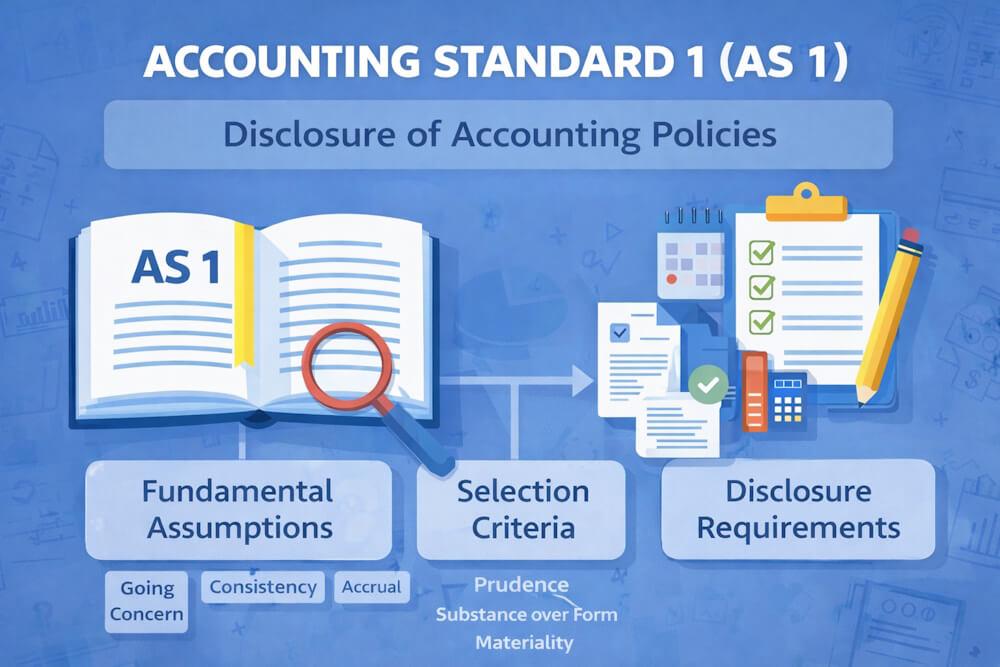

Accounting policies play a crucial role in the preparation of financial statements. While Accounting Standard 1 (AS 1) allows enterprises flexibility in choosing accounting policies, this freedom is not unlimited. The selection of accounting policies must be guided by certain key considerations to ensure that financial statements present a true and fair view of the financial position and performance of an enterprise.

AS 1 specifically highlights three major considerations that govern the selection of accounting policies:

- Prudence

- Substance over Form

- Materiality

These principles act as safeguards against misleading reporting and help maintain reliability and credibility in financial statements.

Meaning of Selection of Accounting Policies

Selection of accounting policies refers to the process of choosing appropriate accounting principles and methods from the available alternatives while preparing financial statements.

Since accounting standards often permit more than one acceptable method, management and accountants must evaluate these alternatives carefully. The chosen policy should not be driven by convenience or profit manipulation, but by the objective of presenting a true and fair view.

Why Proper Selection of Accounting Policies Is Important

Improper selection of accounting policies may:

- Overstate profits or assets

- Understate liabilities or losses

- Mislead users of financial statements

- Distort comparison between enterprises

To prevent such outcomes, AS 1 lays down guiding principles that must be followed while selecting accounting policies.

1. Prudence (Conservatism)

Meaning of Prudence

Prudence refers to the exercise of caution while making accounting judgments under conditions of uncertainty.

According to AS 1:

- Profits are not anticipated

- Losses are provided for, even if the amount cannot be determined with certainty

Prudence ensures that financial statements do not present an overly optimistic picture of the enterprise.

Key Aspects of Prudence

The exercise of prudence ensures that:

- Profits are not overstated

- Losses are not understated

- Assets are not overstated

- Liabilities are not understated

This principle protects users from relying on inflated financial results.

Example 1: Prudence in Inventory Valuation

The most common example of prudence is valuation of inventory at lower of cost and net realisable value (NRV).

Case 1: A trader purchases 500 units at ₹10 per unit. He sells 400 units at ₹15 per unit. If NRV of the remaining 100 units is ₹15 per unit, inventory is valued at cost, i.e., ₹10 per unit.

- Future profits are not anticipated.

Case 2: If NRV of unsold units is ₹8 per unit, inventory is valued at ₹8 per unit.

- Possible loss is recognised immediately.

This reflects prudent accounting.

Example 2: Prudence Does Not Allow Hidden Reserves

Prudence does not permit:

- Creation of hidden reserves

- Deliberate understatement of profits

- Overstatement of liabilities

For example, if a company is facing a damage suit, no provision should be made unless the probability of losing the case is more than the probability of not losing it.

Thus, prudence requires balance—not excessive conservatism.

