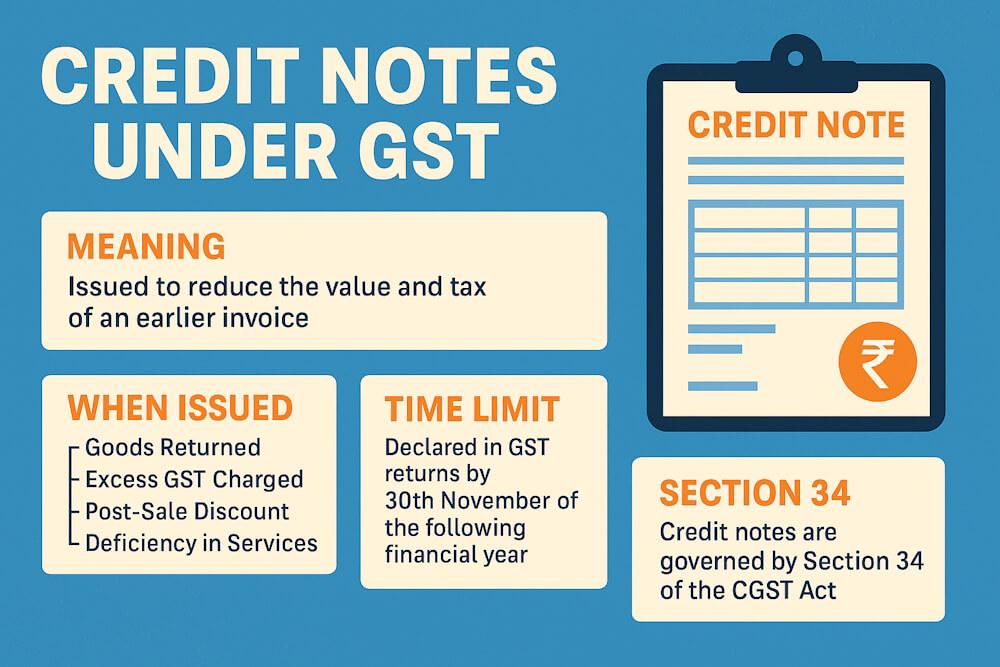

In real business life, invoices don’t always stay final. Prices change, goods are returned, discounts are agreed later, or sometimes tax is simply charged more than required. GST recognises all these realities, and that’s where credit notes come into play.

A credit note is not just an accounting document—it is a legal GST document governed by strict rules under Section 34 of the CGST Act. Issuing it incorrectly or missing timelines can directly affect tax liability and ITC.

Let’s understand credit notes in a simple, practical way.

What Is a Credit Note Under GST?

A credit note is issued by a supplier to the recipient when:

- Taxable value charged earlier is more than actual value

- GST charged is higher than applicable

- Goods are returned by the buyer

- Services are deficient

- Post-sale discount is agreed

In simple words:

“A credit note reduces the value and tax of an earlier invoice.”

Legal Provision for Credit Notes

Credit notes are governed by Section 34(1) of the CGST Act.

It allows a registered supplier to issue one or more credit notes for supplies already made, subject to conditions and time limits.

Situations Where Credit Note Is Issued

Here are the most common real-life cases:

1. Goods Returned

Customer returns defective or excess goods.

2. Excess Tax Charged

Wrong GST rate applied in original invoice.

3. Post-Sale Discount

Discount agreed after invoice issuance.

4. Deficiency in Services

Service not fully delivered as agreed.

Each of these requires proper documentation.

Mandatory Contents of a GST Credit Note

A credit note must contain:

- Supplier name, address, GSTIN

- Credit note number & date

- Reference of original invoice

- Recipient details

- Value of goods/services

- GST rate & tax amount

- Reason for issuing credit note

- Signature or digital signature

These requirements link back to Rule 46 invoice fields.

Time Limit for Issuing Credit Note

This is where many businesses make mistakes.

“Credit note must be declared in GST returns on or before:”

- 30th November of the following financial year, OR

- Date of filing annual return, whichever is earlier.

Missing this deadline means:

- Tax liability cannot be adjusted

- GST paid earlier becomes final

Reporting Credit Notes in GST Returns

Credit notes must be reported in:

- GSTR-1 (details of outward supplies)

- Auto-reflected in GSTR-2B of recipient

- Adjusted in GSTR-3B

This ensures correct tax adjustment and ITC reversal where required.

Impact of Credit Note on ITC

When a supplier issues a credit note:

- Supplier reduces output tax

- Recipient must reverse ITC proportionately

This keeps the GST credit chain balanced.

