With the evolution of accounting practices in India, three terms are frequently used and often confused—Accounting Standards (AS), Indian Accounting Standards (Ind AS), and International Financial Reporting Standards (IFRS). Students, professionals, and even business owners often ask: What is the difference between AS, Ind AS, and IFRS? Why do all three exist? Which one applies to whom?

Understanding these differences is essential to grasp how Indian accounting has transitioned from a purely domestic framework to a globally aligned reporting system. This blog explains Ind AS vs AS vs IFRS, their meanings, scope, objectives, and key differences in a simple and structured way.

Understanding Accounting Standards (AS)

Accounting Standards (AS) refer to the traditional accounting standards issued in India before the introduction of Ind AS. These standards were framed by the Institute of Chartered Accountants of India (ICAI) and notified by the Ministry of Corporate Affairs (MCA).

Key Features of AS

- Designed mainly for domestic reporting

- Largely rule-based in nature

- Focus on historical cost accounting

- Limited use of fair value

- Less extensive disclosure requirements

AS served as the backbone of Indian financial reporting for many years and brought uniformity and discipline in accounting practices.

Understanding Indian Accounting Standards (Ind AS)

Ind AS are accounting standards notified by the Government of India that are converged with IFRS. They were introduced to align Indian financial reporting with global standards while considering domestic legal and economic conditions.

Key Features of Ind AS

- IFRS-converged standards

- Principle-based approach

- Greater use of fair value

- Emphasis on substance over form

- Extensive disclosure requirements

Ind AS represents a significant shift from traditional AS and reflects India’s integration with global capital markets.

Understanding International Financial Reporting Standards (IFRS)

IFRS are global accounting standards issued by the International Accounting Standards Board (IASB). They are used in more than 100 countries across the world.

Key Features of IFRS

- Globally accepted reporting framework

- Highly principle-based

- Extensive use of fair value accounting

- Strong focus on transparency and comparability

- Designed for cross-border financial reporting

IFRS aims to provide a common financial language for global investors and regulators.

“The applicability of AS, Ind AS, and IFRS depends largely on company size and regulatory requirements, which are clearly defined under the roadmap for Ind AS implementation in India.”

Why Do AS, Ind AS, and IFRS Coexist?

The coexistence of AS, Ind AS, and IFRS is a result of:

- Different sizes and types of entities

- Domestic legal requirements

- Global integration of Indian businesses

Small and medium entities continue with AS, large and listed companies follow Ind AS, and IFRS acts as the global benchmark influencing Ind AS.

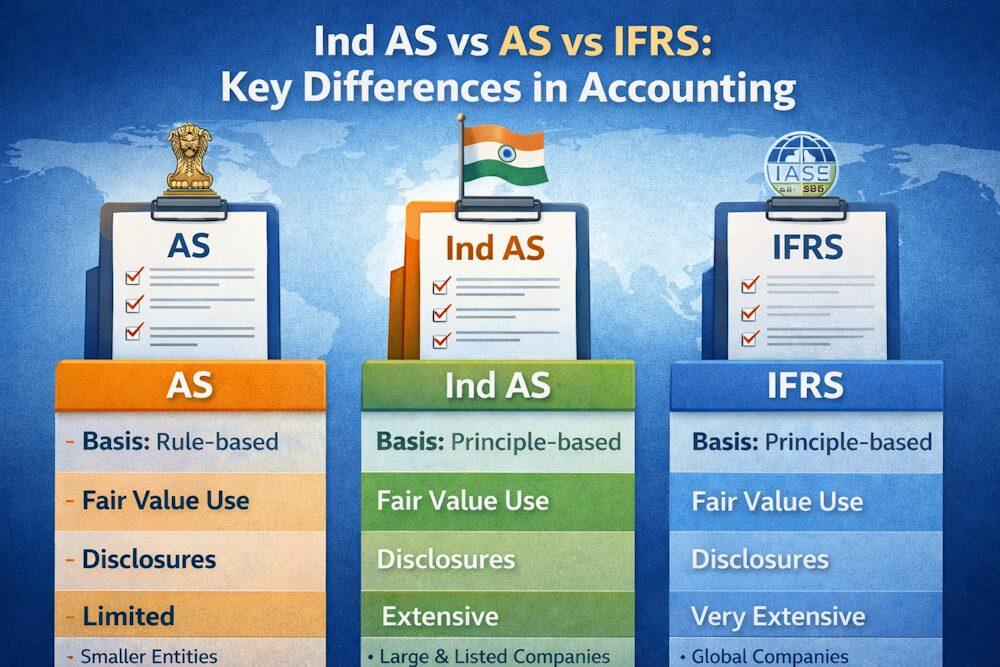

Key Differences Between AS, Ind AS, and IFRS

1. Basis of Accounting

- AS: Mainly rule-based

- Ind AS: Principle-based with guidance

- IFRS: Fully principle-based

Principle-based standards allow more professional judgment compared to rigid rules.

