Every business operates inside an industry — and every industry has a life of its own. It grows, matures, slows down, and sometimes stagnates. Understanding where an industry stands in its lifecycle isn't just useful for economists and analysts. It's practical knowledge that shapes investment decisions, hiring strategies, and long-term business planning.

So what does it really mean when we say an industry is "growing" or "stagnant"? And how should businesses respond when the momentum starts to fade?

Let's break it all down.

What Is a Growth Industry?

A growth industry is one that consistently achieves a higher-than-average rate of expansion compared to the broader economy. These industries tend to be pioneering spaces — they're introducing new products, new services, or entirely new ways of doing things.

Think about the smartphone industry in its early years. A single handheld device that could browse the internet, take photos, play music, and run thousands of apps? That kind of innovation creates explosive consumer demand almost overnight. The smartphone industry became a textbook growth story.

More recently, biotech has taken on that same energy — particularly in India, which has emerged as the third-largest biotech destination in the Asia-Pacific region. The COVID-19 pandemic accelerated this growth dramatically, with Indian vaccines like Covishield and Covaxin not only protecting the country's massive population but also being distributed to more than 100 countries globally.

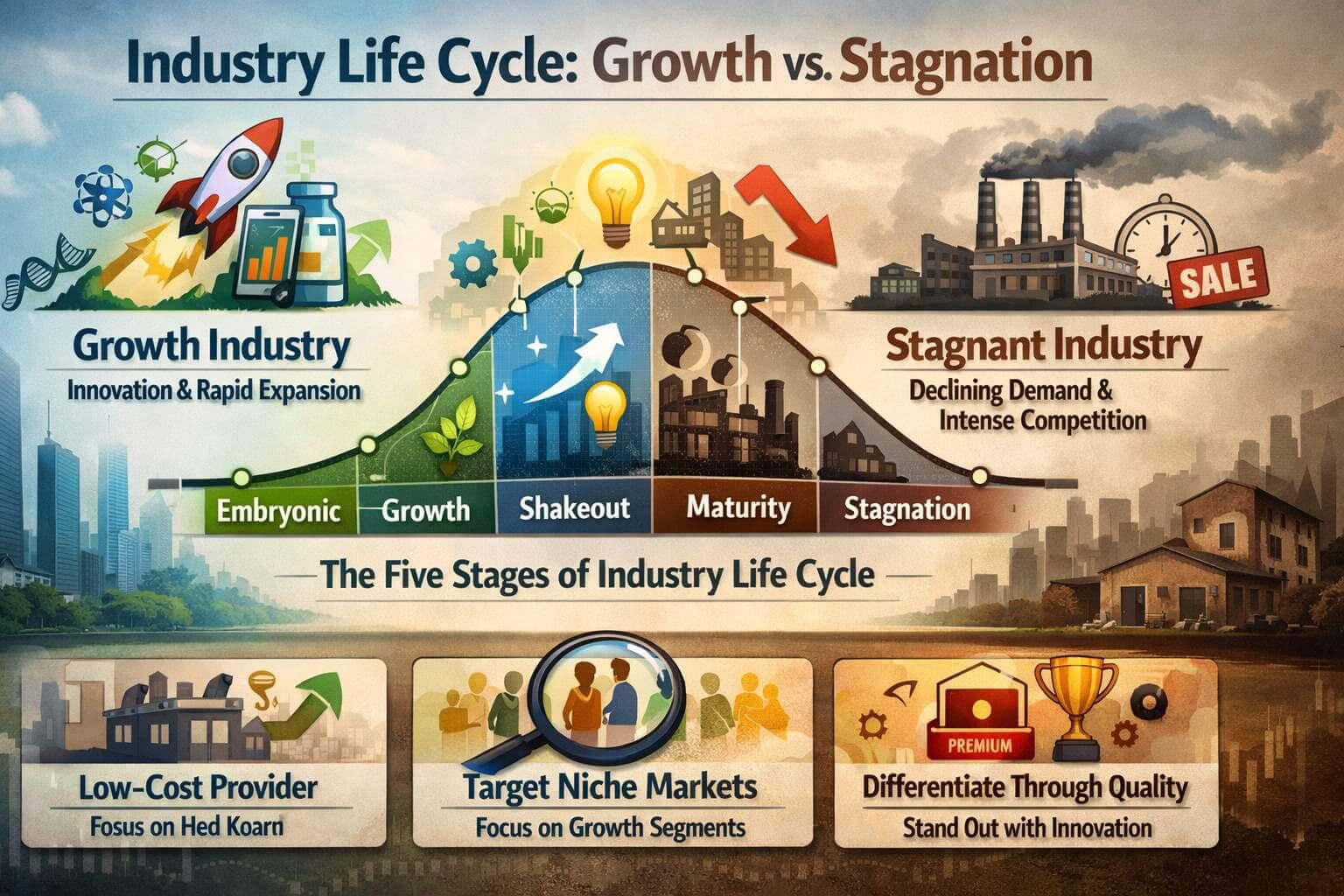

The Five Stages Every Industry Goes Through

No industry stays in the same phase forever. Whether we're talking about steel, software, or pharmaceuticals, industries tend to move through five recognizable stages over time.

Stage 1: The Embryonic Stage

This is the beginning — and it's not easy. Industries in their embryonic stage are characterized by high risk and heavy investment with little immediate return. Pricing flexibility is limited because the market is still figuring out what it wants, and growth is slow.

Think of this as the phase where companies are planting seeds, not harvesting crops. The technology is being developed, consumer awareness is low, and the path to profitability is uncertain. But this is also where the groundwork for everything that follows gets laid.

Stage 2: The Growth Stage

This is where things get exciting. The investments made during the embryonic phase start paying off. Key characteristics of the growth stage include low competition (relative to later stages), rapidly increasing demand, and improving profit margins.

What drives this? Often, it's a combination of innovative products attracting new consumers and complementary goods entering the market that make the core product even more valuable. Entrepreneurs and start-ups bring fresh technology and know-how, which keeps the cycle of innovation going.

