Once cash and cash equivalents are clearly understood, the next crucial step in preparing a Cash Flow Statement is classification of cash flows. Accounting Standard 3 (AS-3) does not treat all cash movements in the same manner. Instead, it requires cash flows to be classified into three distinct categories, based on the nature of activities from which they arise.

This classification is the core of AS-3, because it helps users analyse how an enterprise generates cash, where it invests cash, and how it finances its operations.

Meaning of Cash Flows under AS-3

Cash flows refer to inflows and outflows of cash and cash equivalents during an accounting period.

Important clarifications under AS-3:

- Only actual movement of cash is considered

- Non-cash transactions are excluded

- Movements within cash or cash equivalents are not cash flows

AS-3 requires that cash flows be classified into:

- Operating Activities

- Investing Activities

- Financing Activities

Each category provides different information to users of financial statements.

Why Classification of Cash Flows Is Necessary

If all cash receipts and payments were shown together, the Cash Flow Statement would lose much of its usefulness. Classification helps users:

- Understand the sources of cash generation

- Assess the sustainability of operations

- Evaluate investment and expansion decisions

- Analyse changes in capital structure

AS-3 therefore mandates a structured classification.

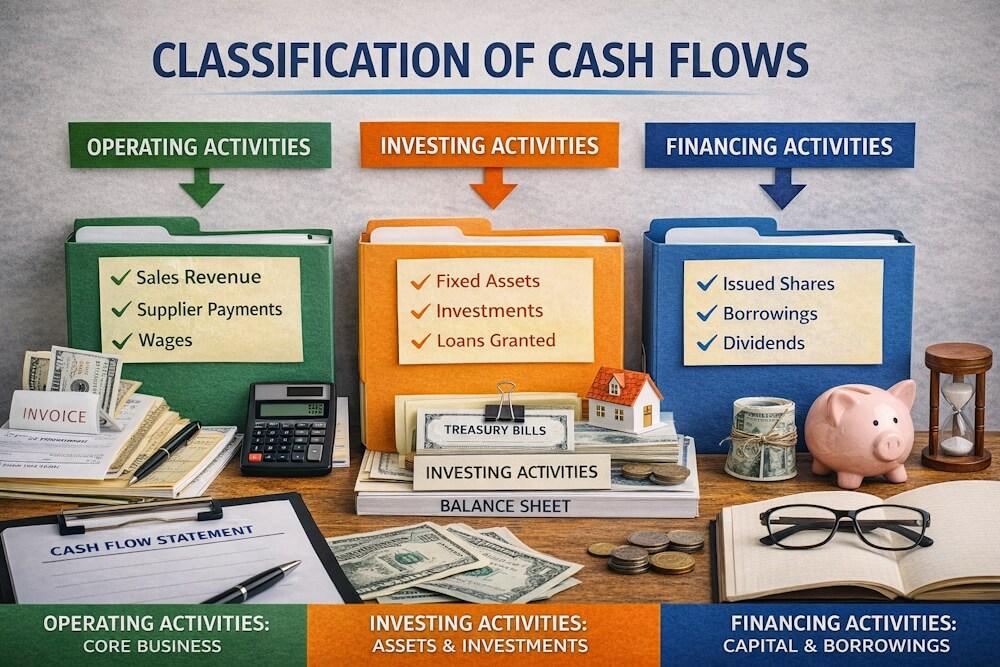

Overview of the Three Types of Cash Flows

| Type of Cash Flow | Related To |

| Operating Activities | Core business operations |

| Investing Activities | Long-term assets & investments |

| Financing Activities | Capital & borrowings |

Each type is discussed in detail below.

