Once a business gets its GST registration, the details recorded in the GST portal—such as business name, address, promoters, authorized signatory, mobile number, email, and so on—may change over time. GST law recognizes this and allows taxpayers to amend their registration details.

Section 28 of the CGST Act, along with Rule 19 of the CGST Rules, lays down the entire process of how to update GST registration details, what changes require approval, what changes do not, and what timelines apply.

In this blog, we'll simplify everything you need to know about GST registration amendments, explain the difference between core and non-core fields, and walk you through the exact procedure for updating changes.

What Is GST Registration Amendment?

A GST amendment means making changes to the details provided at the time of obtaining GST registration.

These changes can be related to:

- Business name

- Business address

- Promoter details

- Authorized signatory

- Contact information

- Business constitution

- Additional places of business

- Nature of business activities

- HSN/SAC codes

Amendments help keep your GST profile accurate and updated.

Section 28 – Legal Framework for Amendment

Section 28 states:

“A registered person must file an application to amend any registration details within 15 days of such change.”

Here’s what the section covers:

- When amendment is required

- Cases where approval is needed

- Effective date of amendment

- Rejection & notice for clarification

- Role of proper officer

Types of GST Registration Amendments

Amendments are divided into two main categories:

Core Fields (Require Officer Approval)

These are the most important fields in GST registration. Any change in these fields affects the identity, address, or ownership of the business.

Core fields include:

- Name of business (legal name)

- Principal place of business

- Additional places of business

- Addition, removal, or modification of partners / promoters / directors

- Authorized signatory changes (in some cases)

Why approval is needed?

To prevent fraud and maintain authenticity.

Non-Core Fields (Do NOT Require Approval)

These fields can be amended by the taxpayer directly on the portal.

Non-core fields include:

- Mobile number

- Email ID

- Bank account details

- Business activity details

- HSN / SAC codes

- Minor corrections

- Unit details

Why no approval?

These changes do not affect legal identity or ownership.

Important: Contact Details Cannot Be Changed Directly

Mobile number and email ID used for login cannot be changed directly.

They can only be updated through:

- Authorized signatory’s DSC or

- OTP verification

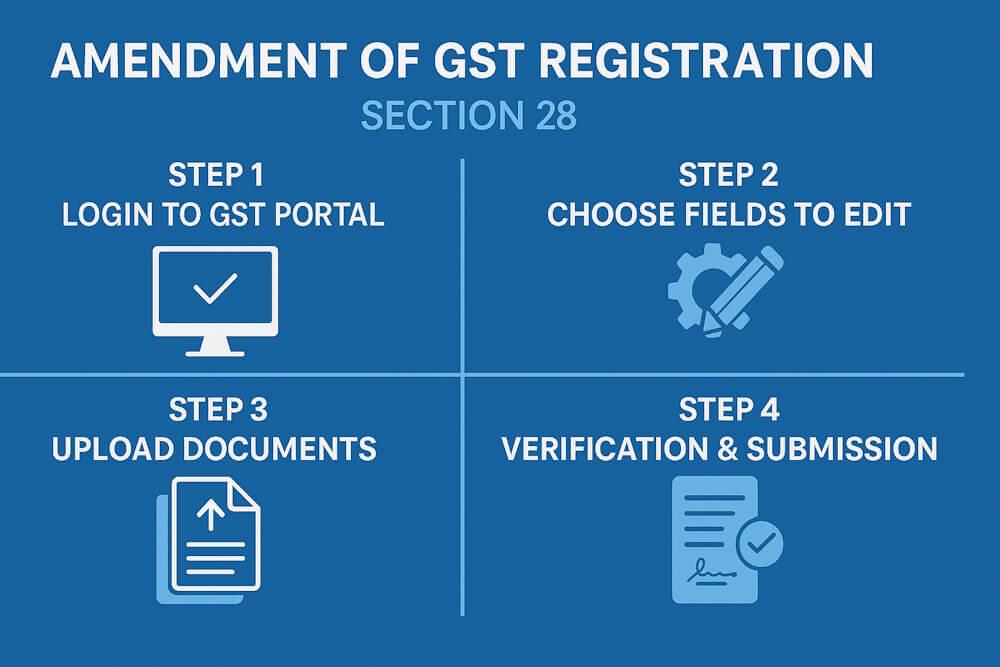

Step-by-Step Procedure to Amend GST Registration

The amendment process is completed through FORM GST REG-14.

