Under the Goods and Services Tax (GST) system, the term “supply” plays a central role. Most supplies involve payment — you sell something, provide a service, and get paid.

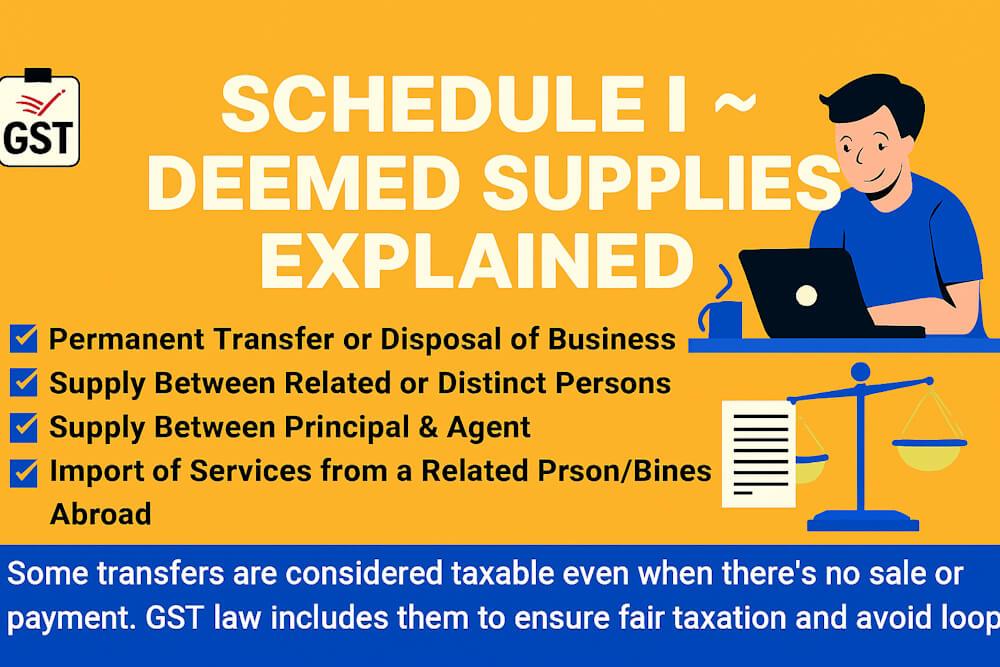

But GST doesn’t stop there. Some activities are treated as supply even when there’s no consideration. These are called “Deemed Supplies.”

They’re listed under Schedule I of the CGST Act, and they exist to prevent businesses from avoiding tax on valuable internal or related-party transactions that still create economic benefit.

In this blog, we’ll break down Schedule I – Deemed Supplies under GST, understand each case in simple words, and go through relatable examples.

What Are Deemed Supplies?

The word “deemed” simply means “treated as.”

So, deemed supplies are transactions that are treated as supplies under GST, even though there’s no sale or payment.

These are special cases where:

- There’s movement or transfer of goods/services,

- But no money changes hands,

- Yet they still create value in business.

GST law includes them to ensure fair taxation and avoid loopholes.

The Four Main Deemed Supply Situations (as per Schedule I)

Schedule I lists four categories of transactions that count as supply even without consideration. Let’s look at each one in simple terms with real-life examples 👇

1. Permanent Transfer or Disposal of Business Assets

If a business permanently transfers or disposes of any of its assets on which input tax credit (ITC) was claimed, it becomes a taxable supply — even if there’s no sale or payment.

In other words, if you’ve already enjoyed tax credit on something, and then you give it away or use it for personal reasons, GST will apply.

💬 Example 1:

A company gives away old office chairs and computers (on which it claimed ITC) to its staff as part of an office renovation.

👉 Since ITC was claimed earlier, this is treated as supply without consideration — GST must be paid on the fair value of the assets.

💬 Example 2:

If a business donates unused goods to charity, and ITC was claimed when those goods were purchased, the donation counts as a deemed supply.

💬 Example 3:

However, if the business never claimed ITC on those goods (say, personal assets or exempt items), then the transfer isn’t treated as supply.

2. Supply Between Related Persons or Distinct Persons

GST law considers some entities “distinct” — even if they belong to the same legal organization. For example, a company’s head office and its branches in different states are treated as distinct persons.

So, transfers of goods or services between them are taxable — even if there’s no payment.

💬 Example 1:

A manufacturer in Gujarat sends goods to its registered branch in Maharashtra.

👉 Even though both belong to the same company, this movement is a deemed supply because they’re distinct registrations under GST.

💬 Example 2:

A head office provides free administrative or IT support to its branch in another state.

👉 The value of that service is considered supply and taxable under GST.

💬 Example 3:

A parent company provides free marketing or HR services to its subsidiary company.

