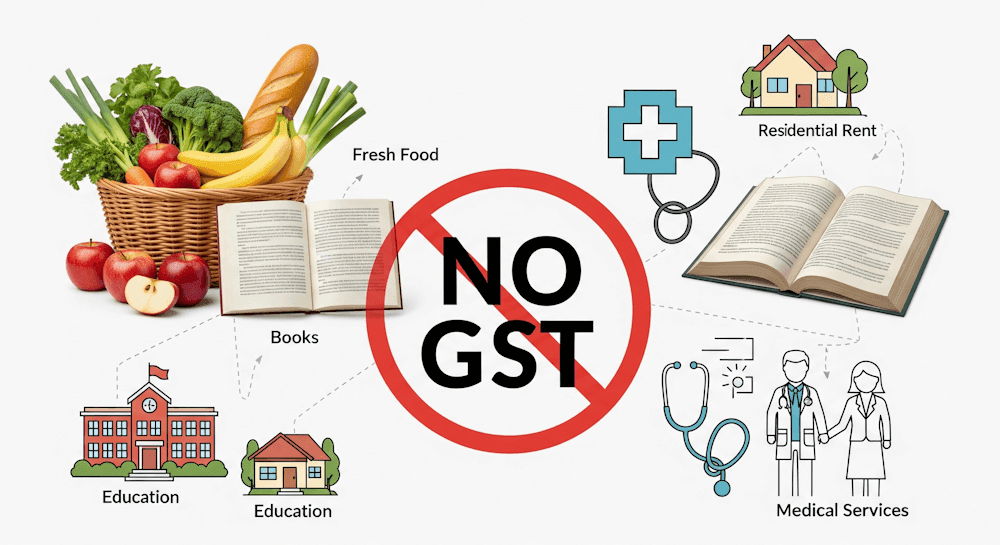

One of the core principles of the Goods and Services Tax (GST) regime is fairness — to make taxation efficient without burdening the common man. To achieve this, the government exempts a wide range of essential goods from GST. These exemptions ensure that basic necessities remain affordable, particularly for low-income households and sectors that are socially or economically sensitive.

Let’s explore the major categories of goods that are exempt from GST, along with illustrations and practical examples.

1. Food & Agricultural Products

This is the most significant group of exempted goods under GST. The government exempts food items that are unprocessed, unbranded, or meant for direct consumption to keep essential commodities affordable.

Examples of Exempt Food Items:

- Cereal grains like rice, wheat, maize, barley

- Pulses (dals) such as urad, moong, masoor, and chana dal

- Flour, atta, maida, suji and besan (if not branded)

- Milk and milk products (like curd, lassi, butter milk) — when unbranded and not in sealed containers

- Vegetables and fruits — fresh, uncut, unprocessed

- Eggs, meat, fish (except when frozen, branded, or processed)

- Salt — all types, including iodized salt

These items are listed under Entry Nos. 45 to 52 of Notification No. 2/2017-CT (Rate).

Illustration Example:

A local kirana shop sells loose rice, pulses, and fresh vegetables — all of which are unbranded and unpacked.

👉 These supplies are wholly exempt from GST.

However, if the same rice is branded and sold in a sealed pack, GST applies (5% generally).

2. Products of Natural Origin (Unprocessed Goods)

Goods that come directly from nature — with minimal or no processing — are generally exempt because they are primary produce.

Examples:

- Unprocessed cereals, fruits, nuts, and vegetables

- Fresh plants, flowers, leaves, and roots

- Raw silk, wool, and cotton fibers (before processing)

- Betel leaves, tender coconuts, natural honey

These are considered agricultural produce and fall under the exemption list because they are mostly used by rural sectors or low-margin suppliers.

3. Animal Husbandry & Dairy Products

To support farmers and small dairy units, many livestock-related goods are exempt from GST.

Examples:

- Live animals like cattle, buffaloes, goats, sheep, poultry, and fish

- Fresh milk (unbranded, unpacked)

- Animal semen used for breeding purposes

- Silkworm cocoons and raw silk

Example:

A dairy farmer selling fresh cow milk to a cooperative society — this transaction is fully exempt. However, flavored milk or milk-based drinks packed in bottles or tetra packs are taxable since they are processed and branded.

4. Agricultural Produce & Related Activities

Agricultural sector products are central to GST exemptions. Goods that are direct output of cultivation or used directly in farming are exempt.

Examples:

- Raw jute, cotton, and wool

- Seeds for sowing — like paddy, maize, cottonseed

- Manure and organic fertilizers (other than chemical)

- Tools used in manual agriculture — hand tools, sickles, ploughs

- Straw and husk of cereals and pulses

These are listed under Entries No. 103–106 in the exemption notification.

Illustration Example:

A farmer sells cotton seeds to a textile mill.

👉 Since cotton seed is used for sowing, it is exempt under GST. But once cotton is processed into yarn or fabric, it becomes taxable.

