In GST, most valuation problems are solved using Section 15 and the standard Valuation Rules (27–31). But certain industries don’t fit into the normal definition of “price actually paid or payable.” Think of businesses like:

- Money changers

- Air travel agents

- Life insurance companies

- Forex brokers

- Mutual fund distributors

These businesses don’t work on a fixed product price. Their income is derived from margins, commission, agency fees, premium components, or conversion spread. That’s why GST has a separate, simplified valuation method under Rule 32 for these sectors.

Let’s break it down category by category.

1. Why Rule 32 Exists?

Rule 32 provides optional, simplified, and sometimes presumptive methods for valuation.

The main reason these special rules exist is:

- The normal transaction value cannot be applied easily to services like foreign currency exchange, insurance, or air travel booking.

- Their earnings often come from spreads or commissions, not a straightforward price.

So GST gives them a special “shortcut valuation” method.

2. Foreign Currency Exchange Services – Rule 32(2)

Money changers earn income through:

- currency conversion rate difference

- commission

- service fee

- hidden margin in exchange rate

Because these margins are not always disclosed clearly, GST provides two methods:

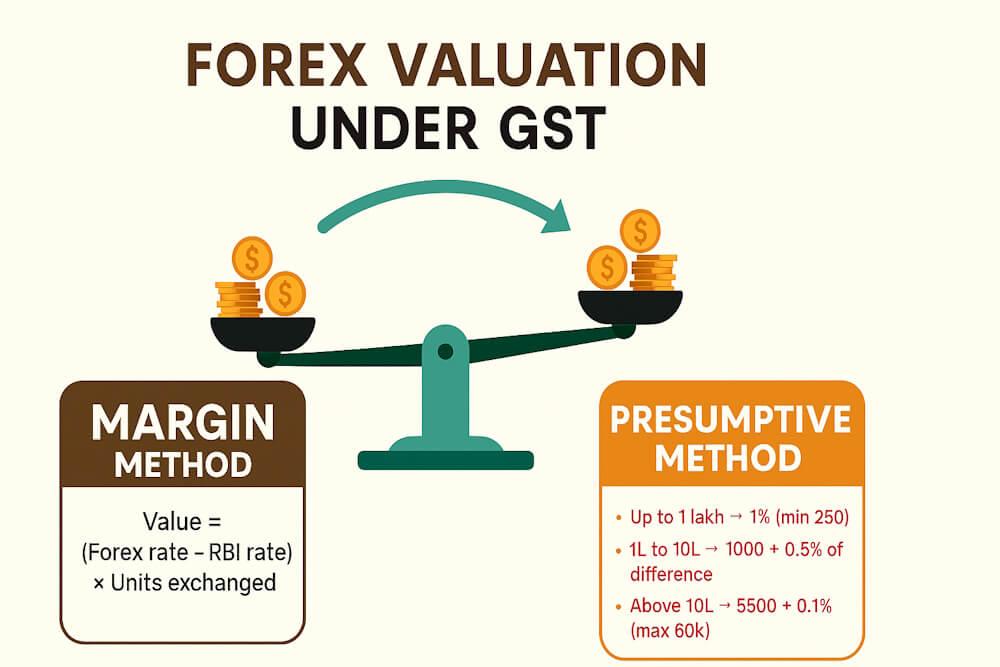

- Method A — Margin method (difference between buying/selling rate and RBI rate)

- Method B — Fixed percentage-based method (presumptive taxation)

The service provider can choose either method, but must stick to it for the entire financial year.

Let’s break them down.

2.1 Method A — Difference Between Exchange Rate and RBI Rate

This method is used when:

- You know the RBI reference rate

- You disclose your own rate

- You want GST on exact margin

Formula:

“Value of supply = (Money changer's rate – RBI reference rate) × Units converted ”

If INR is not involved, then rate is compared with another RBI notified rate.

Example

Customer converts USD to INR.

- Amount converted: 1,000 USD

- RBI reference rate: ₹82 per USD

- Money changer rate: ₹83 per USD

Margin = ₹1 per USD

- Value of supply = 1,000 × 1 = ₹1,000

- GST applies on ₹1,000.

Simple.

2.2 Method B — Fixed Percentage Method (Optional)

If the money changer wants a simpler method, GST gives a fixed presumptive valuation:

For amount ≤ ₹1,00,000. Value = 1% of gross amount (min ₹250)For amount between ₹1,00,000 and ₹10,00,000. Value = ₹1,000 + 0.5% of amount above ₹1,00,000For amount > ₹10,00,000. Value = ₹5,500 + 0.1% of amount above ₹10,00,000 (max ₹60,000)

Let’s work through examples.

Example 1 — Amount Up to ₹1,00,000

Amount exchanged: ₹60,000

Value = 1% of 60,000 = ₹600 (≥ 250)

So GST on ₹600.