Government policy also plays a significant role here. Take India's healthcare sector as an example. Schemes like Karnataka's Yeshasvini Health Insurance made medical care accessible to a far larger section of the population, directly stimulating growth. The central government has also committed to raising healthcare spending to 3% of GDP, allocated ₹35,000 crore for COVID vaccines in the 2021 Union Budget, and introduced a ₹500 billion credit incentive programme to build out healthcare infrastructure.

The results speak for themselves. The number of doctors with recognized medical qualifications in India rose from 827,006 in 2010 to 1,255,786 in 2020 — a reflection of sustained, policy-backed sector growth. The overall healthcare market is estimated to exceed 370 billion US dollars, driven by rising incomes, growing health awareness, and the increasing prevalence of lifestyle diseases such as diabetes, hypertension, and heart conditions.

Stage 3: The Shakeout Stage

After the growth surge comes a period of consolidation. The rapid pace of expansion slows, and competition becomes significantly more intense. Companies that coasted through the growth stage on momentum now have to fight for their share.

The shakeout stage forces businesses to get lean. Cost-cutting becomes a priority, and weaker players often exit the market or get absorbed by stronger ones. New entrants find it increasingly difficult to establish themselves. This is the stage that separates sustainable businesses from those that were just riding the wave.

Stage 4: The Maturity Stage

By this point, the industry is well-established. Growth continues, but at a much more modest pace. The competitive landscape has stabilized, and the focus shifts from acquiring new customers to retaining existing ones. Efficiency and scale matter more here than innovation and disruption.

Stage 5: The Stagnation (or Decline) Stage

This is the stage that no company wants to face — but many eventually do.

Understanding Stagnant Industries

A stagnant industry is one where demand has plateaued or begun to decline. Market valuations hold flat, employment growth stalls, and wage growth slows or stops. In some cases, the stagnation tips into outright decline.

The defining features of a stagnant industry include slow or falling demand relative to the broader economy, intensifying competition for a shrinking pool of customers, consolidation among players, and a general inability to attract new entrants.

It sounds bleak — and it can be. But stagnation doesn't have to mean failure. It does require a different kind of strategy.

How Should Companies Respond to Stagnation?

The instinct in a stagnating industry is often to do one of a few things: slash prices to poach customers, divert cash into other ventures, or pour money into improvements hoping the market will turn around. Industry analysts and strategists generally advise against all three of these impulses.

Instead, companies operating in stagnant industries are better served by aligning their performance targets with the actual opportunities the market still offers — not the opportunities they wish existed.

