1. Introduction

If you’ve ever booked a flight ticket online, you’ve probably noticed a few extra charges apart from the base fare — things like PSF, UDF, and convenience fees.

While most passengers assume these are some random airline surcharges, they actually have a clear regulatory purpose — and yes, GST applies to them too.

In the aviation sector, these charges play a crucial role in maintaining airport infrastructure and ensuring passenger safety. But from a tax perspective, the question is:

Are PSF and UDF taxable under GST? And if yes, who pays the tax — the airline or the airport authority?

To make things clear, the Central Board of Indirect Taxes and Customs (CBIC) has issued several clarifications and circulars explaining the GST treatment of Passenger Service Fees (PSF) and User Development Fees (UDF).

This blog breaks it all down in simple language — what these charges mean, how they’re treated under GST, and what the current applicable tax rates are.

2. What Are PSF and UDF?

Before jumping into tax rules, let’s understand what these charges actually are.

(a) PSF – Passenger Service Fee

Passenger Service Fee is a charge collected by airlines from passengers when they issue tickets.

It’s meant to cover security and passenger facilitation costs at airports.

- Collected by: Airline

- Transferred to: Airport operator or security agency (like CISF)

- Purpose: To fund security services and passenger amenities at terminals

PSF has two components:

- PSF (Security): Used to pay CISF and related security expenses

- PSF (Facilitation): Used for airport maintenance and infrastructure

(b) UDF – User Development Fee

UDF is a fee collected by the airport operator from passengers using the airport. It’s charged for developing, modernizing, and expanding airport facilities.

- Collected by: Airline (on behalf of airport operator)

- Used for: Infrastructure development and maintenance of airports

- Regulated by: Airports Economic Regulatory Authority (AERA)

In short, both PSF and UDF are statutory charges, not arbitrary airline add-ons. They’re approved by AERA and collected as part of the ticket fare.

3. Who Collects and Who Pays GST on These Charges?

Here’s where things get a bit technical.

Although airlines collect PSF and UDF from passengers, they do so on behalf of the airport operator. So the actual service provider in this case is the airport operator (like GMR, GVK, AAI, etc.).

However, airlines act as intermediaries — collecting the charges and remitting them to the airport authority.

Therefore:

- Airlines collect PSF/UDF along with the ticket fare,

- Airlines remit the collected amount to the airport operator,

- GST liability depends on the nature of service being provided.

To clarify this, the CBIC issued Circular No. 115/34/2019-GST, dated 11th October 2019, which explained how GST applies on PSF and UDF.

4. GST on PSF and UDF – Circular No. 115/34/2019-GST

According to this circular:

“PSF and UDF are consideration towards services provided by the airport operator to passengers. The airline only acts as a collecting agent. Therefore, GST is applicable on PSF and UDF, and it is the airport operator who is liable to pay GST.”

Let’s break that down in simpler terms.

- The airport operator provides passenger-related services (like security, infrastructure).

- The airline just collects the amount from the passenger and passes it on.

- So GST is payable by the airport operator on the total PSF/UDF collected.

Airlines don’t pay GST on PSF/UDF separately but must charge it as part of the ticket invoice.

5. GST Rate Applicable on PSF and UDF

Both PSF and UDF are treated as “airport services” under GST. The rate applicable is the same as the rate for air transport support services.

- GST Rate: 18% (9% CGST + 9% SGST)

- HSN Code: 9967 (Supporting services in transport)

So, when you pay ₹500 as PSF or UDF, the airport operator pays GST @18% on that amount to the government.

6. Example – How It Works

Let’s take a practical example to see how GST applies.

Suppose you book a flight from Delhi to Mumbai, and your ticket shows:

- Base Fare: ₹4,000

- PSF: ₹150

- UDF: ₹250

Total before GST: ₹4,400

Now, GST applies as follows:

- On base fare (air transport service): 5% (economy class)

- On PSF/UDF (airport service): 18% (payable by airport operator)

Airline collects the total amount from you — ₹4,400 + ₹200 (GST on fare) = ₹4,600 — and later transfers ₹400 (PSF+UDF) to the airport operator.

The airport operator then pays GST @18% on ₹400 = ₹72 to the government.

7. Input Tax Credit (ITC) Treatment

The airport operator can claim input tax credit on all inputs and services used for:

- Airport maintenance

- Infrastructure development

- Passenger amenities

- Security services

However, airlines cannot claim ITC on the PSF/UDF portion since they are merely acting as collection agents.

In other words:

- GST on PSF/UDF → payable by airport operator

- ITC on that GST → claimable by airport operator (not airline)

8. Whether PSF and UDF Are Considered “Taxable Supply”?

Yes — both are considered taxable supplies under GST.

As per Section 7 of the CGST Act, “supply” includes any service provided for consideration in the course of business. Since PSF and UDF are charges for passenger-related facilities, they qualify as taxable supplies.

However, they are distinct from airfare. While airfare is for “transportation of passengers,” PSF and UDF are for “airport services.” Hence, they attract different GST rates.

