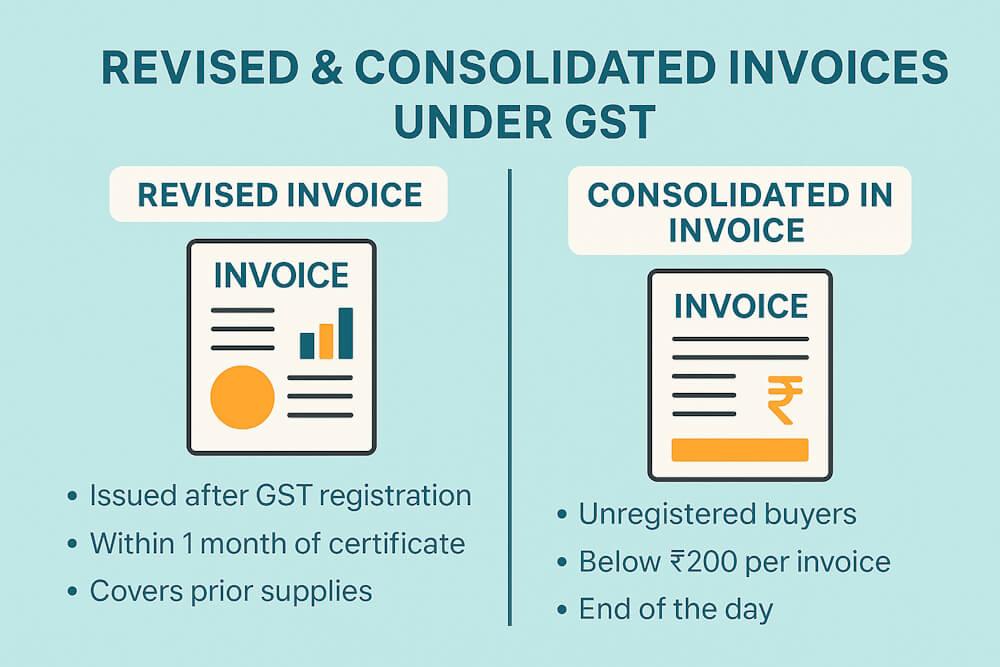

Not all invoices are issued at the “perfect” time. Sometimes businesses start supplying goods or services before receiving the GST registration certificate, or they make several small-value sales in a day where issuing individual invoices simply doesn’t make sense.

That’s exactly why GST law allows Revised Invoices and Consolidated Invoices. These are not optional tricks—they are legally recognised documents with specific rules, time limits, and conditions.

Let’s understand both concepts clearly and practically.

What Is a Revised Invoice Under GST?

A Revised Invoice is issued when:

- A person applies for GST registration

- Starts supplying goods/services from the effective date of registration

- But receives the registration certificate later

During this gap period, normal tax invoices cannot be issued. Once registration is granted, GST allows issuing revised invoices for those earlier supplies.

Legal Basis for Revised Invoice

Revised invoices are governed by Section 31(3)(a) of the CGST Act.

It allows:

- Issuing revised tax invoices

- For supplies made between effective date and registration date

This provision prevents tax loss and protects ITC for customers.

Time Limit for Issuing Revised Invoices

Very important rule:

“Revised invoices must be issued within 1 month from the date of issuance of GST registration certificate.”

Missing this deadline can lead to:

- Compliance issues

- ITC denial for customers

- Possible notices

How Many Revised Invoices Can Be Issued?

There is no limit on the number of revised invoices.

You must issue:

- One revised invoice for each original supply

- Covering goods or services supplied during the gap period

Each revised invoice replaces the earlier non-GST document.

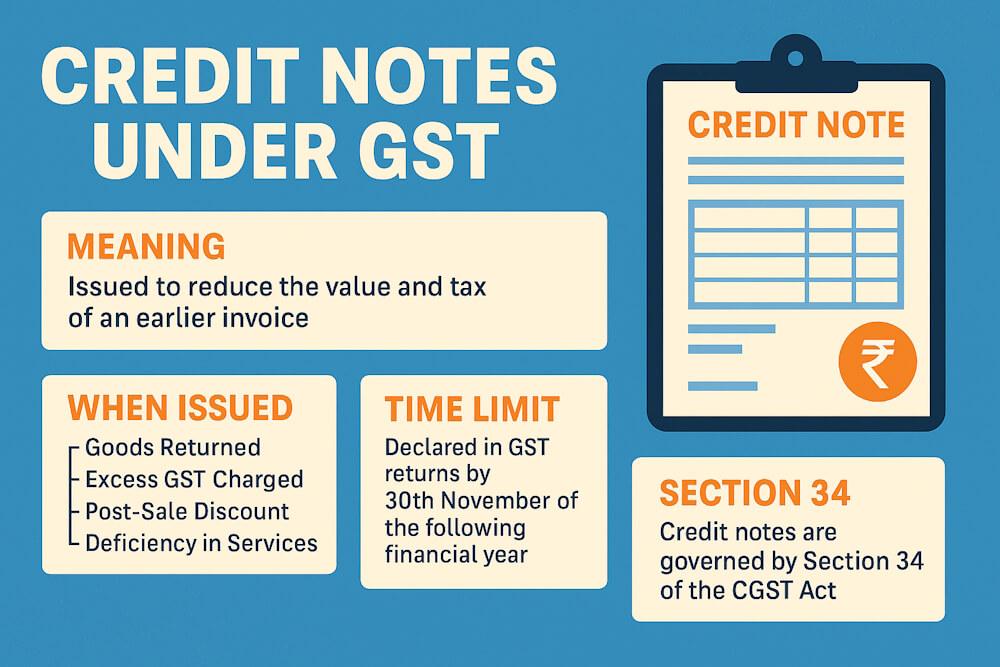

What Is a Consolidated Invoice Under GST?