Let’s go step-by-step:

Step 1: Login to GST portal

Login to: 👉 www.gst.gov.in

Go to: Services → Registration → Amendment of Registration

⭐ Step 2: Choose the Field to Edit

You will see three tabs:

- Business Details

- Principal Place of Business

- Additional Places of Business

- Promoters / Partners

- Authorized Signatory

- Bank Accounts

- State-specific info

Select the field you want to amend.

Step 3: Upload Supporting Documents

Depending on the amendment, documents may be required.

Examples:

- Address change → Rent agreement, electricity bill

- Promoter change → ID proof, photograph

- Business name change → Certificate of incorporation

- Additional place of business → NOC + utility bill

Upload clear documents to avoid objections.

Step 4: Verification & Submission

Submit using:

- DSC (mandatory for companies)

- EVC OTP (for proprietors & partnerships)

- E-sign (for Aadhaar-linked numbers)

Step 5: ARN Generation

After submitting, an Application Reference Number (ARN) is generated.

This can be used to track application status.

Step 6: Approval or Clarification (REG-03)

The officer checks the application.

You may get:

- Approval - If documents are correct.

- REG-03 Notice - If clarification is required.

You must reply via REG-04 within 7 days.

- Rejection (REG-05) - If officer is not satisfied.

Timelines Under Section 28 & Rule 19

- Amendment must be applied within 15 days of the change

- Officer should approve/reject within 15 days

- Effective date can be earlier if justified (but subject to officer approval)

Special Cases in Amendment

1. Amendment in Authorized Signatory

If the person handling GST operations changes:

- Add new authorized signatory

- Remove old one

- Submit authorization letter

- Needs approval

2. Change in Business Name

You must first update:

- PAN database

- MCA records (for companies)

Only then GST portal allows name change.

3. Change in Address

- Requires address proof + NOC.

- Officer may conduct physical verification if required.

4. Adding/Removing Partners or Directors

All KYC documents must be re-uploaded:

- PAN

- Aadhaar

- Photo

- Address proof

- Authorization letter

5. Nature of Business Change

Example: Adding warehousing, e-commerce, or manufacturing.

Usually no approval required unless additional place is added.

Common Reasons for Amendment Rejection

- Blurry documents

- Wrong electricity bill

- Mismatch in name/address on documents

- PAN not updated before name change

- Incorrect business reason selected

- Incomplete information

Practical Examples for Clarity

Example 1: Change of Address

A shop moves to a new commercial space.

Steps:

- Upload rent agreement

- Upload utility bill

- Officer approves

- GST certificate updated

Example 2: Adding New Warehouse

A trader adds a warehouse in another locality.

- Additional place of business must be added

- Supporting documents needed

- Approval required

Example 3: New Partner Added

A partnership firm admits a new partner.

- Add details in promoter tab

- Upload PAN, Aadhaar

- Officer approval mandatory

Example 4: Email Changed

A proprietor changes official email.

- Update in non-core fields

- OTP verification

- No officer approval needed

Impact of Amendment on GST Compliance

- Updated details reflect on invoices

- New address must be used for e-way bills

- Banks and vendors require updated GST certificate

- Proper amendment avoids mismatches in audits

- Helps maintain legal compliance

Conclusion

Section 28 ensures that the GST registration remains accurate and aligned with any changes in the business. Whether you shift your office, add a new partner, update your bank account, or even change your business model, GST law allows smooth amendment procedures.

Keeping your registration details updated helps avoid penalties, notice from departments, and compliance issues during audits.

FAQs

1. What is GST amendment?

It is the process of modifying or updating GST registration details.

2. What are core fields in GST registration?

Name, address, promoters, partners, additional business places.

3. What are non-core fields?

Bank details, contact info, business activity, HSN/SAC codes.

4. How long does amendment approval take?

Usually 15 working days.

5. Which form is used for GST amendment?

FORM GST REG-14.

6. Can I change my GST registered mobile number?

Yes, through OTP verification via authorized signatory.

7. Can business name be changed without MCA/PAN update?

No. PAN database must be updated first.