Example 2 — Amount Between ₹1,00,000 and ₹10,00,000

Amount exchanged: ₹4,00,000

- Value = ₹1,000 + 0.5% of (4,00,000 – 1,00,000)

- = ₹1,000 + 0.5% of 3,00,000

- = ₹1,000 + 1,500

- = ₹2,500

Example 3 — Amount Above ₹10,00,000

Amount exchanged: ₹25,00,000

- Value = ₹5,500 + 0.1% of amount above 10,00,000

- = ₹5,500 + 0.1% of 15,00,000

- = ₹5,500 + 1,500

- = ₹7,000

But maximum allowed = ₹60,000 → Here no issue.

Diagram: Forex Valuation Logic

Forex Valuation Logic

This helps students in exam revision.

3. Air Travel Agents – Rule 32(3)

Air travel agents do not earn the entire ticket value — they earn:

- Commission

- Airline incentive

- Service fees

But since this varies from airline to airline, GST creates a simplified valuation.

Rule 32(3):

For Domestic Bookings → Value = 5% of basic fareFor International Bookings → Value = 10% of basic fare

Let’s unpack this.

Understanding "Basic Fare"

Basic fare means:

The portion of price on which airline pays commission to the agent

It does NOT include:

- Fuel surcharge

- Airport fees

- Taxes

- Add-ons

So GST applies not on ticket value but on basic fare.

Example 1 — Domestic Ticket

Air ticket price breakup:

- Basic fare = ₹4,000

- Fuel surcharge = ₹1,500

- Airport taxes = ₹1,000

- Total ticket = ₹6,500

Rule 32 valuation:

- Value = 5% of basic fare

- = 5% of 4,000

- = ₹200

GST = 18% of 200 = ₹36

Example 2 — International Ticket

- Basic fare = ₹20,000

- Other charges = ₹8,000

Value = 10% of 20,000 = ₹2,000

GST = 18% of 2,000 = ₹360

Why This Rule Exists?

Because:

- Agents do not earn entire ticket value

- Commission varies between airlines

- Airlines sometimes give incentives not directly tied to ticket value

So GST uses a standard percentage.

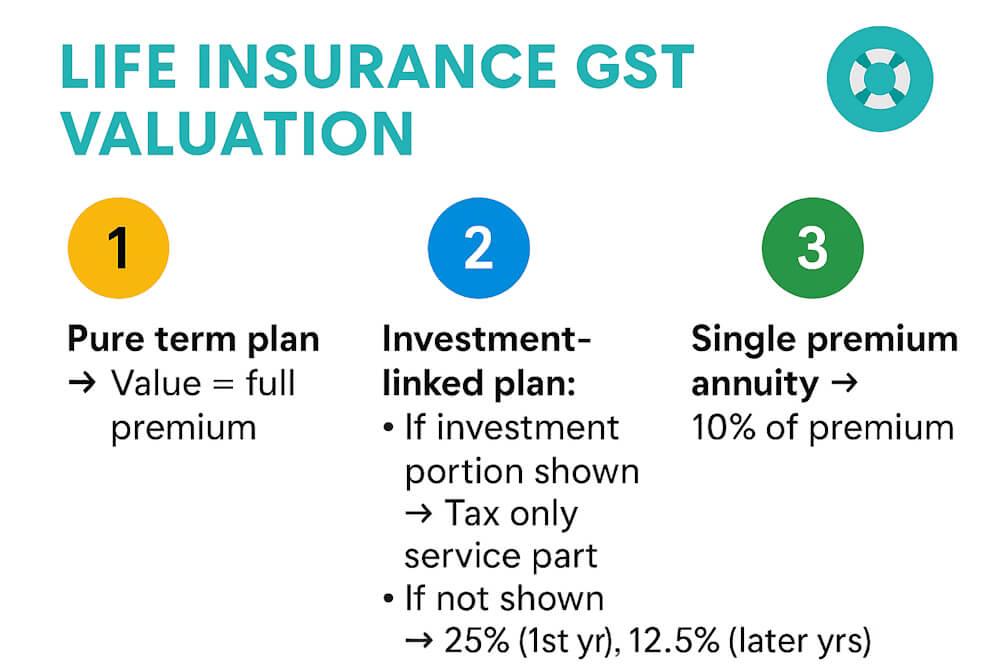

4. Life Insurance Services – Rule 32(4)

Insurance premiums include multiple components:

- Premium for risk cover

- Investment component

- Charges for fund management

- Rider premiums

- Admin expenses

- Surrender charges

It’s difficult to identify the “pure” service portion. Rule 32 gives clarity.

Rule 32(4) breaks it into:

- Pure life insurance (risk only)

- Life insurance with savings component (ULIP/Endowment)

- Single premium annuity policies

- First-year & renewal premium differences

Let’s go category by category.

4.1 Pure Life Insurance (Term Insurance)

- Premium = ONLY risk cover.

- No investment return.

Value = Entire premium.

Example

- Premium = ₹12,000

- Value of supply = ₹12,000

- GST @18% = ₹2,160

4.2 ULIP / Endowment / Money-Back Policies

(Where premium includes savings + risk)

Rule says:

“Value = Gross premium – Sum allocated for investment purposes (if shown separately) ”

Only the service component is taxable.