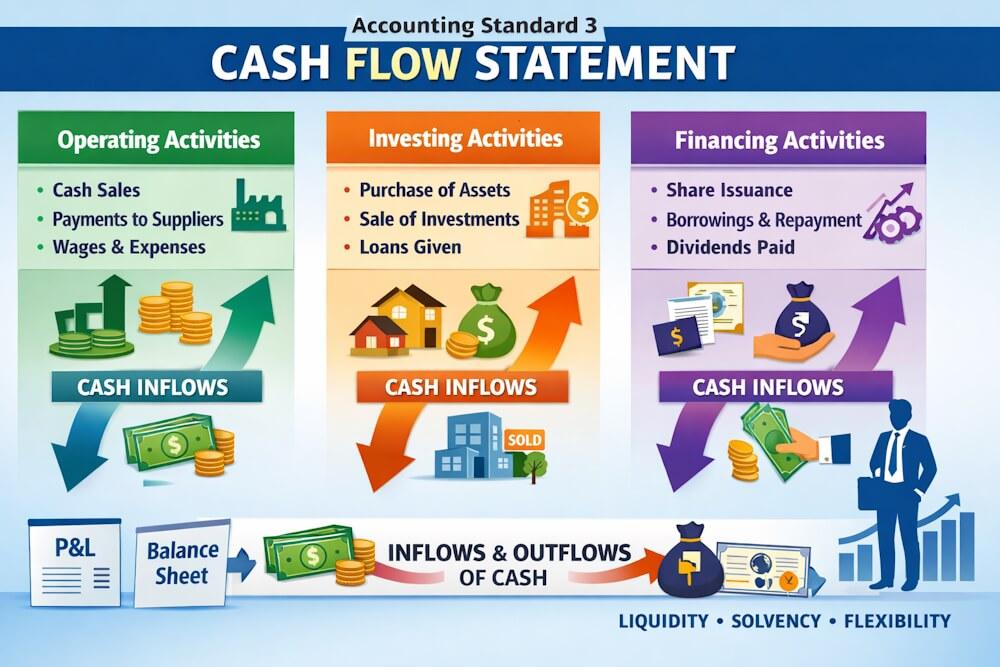

1. Cash Flows from Operating Activities

Meaning of Operating Activities

Operating activities are the principal revenue-producing activities of the enterprise. They also include other activities that are not investing or financing activities.

In simple words, operating cash flows arise from the normal business operations of the enterprise.

Examples of Operating Cash Inflows

Operating cash inflows include:

- Cash received from customers

- Cash received from rendering services

- Cash receipts from royalties, fees, commissions (where applicable)

These inflows indicate how effectively the enterprise generates cash from its core business.

Examples of Operating Cash Outflows

Operating cash outflows include:

- Payments to suppliers for goods and services

- Payments to employees (wages, salaries)

- Payments for operating expenses

Such outflows represent the cost of running day-to-day business operations.

Importance of Operating Cash Flows

Operating cash flows are considered the most important category because they show whether the enterprise can:

- Generate sufficient cash from its main operations

- Maintain operating capability

- Repay loans and pay dividends without relying on external funding

A business with strong operating profits but weak operating cash flows may face liquidity problems.

Operating Cash Flows vs Profit

Operating cash flow is different from profit because:

- Profit includes non-cash expenses like depreciation

- Profit includes accruals and provisions

- Operating cash flow reflects only actual cash movement

AS-3 helps bridge this gap by focusing on cash.

2. Cash Flows from Investing Activities

Meaning of Investing Activities

Investing activities are those activities that relate to the acquisition and disposal of long-term assets and investments.

These activities represent the extent to which an enterprise spends cash for:

- Growth

- Expansion

- Long-term returns

Examples of Investing Cash Inflows

Investing cash inflows include:

- Cash received from sale of fixed assets

- Cash received from sale of long-term investments

- Repayment of loans given to other enterprises

- Interest and dividends received (for non-financial enterprises)

Examples of Investing Cash Outflows

Investing cash outflows include:

- Purchase of fixed assets

- Purchase of long-term investments

- Loans and advances given to other enterprises

These outflows indicate how the enterprise uses cash for future income generation.

Importance of Investing Cash Flows

Investing cash flows help users understand:

- Whether the enterprise is expanding or downsizing

- How much cash is being invested for future growth

- Whether asset sales are being used to support operations

Large investing outflows are not necessarily bad—they may indicate expansion.

3. Cash Flows from Financing Activities

Meaning of Financing Activities

Financing activities are those activities that result in changes in the size and composition of owner’s capital and borrowings.

These activities explain how the enterprise finances its operations and growth.

Examples of Financing Cash Inflows

Financing cash inflows include:

- Proceeds from issue of shares

- Proceeds from issue of debentures

- Amounts borrowed from banks or financial institutions

These inflows represent funds raised from owners and lenders.

Examples of Financing Cash Outflows

Financing cash outflows include:

- Repayment of borrowings

- Redemption of debentures or preference shares

- Payment of dividends

These outflows indicate repayment of capital or returns paid to providers of funds.

Importance of Financing Cash Flows

Financing cash flows help users assess:

- Capital structure of the enterprise

- Dependence on external borrowings

- Dividend policy

- Ability to repay long-term obligations

Difference between Operating, Investing & Financing Cash Flows

| Basis | Operating | Investing | Financing |

| Nature | Core business | Asset & investment related | Capital & borrowings |

| Frequency | Regular | Occasional | Occasional |

| Indicator | Sustainability | Growth strategy | Financial structure |

This distinction is vital for analysis and examination.

