1. Introduction

When GST came into force, it replaced a complex network of taxes with one unified system — but when services cross borders, things get tricky.

For instance:

- If an Indian company provides consulting to a foreign client, is it export?

- If a foreign firm offers digital or management services to an Indian company, is it import?

- Who pays GST, and what’s the place of supply?

To handle this, the IGST Act clearly divides such services into two categories:

- Export of Services

- Import of Services

Understanding their Place of Supply (PoS) is crucial — because it determines whether GST applies in India or not.

2. Relevant Legal Provisions

These transactions are primarily covered under:

- Section 13 of the IGST Act, 2017 → Cross-border services (when one party is outside India)

- Section 2(11) → Import of services

- Section 2(6) → Export of services

- Section 7(5) → Inter-State supply (imports deemed)

- Section 16 → Zero-rated supply (exports)

3. What Is an Export of Services? (Section 2(6) of IGST Act)

A service is treated as an export only if it meets all five conditions

| Condition | Explanation |

| (i) Supplier of service is in India | Indian company or freelancer |

| (ii) Recipient of service is outside India | Client located abroad |

| (iii) Place of supply is outside India | Determined under Section 13 |

| (iv) Payment received in convertible foreign exchange / INR permitted by RBI | Through bank (FIRC/BRC) |

| (v) Supplier and recipient are not “distinct persons” | Not same entity with different GSTINs |

- If all five conditions are met → Zero-rated export (no GST payable). If even one fails → Treated as taxable domestic service.

Example 1 – Consulting Service to a Foreign Client

An Indian firm provides management consulting to a company in the UK.

- Supplier: India

- Recipient: UK

- PoS: UK (recipient location)

- Payment: USD via bank

Export of service → Zero-rated

Example 2 – Service to a Foreign Branch

Indian head office provides back-office support to its own branch in Singapore.

❌ Not export → Same legal entity (distinct person). GST payable as inter-State supply.

Example 3 – Web Design for Overseas Client (Freelancer)

A freelancer in Pune designs a website for a U.S. company and gets paid via PayPal.

- PoS = USA → Export → Zero-rated

Example 4 – Consultancy to Foreign Client But Delivered in India

Foreign company hires Indian consultant for a project executed in Mumbai.

- PoS = India → Not export → GST payable

4. What Is an Import of Services? (Section 2(11) of IGST Act)

A service qualifies as an import when all three conditions are met:

| Condition | Explanation |

| (i) Supplier located outside India | e.g., U.S.-based consultant |

| (ii) Recipient located in India | Indian business or individual |

| (iii) Place of supply in India | As per Section 13 |

Then, GST is payable under Reverse Charge Mechanism (RCM) by the recipient in India.

Example 5 – Import of Consultancy Services

ABC Pvt. Ltd. (India) hires a management consultant from Singapore.

- Supplier: Singapore

- Recipient: India

- PoS: India

✅ Import of service → GST payable under RCM by ABC Pvt. Ltd.

Example 6 – Import of Legal Services

Indian company takes legal advice from a U.K. law firm.

- PoS = India → Import → GST under RCM.

Example 7 – Subscription to Online Software (OIDAR)

XYZ Pvt. Ltd. uses a U.S.-based SaaS tool.

- PoS = India → Import → GST under RCM (if registered business).

5. Determining Place of Supply (PoS) for Cross-Border Services

Let’s recap the core logic of Section 13 for international services:

| Situation | Section | Place of Supply |

| General Rule | 13(2) | Recipient’s location |

| Services requiring physical presence | 13(3) | Where performed |

| Immovable property-related services | 13(4) | Property location |

| Admission or organization of events | 13(5)/(6) | Event location |

| Intermediary services | 13(8)(b) | Supplier’s location |

| Goods/passenger transport | 13(9)/(11) | Embarkation / destination |

| OIDAR (online services) | 13(12A) | Recipient’s location |

6. How Export and Import Differ in GST

| Basis | Export of Services | Import of Services |

| Supplier location | In India | Outside India |

| Recipient location | Outside India | In India |

| Place of Supply | Outside India | In India |

| Tax liability | Zero-rated (no GST) | Reverse charge (recipient pays) |

| Benefit | LUT/Refund claim | ITC eligible under RCM |

| Example | Indian firm serves US client | Indian company hires UK consultant |

7. Practical Scenarios

Scenario 1 – Marketing Services to Foreign Company

An Indian agency runs digital ads for a UK brand targeting Indian customers.

