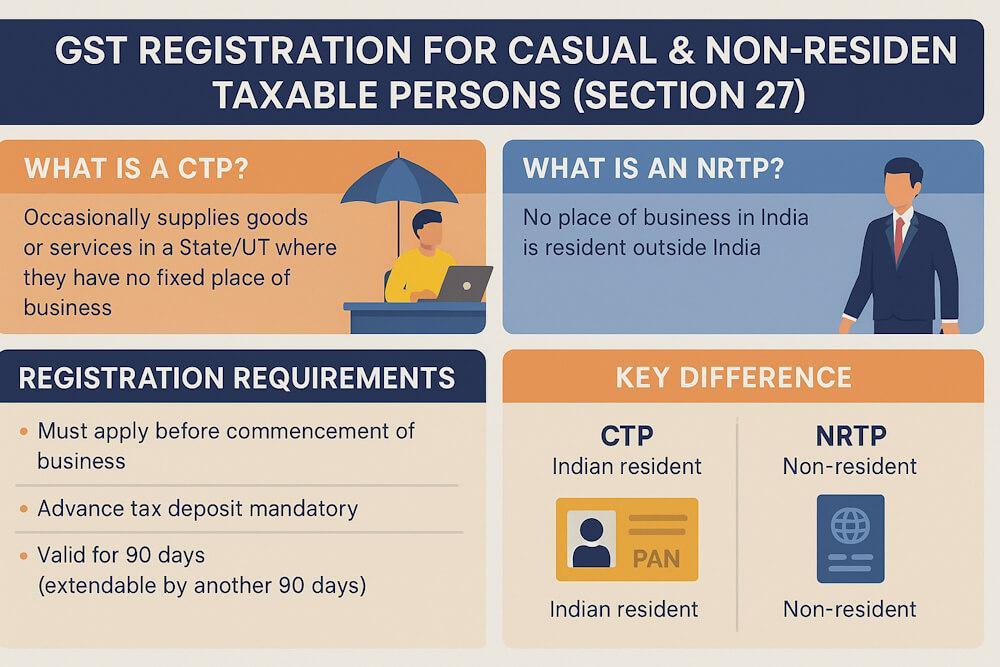

Under GST, most businesses operate from a fixed place—an office, shop, warehouse, or factory. But what about people who do not have a permanent place of business in a particular state but still carry out supply? This is where the concept of Casual Taxable Person (CTP) and Non-Resident Taxable Person (NRTP) becomes important.

Section 27 of the CGST Act specifically governs how these categories must register and operate. Their registration rules are completely different from regular taxpayers, especially regarding advance tax, validity period, and renewal.

This blog simplifies everything you need to know about Section 27, making it easy to understand how CTPs and NRTPs function under the GST law.

What Is a Casual Taxable Person (CTP)?

A Casual Taxable Person is someone who occasionally undertakes supply of goods or services in a State/UT where they do not have a fixed place of business.

Examples of CTPs:

- A trader from Gujarat attending a 5-day exhibition in Delhi

- A handicraft seller from Rajasthan setting up a festival stall in Mumbai

- A marketing company participating in events in another state

- A food stall owner opening temporary counters at fairs

- A business displaying products at trade shows outside their home state

These persons do not have a regular business setup in those states, which is why GST requires a special registration process.

What Is a Non-Resident Taxable Person (NRTP)?

A Non-Resident Taxable Person is similar to a CTP but is not resident in India. They may be:

- Foreign companies exhibiting goods in India

- Overseas businesses supplying services temporarily

- International sellers showcasing products at expos

They do not have a fixed business place in India but make taxable supplies within the country.

