In the previous blog, Fundamental Accounting Assumptions, we learned that financial statements are prepared based on three basic beliefs – going concern, accrual basis, and consistency. These assumptions ensure that the accounting data is prepared on a stable and logical foundation.

But even when these assumptions are followed, one more question remains: Is the information actually useful?

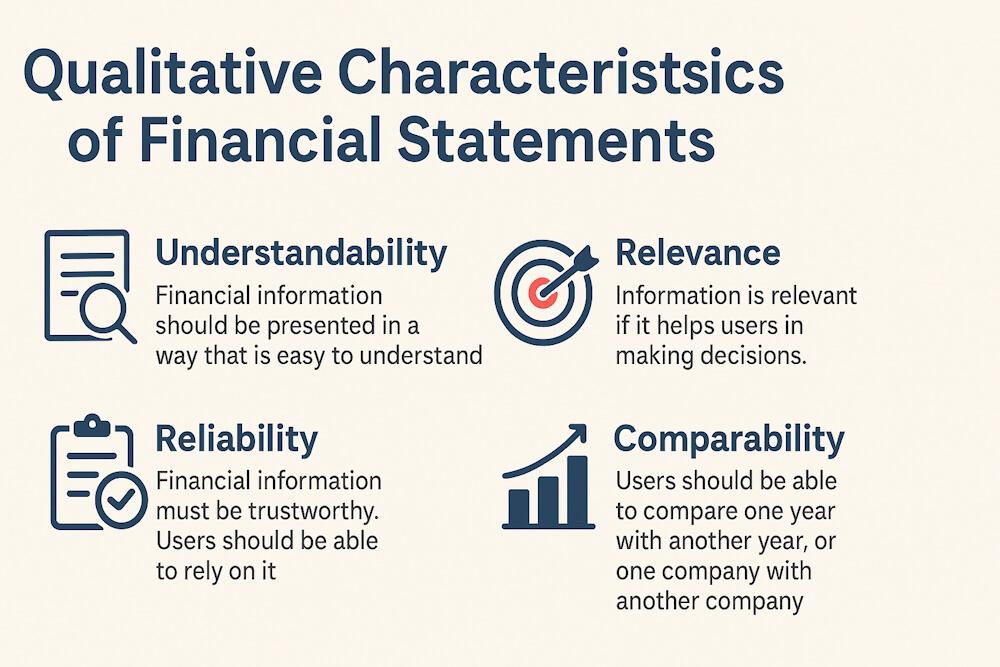

This is where Qualitative Characteristics of Financial Statements come into play. These characteristics decide whether financial information is understandable, relevant, reliable, and comparable for the people who use it.

Let us understand these characteristics in a simple and practical way.

What are Qualitative Characteristics?

Qualitative characteristics are the qualities that make financial information useful. If financial data does not have these qualities, it may be correct in numbers but still useless for decision-making.

The accounting framework identifies four main qualitative characteristics:

- Understandability

- Relevance

- Reliability

- Comparability

These qualities ensure that financial statements actually help users such as investors, lenders, employees, and government.

1. Understandability

Financial information should be presented in a way that is easy to understand.

This does not mean that accounting should be oversimplified. It means that financial statements should be prepared assuming that users have a reasonable knowledge of business and accounting.

For example, if a company shows “Deferred Tax Liability” in the balance sheet, it should be explained clearly in the notes. Otherwise, even correct data will be confusing.

A financial statement that no one can understand is as bad as not having one at all.

2. Relevance

Information is relevant if it helps users in making decisions.

For example:

- Profit figures help investors decide whether to invest

- Cash flow helps banks decide whether to lend

- Expenses help management control costs

If information does not affect decisions, it is not relevant.

Materiality

Materiality is part of relevance. Information is material if its absence or mistake can influence decisions.

For example:

- Losing ₹500 in a big company may not matter

- Losing ₹50,000 may be very important

So, companies must disclose only important information and not overload users with unnecessary data.

3. Reliability

Financial information must be trustworthy. Users should be able to rely on it.

Reliable information must:

- Be free from major errors

- Be neutral (not biased)

- Reflect the real nature of transactions

For example, showing fake profits or hiding losses makes financial statements unreliable.

Important parts of reliability

- Faithful representation – Transactions must be recorded as they actually happened

- Substance over form – Economic reality is more important than legal form

- Neutrality – No manipulation to favor one group

- Prudence – Caution in uncertain situations

- Completeness – No important information should be missing

4. Comparability

Users should be able to compare:

- One year with another year

- One company with another company

This is only possible when accounting methods are consistent.

For example, if depreciation method is changed every year, profit comparison becomes meaningless.

Constraints on Qualitative Characteristics

Sometimes, perfect information is not possible. The framework recognises two major constraints:

1. Timeliness

Information must be given on time. Late information loses value even if it is accurate.

2. Cost vs Benefit

The cost of providing information should not exceed its benefit.

How Qualitative Characteristics Work Together

All four characteristics must work together. Information that is:

- Relevant but not reliable

- Reliable but not understandable

- Understandable but not comparable

is still not useful.

Conclusion

The Qualitative Characteristics of Financial Statements ensure that financial information is not just accurate but also meaningful.

When combined with the Fundamental Accounting Assumptions discussed in previous blog, these characteristics make financial statements powerful tools for decision-making.

In the next blog, we will explore the Elements of Financial Statements – Assets, Liabilities, Equity, Income and Expenses.

Frequently Asked Questions (FAQs)

1. What are qualitative characteristics of financial statements?

They are the qualities that make financial information useful, such as relevance, reliability, understandability, and comparability.

2. Why is relevance important in financial reporting?

Relevant information helps users make proper financial decisions by showing useful and meaningful data.

3. What does reliability mean in accounting?

It means the information is free from errors, bias, and correctly represents the business reality.

4. How does comparability help users?

It allows users to compare financial performance between different periods or different companies.

5. What is materiality in accounting?

Materiality refers to the importance of information. If missing or wrong data can affect decisions, it is material.

6. Why should financial statements be understandable?

So that users with basic business knowledge can easily read and interpret financial information.

7. What are the main constraints on qualitative characteristics?

Timeliness and cost-benefit are the main constraints that limit how much and how quickly information can be provided.