After understanding the types of cash flows—operating, investing, and financing—the most critical and often confusing part of Accounting Standard 3 (AS-3) is classification of specific cash flows. Many items do not appear straightforward and require careful application of AS-3 rules.

This blog explains how different cash flows are classified under AS-3, along with clear rules and practical examples, exactly as required for exams and real-life application.

Why Classification Rules Are Important under AS-3

Classification of cash flows determines:

- Where a cash item will appear in the Cash Flow Statement

- Whether it affects operating, investing, or financing cash flows

- How users interpret liquidity, growth, and financing structure

Incorrect classification may:

- Distort operating cash flow

- Mislead users

- Lead to loss of marks in exams

AS-3 therefore provides specific classification rules for commonly confusing items.

General Rule for Classification

Under AS-3, classification depends on the nature of the activity, not merely on the nature of receipt or payment.

- Operating → related to principal revenue-producing activities

- Investing → related to long-term assets and investments

- Financing → related to capital and borrowings

This principle is applied consistently throughout AS-3.

Classification of Interest Paid

Rule under AS-3

Interest paid may be classified as:

- Operating activity, or

- Financing activity

depending on the nature of the enterprise.

Treatment

- Financial enterprises → Interest paid is an operating cash flow

- Non-financial enterprises → Interest paid is generally a financing cash flow

Example

A manufacturing company pays interest on a bank loan. Since lending is not its main business, interest paid is classified as a financing activity.

However, for a bank or finance company, interest paid forms part of regular operations and is therefore an operating activity.

Classification of Interest Received

Rule under AS-3

Interest received may be:

- Operating activity (financial enterprise), or

- Investing activity (non-financial enterprise)

Example

- A bank receives interest on loans → Operating cash flow

- A trading company receives interest on fixed deposits → Investing cash flow

This distinction is extremely important in exams.

Classification of Dividends Received

Rule under AS-3

- Financial enterprises → Dividend received = Operating activity

- Non-financial enterprises → Dividend received = Investing activity

Example

A manufacturing company receives dividend income from shares held as investments. This is classified as an investing cash inflow.

Classification of Dividends Paid

Rule under AS-3

Dividends paid are classified as:

- Financing cash outflow

Reason: Dividends represent return to owners and affect capital structure.

Example

If a company pays ₹2,00,000 as dividend to shareholders, it is shown under financing activities, irrespective of the nature of the enterprise.

Classification of Income Tax Paid

General Rule

Income tax paid is generally classified as:

- Operating activity

because it arises from operating profits.

Exception

If income tax can be specifically identified with:

- Investing activities, or

- Financing activities

then it may be classified accordingly.

Example

Capital gains tax paid on sale of land:

- Since sale of land is an investing activity

- Related tax may also be classified as investing cash outflow

If such identification is not possible, tax is shown under operating activities.

Classification of Extraordinary Items

Rule under AS-3

Cash flows arising from extraordinary items are classified:

- According to the nature of the activity to which they relate

They should be separately disclosed.

Example

Compensation received from insurance claim for destruction of machinery:

- Nature → related to fixed asset

- Classification → Investing cash inflow

Classification of Insurance Claims

Insurance claims are classified based on what they compensate for.

Examples

- Insurance claim for loss of stock → Operating cash inflow

- Insurance claim for damage to machinery → Investing cash inflow

Classification of Loans and Advances

For Non-Financial Enterprises

- Loans given → Investing activity

- Repayment of loans received → Financing activity

For Financial Enterprises

- Loans and advances are part of core operations

- Therefore: Loans given and Loans recovered

are classified as operating activities.

Classification of Purchase and Sale of Fixed Assets

Rule under AS-3

- Purchase of fixed assets → Investing cash outflow

- Sale of fixed assets → Investing cash inflow

Example

- Purchase of machinery worth ₹5,00,000 → Investing cash outflow

- Sale of old plant for ₹1,50,000 → Investing cash inflow

Classification of Issue and Redemption of Shares

Rule

- Issue of shares → Financing cash inflow

- Redemption of shares → Financing cash outflow

Example

If a company issues equity shares for ₹10,00,000, it is shown as financing inflow.

