In GST compliance, two documents create the most confusion—Credit Notes and Debit Notes. Many people mix them up, use them interchangeably, or treat them as simple accounting adjustments. That’s where problems start.

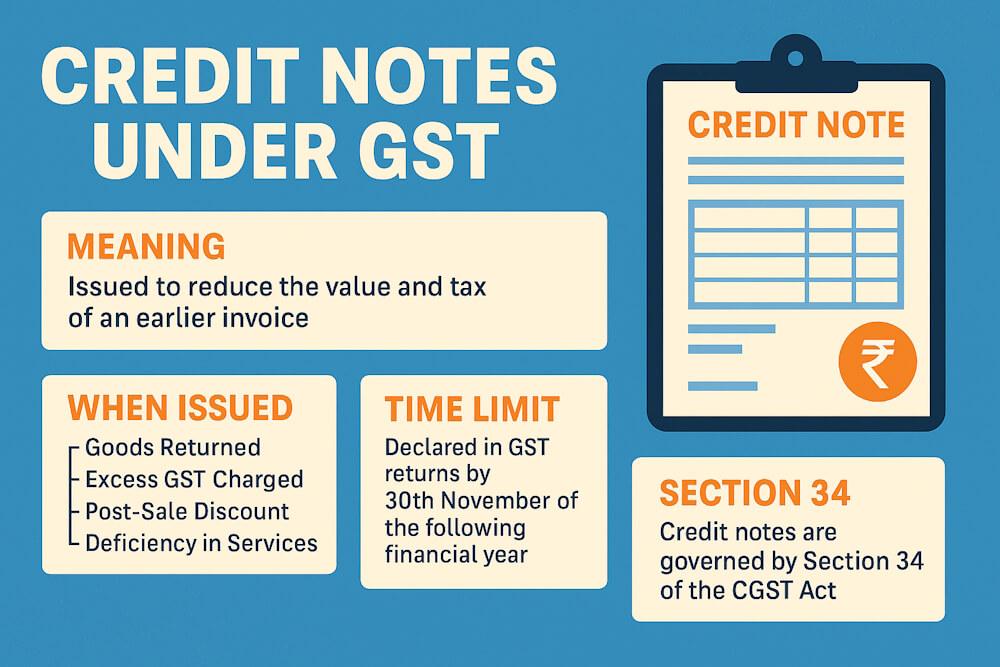

Under GST, credit notes and debit notes are legal tax documents governed by Section 34 of the CGST Act. They directly affect tax liability, ITC, and return filings. Using the wrong one—or using the right one at the wrong time—can trigger GST notices.

So let’s clearly understand the difference between credit note and debit note under GST, with examples you’ll actually relate to.

What Is a Credit Note Under GST?

A credit note is issued when the supplier needs to reduce the value or tax of an already-issued invoice.

It is commonly issued when:

- Goods are returned

- Excess GST was charged

- Post-sale discount is given

- Services were deficient

👉 Credit note = reduction in tax/value

What Is a Debit Note Under GST?

A debit note is issued when the supplier needs to increase the value or tax of an earlier invoice.

It is issued when:

- GST was undercharged

- Value was underbilled

- Additional charges are added later

- Price is revised upward

👉 Debit note = increase in tax/value

Credit Note vs Debit Note: Side-by-Side Comparison

| Basis | Credit Note | Debit Note |

| Purpose | Reduce invoice value/tax | Increase invoice value/tax |

| Issued when | Excess charged | Short charged |

| GST impact | Decreases output tax | Increases output tax |

| ITC impact | ITC to be reversed by buyer | Additional ITC allowed |

| Legal section | Section 34(1) | Section 34(3) |

| Common use case | Sales return, discount | Undercharged GST |

| Affects revenue | Reduces | Increases |

This table alone clears 80% of confusion.

Practical Examples (Very Important)

Example 1: Excess GST Charged

Invoice issued with GST ₹18,000, Actual GST should be ₹12,000

- Credit note issued for ₹6,000

- Supplier reduces tax

- Buyer reverses ITC

Example 2: Undercharged GST

Invoice issued with GST ₹12,000, Actual GST should be ₹18,000

- Debit note issued for ₹6,000

- Supplier pays additional tax

- Buyer claims extra ITC

Time Limit: Credit Note vs Debit Note

This is where many businesses go wrong.

Credit Note Time Limit

Must be declared:

- On or before 30th November of next financial year

- Or before filing annual return (whichever is earlier)

Debit Note Time Limit

Same reporting deadline applies, but:

- Debit notes are now treated independently

- Not linked to original invoice financial year

Missing deadlines = compliance trouble.

Reporting in GST Returns

Both notes must be reported in:

- GSTR-1

- Reflected in GSTR-2B

- Adjusted in GSTR-3B

If not reported properly:

- Tax adjustment not allowed

- ITC mismatch occurs

Credit/Debit Notes vs Revised Invoice (Quick Clarity)

Many people confuse these too.

- Revised Invoice → Used only for pre-registration supplies

- Credit/Debit Notes → Used after tax invoice is issued

Each has a different legal purpose.

Common Mistakes Businesses Make

- Issuing credit note instead of debit note (or vice versa)

- Not mentioning original invoice reference

- Missing Section 34 time limits

- Not reversing or claiming ITC properly

- Treating notes as accounting-only documents

These mistakes are frequently caught during GST audits.

Why GST Closely Monitors These Notes

Because:

- Credit notes reduce tax

- Debit notes increase tax

- Both directly affect government revenue

That’s why documentation, timing, and reporting accuracy matter a lot.

Recommended Reading

To get full clarity on GST invoice adjustments, also read:

- Start with Understanding GST Tax Invoices: A Simple Beginner Guide.

- For original invoice rules, read GST Tax Invoice Rules for Goods: Time, Format & Cases and GST Tax Invoice Rules for Services: Time, Limits & Use.

- For downward tax adjustments, read Credit Notes Under GST: Meaning, Rules & Time Limits.

- For upward tax adjustments, read Debit Notes Under GST: Rules, Amendments & Use.

- For invoice correction before registration, read Revised & Consolidated Invoices Under GST: Rules Explained.

These blogs together complete the GST invoice correction framework.

FAQs

1. Which is issued for sales return under GST?

Credit note.

2. Which note increases GST liability?

Debit note.

3. Can both notes be issued for one invoice?

Yes, if circumstances require, but with proper justification.

4. Are credit and debit notes mandatory?

Yes, when value or tax adjustment is required.

5. Do both affect ITC?

Yes. Credit notes reduce ITC, debit notes allow additional ITC.

6. Are these notes reported in GST returns?

Yes, both must be reported in GSTR-1 and GSTR-3B.