5. Educational and Cultural Supplies (Goods Segment)

Some goods used for education or cultural preservation are also exempt.

Examples:

- Printed books, newspapers, periodicals, and journals

- Maps and charts for educational purposes

- Manuscripts, music sheets, and art works for public libraries or educational institutions

These goods are considered part of the public knowledge sector, and therefore GST is not levied to promote learning and information access.

Example:

A publishing house supplies textbooks to a school.

👉 This sale is exempt from GST under Entry No. 119 of Notification 2/2017.

However, if the same publisher sells stationery or notebooks, those are taxable at 12–18%, depending on type.

6. Health & Sanitation Essentials

Some basic medical and hygiene goods are also exempt or kept at nil rate due to their public health significance.

Examples:

- Human blood and blood plasma

- Contraceptives

- Sanitary napkins (now at 0% GST after the 2018 amendment)

- Vaccines supplied to Government hospitals under specific schemes

These are either listed as exempt goods or are zero-rated under special notifications.

Example:

Supplies of human blood by blood banks to hospitals are exempt under Notification 2/2017.

Similarly, sale of sanitary napkins — earlier taxed at 12% — has been fully exempted post amendment, in the interest of women's hygiene and affordability.

7. Public Utility and Welfare-Based Goods

Some exemptions are provided for goods used in public welfare or charitable activities, especially when sold by government bodies or non-profits.

Examples:

- Handicraft products made by registered self-help groups

- Khadi fabric and Khadi garments sold through Government-approved outlets

- Goods supplied to defense canteens (CSDs) for armed forces

- Goods meant for disaster relief or charitable distribution

These exemptions reflect the social responsibility aspect of GST, ensuring that welfare-oriented goods aren’t taxed.

Example:

If the Khadi Village Industries Commission (KVIC) sells handmade khadi fabric directly to consumers, 👉 the sale is fully exempt from GST. However, if a private retailer sells branded khadi shirts, those are taxable.

8. Renewable Energy & Environmental Products

With India focusing on sustainability, renewable energy goods also receive exemption benefits.

Examples:

- Biogas

- Solar cookers, solar lanterns, and solar water heaters

- Wind mills and wind-operated water pumps

These exemptions encourage the use of clean energy and help reduce dependency on fossil fuels.

Example:

A manufacturer supplying biogas plants to a rural household cluster under a government scheme — this supply is exempt from GST.

9. Miscellaneous Exempted Goods

The list of exempt goods under Notification 2/2017 also includes several miscellaneous categories:

- Water (other than aerated, mineral, or bottled)

- Firewood and wood charcoal

- Bangles made of glass or plastic

- Clay idols and earthen pots

- Human hair (raw, unworked)

- Newspapers and periodicals

- Unbranded natural honey

These items represent low-income sectors or traditional goods that should not carry tax burdens.

10. Conditional Exemptions – When GST Applies Partially

Not all exemptions are absolute. Some goods are exempt only under specific conditions.

Examples:

- Bran of wheat or rice – exempt only when not branded.

- Puffed rice, papad, or khakhra – exempt if not branded and sold in loose form.

- Organic manure – exempt only when sold without chemical additives.

If these conditions aren’t met, normal GST rates (usually 5–12%) apply.

11. Understanding Zero-Rated vs Exempt Goods

Many people confuse “zero-rated” and “exempt” goods, but they’re different under GST law.

| Category | Tax Rate | ITC Claim | Example |

| Exempt Goods | 0% | ❌ Not Allowed | Unbranded food grains |

| Zero-Rated Goods | 0% | ✅ Allowed | Exports, SEZ supplies |

So, while both have no GST on the sale, zero-rated goods still allow Input Tax Credit, whereas exempt goods block ITC.

12. Practical Impact on Suppliers

Businesses dealing in exempt goods:

- Cannot charge GST to customers

- Cannot claim ITC on purchases used for making exempt supplies

- Must maintain separate books of accounts to identify exempt turnover

For small traders and agricultural suppliers, this is beneficial — less compliance, no tax collection burden.

13. Key Takeaways

- Most essential commodities and primary produce are exempt from GST under Notification 2/2017.

- Exempt goods cover unbranded food items, agricultural produce, and public welfare products.

- Conditional exemptions apply when goods are unbranded, unprocessed, or sold by certain entities.

- The GST Council reviews the list regularly to ensure balance between affordability and revenue.

- Businesses supplying exempt goods cannot claim ITC on related purchases.

- Exemptions help achieve social equity and economic support for key sectors like agriculture, health, and education.

14. Conclusion

GST exemptions for goods reflect the government’s policy of protecting essential needs while taxing luxuries. Items that form the backbone of daily living — food, education, health, and agriculture — are deliberately kept out of the tax net.

Through Notification No. 2/2017 and subsequent amendments, India’s GST framework ensures that the poor and middle-class consumers aren’t overburdened. These exemptions not only make essentials affordable but also promote fairness and inclusivity in India’s taxation system.