- PoS = India (service used in India)

- Not export → GST payable.

Scenario 2 – IT Services for Overseas Client

Indian IT company provides back-end tech support to a U.S. firm, used outside India.

- PoS = USA → Export → Zero-rated.

Scenario 3 – Online Training Conducted by Foreign Trainer

Foreign coach conducts virtual sessions for Indian corporate employees.

- PoS = India → Import → Indian company pays IGST under RCM.

Scenario 4 – Intermediary Services

Indian agent arranges deals between two foreign buyers.

- PoS = India (supplier’s location under Section 13(8)(b))

- Not export → GST applicable.

Scenario 5 – Cross-border Event Management

Indian event planner organizes an exhibition in Dubai.

- PoS = Dubai → Export → Zero-rated.

Scenario 6 – Consultancy by Foreign Company to Indian Branch Abroad

Foreign consultant provides service to an Indian company’s Dubai branch.

- Recipient outside India → Export → Zero-rated.

8. Recent CBIC Circulars & Clarifications

| Circular / Notification | Date | Key Highlights |

| Circular 209/3/2024-GST | July 2024 | Clarifies export/import classification under Sec. 13 |

| Notification 09/2024-IGST | Oct 2024 | Defines destination principle for B2B services |

| CBIC FAQ (Jan 2025) | Jan 2025 | Examples of PoS for hybrid services (online + offline) |

| DGARM Clarification | 2024 | Cross-checking export claims via foreign remittance data |

9. Zero-Rated Supplies and Refunds

Export of services are zero-rated under Section 16 of the IGST Act, meaning:

- No GST payable, and

- Exporter can claim refund of:

- Input Tax Credit (ITC), or

- IGST paid on export invoices.

Two Ways to Export Without Paying GST:

| Option | Procedure | Benefit |

| 1. LUT (Letter of Undertaking) | Export without paying IGST | Refund of input tax credit |

| 2. Pay IGST & Claim Refund | Pay IGST on export invoice | Refund of IGST amount |

Example – Export via LUT

An Indian software firm exports services to the U.S. under LUT.

- No GST charged on invoice.

- Refund of input GST on rent, software, etc.

Example – Export with IGST Payment

Consultancy firm pays IGST on export invoice → later claims refund from GST portal.

10. Key Case Law References

Let’s look at important rulings that shaped PoS interpretation

Case 1 – Material Recycling Association of India (2020-TIOL-1274-HC-AHM-GST)

- Facts: Association arranged international conferences.

- Held: If event held outside India, PoS = foreign venue → Export → No GST.

Case 2 – Toshniwal Brothers (SR) Pvt. Ltd. (2022)

- Facts: Indian company acted as intermediary between foreign suppliers.

- Held: PoS = India (Section 13(8)(b)) → GST applicable.

Case 3 – Infinera India Pvt. Ltd. (2021)

- Facts: Indian R&D unit provided design services to foreign parent.

- Held: Separate legal entities → Export → Zero-rated.

Case 4 – Sutherland Mortgage Services (2023)

- Facts: Indian BPO provided services to U.S. company but used Indian infrastructure.

- Held: PoS = USA → Export → Zero-rated.

Case 5 – Ispat Industries Ltd. (Legacy Reference)

Held: For import of management services, recipient liable under reverse charge → PoS India.