A Consolidated Invoice allows businesses to combine multiple small transactions into one single invoice.

This is permitted when:

- Supply value is less than ₹200 per transaction

- Buyer is unregistered

- Buyer does not demand an invoice

Instead of issuing multiple invoices, you can issue one consolidated invoice at the end of the day.

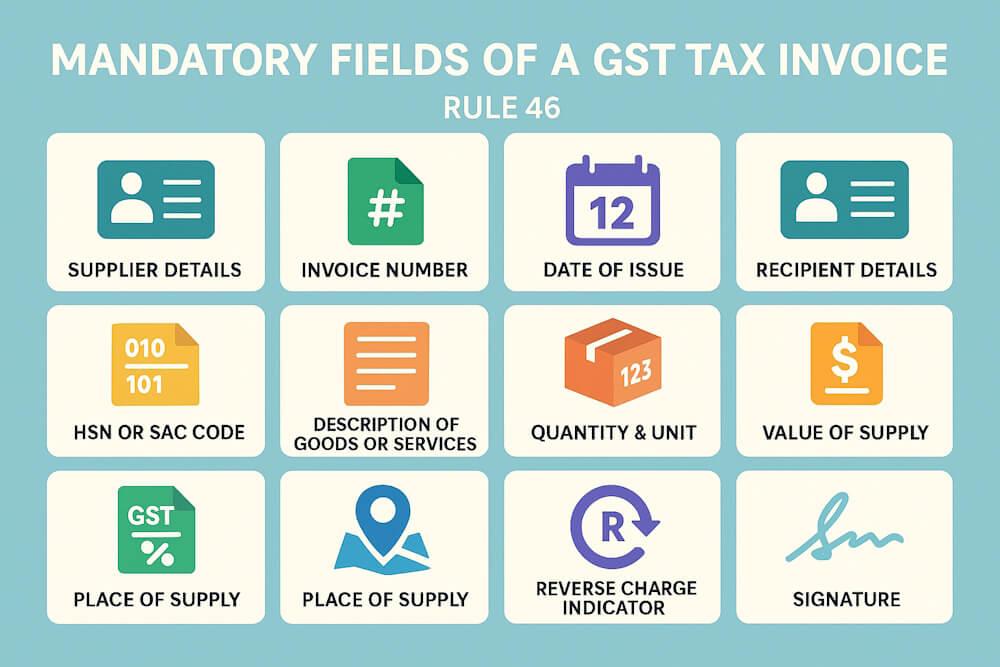

Legal Basis for Consolidated Invoice

Consolidated invoices are allowed under Rule 46 of the CGST Rules.

This rule recognises the practical difficulty of issuing invoices for every small retail sale.

When Can You Issue a Consolidated Invoice?

All these conditions must be satisfied:

- Value per supply < ₹200

- Buyer is unregistered

- Buyer does not ask for invoice

- Supplies are made in the same day

If even one condition fails, a normal invoice must be issued.

Revised Invoice vs Consolidated Invoice (Quick Comparison)

| Point | Revised Invoice | Consolidated Invoice |

| Purpose | Correct pre-registration supplies | Combine small B2C sales |

| Legal section | Section 31(3)(a) | Rule 46 |

| Time limit | 1 month from registration | End of the day |

| Buyer type | Registered / Unregistered | Unregistered only |

| Value limit | No limit | Below ₹200 per supply |

Common Mistakes Businesses Make

- Issuing revised invoices after 1 month

- Issuing consolidated invoice for registered buyers

- Combining invoices above ₹200

- Missing tax details in consolidated invoice

- Forgetting to report revised invoices in GSTR-1

These mistakes often trigger GST scrutiny.

Reporting in GST Returns

Both revised and consolidated invoices must be:

- Reported in GSTR-1

- Included in GSTR-3B

Even though consolidated invoices simplify billing, tax reporting remains compulsory.

How These Invoices Fit Into the GST Invoicing Chain

Revised and consolidated invoices connect directly with:

- Invoice timing rules

- Mandatory invoice fields (Rule 46)

- GST return reporting

They are part of the same invoice ecosystem—not exceptions.

Recommended Reading

For complete clarity on GST invoicing, also read:

- Start with Understanding GST Tax Invoices: A Simple Beginner Guide to know why invoices matter in GST.

- For invoice timing rules, refer to GST Tax Invoice Rules for Goods: Time, Format & Cases and GST Tax Invoice Rules for Services: Time, Limits & Use.

- If your supplies are recurring, Continuous Supply Under GST: Goods vs Services Explained helps decide invoice timing.

- To avoid missing mandatory details, read Mandatory Fields of GST Tax Invoice: Rule 46 Explained.

- For e-invoice-related rules, check E-Invoicing Under GST: Meaning, Rules & Step-by-Step and Invoice Registration Portal (IRP) & IRN Under GST.

- For large B2C sellers, Dynamic QR Code Rules for B2C Invoices Under GST is also important.

Together, these blogs form a complete GST invoicing guide.

FAQs

1. When should a revised invoice be issued under GST?

Within one month from the date of GST registration certificate.

2. Can revised invoices be issued for services also?

Yes. Revised invoices apply to both goods and services.

3. Can consolidated invoice include registered buyers?

No. It is allowed only for unregistered buyers.

4. Is consolidated invoice mandatory?

No. It is optional but allowed for convenience.

5. Are consolidated invoices reported in returns?

Yes. They must be reported in GSTR-1 and 3B.

6. What happens if revised invoice is not issued on time?

It may cause compliance issues and ITC denial.