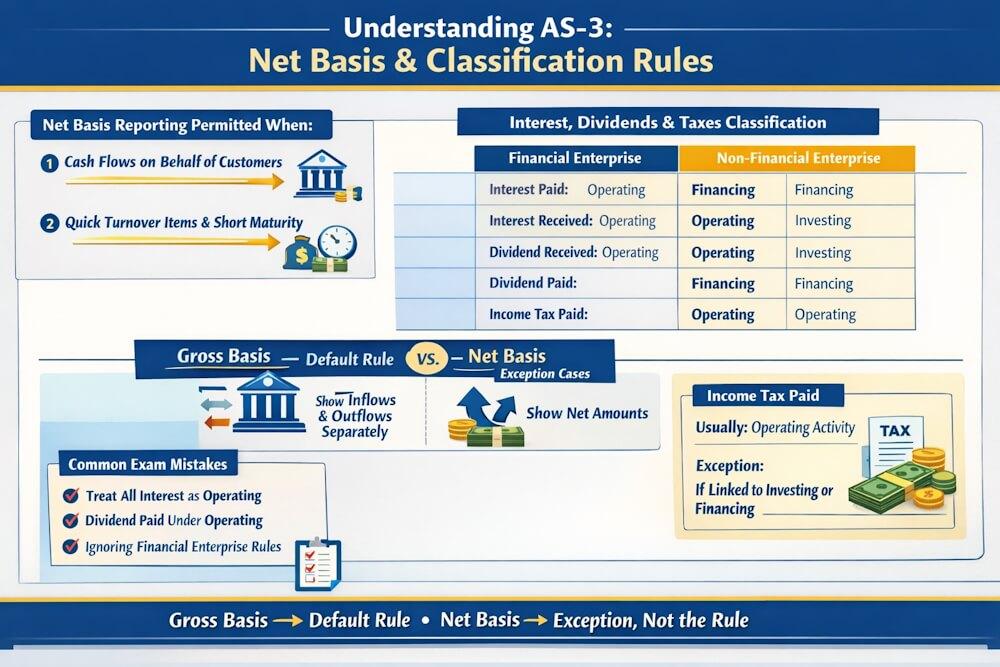

After understanding operating cash flows and the methods of preparation, Accounting Standard 3 (AS-3) moves into some special but very important reporting rules. These relate to net basis reporting and the classification of interest, dividends, and income tax.

These items look simple on the surface, but incorrect treatment can completely change the interpretation of a Cash Flow Statement. AS-3 therefore lays down clear rules to ensure consistency and comparability.

What Is Net Basis Reporting under AS-3?

Normally, AS-3 requires cash flows to be reported on a gross basis, meaning:

- Cash inflows and outflows are shown separately

- Netting is not encouraged

However, AS-3 allows net basis reporting in specific situations where showing gross figures would not add meaningful information.

When Is Net Basis Reporting Permitted?

AS-3 permits reporting cash flows on a net basis in the following cases:

1. Cash Flows on Behalf of Customers

When cash receipts and payments:

- Reflect activities of the customer rather than the enterprise, and

- Result in quick turnover

they may be reported on a net basis.

Example: A bank receiving and paying money on behalf of its customers.

2. Items with Quick Turnover, Large Amounts & Short Maturity

Cash flows may be reported on a net basis when they relate to:

- Items with short maturity

- Large volumes of cash

- Quick turnover

Examples include:

- Purchase and sale of investments

- Acceptance and repayment of deposits

- Advances made and recovered

Net Basis Reporting for Financial Enterprises

For financial enterprises, AS-3 specifically allows net reporting for:

- Loans and advances

- Acceptance and repayment of deposits

This is because such transactions form part of their core operating activities and involve rapid movement of funds.

Why Net Basis Reporting Is Restricted

AS-3 restricts net basis reporting because:

- Gross reporting provides more transparent information

- Netting may hide significant cash movements

- Users may lose insight into liquidity management

Therefore, net basis reporting is allowed only in clearly defined cases.

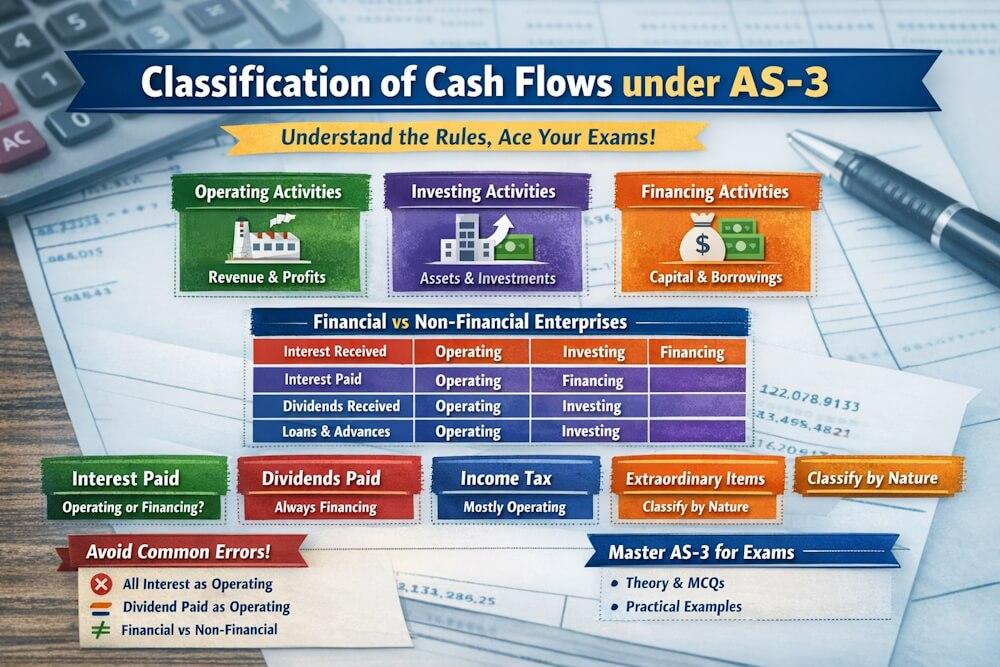

Treatment of Interest under AS-3

Interest is one of the most frequently tested areas under AS-3. Its classification depends on the nature of the enterprise.

