Not every business transaction ends in a confirmed sale. In the real world, goods are often sent on approval, on trial, or for exhibition purposes. Jewellery, garments, electronics, books, and even machinery businesses do this all the time.

GST understands this reality. That’s why special invoicing rules exist for sale-or-return transactions and exhibition goods. The problem is—many businesses either don’t know these rules or follow them halfway, which later results in notices and penalties.

Let’s clear it all up in simple terms.

What Does “Sale or Return” Mean Under GST?

Sale or return (also called goods sent on approval) means:

- Goods are sent to a buyer

- Buyer checks, tests, or displays them

- Sale is confirmed only after approval

At the time of sending goods, ownership does not transfer. That’s the key reason GST treats it differently.

Is Sending Goods on Approval a “Supply”?

No-not immediately.

As long as:

- There is no consideration

- Buyer has not accepted the goods

It is not treated as supply under GST at that moment.

So naturally, no tax invoice is issued at dispatch.

What Document Is Used Instead of Invoice?

When goods are sent on approval:

- Delivery Challan is issued

- E-way bill (if applicable) accompanies the goods

The delivery challan must include:

- Description of goods

- Quantity

- Value (for reference)

- Reason for movement (“sent on approval”)

This document legally allows movement without tax payment.

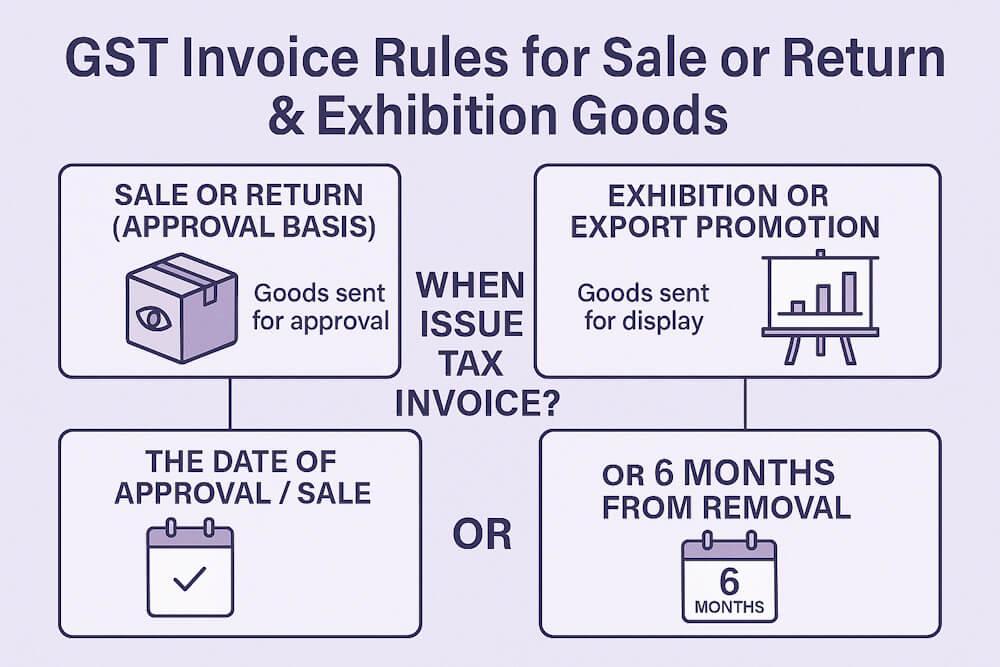

When Must the Tax Invoice Be Issued?

GST provides two clear deadlines.

Invoice must be issued at the earlier of:

- The date when buyer approves/accepts the goods

- Six months from the date of removal of goods

This 6-month rule is non-negotiable.

Example:

Goods sent on approval on 1 January Buyer doesn’t respond

- Invoice must be issued by 30 June, even if goods are not returned or accepted

What If Goods Are Returned Within 6 Months?

If goods are returned within the 6-month period:

- No tax invoice is required

- No GST is payable

- Delivery challan records remain sufficient

This is common in garment and jewellery businesses.

Goods Sent for Exhibition or Export Promotion

Businesses often send goods:

- Outside India for exhibitions

- On consignment basis

- For display at trade fairs

At this stage:

- There is no sale

- There is no consideration

So GST does not treat this as supply initially.

Which Document Is Used for Exhibition Goods?

Just like approval sales:

- Delivery Challan

- E-way bill (where applicable)

No tax invoice is issued when goods are merely sent for exhibition.

What Happens After Exhibition?

Three possibilities exist:

Case 1: Goods Are Sold Abroad

- Supply is treated as having occurred on date of sale

- Tax invoice issued for quantity sold

- Export rules apply (IGST or LUT)

Case 2: Goods Are Brought Back to India

- No supply

- No tax invoice

- No GST impact

Case 3: Goods Are Neither Sold Nor Returned Within 6 Months

- Supply is deemed to have taken place

- Tax invoice must be issued

- GST becomes payable

This avoids indefinite tax postponement.

Why GST Introduced the 6-Month Rule

Without a time limit, businesses could keep goods “on approval” forever and delay tax.

The 6-month rule:

- Protects revenue

- Ensures clarity

- Keeps records clean

It’s one of the most strictly checked provisions during audits.

How These Rules Help Businesses (When Followed Correctly)

- Avoids paying tax on unsold goods

- Improves cash flow

- Reduces unnecessary GST blockage

- Keeps buyer-seller relationship flexible

But only if documentation is done properly.

Common Mistakes Businesses Make

- Issuing tax invoice at dispatch (wrong)

- Forgetting the 6-month deadline

- Missing delivery challan details

- No tracking of approval goods

- Treating exhibition goods as exports immediately

These mistakes almost always lead to GST notices.

Practical Industries Affected Most

- Jewellery traders

- Garment wholesalers

- Electronics distributors

- Book publishers

- Machinery dealers

- Export promotion agencies

If you’re in one of these, this blog is especially relevant.

Simple Compliance Checklist

- Use delivery challan

- Generate e-way bill if required

- Track approval date

- Monitor 6-month deadline

- Issue invoice immediately on approval

- Maintain return records

Following this avoids 90% of issues.

FAQs

1. Is GST payable when goods are sent on approval?

No, GST is payable only when goods are approved or after 6 months.

2. What happens if buyer partially accepts goods?

Invoice must be issued only for the accepted quantity.

3. Can delivery challan be used for inter-State movement?

Yes, with e-way bill wherever applicable.

4. Are exhibition goods treated as exports immediately?

No. They become exports only when sold abroad.

5. Is the 6-month rule applicable for both approval and exhibition goods?

Yes, Section 31(7) applies to both situations.

6. What if invoice is not issued after 6 months?

GST liability arises, along with interest and penalties.