

A common mistake is treating all short-term investments as cash equivalents.

AS-3 makes it clear:

- All cash equivalents are short-term investments

- But not all short-term investments are cash equivalents

The key tests are:

- Liquidity

- Certainty of value

- Insignificant risk

Only when these conditions are satisfied can an investment be classified as a cash equivalent.

Illustration: Debentures Redeemable Within Three Months

If an enterprise purchases debentures (Debentures are documents issued by a company acknowledging its debt and agreeing to pay interest):

- Amount: ₹10 lakhs

- Redeemable within three months

Then:

- If held for short term → treated as cash equivalent

- If held as long-term investment → treated as investing activity

Thus, intention and maturity both matter.

Restricted Cash Balances

Sometimes, enterprises hold cash balances that are not freely available for use, such as:

- Bank balances in foreign countries subject to exchange controls

- Cash held for specific purposes

AS-3 requires disclosure of:

- Amount of such restricted cash

- Reasons why it is not available

This helps users assess true liquidity.

Relationship Between Cash, Cash Equivalents & Liquidity

Cash and cash equivalents together indicate:

- Short-term financial strength

- Ability to meet immediate obligations

- Liquidity position of the enterprise

That is why AS-3 treats them as a combined category.

Importance of Cash & Cash Equivalents for Users

For Investors

Helps assess dividend-paying ability and financial stability.

For Creditors

Shows ability to meet short-term liabilities and interest payments.

For Management

Supports cash planning, budgeting, and working capital management.

Cash & Cash Equivalents from Exam Perspective

This topic is frequently tested through:

- MCQs

- Short notes

- Classification problems

- Practical questions

Common exam traps include:

- Treating equity shares as cash equivalents

- Ignoring three-month maturity rule

- Treating exchange differences as cash flows

A clear understanding avoids such mistakes.

Link with Other AS-3 Topics

Understanding cash and cash equivalents is essential before studying:

- Types of cash flows

- Classification rules

- Direct and indirect methods

It forms the base of the entire Cash Flow Statement.

“This article explains one of the most important building blocks of the Cash Flow Statement. For a complete understanding of Accounting Standard 3, including types of cash flows, classification rules, preparation methods, and illustrations, refer to our Accounting Standard 3 (AS-3): Cash Flow Statement – Complete Guide.”

Conclusion

Cash and cash equivalents form the backbone of the Cash Flow Statement under Accounting Standard 3. AS-3 provides a clear and strict definition to ensure that only truly liquid and low-risk items are included.

By correctly identifying cash and cash equivalents, enterprises ensure that their Cash Flow Statements present a true picture of liquidity. For students and professionals alike, mastering this concept is essential for both examinations and practical application of AS-3.

FAQs

1: What is meant by cash under AS 3?

Answer: Cash under AS 3 includes cash in hand and deposits repayable on demand with banks or financial institutions.

2: What are cash equivalents as per AS 3?

Answer: Cash equivalents are short-term, highly liquid investments that are readily convertible into known amounts of cash and subject to insignificant risk of value changes.

3: What is the three-month rule in cash equivalents?

Answer: An investment qualifies as a cash equivalent only if it has a maturity of three months or less from the date of acquisition.

4: Are equity shares treated as cash equivalents?

Answer: No, investments in equity shares are generally not treated as cash equivalents due to uncertainty in realisable value.

5: Are exchange differences treated as cash flows?

Answer: No, exchange gains or losses arising from foreign currency cash balances are not considered cash flows under AS 3.

6: Why is break-up of cash and cash equivalents required?

Answer: AS 3 requires disclosure of the break-up of opening and closing cash and cash equivalents to improve transparency and understanding of liquidity.

7: Are transfers between cash and bank cash flows?

Answer: No, movements within cash or cash equivalents do not result in cash flows as they do not change total cash position.