Classification of Borrowings

Rule

- Loan received → Financing cash inflow

- Loan repaid → Financing cash outflow

This applies to:

- Bank loans

- Debentures

- Long-term borrowings

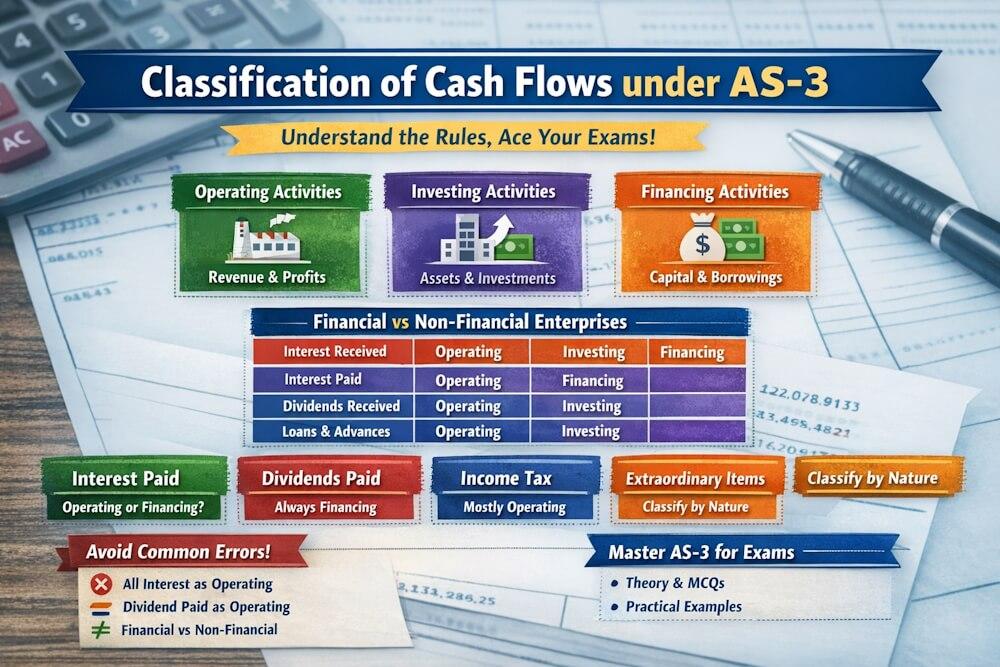

Classification of Cash Flows for Financial vs Non-Financial Enterprises

| Item | Financial Enterprise | Non-Financial Enterprise |

| Interest received | Operating | Investing |

| Interest paid | Operating | Financing |

| Dividend received | Operating | Investing |

| Loans & advances | Operating | Investing |

This table is highly important for exams.

Why AS-3 Allows Different Classifications

AS-3 recognises that:

- Nature of business differs

- Same transaction may have different meanings

Hence classification depends on business context, not just transaction type.

Common Classification Mistakes to Avoid

Students often:

- Treat all interest as operating

- Classify dividend paid as operating

- Ignore distinction between financial and non-financial enterprises

- Misclassify insurance claims

Avoiding these errors can significantly improve exam scores.

Link with Other AS-3 Topics

Correct classification is essential for:

- Preparing Cash Flow Statements

- Applying direct and indirect methods

- Analysing liquidity and solvency

Without proper classification, even a correctly prepared statement becomes misleading.

Importance of Classification from Exam Perspective

This topic is:

- Frequently asked in theory questions

- Core of practical problems

- Tested through MCQs and case studies

A strong grip on classification rules is essential to master AS-3.

Conclusion

Classification of cash flows under Accounting Standard 3 is not mechanical; it requires understanding the nature of activities and the business context. AS-3 provides clear rules to ensure consistency, comparability, and transparency in reporting cash movements.

By applying these classification rules correctly, enterprises can present meaningful Cash Flow Statements, and students can confidently handle both theory and practical questions related to AS-3.

“This article focuses on the detailed classification rules under Accounting Standard 3. For a complete, structured understanding of AS-3, including cash and cash equivalents, types of cash flows, preparation methods, disclosures, and practical illustrations, refer to our Accounting Standard 3 (AS-3): Cash Flow Statement – Complete Guide.”

FAQs

1: What is meant by classification of cash flows under AS 3?

Answer: Classification of cash flows under AS 3 refers to grouping cash receipts and payments into operating, investing, and financing activities based on their nature.

2: How is interest paid classified under AS 3?

Answer: For financial enterprises, interest paid is an operating activity. For non-financial enterprises, it is generally classified as a financing activity.

3: How is interest received classified under AS 3?

Answer: Interest received is classified as an operating activity for financial enterprises and as an investing activity for non-financial enterprises.

4: How are dividends paid shown in Cash Flow Statement?

Answer: Dividends paid are classified as financing cash outflows under AS 3 as they represent returns to shareholders.

5: How is income tax paid classified under AS 3?

Answer: Income tax paid is generally classified as an operating activity unless it can be specifically identified with investing or financing activities.

6: How are insurance claims classified under AS 3?

Answer: Insurance claims are classified based on the nature of loss. Claims for stock loss are operating cash flows, while claims for fixed assets are investing cash flows.

7: How are loans and advances treated under AS 3?

Answer: For financial enterprises, loans and advances are operating activities. For non-financial enterprises, loans given are investing activities.