Interest Paid

Classification Rule

- Financial enterprises → Interest paid = Operating activity

- Non-financial enterprises → Interest paid = Financing activity

Explanation

For financial enterprises, lending and borrowing are part of regular operations. Therefore, interest paid forms part of operating cash flows.

For non-financial enterprises, interest paid represents the cost of finance, not the core business activity.

Example

A manufacturing company pays interest on a term loan. This is classified as a financing cash outflow.

Interest Received

Classification Rule

- Financial enterprises → Interest received = Operating activity

- Non-financial enterprises → Interest received = Investing activity

Example

- A bank receives interest on loans → Operating cash inflow

- A trading company earns interest on fixed deposits → Investing cash inflow

Treatment of Dividends under AS-3

Dividends are treated differently depending on whether they are received or paid.

Dividend Received

Classification Rule

- Financial enterprises → Dividend received = Operating activity

- Non-financial enterprises → Dividend received = Investing activity

Example

A manufacturing company receives dividend on shares held as investments. This is an investing cash inflow.

Dividend Paid

Classification Rule

- Dividend paid is always classified as a financing activity

Reason

Dividend represents a return to shareholders and affects the capital structure of the enterprise.

Example

Dividend paid to equity shareholders of ₹3,00,000 → Financing cash outflow

Treatment of Income Tax under AS-3

General Rule

Income tax paid is generally classified as:

- Operating activity

This is because income tax arises from operating profits.

Exception to the Rule

If income tax can be specifically identified with:

- Investing activities, or

- Financing activities

then it should be classified accordingly.

Examples

- Capital gains tax paid on sale of land → Investing cash outflow

- If tax relates to multiple activities and cannot be identified separately → Shown under operating activities

Why AS-3 Gives This Treatment to Tax

AS-3 recognises that:

- Income tax is linked to profit generation

- In most cases, it is impractical to split tax precisely

Therefore, operating classification is the default treatment.

Combined Understanding: Interest, Dividends & Taxes

| Item | Financial Enterprise | Non-Financial Enterprise |

| Interest paid | Operating | Financing |

| Interest received | Operating | Investing |

| Dividend received | Operating | Investing |

| Dividend paid | Financing | Financing |

| Income tax paid | Operating (generally) | Operating (generally) |

This table is extremely important for exams.

Common Exam Mistakes to Avoid

Students often:

- Treat all interest as operating

- Show dividend paid under operating activities

- Forget special treatment for financial enterprises

- Net items that should be shown gross

Avoiding these mistakes can significantly improve scores.

Importance from Practical Perspective

Correct treatment of interest, dividends, and taxes:

- Improves comparability of cash flows

- Prevents misleading presentation

- Helps analysts assess financing costs and returns

Net basis reporting ensures clarity without unnecessary complexity.

Net Basis vs Gross Basis: A Final Reminder

- Gross basis → Default rule under AS-3

- Net basis → Exception, not the rule

Always check whether net reporting is specifically permitted.

“ This article explains how operating cash flows are calculated using the direct and indirect methods. For a complete understanding of Accounting Standard 3, including cash and cash equivalents, classification rules, net basis reporting, disclosures, and practical illustrations, refer to our Accounting Standard 3 (AS-3): Cash Flow Statement – Complete Guide.” ”

Conclusion

Accounting Standard 3 lays down clear but nuanced rules for net basis reporting and the treatment of interest, dividends, and income tax. These rules ensure that Cash Flow Statements remain meaningful, comparable, and transparent.

For students, this is a high-scoring topic if the rules are understood clearly. For practitioners, correct application prevents misclassification and enhances the quality of financial reporting.

FAQs

1: What is net basis reporting under AS 3?

Answer: Net basis reporting means presenting cash inflows and outflows after netting them off. AS 3 allows this only in specific cases such as cash flows on behalf of customers or items with quick turnover.

2: When does AS 3 allow net basis reporting?

Answer: AS 3 permits net reporting when cash flows relate to customers’ activities, have quick turnover, large amounts, and short maturity, especially for financial enterprises.

3: How is interest paid classified under AS 3?

Answer: For financial enterprises, interest paid is an operating activity. For non-financial enterprises, interest paid is classified as a financing activity.

4: How is interest received classified under AS 3?

Answer: Interest received is an operating cash flow for financial enterprises and an investing cash flow for non-financial enterprises.

5: How are dividends received treated under AS 3?

Answer: Dividend received is classified as an operating activity for financial enterprises and as an investing activity for non-financial enterprises.

6: How are dividends paid shown in the Cash Flow Statement?

Answer: Dividends paid are always classified as financing cash outflows under AS 3, as they represent returns to shareholders.

7: How is income tax paid classified under AS 3?

Answer: Income tax paid is generally classified as an operating activity unless it can be specifically identified with investing or financing activities.