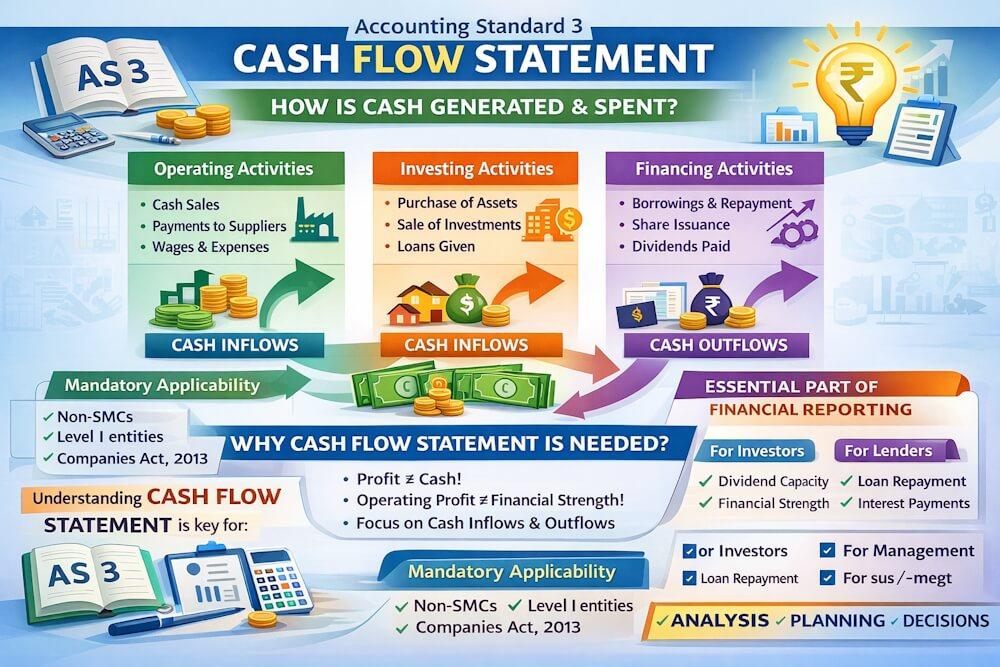

Among the three types of cash flows prescribed under Accounting Standard 3 (AS-3), cash flow from operating activities is considered the most important. This is because operating activities represent the core business operations of an enterprise and indicate whether the business is capable of generating sufficient cash from its normal activities.

AS-3 allows two methods for reporting cash flows from operating activities:

- Direct Method

- Indirect Method

Understanding these two methods clearly is essential not only for examinations but also for practical preparation of Cash Flow Statements.

Meaning of Cash Flow from Operating Activities

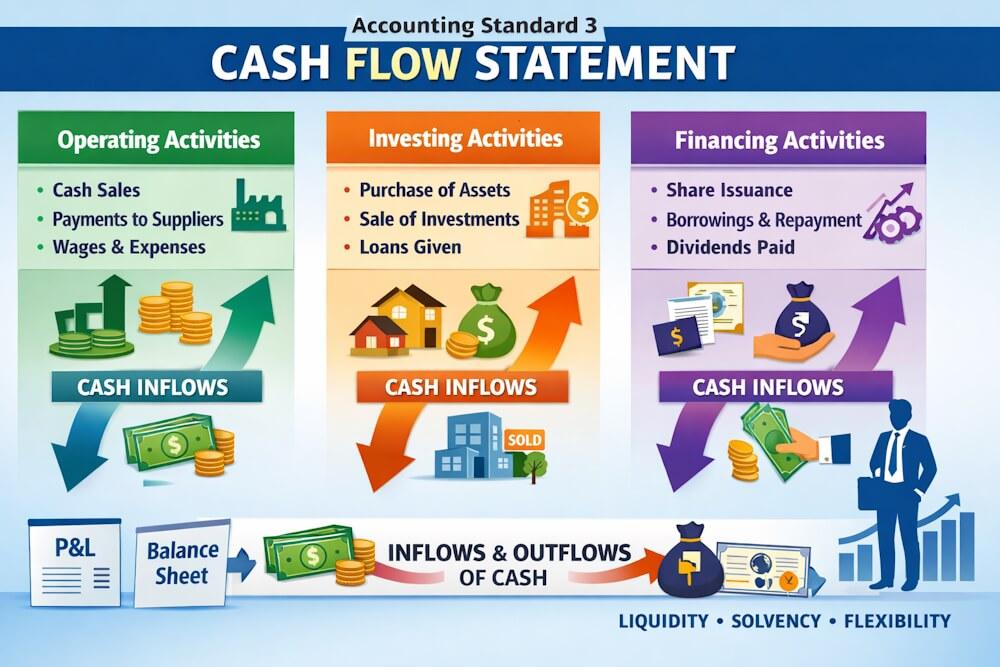

Cash flows from operating activities are the cash inflows and outflows arising from the principal revenue-producing activities of the enterprise. They also include other activities that are not classified as investing or financing activities.