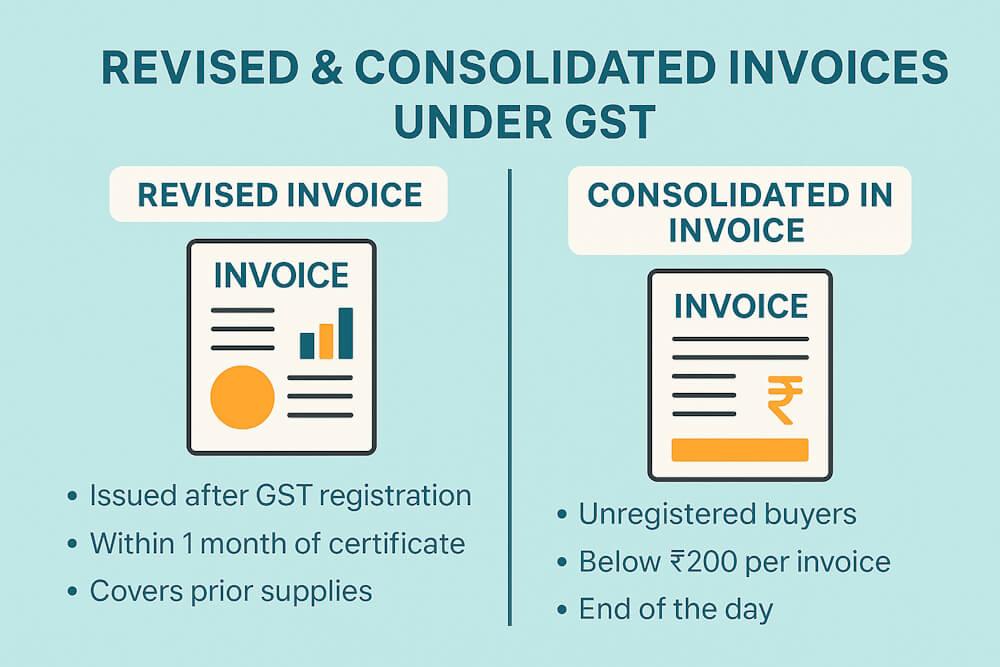

Credit Note vs Revised Invoice

| Point | Credit Note | Revised Invoice |

| Purpose | Reduce value/tax | Correct pre-registration supplies |

| Section | Section 34 | Section 31 |

| Time limit | Up to Nov 30 next FY | 1 month from registration |

| Linked to invoice | Yes | Yes |

They serve very different purposes.

Common Mistakes Businesses Make

- Issuing credit note but not reporting in GSTR-1

- Missing time limit under Section 34

- Issuing credit note without original invoice reference

- Not reversing ITC properly

- Treating credit note as accounting entry only

These mistakes often lead to GST notices.

Practical Example (Easy to Understand)

Example: Excess GST Charged

Invoice issued with 18% GST instead of 12%

- Credit note issued for extra 6%

- Reported in GSTR-1

- Tax adjusted in GSTR-3B

Simple—but only if done on time.

Why Credit Notes Are Closely Scrutinised

Credit notes directly reduce:

- Tax payable

- Government revenue

That’s why GST officers closely check:

- Reasons

- Timing

- Reporting accuracy

Proper documentation is essential.

Recommended Reading

To understand credit notes in the full GST invoicing framework, also read:

- Start with basics in Understanding GST Tax Invoices: A Simple Beginner Guide.

- For original invoice rules, refer to GST Tax Invoice Rules for Goods: Time, Format & Cases and GST Tax Invoice Rules for Services: Time, Limits & Use.

- To see how invoice corrections work, read Revised & Consolidated Invoices Under GST: Rules Explained.

- For invoice structure and mandatory details, read Mandatory Fields of GST Tax Invoice: Rule 46 Explained.

- For post-invoice adjustments, this blog works alongside Debit Notes, which we’ll cover next.

FAQs

1. Is issuing a credit note mandatory under GST?

Yes, when taxable value or tax charged earlier is excess.

2. Can multiple credit notes be issued for one invoice?

Yes, GST allows multiple credit notes.

3. Is there a limit on credit note value?

No, but it must relate to original invoice.

4. Can credit note be issued without GST impact?

Yes, commercial credit notes may exist, but GST impact differs.

5. What if credit note is not reported on time?

Tax adjustment is not allowed.

6. Is credit note required for sales return?

Yes, GST credit note is mandatory.