When GST rates change, businesses don’t just cheer or complain about higher or lower taxes. The real headache is figuring out which rate applies when your transactions fall on both sides of the date. It’s a problem that has confused shopkeepers, service providers, and even accountants.

Let’s break it down without the jargon.

Why Rate Change Timing Matters

Imagine this. You sell a TV in June, but the customer takes delivery in July, and that’s exactly when the tax rate drops. Should you use the June rate because the invoice was raised earlier? Or the July rate because the TV actually left your shop then? The answer decides whether your customer pays more or less, and whether your GST return matches up with reality.

Supply Before Rate Change

If the actual supply happened before the new rate kicked in, the law generally says stick with the old rate, even if you raise the invoice or collect payment later.

One trader I met in Delhi supplied a sofa set on June 28th. GST rates were reduced on July 1st. He collected the money a week later, but the delivery had already happened. The tax officer told him: sorry, supply was before the cut, so you still pay the old rate. The invoice date and payment didn’t matter as much—the sofa was already gone before July 1st.

Supply After Rate Change

Now flip the situation. Suppose the goods or service are actually supplied after the new rate takes effect. In that case, the new rate applies, no matter what you did earlier.

Take laptops as an example. A dealer issued the invoice on June 28th, but the laptops were delivered on July 5th, after the tax rate dropped. The customer insisted on the reduced rate, and legally, he was right. Supply happened in July, so July’s lower GST applied.

Even services follow the same logic. A wedding planner collected ₹50,000 advance in June for a July wedding. Since the event—the actual service—happened in July, the planner couldn’t stick with June’s rate. She had to adjust GST to the new rate, even though she got the money earlier.

When Life Gets Messy

Of course, real business doesn’t always follow a clean timeline. Sometimes the invoice is dated before, payment comes later, and supply happens in between. That’s where most disputes crop up.

I remember a shopkeeper who sold air conditioners. He raised invoices in late June, got paid in early July, and delivered the ACs the same week. Supply had clearly crossed into July, which meant the new lower rate applied. But he mistakenly used June’s rate because the invoice was earlier. Customers caught it and demanded refunds, forcing him to reissue invoices and fix his returns.

Services: The Extra Twist

Goods are tricky enough, but services add another layer. Many services stretch across months—like tuition classes, internet connections, or annual maintenance. In such cases, businesses often have to split the billing into two parts: before the rate change and after it.

For example, if an internet provider charges ₹12,000 annually starting April, and GST rates change on October 1st, the provider can’t apply one flat rate. They need to treat April to September at the old rate and October to March at the new one. It’s extra paperwork, but that’s how the rules ensure fairness.

Real Stories That Make It Clear

- A tutor got an advance payment on June 20th for classes scheduled in July. The rate changed on July 1st. Since the classes happened in July, the new rate kicked in, and the advance had to be adjusted.

- A builder handed over a flat on June 28th, just days before the GST rate change. The invoice went out in July. Even then, the old rate applied because the supply—the possession of the flat—was already done in June.

- A wedding caterer collected full payment in June but provided the food service in July. Tax officers said, “supply is July, so pay July’s rate.” The caterer had to recalculate and pay the difference.

Why Businesses Slip Up

Most of the mistakes come from focusing only on invoice or payment and ignoring the actual supply date. But GST doesn’t see it that way. The law always asks: When did the goods or services actually change hands? That date usually decides which rate applies.

The problem is, mismatched rates create unhappy customers and mismatched returns. Buyers may lose ITC if you use the wrong rate. Worse, the GST portal picks up these mismatches, and notices follow.

Wrapping It Up

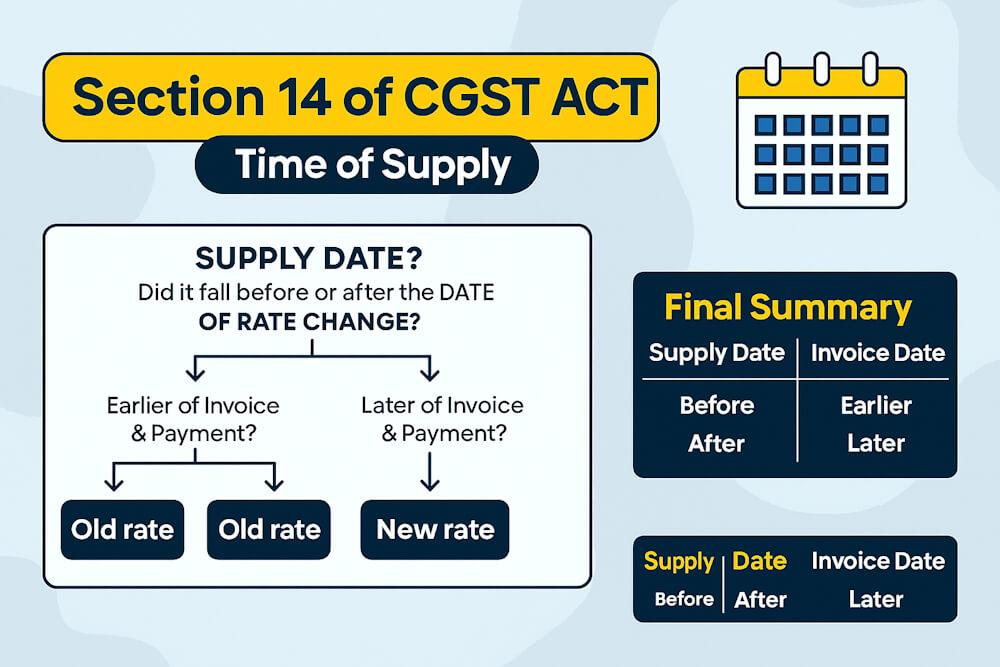

Here’s the thumb rule: when rates change, don’t get lost in paperwork. Track the supply date first. If supply happened before the change, the old rate stands. If supply happened after, the new rate applies—even if you invoiced or collected money earlier.

It may feel like overkill, but these rules stop unfair advantages. Sellers can’t sneak in old higher rates after a cut, and buyers can’t avoid new higher rates by pretending supply was earlier.

So the next time you hear about GST rate changes, don’t panic. Just map three dates—supply, invoice, and payment—and let supply timing lead the way. That way you won’t end up reissuing invoices or answering uncomfortable questions from the taxman.