If you’ve ever dealt with long-term contracts, subscriptions, or recurring billing, you’ve already experienced continuous supply—even if you didn’t call it that. GST law recognises that not every supply happens in one go. Some supplies stretch over weeks, months, or even years.

That’s exactly why GST created separate rules for continuous supply of goods and services. And this is also where many businesses get confused, issue invoices at the wrong time, and later receive GST notices.

So in this blog, let’s break it down calmly and clearly—what continuous supply means, how it differs for goods and services, and how invoicing actually works in real life.

What Is Continuous Supply Under GST?

Under GST, a supply is considered continuous when:

- It is provided continuously or on a recurring basis

- It is done under a contract

- Invoicing or payments happen periodically

However, GST defines continuous supply of goods and continuous supply of services separately, and the rules are not the same.

Continuous Supply of Goods – Meaning

Continuous supply of goods means:

- Goods are supplied continuously or repeatedly

- Supply happens under a contract

- Invoices are raised on a regular or periodic basis

Examples:

- Gas supplied through pipelines

- Water supply

- Electricity

- Raw materials supplied daily under a contract

Even though goods are involved, the supply doesn’t happen as a one-time sale.

Continuous Supply of Services – Meaning

Continuous supply of services means:

- Services are provided continuously or on a recurring basis

- The contract duration is more than 3 months

- Payments are periodic

Examples:

- AMC (Annual Maintenance Contracts)

- Internet and telecom services

- Security services

- Housekeeping contracts

- SaaS subscriptions

- Consulting retainers

This category is far more common than people realise.

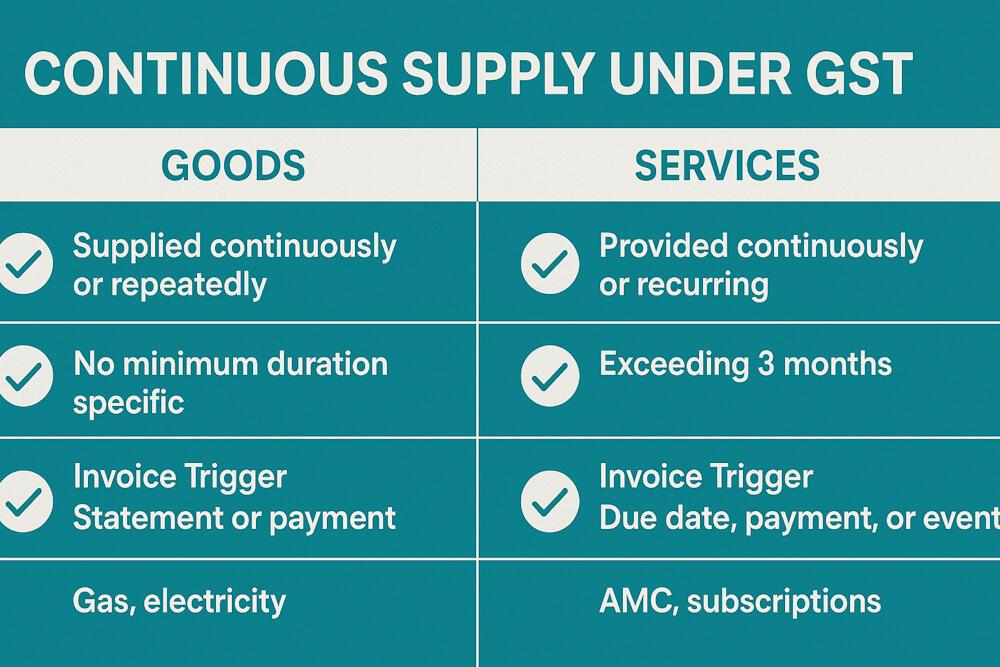

Key Difference Between Goods and Services (At a Glance)

| Point | Goods | Services |

| Physical movement | Yes | No |

| Minimum duration | Not specified | More than 3 months |

| Invoice trigger | Statement/payment | Due date/payment/event |

| Examples | Gas, electricity | AMC, subscriptions |

This difference decides when your invoice must be issued.

Invoice Rules for Continuous Supply of Goods

If goods are supplied continuously and successive payments or statements are involved:

“Invoice must be issued before or at the time each statement is issued or payment is received”

Example:

A factory supplies gas daily and raises a monthly bill.

- Invoice issued at the end of each billing period

- Not for every single delivery

This keeps compliance practical and realistic.

Invoice Rules for Continuous Supply of Services

This is where GST becomes very specific.

Case 1: Due Date Mentioned in Contract

Invoice must be issued on or before the due date of payment.

Example: AMC contract says payment due on 5th of every month

- Invoice must be issued on or before 5th

Case 2: Due Date NOT Mentioned

Invoice must be issued when payment is received.

This is common in flexible consulting arrangements.

Case 3: Payment Linked to Completion of Event

Invoice must be issued on or before completion of that event.

Example: Software project paid after phase completion

- Invoice issued at milestone completion

Why GST Uses Different Rules for Goods and Services

Because the nature of supply is different.

- Goods involve logistics and movement

- Services involve time, effort, and milestones

If GST applied one rule to both, compliance would become unrealistic. These separate rules allow flexibility while keeping tax collection timely.

What Happens If Supply Stops Midway?

If a continuous service contract ends early:

- Invoice must be issued when supply stops

- Only for the portion of service actually provided

This protects both the supplier and the recipient during disputes.

Advance Payments in Continuous Supply

For services:

- Advance received → Receipt Voucher issued

- Service not provided later → Refund Voucher issued

For goods:

- Advance rules are more relaxed compared to services, but documentation still matters.

This difference often surprises businesses.

Common Mistakes Businesses Make

- Treating long-term services as one-time supply

- Issuing invoice after due date

- Ignoring milestone-based invoicing

- Mixing goods rules with service rules

- Issuing invoice only at year-end

- Missing receipt vouchers for advances

These mistakes usually surface during GST audits.

Practical Examples You’ll Relate To

Security Agency

- Monthly billing → continuous supply of services

- Invoice issued every month before due date

Gas Supplier

- Daily supply, monthly billing → continuous supply of goods

- Invoice issued with monthly statement

SaaS Company

- Annual subscription → continuous supply of services

- Invoice as per contract payment terms

Why Continuous Supply Rules Matter So Much

Because GST is invoice-driven.

Wrong timing of invoice means:

- Wrong tax period

- Interest liability

- ITC mismatch for customers

- Audit objections

Following continuous supply rules keeps:

- Cash flow predictable

- Compliance clean

- Customer trust intact

FAQs

1. Is continuous supply applicable only to large businesses?

No. Even small businesses with recurring contracts fall under it.

2. Do subscriptions count as continuous supply?

Yes. Most subscriptions qualify as continuous supply of services.

3. Is minimum duration required for goods?

No fixed duration for goods. For services, it must exceed 3 months.

4. Can I issue one invoice for the entire year?

Only if contract and payment terms allow it and GST rules are satisfied.

5. What happens if invoice is issued late?

Interest, penalties, and ITC issues for the recipient.

6. Are continuous supply rules optional?

No. They are mandatory under Section 31 of CGST Act.