👉 Even without payment, it’s a deemed supply between related persons.

Important Note:

If such transactions happen within the same state and same registration, they are not considered distinct persons — so GST doesn’t apply.

3. Supply Between Principal and Agent

In many businesses, goods are sold through agents — and GST treats some of these transfers as deemed supplies.

When a principal gives goods to an agent to sell on their behalf (or vice versa), it counts as a supply, even if money hasn’t yet exchanged hands.

💬 Example 1:

A manufacturer sends goods worth ₹5 lakh to its authorized agent in another city to sell them.

👉 The transfer is treated as supply between principal and agent.

💬 Example 2:

An agent sells goods in his own name on behalf of the manufacturer and keeps the sale proceeds.

👉 This is also treated as supply under Schedule I.

The idea is simple — goods have changed hands for business use, so GST applies, even before payment happens.

💬 Example 3:

If an agent only facilitates sales (doesn’t take possession of goods), it’s not a supply between them — it’s just a normal service transaction taxable on commission.

4. Import of Services from a Related Person or Business Establishment Abroad

When an Indian company receives services from its foreign parent company, subsidiary, or branch, it’s treated as a supply — even if no money is paid.

This rule ensures that cross-border services between related entities are taxed fairly in India.

💬 Example 1:

An Indian branch receives management or accounting services from its U.S. head office free of charge.

👉 It’s a deemed supply — taxable in India under GST.

💬 Example 2:

An Indian subsidiary gets technical advice or IT support from its parent company abroad without payment.

👉 Still considered a taxable supply.

💬 Example 3:

If an Indian company receives design or R&D services from its overseas office and uses them for business in India, GST applies even without consideration.

Key Point — Why GST Taxes These “Free” Transactions

The logic behind taxing deemed supplies is fairness and transparency.

Without these rules, businesses could easily move goods or services between related entities or branches and avoid paying GST — even though the goods were being used or consumed.

So, by treating these internal or unpaid transactions as “supplies,” GST ensures that:

- Input tax credit is properly adjusted,

- Tax applies on actual business use, and

- Revenue leakage is avoided.

Determining Value of Deemed Supplies

Since there’s no payment, the value of deemed supply is determined using fair or open market value. In simple terms, the tax applies on what that good or service would cost if sold in the open market.

💬 Example:

A company gives an employee a phone worth ₹25,000 for personal use. Even though it’s free, GST will be calculated on ₹25,000 (the phone’s value).

Common Business Scenarios Covered by Schedule I

Here are some everyday business examples that often qualify as deemed supplies:

| Scenario | GST Treatment |

| Company donates inventory (ITC claimed) to charity | Deemed supply – taxable |

| Head office provides HR services to branch in another state | Deemed supply – taxable |

| Goods sent from factory to warehouse in another state | Deemed supply – taxable |

| Manufacturer sends goods to agent for sale | Deemed supply – taxable |

| Parent company abroad provides free consultancy to Indian subsidiary | Deemed supply – taxable |

| Gifts to employees beyond ₹50,000 per year | Deemed supply – taxable on amount exceeding limit |

What’s Not a Deemed Supply

Just to avoid confusion, here are a few examples not treated as supply under Schedule I:

- Free samples distributed without claiming ITC on them.

- Stock transfer within the same state and same GST registration.

- Employer giving gifts to employees up to ₹50,000 per year.

- Import of services for personal use (not for business).

These are kept outside Schedule I to avoid unnecessary taxation of personal or minor transactions.

Simplified Checklist: Is It a Deemed Supply?

Here’s a quick way to check if your transaction might fall under Schedule I:

- ✅ Is it done between related or distinct persons?

- ✅ Has ITC been claimed on the goods or service?

- ✅ Is the transaction linked to business or office use?

- ✅ Is there any transfer of goods or service ownership?

If yes to most of these, it’s likely a deemed supply and should be declared in your GST returns.

Why Deemed Supply Rules Matter for Businesses

Ignoring Schedule I transactions can cause trouble during GST audits. Even if no payment happens, such supplies must be reported — and tax should be calculated on their fair value.

Here’s why understanding this matters:

- It prevents GST compliance errors.

- It avoids penalties for underreporting.

- It helps maintain accurate input tax credit reconciliation.

In short, Schedule I ensures that all internal and related-party transactions are transparent and tax-accounted.

Final Thoughts

Schedule I of the CGST Act may seem technical, but it’s crucial for understanding how GST captures hidden or unpaid transactions.

It ensures that business assets, inter-branch transfers, agent dealings, and related-party services are taxed fairly — even when no money changes hands.

In simple terms:

“If something of business value moves, changes ownership, or is used for benefit — even without payment — it could be a deemed supply.”

By keeping track of these situations, businesses stay GST-compliant, prevent disputes, and maintain clear records for audits.