In simple words, operating cash flows show how much cash is generated or used by the day-to-day business operations.

Examples of Operating Cash Flows

Operating Cash Inflows

- Cash received from customers

- Cash received for rendering services

- Cash receipts from commissions, fees, and royalties

Operating Cash Outflows

- Payments to suppliers for goods and services

- Payments to employees (salaries and wages)

- Payments for operating expenses

These items are directly connected with the regular operations of the business.

Why Operating Cash Flows Are Important

Operating cash flows indicate:

- Ability of the enterprise to generate cash internally

- Capacity to maintain operating capability

- Ability to repay loans and pay dividends

- Need (or absence of need) for external financing

An enterprise may show profits but still face liquidity problems if operating cash flows are weak.

Methods of Reporting Operating Cash Flows under AS-3

AS-3 permits two methods for reporting cash flows from operating activities:

- Direct Method

- Indirect Method

Both methods arrive at the same net operating cash flow, but they differ in presentation and approach.

1. Direct Method

Meaning of Direct Method

Under the direct method, major classes of gross cash receipts and gross cash payments are disclosed separately.

This method shows:

- Cash received from customers

- Cash paid to suppliers

- Cash paid to employees

- Cash paid for operating expenses

Thus, it provides a clear and transparent picture of operating cash flows.

Format of Direct Method (Conceptual)

Under the direct method, operating cash flows are presented as:

- Cash receipts from customers

- Less: Cash paid to suppliers

- Less: Cash paid to employees

- Less: Other operating expenses paid

- Less: Income tax paid

= Net Cash Flow from Operating Activities

Advantages of Direct Method

AS-3 states that the direct method is preferable because:

- It provides more useful information

- It helps users estimate future cash flows

- It shows actual cash receipts and payments

- It improves transparency

For this reason, AS-3 encourages enterprises to use the direct method.

Limitations of Direct Method

Despite its advantages, the direct method:

- Requires detailed cash records

- Is more difficult to prepare

- Is less commonly used in practice

Because of these practical difficulties, many enterprises use the indirect method.

2. Indirect Method

Meaning of Indirect Method

Under the indirect method, net profit or loss is adjusted for:

- Non-cash items

- Non-operating items

- Changes in working capital

The method starts with net profit as per Profit and Loss Account and converts it into cash from operating activities.

Steps under Indirect Method

The indirect method involves the following adjustments:

Step 1: Start with Net Profit / Net Loss

The starting point is:

- Net profit before tax (in many cases)

Step 2: Adjust for Non-Cash Expenses and Incomes

Add back non-cash expenses such as:

- Depreciation

- Amortisation

Subtract non-cash incomes, if any.

Reason: These items affect profit but do not involve cash movement.

Step 3: Adjust for Non-Operating Items

Remove items relating to:

- Investing activities

- Financing activities

Examples:

- Profit on sale of fixed assets (deducted)

- Loss on sale of fixed assets (added back)

These items belong to investing activities, not operating activities.

Step 4: Adjust for Changes in Working Capital

Changes in current assets and current liabilities are adjusted:

- Increase in current assets → Decrease cash

- Decrease in current assets → Increase cash

- Increase in current liabilities → Increase cash

- Decrease in current liabilities → Decrease cash

This adjustment converts accrual-based profit into cash-based figure.

Step 5: Deduct Income Tax Paid

Income tax paid is usually deducted to arrive at:

- Net cash flow from operating activities

Example to Understand Indirect Method (Conceptual)

Suppose:

- Net profit = ₹5,00,000

- Depreciation = ₹50,000

- Increase in debtors = ₹40,000

- Increase in creditors = ₹30,000

Operating cash flow would be adjusted as:

- Start with profit

- Add depreciation

- Deduct increase in debtors

- Add increase in creditors

This shows how profit is converted into cash.

Direct Method vs Indirect Method – Key Differences

| Basis | Direct Method | Indirect Method |

| Starting point | Cash receipts & payments | Net profit |

| Focus | Actual cash movement | Adjustment of profit |

| Transparency | High | Moderate |

| Preference under AS-3 | Preferred | Allowed |

| Practical use | Less common | More common |

Which Method Is Better under AS-3?

AS-3 clearly states that:

- Direct method is preferable

However:

- Both methods are permitted

- Enterprises may choose either method

The preference for the direct method is based on usefulness, not compulsion.

Common Exam Mistakes to Avoid

Students often:

- Forget to adjust non-cash items

- Treat depreciation as cash outflow

- Ignore working capital changes

- Mix investing items with operating activities

Clear conceptual understanding avoids these errors.