Example

- Annual premium = ₹50,000

- Investment portion (clearly shown) = ₹42,000

Value = 50,000 – 42,000 = ₹8,000,

GST = 18% of 8,000 = ₹1,440

4.3 If Investment Portion Is NOT Separately Shown

GST gives a percentage method:

“First-year premium → 25% taxable,Subsequent years → 12.5% taxable ”

Example

Annual premium (not separated) = ₹40,000

First year:

Value = 25% × 40,000 = ₹10,000

Next years:

Value = 12.5% × 40,000 = ₹5,000

4.4 Single Premium Annuity Policies

For policies like Jeevan Akshay where only one premium is paid:

“Value = 10% of single premium ”

Example

- Single premium = ₹5,00,000

- Value = 10% × 5,00,000 = ₹50,000

GST = 18% of 50,000 = ₹9,000

Diagram: Life Insurance Valuation

Life Insurance Valuation

5. Rule 32(5) – Second-hand Goods Dealers (Quick Note)

Although not required in your topic list, Rule 32 also covers:

- Used car dealers

- Second-hand goods sellers

But since your blog focuses on forex, travel agents, and insurance, we’ll skip detailed analysis here.

6. Common Questions and Doubts

Students usually get confused with:

Whether forex must choose RBI method or percentage method?

They can choose ANY one for whole year.

Whether GST on international ticket is different?

Yes—10% valuation instead of 5%.

Whether fuel surcharge is part of basic fare?

No.

Whether investment portion of insurance can be estimated?

Only if not separately shown → use percentages.

Whether surrender charges are taxable?

Yes—part of service.

7. Practical Business Impact

Forex Dealers

Get predictable valuation even if margins vary.

Travel Agents

Don’t worry about complex commission breakup.

Insurance Companies

Clarity on taxable and non-taxable portions of premium.

8. Quick Summary Table

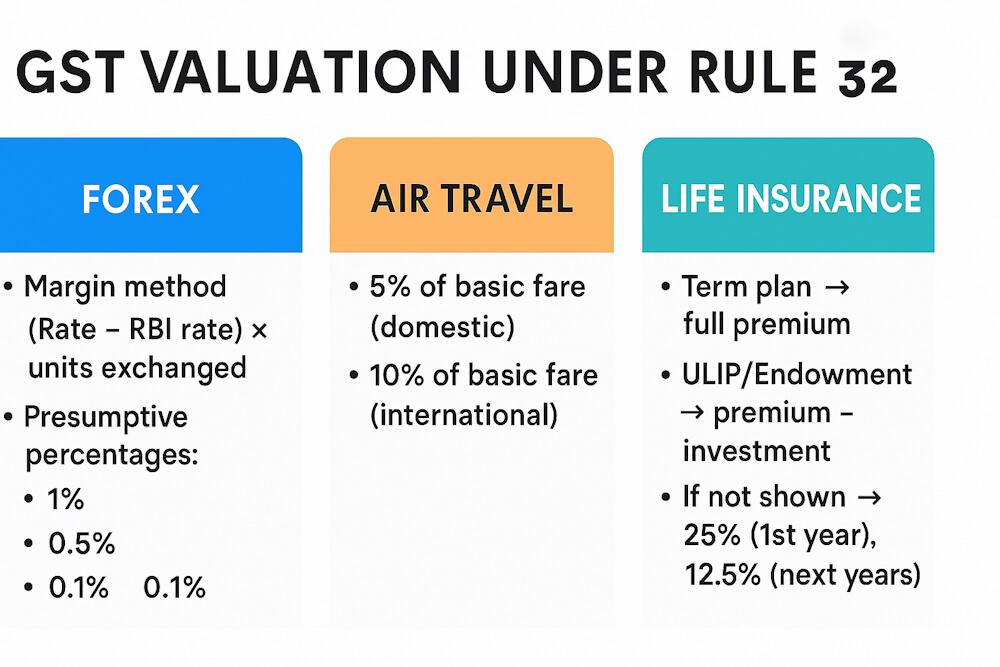

RULE 32 SUMMARY:

FOREX:

1. Margin method

2. Presumptive percentages (1%, 0.5%, 0.1%)

AIR TRAVEL AGENTS:

- 5% of basic fare (domestic)

- 10% of basic fare (international)

LIFE INSURANCE:

- Term plan → full premium

- ULIP/Endowment → premium – investment

- If not shown → 25% (1st year), 12.5% (next years)

- Single premium annuity → 10% of premium

FOREX:

- Margin method

- Presumptive percentages (1%, 0.5%, 0.1%)

AIR TRAVEL AGENTS:

- 5% of basic fare (domestic)

- 10% of basic fare (international)

LIFE INSURANCE:

- Term plan → full premium

- ULIP/Endowment → premium – investment

- If not shown → 25% (1st year), 12.5% (next years)

- Single premium annuity → 10% of premium

Final Thoughts

Rule 32 is honestly one of the most practical and student-friendly valuation rules in GST. It reduces complexity, gives clarity to specialized industries, and makes compliance predictable. Whether you're a student preparing for exams or a professional helping clients, knowing these rules helps you instantly determine GST liability without overthinking.

If you understand the logic behind each category and remember the percentages, Rule 32 becomes one of the easiest scoring chapters.