If a credit note reduces tax and value, a debit note does exactly the opposite. It increases the taxable value or GST that was short charged earlier. In real business life, this happens more often than people admit—wrong tax rate, undervaluation, additional charges, or price revisions after invoicing.

Debit notes are not just accounting adjustments. Under GST, they are legally recognised tax documents governed by Section 34 of the CGST Act, and they directly affect tax liability and ITC.

Let’s break this down in a very simple, practical way.

What Is a Debit Note Under GST?

A debit note is issued by a supplier to a recipient when:

- Taxable value charged earlier is less than actual value

- GST charged earlier is lower than applicable

- Additional amount is payable after invoice

- Price is revised upward post supply

In short:

“A debit note increases the value and GST of an earlier invoice.”

Legal Provision for Debit Notes

Debit notes are covered under Section 34(3) of the CGST Act.

Earlier, debit notes were linked to the financial year of the original invoice, which caused confusion. This was later amended.

Important Amendment Related to Debit Notes

Key Change (Very Important)

Earlier:

- Debit note time limit depended on original invoice year

Now:

- Debit notes are treated independently

- Time limit is calculated from the date of debit note itself

This amendment simplified compliance and removed unnecessary restrictions.

When Should a Debit Note Be Issued?

Debit notes are commonly issued in these situations:

1. Undercharged GST

Invoice raised with 12% GST instead of 18%.

2. Underbilled Value

Quantity or value short-charged earlier.

3. Additional Charges

Freight, packing, or service charges added later.

4. Price Revision

Price increased after supply due to contract terms.

Mandatory Contents of a GST Debit Note

A debit note must contain:

- Supplier name, address, GSTIN

- Debit note number & date

- Reference of original invoice

- Recipient details

- Additional taxable value

- GST rate & tax amount

- Reason for issuing debit note

- Signature or digital signature

These fields are similar to invoice requirements under Rule 46.

Time Limit for Reporting Debit Notes

Debit notes must be declared in GST returns:

- On or before 30th November of the following financial year, or

- Date of filing annual return, whichever is earlier.

Because debit notes increase tax liability, missing this deadline leads to:

- Short payment of tax

- Interest liability

- Possible penalties

Reporting Debit Notes in GST Returns

Debit notes must be reported in:

- GSTR-1 (outward supplies)

- Reflected in GSTR-2B of recipient

- Included in GSTR-3B

Once reported, tax becomes payable immediately.

Impact of Debit Note on ITC

When debit note is issued:

- Supplier pays additional output tax

- Recipient becomes eligible for additional ITC, subject to conditions

This keeps the GST credit chain intact.

Debit Note vs Credit Note (Quick Comparison)

| Point | Debit Note | Credit Note |

| Purpose | Increase value/tax | Reduce value/tax |

| Section | 34(3) | 34(1) |

| Tax impact | Increases tax | Reduces tax |

| ITC effect | Extra ITC allowed | ITC reversal required |

Both documents must be handled carefully.

Common Mistakes Businesses Make

- Forgetting to issue debit note for undercharged GST

- Treating debit note as accounting entry only

- Not reporting debit note in GSTR-1

- Assuming old financial-year restrictions still apply

- Delaying tax payment

These errors usually show up during GST audits.

Practical Example (Easy to Understand)

Example: Undercharged GST

Original invoice issued with GST ₹10,000. Actual GST should be ₹15,000

- Debit note issued for ₹5,000 GST

- Reported in GSTR-1

- Paid in GSTR-3B

Simple—but compliance timing matters.

Why Debit Notes Are Closely Monitored

Debit notes increase:

- Tax liability

- Government revenue

That’s why GST officers check:

- Timing

- Reason

- Return matching

Proper documentation protects you during scrutiny.

Recommended Reading

To understand debit notes in the full GST invoicing framework, also read:

- Start with the basics in Understanding GST Tax Invoices: A Simple Beginner Guide.

- For original invoice rules, read GST Tax Invoice Rules for Goods: Time, Format & Cases and GST Tax Invoice Rules for Services: Time, Limits & Use.

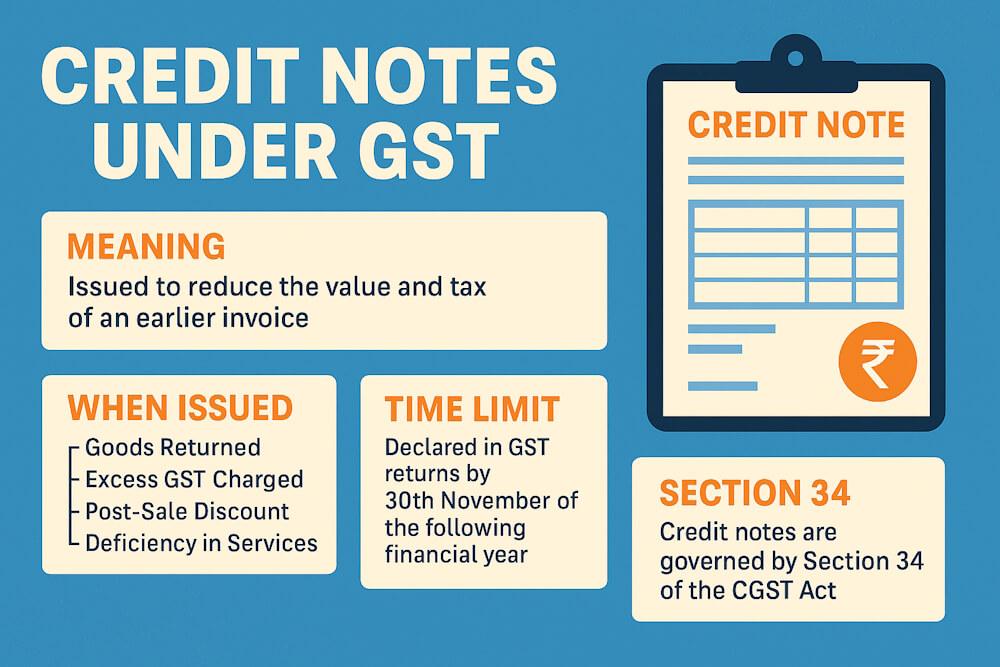

- To understand downward adjustments, refer to Credit Notes Under GST: Meaning, Rules & Time Limits.

- For invoice corrections before registration, read Revised & Consolidated Invoices Under GST: Rules Explained.

- For invoice structure and mandatory fields, check Mandatory Fields of GST Tax Invoice: Rule 46 Explained.

Together, these blogs complete the GST invoice correction and adjustment cycle.

FAQs

1. Is debit note mandatory under GST?

Yes, when taxable value or GST was undercharged earlier.

2. Can multiple debit notes be issued for one invoice?

Yes, GST allows multiple debit notes.

3. Is there any value limit on debit notes?

No, but it must relate to the original invoice.

4. Does debit note increase tax liability?

Yes, additional tax becomes payable.

5. Can debit note be issued after one year?

Yes, subject to reporting deadlines under Section 34.

6. Is ITC available on debit note?

Yes, recipient can claim additional ITC if conditions are met.