If there’s one small detail that causes big GST problems, it’s the HSN code. Many businesses either ignore it, use the wrong one, or copy it blindly from old invoices. Everything seems fine—until a notice arrives asking why the tax rate doesn’t match the classification.

In this blog, we’ll break down HSN code rules under GST in a very simple way—what HSN means, how many digits you need, where it’s mandatory, and what mistakes you should seriously avoid.

What Is an HSN Code?

HSN stands for Harmonised System of Nomenclature.

It’s an internationally accepted system used to:

- Classify goods

- Apply correct tax rates

- Standardise reporting

GST adopted HSN to ensure uniform classification across India.

Simply put:

“HSN code tells the government what exactly you are selling.”

Why HSN Codes Are Important in GST

HSN codes directly affect:

- GST tax rate

- Invoice correctness

- Return matching

- ITC eligibility

A wrong HSN can mean:

- Underpaid or overpaid tax

- ITC mismatch

- Interest and penalties

That’s why GST officers pay close attention to HSN during audits.

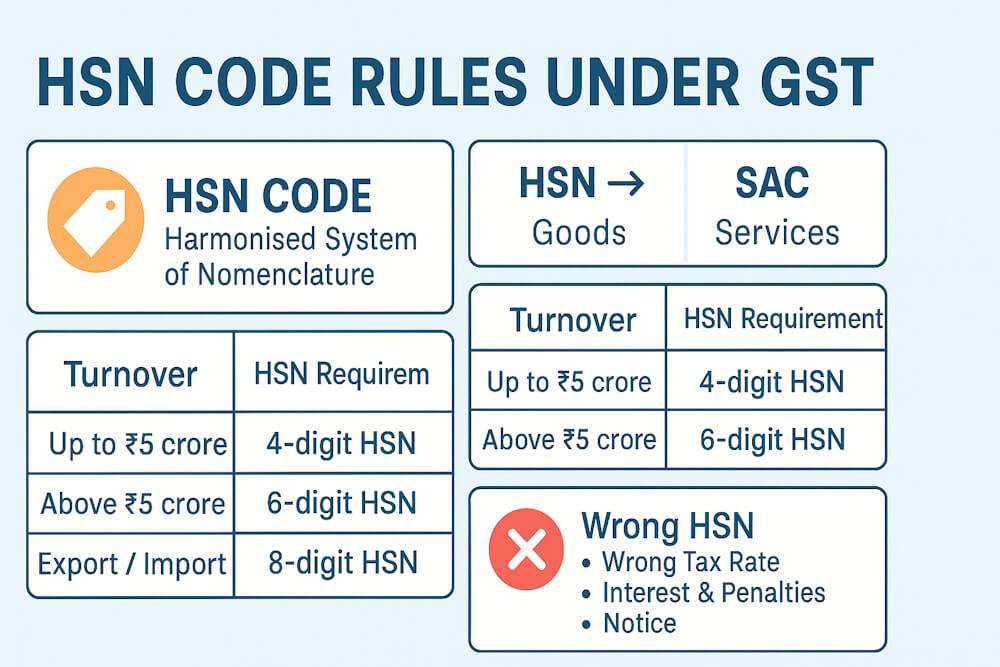

HSN Code Rules Based on Turnover

GST doesn’t treat everyone the same. HSN digit requirement depends on annual turnover.

Current Rules:

| Turnover | HSN Requirement |

| Up to ₹5 crore | 4-digit HSN |

| Above ₹5 crore | 6-digit HSN |

| Export / Import | 8-digit HSN |

Using fewer digits than required makes the invoice non-compliant.

Is HSN Mandatory on All GST Invoices?

Yes, in most cases.

HSN must be mentioned on:

- Tax invoices

- Credit notes

- Debit notes

Relaxation applies only in limited B2C cases, but even there, HSN is strongly recommended for safety.

This ties directly with Rule 46, which we discussed earlier.

HSN vs SAC – Don’t Mix Them Up

| Code Type | Used For |

| HSN | Goods |

| SAC | Services |

Using SAC for goods or HSN for services is a common but serious mistake.

Where Exactly Is HSN Mentioned in an Invoice?

HSN code is usually mentioned:

- Against each line item

- Near description of goods

It must match:

- Nature of goods

- Tax rate applied

This also links with tax invoice rules for goods, discussed earlier.

What Happens If You Use the Wrong HSN Code?

This is where problems begin.

Wrong HSN can lead to:

- Wrong GST rate

- Short payment of tax

- Interest on differential tax

- Penalties

- Department notices

In some cases, buyer’s ITC can also be denied.

Common HSN Mistakes Businesses Make

- Copying HSN from competitors

- Using outdated HSN codes

- Using 2-digit HSN when 4 digits are required

- Applying wrong tax rate with correct HSN

- Same HSN for different goods

These issues usually surface during:

- GST audit

- Scrutiny assessment

- ITC mismatch cases

HSN Codes in E-Invoicing

If e-invoicing applies to you:

- HSN is mandatory

- Incorrect HSN can lead to IRP rejection

- QR code validation depends on correct classification

So accuracy becomes even more important.

Practical Tip: How to Choose the Correct HSN

- Refer to GST rate schedules

- Use CBIC notifications

- Check explanatory notes

- Consult professional if confused

- Don’t guess

Spending 10 minutes here can save months of trouble later.

How HSN Connects With Other GST Rules

HSN doesn’t work alone. It connects with:

- Tax invoice rules for goods

- Mandatory invoice fields (Rule 46)

- GST returns (GSTR-1 & 3B)

That’s why HSN errors often affect multiple compliance areas at once.

Recommended Reading

To understand HSN codes in the full GST invoicing context, you should also read:

- Start with the basics in Understanding GST Tax Invoices: A Simple Beginner Guide to know why invoices drive the entire GST system.

- If you deal in physical products, GST Tax Invoice Rules for Goods: Time, Format & Cases explains where and how HSN must be shown in goods invoices.

- Service providers should compare HSN with SAC in GST Tax Invoice Rules for Services: Time, Limits & Use to avoid classification errors.

- For long-term or recurring contracts, Continuous Supply Under GST: Goods vs Services Explained helps you apply HSN correctly in periodic invoices.

- To understand where HSN fits inside invoice structure, read Mandatory Fields of GST Tax Invoice: Rule 46 Explained.

Together, these guides form a complete GST invoicing series.

FAQs

1. Is HSN mandatory for small businesses?

Yes, if turnover exceeds prescribed limits. Even otherwise, it’s recommended.

2. Can one product have multiple HSN codes?

No. One product should fall under one correct classification.

3. Is HSN required for B2C invoices?

In many cases yes, especially if turnover exceeds limits.

4. What if GST rate changes for an HSN?

You must update tax rates immediately.

5. Can wrong HSN block ITC?

Yes. ITC can be denied if classification is incorrect.

6. Is HSN needed on delivery challan?

Not mandatory, but recommended for clarity.