2. Global Alignment

- AS: Not aligned with IFRS

- Ind AS: Converged with IFRS (with carve-outs and carve-ins)

- IFRS: Global standard itself

Ind AS bridges the gap between domestic standards and IFRS.

3. Use of Fair Value

- AS: Limited use of fair value

- Ind AS: Significant use of fair value

- IFRS: Extensive reliance on fair value

Fair value accounting improves relevance but increases complexity.

4. Disclosure Requirements

- AS: Minimal disclosures

- Ind AS: Extensive disclosures

- IFRS: Very detailed disclosures

Greater disclosures enhance transparency and investor confidence.

5. Treatment of Financial Instruments

- AS: Simplified and limited guidance

- Ind AS: Complex and detailed treatment

- IFRS: Highly comprehensive framework

Ind AS and IFRS provide advanced guidance for modern financial instruments.

6. Consolidation and Group Reporting

- AS: Limited consolidation requirements

- Ind AS: Mandatory consolidation with detailed rules

- IFRS: Robust consolidation framework

This makes Ind AS and IFRS more suitable for multinational groups.

7. Revenue Recognition

- AS: Rule-based revenue recognition

- Ind AS: Based on transfer of control

- IFRS: Uniform global revenue model

Ind AS follows IFRS principles in recognising revenue.

8. Applicability

- AS: Small and medium entities

- Ind AS: Listed and large unlisted companies

- IFRS: Companies operating in IFRS-adopting countries

Applicability depends on size, listing status, and regulatory requirements.

Tabular Comparison: Ind AS vs AS vs IFRS

| Basis | AS | Ind AS | IFRS |

| Nature | Rule-based | Principle-based | Principle-based |

| Global alignment | No | Yes (converged) | Yes |

| Fair value | Limited | Significant | Extensive |

| Disclosures | Limited | Extensive | Very extensive |

| Applicability | Smaller entities | Large & listed entities | Global companies |

| Issuing authority | ICAI / MCA | MCA (based on ICAI & NFRA) | IASB |

Impact on Financial Statements

The choice of accounting framework affects:

- Reported profits

- Asset and liability values

- Disclosure quality

- Comparability across companies

Ind AS and IFRS often result in more volatile but realistic financial results due to fair value measurement.

Which Framework Is Better?

There is no single “best” framework. Each serves a purpose:

- AS is simple and suitable for smaller entities

- Ind AS balances global standards with Indian realities

- IFRS provides maximum global comparability

The selection depends on regulatory requirements and business scale.

Importance for Students and Professionals

Understanding the differences between AS, Ind AS, and IFRS is critical for:

- Professional exams

- Financial statement analysis

- Corporate compliance

- Cross-border transactions

These concepts are frequently tested and applied in practice.

Future of Accounting Standards in India

Over time:

- Use of Ind AS is expected to expand

- Differences with IFRS may reduce

- Global convergence will strengthen

However, AS will continue to exist for smaller entities to ensure simplicity and cost-effectiveness.

Conclusion

AS, Ind AS, and IFRS represent different stages in the evolution of accounting standards in India. AS laid the foundation for uniform reporting, Ind AS aligned India with global practices, and IFRS acts as the international benchmark.

Understanding Ind AS vs AS vs IFRS helps learners and professionals appreciate how Indian accounting has progressed from domestic focus to global relevance, while still balancing legal and economic realities. This knowledge is essential in today’s interconnected financial world.

FAQs

1: What is the main difference between AS and Ind AS?

AS are traditional, rule-based Indian Accounting Standards, while Ind AS are IFRS-converged, principle-based standards with greater use of fair value and disclosures.

2: How is Ind AS different from IFRS?

Ind AS is converged with IFRS but includes carve-outs and carve-ins to suit Indian laws and economic conditions, whereas IFRS is applied globally without country-specific modifications.

3: Why does India follow both AS and Ind AS?

India follows AS for smaller entities to maintain simplicity, while Ind AS is applied to large and listed companies to ensure global comparability.

4: Which accounting framework uses fair value the most?

IFRS uses fair value most extensively, followed by Ind AS, while AS relies mainly on historical cost.

5: Are disclosure requirements the same under AS, Ind AS, and IFRS?

No. Disclosure requirements are limited under AS, more extensive under Ind AS, and most detailed under IFRS.

6: Which companies are required to follow Ind AS?

Listed companies and large unlisted companies meeting prescribed net worth criteria are required to follow Ind AS.

7: Is IFRS mandatory in India?

No. IFRS is not directly mandatory in India. Instead, India follows IFRS-converged standards known as Ind AS.