NRTP Examples:

- A Dubai electronics company attending an expo in Delhi

- A Singapore-based designer selling goods at an Indian festival

- A foreign consultant supplying services temporarily in India

CTP vs NRTP – Key Difference

| Feature | CTP | NRTP |

| Residency | Indian residents | Non-residents |

| Business presence | No fixed place in a state | No business presence in India |

| PAN requirement | PAN required | No PAN required; passport used |

| Validity | 90 days | 90 days |

| Advance tax | Mandatory | Mandatory |

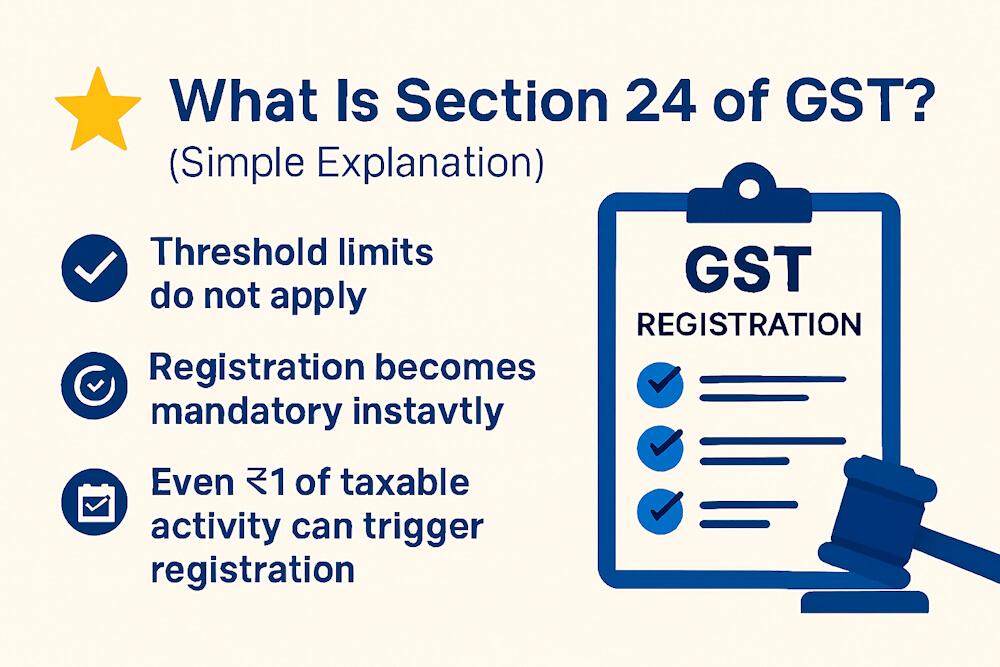

Why Do CTP & NRTP Require Special Registration?

They operate temporarily and may leave the state or country after completing their event or activity. GST law ensures:

- Proper tax tracking

- Prevents tax leakage

- Ensures they deposit tax in advance

- Ensures compliance even for short-term businesses

CTP & NRTP Registration – Section 27 Explained

Section 27 creates one of the most unique GST registration systems, with three main rules:

- Registration is mandatory before starting business

- Advance tax deposit is compulsory

- Registration has limited validity (90 days + extension)

Let’s break these down.

1. Mandatory Registration Before Starting Business

Unlike regular taxpayers, CTP & NRTP cannot begin any supply without registration.

Meaning:

They must apply for GST registration before starting the event, exhibition, or temporary business.

Supplies made without registration are illegal under GST.

2. Advance Tax Deposit Requirement

CTPs & NRTPs must deposit estimated tax liability in advance at the time of registration.

This is a crucial part of Section 27.

How does it work?

Suppose a seller expects to make sales of ₹5,00,000 during a 4-day exhibition.

GST @ 18% = ₹90,000 (approx.)

- They must deposit ₹90,000 in advance before registration is approved.

Why advance tax?

Because after the event, some CTP/NRTP may leave without paying GST. So the government collects estimated tax upfront.

Adjustment

After filing the GSTR-3B for the period, this advance deposit is adjusted. If more tax is due, they must pay the balance. If less is due, refund procedures apply.

3. Validity of Registration – 90 Days

The GST registration certificate issued to CTP/NRTP is valid for:

90 days from the effective date of registration.

