Financial statements are prepared with the objective of presenting a true and fair view of the financial position and performance of an enterprise. However, while preparing these statements, accountants do not start from zero every time. There are certain basic assumptions that are automatically presumed to be followed unless stated otherwise. These basic assumptions are known as Fundamental Accounting Assumptions.

Accounting Standard 1 (AS 1) formally recognises these assumptions and lays down clear guidance on their treatment and disclosure. Understanding these assumptions is essential because they form the foundation of financial reporting and influence how income, expenses, assets, and liabilities are recorded.

“Fundamental accounting assumptions form the base of financial reporting. For a broader understanding of why disclosures are required, you can read our detailed article on Accounting Standard 1 (AS 1): Meaning, Objective & Applicability.

These assumptions directly influence how accounting principles are applied in practice, which is discussed in Accounting Policies under AS 1: Meaning, Nature & Areas of Differences.”

Meaning of Fundamental Accounting Assumptions

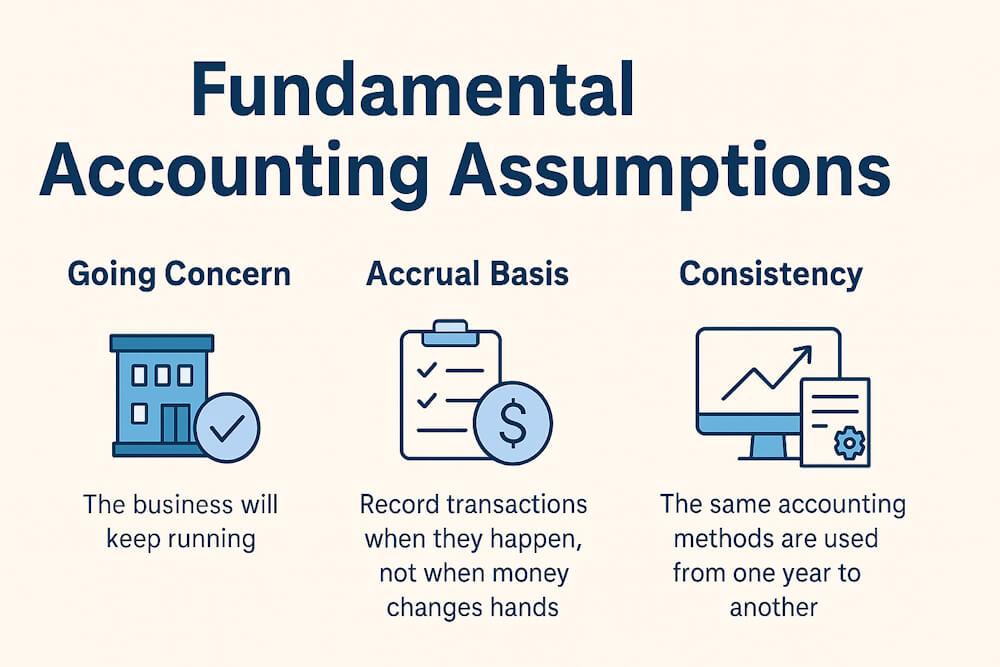

Fundamental accounting assumptions are the basic premises on which financial statements are prepared and presented. These assumptions are considered so fundamental that they are normally taken for granted.

AS 1 recognises three fundamental accounting assumptions:

- Going Concern

- Consistency

- Accrual Basis of Accounting

If these assumptions are followed, no specific disclosure is required in the financial statements. However, if any of these assumptions is not followed, the fact must be clearly disclosed.

Why Are Fundamental Accounting Assumptions Important?

These assumptions ensure:

- Uniformity in accounting practices

- Reliability of financial information

- Comparability of financial statements across periods

- Logical measurement of profit and financial position

Without these assumptions, financial statements would lose their meaning and usefulness for users such as investors, lenders, and management.

1. Going Concern Assumption

Meaning of Going Concern

The Going Concern assumption means that an enterprise is expected to continue its operations in the foreseeable future. It assumes that the business has neither the intention nor the necessity to liquidate or significantly reduce its operations.

In simple terms, the business is assumed to be not closing down in the near future.

Impact of Going Concern on Financial Statements

When financial statements are prepared on a going concern basis:

- Assets are recorded at cost or value in use, not at liquidation value

- Liabilities are recognised on the assumption that they will be settled in the normal course of business

- Profits are retained to replace assets consumed during operations

- Provisions are made for liabilities that will arise during normal business activities

If the going concern assumption were not applied, assets would have to be valued at distress sale prices, and liabilities might become immediately payable.

Example: Going Concern Assumption

Suppose a manufacturing company owns machinery costing 10,00,000. Under the going concern assumption, the machinery is shown at cost less depreciation because it is expected to be used for several years.

However, if the company is about to shut down, the machinery would be valued at its net realisable value, which could be much lower. This would drastically change the financial position of the enterprise.

Disclosure Requirement

- If followed: No disclosure required

- If not followed: The fact must be disclosed clearly in the financial statements

2. Consistency Assumption

Meaning of Consistency

The Consistency assumption means that the same accounting policies are applied for similar transactions from one accounting period to another.