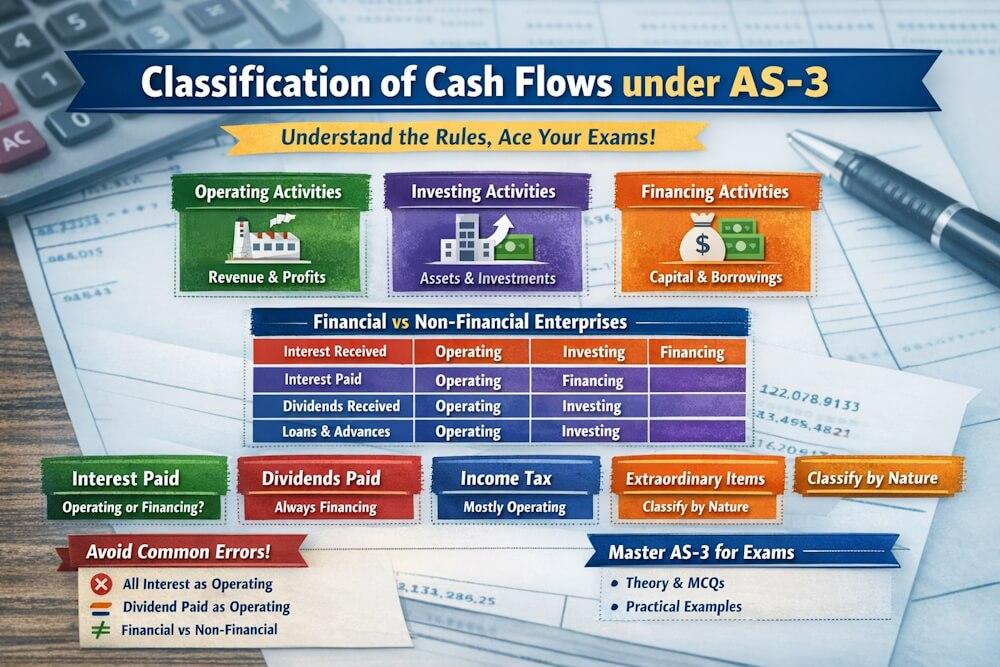

Classification Depends on Nature of Activity

AS-3 emphasises that classification of cash flows depends on the nature of the activity, not merely on the type of receipt or payment.

For example:

- Purchase of machinery → Investing activity

- Payment of wages → Operating activity

- Repayment of loan → Financing activity

This principle prevents misclassification.

Special Note on Financial Enterprises

For financial enterprises:

- Loans and advances are operating activities

- Interest received is operating cash flow

For non-financial enterprises:

- Loans given are investing activities

- Interest received is investing cash flow

This distinction is important and frequently tested in exams.

Inter-relationship of the Three Types of Cash Flows

The three types of cash flows are inter-related:

- Strong operating cash flows reduce dependence on financing

- Investing activities influence future operating cash flows

- Financing activities support operating and investing needs

A balanced combination reflects financial health.

Why Separate Disclosure Is Required

AS-3 requires separate disclosure so that users can:

- Analyse cash generated internally vs externally

- Identify reliance on borrowings

- Understand long-term investment patterns

Without classification, these insights would be lost.

Common Exam Mistakes to Avoid

Students often:

- Treat all receipts as operating cash flows

- Misclassify purchase of assets as operating activity

- Ignore distinction between financial and non-financial enterprises

A clear conceptual understanding avoids these errors.

Importance of Types of Cash Flows from Exam Perspective

This topic is:

- Frequently asked in theory questions

- Heavily tested in classification problems

- Critical for preparing full Cash Flow Statements

A strong grip on this concept ensures accuracy in practical questions.

Link with Other AS-3 Topics

Understanding types of cash flows is essential before studying:

- Classification rules for specific items

- Direct and indirect method of operating cash flows

- Net basis reporting

It forms the conceptual backbone of AS-3.

“This article explains the core classification of cash flows under Accounting Standard 3. For a complete, structured understanding of AS-3, including cash and cash equivalents, classification rules, preparation methods, disclosures, and illustrations, refer to our Accounting Standard 3 (AS-3): Cash Flow Statement – Complete Guide.”

Conclusion

Accounting Standard 3 classifies cash flows into operating, investing, and financing activities to provide meaningful insights into an enterprise’s cash management. Each type of cash flow serves a different analytical purpose and together they present a complete picture of liquidity, growth, and financial structure.

For students, mastering this classification is essential for examinations. For users of financial statements, it is a powerful tool for analysing the financial health of an enterprise. A Cash Flow Statement prepared without proper classification fails to achieve the objectives of AS-3.

FAQs

1: What are cash flows as per AS 3?

Answer: Cash flows are inflows and outflows of cash and cash equivalents during an accounting period, classified into operating, investing, and financing activities.

2: What are operating cash flows?

Answer: Operating cash flows arise from the principal revenue-producing activities of an enterprise, such as cash receipts from customers and payments to suppliers and employees.

3: What are investing cash flows?

Answer: Investing cash flows relate to the acquisition and disposal of long-term assets and investments, such as purchase or sale of fixed assets and investments.

4: What are financing cash flows?

Answer: Financing cash flows are those that result in changes in the capital and borrowings of an enterprise, such as issue of shares, borrowings, and repayment of loans.

5: Why does AS 3 classify cash flows into three categories?

Answer: Classification helps users analyse cash generated from operations, cash used for investments, and cash raised or repaid through financing activities.

6: Are all cash receipts treated as operating cash flows?

Answer: No, cash receipts are classified based on their nature. Some receipts relate to investing or financing activities rather than operating activities.

7: How are cash flows treated for financial enterprises?

Answer: For financial enterprises, loans and advances and interest received are treated as operating cash flows under AS 3.