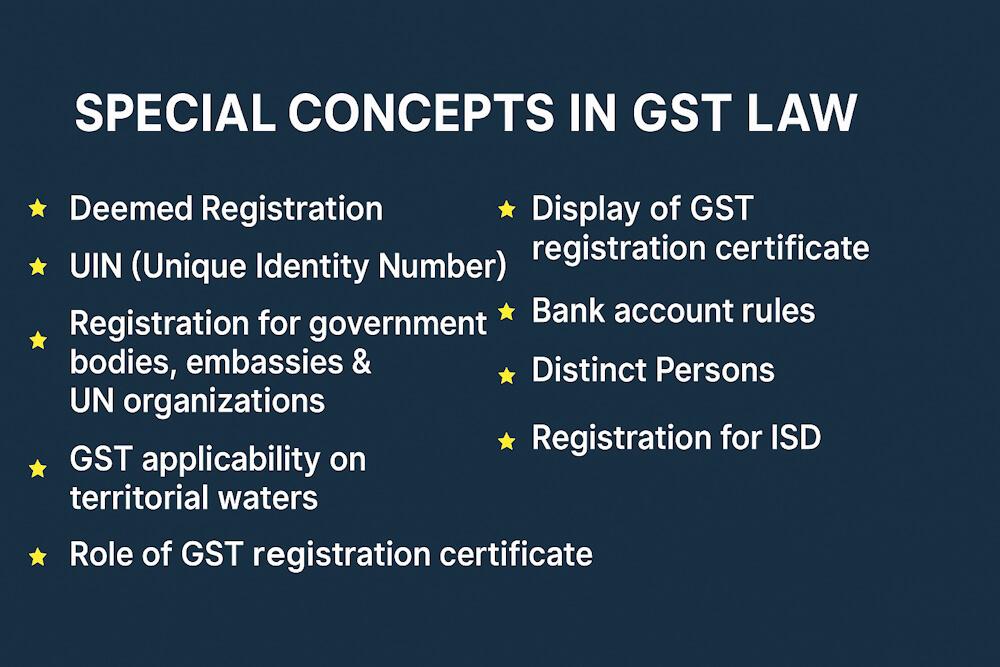

Once you understand GST registration, amendments, cancellation, and revocation, there are a few special concepts in the GST law that complete the registration chapter. These concepts are often ignored but extremely important for businesses, government bodies, foreign missions, and even tax professionals.

These include:

- Deemed registration

- UIN (Unique Identity Number)

- Registration for government bodies, embassies & UN organizations

- GST applicability on territorial waters

- Role of TDS/TCS registrants

- Display of GST registration certificate

- Bank account rules

This blog breaks down these special provisions in simple, practical language, based directly on Sections 25 and 26 of the CGST Act and relevant GST Rules.

1. Deemed Registration (Section 26)

Deemed registration means that the applicant is considered automatically registered when approval is delayed beyond legal timelines.

Why does deemed registration exist?

To prevent officers from delaying approval unnecessarily.

When does deemed registration happen?

If the GST officer does not respond within:

- 3 working days after Aadhaar authentication

- 7 working days if Aadhaar authentication is not done

- Extended timeline (in case of physical verification)

If no action is taken within the prescribed time →

- Registration is deemed approved

- GSTIN is auto-generated

Benefits of Deemed Registration

- Prevents administrative delays

- Ensures transparency

- Allows businesses to start operations quickly

Example

A business applies for GST on 1st April. No notice or rejection by 10th April.

- GST registration is automatically approved.

2. UIN (Unique Identity Number)

UIN is a special type of registration issued to:

- Foreign diplomatic missions

- Embassies

- Consulates

- United Nations bodies

- Specialized international organizations

These bodies are not liable to pay GST but may claim a refund of taxes paid on notified supplies.

Who Can Get a UIN?

The following categories are eligible:

| Organization Type | Examples |

| UN bodies | UNICEF, WHO, UNDP |

| Embassies & High Commissions | US Embassy, UK High Commission |

| Consulates | German Consulate |

| Multilateral institutions | World Bank, IMF |

| Any person notified by Government | Special international organizations |

Purpose of UIN

UIN holders are not regular taxpayers. They get UIN so they can:

- Receive supplies within India

- Pay GST on those supplies

- Claim refund of GST paid

- Maintain international privileges

How Do UIN Holders Claim Refund?

They must file:

- GSTR-11 (Monthly Statement)

- Provide details of purchases

- Apply for refund of GST paid

Example

The Canadian High Commission purchases office supplies worth ₹5 lakh and pays GST. Using their UIN → They file GSTR-11 → Claim refund.