2. Substance over Form

Meaning of Substance over Form

Substance over form means that transactions and events should be accounted for according to their economic reality, and not merely their legal form.

In accounting, the substance of a transaction is more important than how it is legally structured.

Importance of Substance over Form

If accounting were based only on legal form:

- Financial statements may become misleading

- Economic reality may be ignored

- Users may get an incorrect picture of business transactions

AS 1 therefore requires that accounting policies reflect the true substance of transactions.

Practical Explanation

A transaction may be legally structured in a particular way, but its financial effect could be different. Accounting policies must capture the real intention and financial impact of such transactions.

This principle prevents manipulation through legal structuring of transactions.

Role in Selection of Accounting Policies

While selecting accounting policies, enterprises must ensure that:

- Policies reflect economic reality

- Transactions are not misrepresented

- Financial statements are not misleading

Substance over form strengthens the credibility of financial reporting.

3. Materiality

Meaning of Materiality

Materiality means that financial statements should disclose all material items, i.e., items whose omission or misstatement could influence the decisions of users.

Materiality is not only about size, but also about nature.

Materiality Is Not Just Quantitative

An item may be small in amount but still material due to its nature.

For example:

- A small loss due to fraud may indicate serious weaknesses in internal control

- Such information is material despite its low monetary value

Thus, materiality involves professional judgment.

Quantitative Examples of Materiality (As per AS 1)

AS 1 provides examples where quantitative limits of materiality are specified:

- Income or expenditure disclosure - Any item exceeding 1% of revenue from operations or ₹1,00,000, whichever is higher, must be disclosed separately.

- Shareholding disclosure - Shares held by each shareholder holding more than 5% of total shares must be disclosed in the notes to accounts.

These thresholds help ensure adequate disclosure.

Materiality and Selection of Accounting Policies

While selecting accounting policies:

- Material items must be disclosed clearly

- Immaterial details need not clutter financial statements

- Focus should remain on information relevant to users

Materiality ensures clarity without overloading financial statements.

Interrelationship Between Prudence, Substance over Form & Materiality

These three principles do not operate in isolation. Together, they guide the selection of appropriate accounting policies:

- Prudence prevents overstatement

- Substance over form ensures economic reality

- Materiality ensures relevance

When applied together, they help achieve the objective of true and fair presentation.

Impact of These Principles on Financial Statements

Selection of accounting policies based on these principles:

- Enhances reliability of financial statements

- Improves decision-making by users

- Prevents manipulation of profits

- Ensures consistency and transparency

Ignoring these principles can lead to distorted financial reporting.

Role of Professional Judgment

AS 1 recognises that accounting involves judgment. However, such judgment must be exercised:

- Within the framework of accounting standards

- In line with prudence, substance, and materiality

- In the interest of fair presentation

Professional judgment without these guiding principles may lead to biased reporting.

Why AS 1 Emphasises These Considerations

AS 1 does not prescribe specific accounting methods for every situation. Instead, it provides principles-based guidance for selecting accounting policies.

This approach:

- Allows flexibility

- Prevents misuse of flexibility

- Balances standardisation with practicality

The emphasis on prudence, substance over form, and materiality ensures responsible use of accounting discretion.

Conclusion

The selection of accounting policies is one of the most critical aspects of financial reporting. Accounting Standard 1 recognises that while enterprises have flexibility in choosing accounting policies, such choices must be governed by sound principles.

The principles of Prudence, Substance over Form, and Materiality act as guiding pillars that ensure financial statements remain reliable, transparent, and meaningful. By applying these principles carefully, enterprises can present a true and fair view of their financial performance and position.

For students and professionals, understanding these principles is essential—not only for exams but also for real-world accounting practice.

FAQs

1: What is meant by selection of accounting policies?

Answer: Selection of accounting policies refers to choosing appropriate accounting principles and methods from available alternatives while preparing financial statements to present a true and fair view.

2: What are the major considerations for selection of accounting policies under AS 1?

Answer: Accounting Standard 1 identifies three major considerations: Prudence, Substance over Form, and Materiality.

3: What is prudence as per AS 1?

Answer: Prudence means exercising caution while making accounting estimates so that profits are not overstated and losses are provided for even if the amount is uncertain.

4: Does prudence allow creation of hidden reserves?

Answer: No, prudence does not permit creation of hidden reserves or deliberate understatement of profits or assets.

5: What is the meaning of substance over form?

Answer: Substance over form means accounting for transactions according to their economic reality rather than merely their legal form.

6: What is materiality in accounting?

Answer: Materiality refers to the significance of an item whose omission or misstatement could influence the decisions of users of financial statements.

7: Is materiality based only on amount?

Answer: No, materiality is based on both the size and nature of an item. Even small amounts may be material due to their nature.

8: Why does AS 1 emphasize these principles?

Answer: AS 1 emphasizes prudence, substance over form, and materiality to ensure reliability, transparency, and true and fair presentation of financial statements.