11. Common Errors in Classifying Export & Import of Services

- Treating intermediary exports as zero-rated (wrong — PoS = India)

- Failing to receive payment in foreign exchange → not export

- Incorrectly applying Section 12 (domestic rule) instead of Section 13

- Not reporting export invoice in GSTR-1 or LUT filing

- Ignoring RCM on imported consultancy, legal, or software services

12. Practical Compliance Tips

- Use “Recipient outside India” clause in service agreements

- Keep FIRC/BRC proofs for all export receipts

- Mention country of recipient on export invoices

- Ensure PoS outside India under Section 13(2)

- Report exports correctly in GSTR-1 and GSTR-3B

- Pay RCM timely on imported services

- Maintain foreign payment trail for refund verification

13. Summary Table – Import vs Export at a Glance

| Parameter | Export of Services | Import of Services |

| Supplier | In India | Outside India |

| Recipient | Outside India | In India |

| Place of Supply | Outside India | In India |

| GST Payable By | Supplier (Nil, zero-rated) | Recipient (RCM) |

| Currency | Foreign exchange | Any |

| Benefit | Zero-rated refund | ITC credit under RCM |

| Example | Indian IT firm to US client | Indian firm hires UK consultant |

14. Key Takeaways

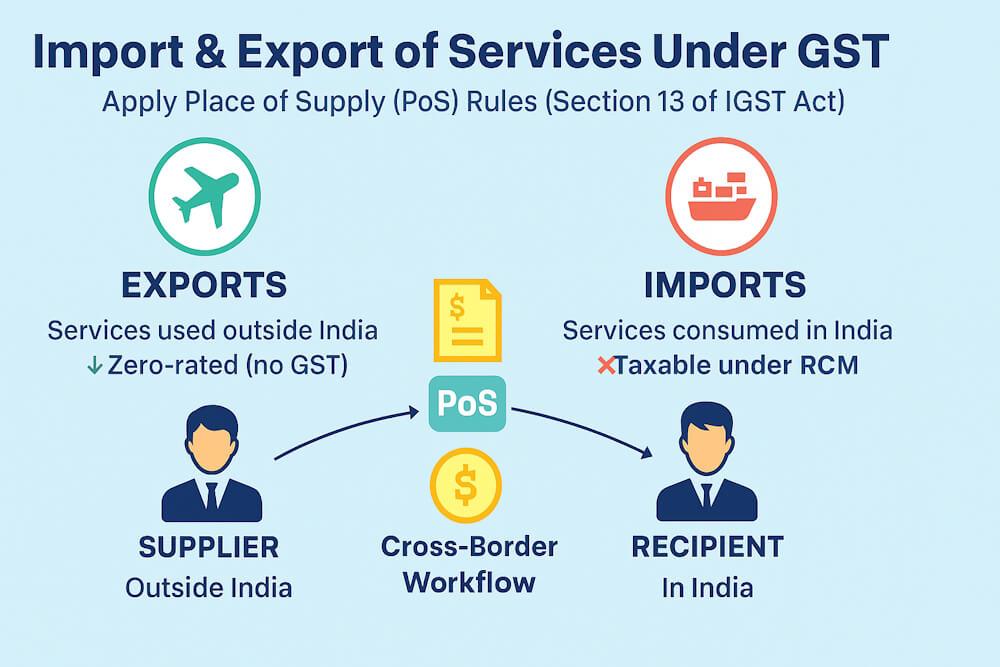

- Exports = Services used outside India → Zero-rated

- Imports = Services consumed in India → Taxable under RCM

- PoS determines taxability, not payment location

- Section 13 is the backbone for all cross-border service rules

- Always check: supplier → recipient → PoS → payment → relationship

15. Final Thoughts

The Place of Supply rules for imports and exports of services ensure that GST follows the destination principle — tax goes where the service is consumed, not where it is produced.

For businesses, the real challenge is interpreting PoS correctly and maintaining the documentation trail — especially for digital, consultancy, or hybrid services.

In summary:

“🌍 Export of services = Zero-rated reward. 🧾 Import of services = Reverse charge responsibility.”

By following these rules, businesses can stay compliant and enjoy the full benefits of GST’s global framework.