Consistency helps users compare:

- Financial statements of the same enterprise over different years

- Trends in performance and financial position

Why Consistency Is Necessary

If accounting policies change frequently:

- Profits may fluctuate due to accounting changes rather than actual performance

- Comparisons between periods become meaningless

- Users may be misled

Consistency ensures that changes in financial results reflect real economic changes, not changes in accounting methods.

Permissible Changes under Consistency

AS 1 allows changes in accounting policies only if the change is required:

- By a statute

- By an accounting standard

- For a more appropriate presentation of financial statements

Thus, consistency does not mean rigidity. It allows flexibility when justified.

Example: Consistency Assumption

An enterprise values its inventory using the FIFO method every year. This consistent application allows comparison of inventory values and profits across years.

If the enterprise changes to the Weighted Average method, it must justify the change and disclose its effect. Without disclosure, users may wrongly interpret changes in profit.

Disclosure Requirement

- If followed: No disclosure required

- If not followed: Disclosure is mandatory

3. Accrual Basis of Accounting

Meaning of Accrual Basis

Under the Accrual basis of accounting, transactions are recognised when they occur, not when cash is received or paid.

- Income is recognised when earned

- Expenses are recognised when incurred

This ensures better matching of revenue with related costs.

Importance of Accrual Basis

Accrual accounting provides a more realistic measure of profit or loss because it reflects activities of the enterprise during an accounting period rather than cash movements.

For example:

- Sales made on credit are recognised as revenue

- Expenses incurred but not paid are recognised as expenses

Risk Associated with Accrual Basis

Accrual accounting may sometimes lead to recognition of income before actual receipt of cash. This can result in overstatement of profits and erosion of capital if dividends are declared based on unrealised profits.

To address this risk, accounting standards require that:

- Revenue should be recognised only when realisation is reasonably certain

Legal Requirement

Section 128(1) of the Companies Act, 2013 mandates that companies must maintain their accounts only on accrual basis.

Therefore, it is generally assumed that accrual accounting is followed unless stated otherwise.

Example: Accrual Basis of Accounting

Suppose a company provides services worth 50,000 in March but receives payment in April.

- Under accrual basis: Income is recognised in March

- Under cash basis: Income would be recognised in April

Accrual accounting ensures that income is matched with the period in which services are provided.

Disclosure Requirement

- If followed: No disclosure required

- If not followed: The fact must be disclosed

If any income or expense is recognised on a cash basis, it must be clearly stated.

Combined View of Fundamental Accounting Assumptions

| Assumption | If Followed | If Not Followed |

| Going Concern | No disclosure required | Disclosure required |

| Consistency | No disclosure required | Disclosure required |

| Accrual Basis | No disclosure required | Disclosure required |

This table clearly shows that disclosure is required only when there is a deviation from fundamental assumptions.

Disclosure of Deviations from Fundamental Assumptions

AS 1 specifically states that if any of the three fundamental assumptions is not followed, the fact must be disclosed in the financial statements.

This ensures transparency and prevents users from making incorrect assumptions about the financial data presented.

Example: Disclosure of Deviation

If an enterprise prepares its accounts on a cash basis instead of accrual basis for certain transactions, it must disclose this deviation. Failure to disclose would result in misleading financial statements.

Importance of Fundamental Accounting Assumptions in Practice

Fundamental accounting assumptions:

- Form the base of accounting standards

- Ensure reliability and comparability

- Protect users from misleading information

- Support professional judgment of accountants

Without these assumptions, accounting would become inconsistent and unreliable.

Conclusion

Fundamental accounting assumptions are the backbone of financial reporting. Accounting Standard 1 formally recognises these assumptions and ensures that financial statements are prepared on a consistent, logical, and transparent basis.

The assumptions of Going Concern, Consistency, and Accrual Basis are so fundamental that they are normally assumed to be followed. However, AS 1 ensures accountability by requiring disclosure whenever there is a deviation.

For students, professionals, and users of financial statements, understanding these assumptions is crucial because they directly influence profit measurement, asset valuation, and financial interpretation.

FAQs

1: What are fundamental accounting assumptions under AS 1?

Answer: Accounting Standard 1 recognises three fundamental accounting assumptions: Going Concern, Consistency, and Accrual Basis of Accounting. These assumptions form the foundation for preparing financial statements.

2: Why are fundamental accounting assumptions important?

Answer: They ensure reliability, comparability, and logical measurement of profits and financial position. Without these assumptions, financial statements may become misleading.

3: What is the going concern assumption?

Answer: The going concern assumption means that an enterprise is expected to continue its operations in the foreseeable future and is not likely to liquidate or reduce operations materially.

4: What does the consistency assumption mean?

Answer: Consistency means using the same accounting policies for similar transactions across accounting periods, enabling meaningful comparison of financial statements over time.

5: What is accrual basis of accounting?

Answer: Under the accrual basis, income and expenses are recognised when they occur, not when cash is received or paid. This provides a more accurate picture of business performance.

6: Is disclosure required if fundamental accounting assumptions are followed?

Answer: No, if all fundamental accounting assumptions are followed, no specific disclosure is required in the financial statements.

7: When is disclosure of fundamental accounting assumptions required?

Answer: Disclosure is required when any of the fundamental accounting assumptions—Going Concern, Consistency, or Accrual—is not followed while preparing financial statements.

8: Is accrual basis mandatory for companies?

Answer: Yes, as per the Companies Act, 2013, companies are required to maintain their accounts on an accrual basis.