Three strategic approaches tend to work well in this environment:

Becoming the low-cost provider. When demand isn't growing, competing on price is one of the clearest ways to capture a larger share of what's available. But this requires genuine operational efficiency — not just aggressive discounting.

Targeting the fastest-growing segments. Even in a stagnant industry, some segments move faster than others. A focused strategy that identifies and serves those pockets of growth can sustain a company even when the broader industry isn't expanding.

Differentiating through quality or innovation. Premium positioning remains viable even in stagnation. If you can offer something meaningfully better than the competition — whether through product quality, customer service, or innovation — there will always be customers willing to pay for it.

Importantly, these approaches aren't mutually exclusive. A company can pursue cost efficiency in its operations while still differentiating on quality in its customer-facing offerings.

India's Growth Story: A Macro View

It's worth zooming out for a moment. Industrial growth and national economic growth are deeply intertwined — and India offers one of the most compelling case studies of the past two decades.

India has gone from the twelfth-largest economy in the world (2007) to one of the top five — a dramatic leap driven by several structural shifts: rapid growth in consumer households, a tripling of internet users by 2025, accelerating urbanization, major investments in infrastructure, and an expanding renewable energy sector.

These macro trends create the conditions for new growth industries to emerge. When hundreds of millions of people gain internet access, enter the middle class, and move to cities, entirely new markets open up. That's the environment in which biotech, healthtech, fintech, and clean energy are all growing so rapidly in India today.

Final Thoughts

Understanding where an industry sits in its lifecycle — embryonic, growth, shakeout, maturity, or stagnation — is one of the most practically useful frameworks in business strategy. It helps companies set realistic expectations, allocate resources wisely, and choose the right competitive approach for their current reality.

Growth industries reward boldness and innovation. Stagnant ones reward discipline and focus. The companies that thrive over the long run are the ones that know which game they're playing — and adjust accordingly.

Also Read: - Business Ethics in International Business: A Guide

Frequently Asked Questions (FAQs)

Q1: What is a growth industry, and how is it different from a mature industry?

A growth industry expands at a pace significantly faster than the overall economy, typically driven by new technology, innovation, or unmet consumer demand. A mature industry, on the other hand, has largely saturated its potential market and grows slowly, if at all. The competitive dynamics, investment strategies, and profitability profiles of the two are quite different.

Q2: What are the five stages of industry development?

Industries typically move through five stages: the embryonic stage (high risk, slow growth, heavy investment), the growth stage (rapid demand expansion, improving profits), the shakeout stage (slowing growth, intense competition), the maturity stage (stable but modest growth), and the stagnation or decline stage (flat or falling demand, market consolidation).

Q3: What causes an industry to stagnate?

Several factors can cause stagnation: market saturation (most potential customers already have the product), technological obsolescence (a newer solution has replaced the old one), demographic shifts, or simply the natural end of a long growth cycle. In some cases, regulatory changes or macroeconomic conditions also contribute.

Q4: Can a stagnant industry become a growth industry again?

Yes, though it's uncommon without a significant disruptive force. Technological breakthroughs, major regulatory changes, or entirely new use cases can reinvigorate a stagnant industry. The music industry, for example, saw stagnation followed by renewal when streaming platforms transformed how consumers access and pay for music.

Q5: Why is the biotech industry considered a growth industry in India?

India is currently the third-largest biotech destination in the Asia-Pacific region. The industry saw accelerated growth during the COVID-19 pandemic, with Indian vaccines being distributed globally. Government investment, growing healthcare infrastructure, and rising health awareness among a large population all continue to fuel the sector's expansion.

Q6: What strategic mistakes do companies in stagnant industries commonly make?

The three most common mistakes are engaging in destructive price wars that reduce profitability for everyone, diverting business cash into unrelated ventures too hastily, and over-investing in operational improvements based on the unrealistic hope that growth will return. Companies are better off aligning strategies with what the market actually offers rather than what they hope it will become.

Q7: How does government policy influence industry growth?

Government policy can be a major growth driver. Subsidies, tax incentives, public healthcare schemes, infrastructure investment, and trade policies all directly affect how quickly industries can expand. India's healthcare sector is a clear example — government initiatives like increased GDP spending on health, vaccine funding, and credit incentive programmes have directly contributed to sector-wide growth.