9. What About Exemptions?

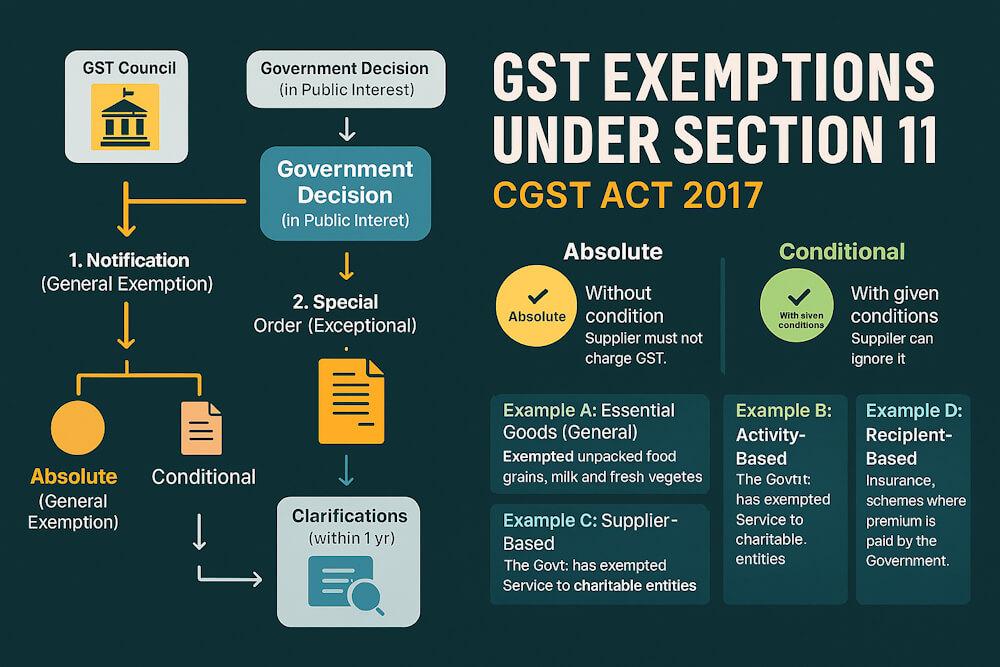

Some people assume PSF or UDF might be exempt since they relate to public utility. But the GST exemption notifications (like 12/2017-Central Tax Rate) do not list PSF or UDF as exempt services.

So, as of now:

- ❌ No exemption applies to PSF or UDF.

- ✅ They are fully taxable at 18% GST.

10. Responsibility Matrix – Who Does What

Here’s a simple breakdown of the roles under GST for PSF and UDF:

| Entity | Role | GST Liability |

| Passenger | Pays PSF/UDF as part of ticket fare | ❌ No direct liability |

| Airline | Collects PSF/UDF from passenger | ❌ Acts only as agent |

| Airport Operator (AAI/GMR/etc.) | Provides airport services | ✅ Liable to pay 18% GST |

| Government | Regulates rates via AERA | — |

This structure ensures that the tax burden is correctly placed on the actual service provider (airport authority).

11. Relevant Notifications & References

The following are key references for PSF and UDF under GST:

| Notification / Circular | Date | Subject |

| Circular No. 115/34/2019-GST | 11 Oct 2019 | Clarification on GST on PSF and UDF |

| Notification No. 11/2017-Central Tax (Rate) | 28 June 2017 | GST rates for air and airport services |

| AERA Guidelines | Various | Rules governing UDF and PSF charges |

| CBIC FAQs on Transportation | — | Clarified collection and tax responsibility |

These circulars made it clear that airport operators, not airlines, are the taxable persons for these fees.

12. Why CBIC Issued the Clarification

Before 2019, there was confusion — airlines were collecting PSF/UDF, so many thought airlines should pay GST on those charges.

But that created double taxation issues, since both airlines and airports were charging GST.

The CBIC stepped in to clarify:

- Airlines collect PSF/UDF as pure agents (under Rule 33 of CGST Rules).

- Hence, these charges don’t form part of airline’s taxable value.

- The airport operator alone is responsible for paying GST on PSF/UDF collected.

This removed ambiguity and ensured tax uniformity across the aviation sector.

13. Impact on Airlines and Airports

For Airlines:

- Reduced compliance burden — no need to pay GST on PSF/UDF.

- Must clearly disclose PSF and UDF on tickets and invoices.

For Airport Operators:

- Must account for GST @18% on PSF/UDF collected through airlines.

- Can claim input tax credit on eligible expenses.

For Passengers:

- No extra tax burden — GST is already included in ticket pricing.

- More transparency on what each charge represents.

14. Example – End-to-End Transaction Flow

- Passenger buys ticket from airline (₹4,000 + ₹400 PSF/UDF).

- Airline collects ₹4,400 + GST (on fare only).

- Airline transfers ₹400 PSF/UDF to airport operator.

- Airport operator pays GST @18% on ₹400 = ₹72.

- Airport operator files GST return and claims ITC for eligible inputs.

Simple, transparent, and aligned with GST’s “destination-based tax” principle.

15. Final Thoughts

The introduction of GST in the aviation sector brought consistency and transparency, but it also required clear separation of taxable services.

Charges like PSF and UDF are no longer a mystery — they are legitimate airport fees that fund security and infrastructure, and GST applies at 18%, payable by the airport operator.

Passengers need not worry about being double-taxed, and airlines simply act as collecting agents under Rule 33.

In short:

- PSF and UDF are airport services, not airline services.

- GST @18% applies, paid by the airport authority.

- Airlines collect, but do not pay, the tax.

This system ensures accountability at every stage — from the ticket counter to the tarmac.