3. Registration for Persons Required to Deduct or Collect Tax (TDS/TCS)

TDS Deductors (Government Departments)

Special entities like:

- Central Government

- State Government

- Local authorities

- PSUs

- Government agencies

must register under GST only for TDS deduction, even if they don’t make taxable supplies.

TCS Collectors (E-commerce Operators)

E-commerce operators like:

- Amazon

- Flipkart

- Zomato

- Swiggy

must register as TCS collectors under Section 52.

These registrations are not the same as regular GST registration.

4. GST Registration for Territorial Waters

A unique provision in GST law concerns territorial waters, which extend 12 nautical miles from India’s coastline.

Who Must Register?

Businesses making supplies from territorial waters must register in the nearest coastal state.

Example

An offshore drilling vessel supplying services 10 nautical miles from Mumbai coast must register in Maharashtra, not in the ocean zone.

This avoids confusion about jurisdiction.

5. Registration for SEZ Units and Developers

Special Economic Zones (SEZs) have their own rules:

SEZ unit must have separate GST registration

Even if the entity already has a GSTIN in the same state.

SEZ developer must also have separate registration

Supplies to SEZ are zero-rated

Suppliers treat them as exports.

6. Display of GST Registration Certificate (Section 25(6))

Every registered person must:

- Display the GST registration certificate at the premises

- Display GSTIN on signboards and invoices

Failure to display

May result in penalty under Section 125.

7. Bank Account Requirement

Bank account must be:

- In the name of the business

- Linked to PAN (except proprietors)

- Updated within 30 days of registration

Without a valid bank account:

- ITC can be blocked

- Refunds cannot be processed

- Registration may be suspended

8. Legal Name vs Trade Name

In GST:

- Legal Name = Name on PAN

- Trade Name = Business brand name

Example:

- Legal Name: Aman Kumar

- Trade Name: Aman Electronics Store

Both must be correctly shown in GST registration.

9. Distinct Persons (Important Registration Concept)

A person registered in different states is treated as distinct persons for GST.

Example: A company with branches in Delhi, Gujarat, and Karnataka has:

3 different GSTINs → treated as 3 distinct taxable persons.

This affects:

- ITC

- Invoicing

- Cross-charge

- Compliance

10. Registration for ISD (Input Service Distributor)

An ISD registration is required when:

- A head office receives invoices for services used by branches

- ITC must be distributed among branches

Example: Head office in Mumbai gets advertising services for all branches. It must distribute ITC to branches using ISD registration.

11. Voluntary Registration

Even if turnover is below threshold, a business may voluntarily register.

Benefits:

- Can issue GST invoices

- Can claim ITC

- Better business credibility

- Required by many corporate clients

Drawback:

- Must file returns regularly

- Full compliance required

12. Proper Officer for Registration

GST law defines:

- Jurisdictional officer

- Role of commissioner

- Powers for site verification

- Approval and rejection powers

Having clarity helps in resolving disputes.

Examples to Understand Special Concepts

Example 1: Deemed Registration

Officer delayed approval beyond 7 days → GST approved automatically.

Example 2: UIN Refund

UNICEF pays GST on hotel bookings → files GSTR-11 → receives refund.

Example 3: Offshore Business

A company drilling oil 8 nautical miles off Chennai coast registers in Tamil Nadu.

Example 4: SEZ Unit

A software company in Chennai SEZ must take separate GST registration as “SEZ Unit”.

Example 5: ISD

Head office distributes ₹50,000 ITC to two branches via ISD registration.

Conclusion

This chapter of GST registration contains several special concepts that apply to embassies, government bodies, offshore businesses, SEZ units, and multi-state companies. Understanding these provisions ensures complete GST compliance and prevents registration-related disputes.

These concepts—deemed registration, UIN, territorial water rules, SEZ registration, ISD, and display requirements—are all essential parts of GST law even though they are not commonly discussed.

FAQs

1. What is deemed registration under GST?

Automatic approval of GST registration when the officer fails to act within the prescribed timeline.

2. What is a UIN in GST?

A special identity number for embassies, consulates, UN bodies to claim GST refunds.

3. Who needs ISD registration?

A head office distributing ITC to branches.

4. What are territorial waters in GST?

Supplies made within 12 nautical miles require GST registration in the nearest coastal state.

5. Do SEZ units need separate GST registration?

Yes. SEZ units require a separate GSTIN even within the same state.

6. Can TDS/TCS entities get regular GST registration?

No. They receive special TDS/TCS registration only.

7. Why is the GST certificate display mandatory?

To verify authenticity and ensure transparency at business premises.