Importance of Operating Cash Flow in Practical Analysis

Operating cash flow helps in:

- Assessing sustainability of operations

- Detecting earnings manipulation

- Analysing liquidity strength

- Evaluating dividend-paying capacity

Analysts rely heavily on this figure.

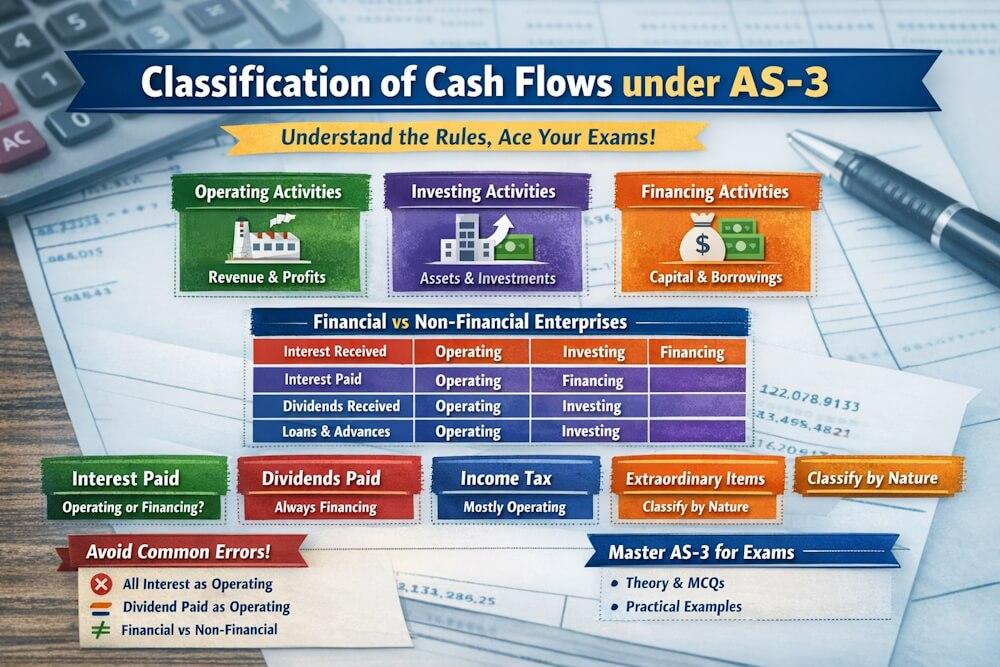

Link with Other AS-3 Topics

Operating cash flow:

- Builds on classification rules

- Forms base for full Cash Flow Statement

- Is essential before studying net basis reporting

Understanding this topic is crucial for mastering AS-3.

Operating Cash Flows from Exam Perspective

This topic is:

- Frequently tested in practical problems

- Asked in theory questions

- A scoring area when concepts are clear

Students who master this topic usually perform well in Cash Flow Statement questions.

Conclusion

Cash flow from operating activities represents the cash-generating ability of the core business. Accounting Standard 3 allows two methods—direct and indirect—for reporting operating cash flows, with a preference for the direct method.

While the indirect method is more commonly used in practice, understanding both methods is essential for examinations and real-world application. A correct and logical presentation of operating cash flows ensures meaningful analysis of an enterprise’s financial health.

“This article explains how operating cash flows are calculated using the direct and indirect methods. For a complete understanding of Accounting Standard 3, including cash and cash equivalents, classification rules, net basis reporting, disclosures, and practical illustrations, refer to our Accounting Standard 3 (AS-3): Cash Flow Statement – Complete Guide.”

FAQs

1: What are operating cash flows under AS 3?

Answer: Operating cash flows are cash inflows and outflows arising from the principal revenue-producing activities of an enterprise.

2: What is the direct method of operating cash flows?

Answer: Under the direct method, major classes of gross cash receipts and payments such as cash from customers and cash paid to suppliers are shown separately.

3: What is the indirect method of operating cash flows?

Answer: Under the indirect method, net profit is adjusted for non-cash items, non-operating items, and changes in working capital to arrive at operating cash flow.

4: Which method is preferred under AS 3?

Answer: Accounting Standard 3 prefers the direct method because it provides more useful and transparent information about cash receipts and payments.

5: Why are non-cash items adjusted in the indirect method?

Answer: Non-cash items like depreciation affect profit but do not involve actual cash movement, so they are adjusted to calculate cash from operations.

6: How are changes in working capital treated?

Answer: Increase in current assets decreases cash, while increase in current liabilities increases cash when computing operating cash flows under the indirect method.

7: Are operating cash flows important for analysis?

Answer: Yes, operating cash flows indicate the ability of an enterprise to generate cash from core operations and meet obligations without external financing.