If they need more time:

- They may apply for extension of another 90 days

- Again, advance tax must be paid for the extended period

Maximum validity possible = 180 days

4. No Eligibility for Composition Scheme

CTP & NRTP cannot opt for the Composition Scheme.

This is because:

- Composition scheme is for long-term regular suppliers

- CTP/NRTP operate only temporarily

5. Returns to Be Filed by CTP & NRTP

Even though they operate temporarily, they must file:

- GSTR-1 (Outward supplies)

- GSTR-3B (Monthly return)

- Payment of tax through cash ledger (adjusted against advance deposit)

6. PAN Requirement

- For CTP – PAN Required

- For NRTP – Passport Allowed

NRTPs can apply using:

- Passport number, or

- PAN of a foreign entity (if available)

7. Invoicing Rules for CTP & NRTP

CTP/NRTP must issue GST invoices, just like regular taxpayers:

- GSTIN must be mentioned

- CGST + SGST or IGST depending on place of supply

- Tax collected normally

Examples to Understand CTP/NRTP Clearly

Example 1: Food Stall at Mumbai Festival

A Delhi-based food business attends a 7-day festival in Mumbai.

Since they do not have a permanent place of business in Mumbai:

- They must apply as a CTP

- Estimate sales → Pay advance tax

- Get registration

- Sell food legally

- File returns

Example 2: Foreign Company at an Expo

A Korean electronics company participates in an expo in Delhi.

- They must register as NRTP

- Passport allowed

- Advance tax deposit mandatory

- Registration valid for 90 days

Example 3: Exhibition Extended by 30 Days

CTP’s exhibition extended due to high footfall.

- Apply for extension

- Pay additional advance tax

- Extended registration granted

Example 4: Refund of Extra Advance Tax

CTP deposited ₹90,000 in advance but actual sales resulted in GST of ₹70,000.

- ₹20,000 refundable after filing returns

Common Mistakes Made by CTPs/NRTPs

Applying for registration after starting supply

Registration MUST be pre-event.

Estimating tax incorrectly

Underpaying advance tax leads to rejections.

Not filing returns

Even for temporary events, non-filing leads to penalties.

Forgetting to apply for extension

Once registration expires, supplies become illegal.

Assuming they can use the same GSTIN across states

CTPs need separate GST registration for each state where they operate.

Advantages of CTP/NRTP Registration

- Legal compliance

- Ability to issue GST invoices

- Avail input tax credit (ITC) rules (only in certain cases)

- Expanded business opportunities during events

- Builds credibility with customers & government agencies

Limitations of CTP/NRTP Registration

- Short validity

- Advance tax burden

- No composition scheme

- No permanent place of business

- Higher compliance for short-term operations

Conclusion

Section 27 ensures that people or entities who operate temporarily in a state still remain fully compliant with GST laws. Whether you are an Indian seller attending a fair in another state or a foreign business visiting India for an exhibition, GST clearly outlines the process to ensure transparency, accountability, and tax compliance.

Understanding CTP and NRTP registration rules helps businesses avoid penalties, operate legally, and comply with all GST regulations even when operating for a short duration.

FAQs

1. Who is a Casual Taxable Person under GST?

A person who occasionally supplies goods or services in a state where they do not have a fixed place of business.

2. Who is a Non-Resident Taxable Person?

A foreign entity or non-resident individual supplying goods/services in India without a fixed place of business.

3. Is advance tax mandatory for CTP/NRTP?

Yes. They must pay estimated GST liability in advance before registration.

4. How long is the registration of a CTP or NRTP valid?

90 days, extendable by another 90 days.

5. Can a CTP or NRTP opt for composition scheme?

No. They are not eligible for the composition scheme.

6. Can a CTP supply goods without GST registration?

No. They must register before supplying goods or services.

7. Is PAN required for NRTP?

No. A passport number is sufficient.