When people first learn GST, they usually think valuation is simple: “Just take the price on the invoice and apply GST.” But once discounts, subsidies, or those little additional charges enter the picture, the valuation becomes a different game altogether. And honestly, in practical business situations, these three elements—discounts, subsidies, and additional charges—show up more often than clean, straightforward billing.

Accurate valuation is crucial for every business, as even small errors can lead to significant financial consequences.

- Tax liability

- ITC

- Audit trail

- Matching with GSTR-2A/2B and GSTR-1

- Compliance ratings

So in this blog, we’re going to break down all the rules relating to discounts, subsidies, and additional charges under GST.

Let’s go layer by layer.

1. Understanding Value of Supply — Before Applying Adjustments

Before adding or reducing anything, Section 15 says that GST is charged on the transaction value, i.e.:

“The price actually paid or payable for the supply if supplier and recipient are not related and price is the sole consideration.”

Once that is clear, Section 15(2) and 15(3) come into play.

- Section 15(2) → Things you must add

- Section 15(3) → Discounts you may subtract

This is the foundation.

Now let's go deeper.

2. Discounts Under GST (Section 15(3))

This is where most confusion happens because businesses give multiple types of discounts.

GST classifies discounts into:

- Before supply (on-invoice) discounts

- After-supply (post-supply) discounts

- Secondary discounts

- Conditional quantity-based discounts

- Turnover or annual performance discounts

Let’s understand how each affects GST valuation.

2.1 On-Invoice Discounts (Allowed Deductions)

If the discount is known at or before the time of supply and is recorded in the invoice, it is allowed as a deduction.

Example

- List price of goods: ₹10,000

- Discount shown on invoice: 10% (₹1,000)

- Taxable value = ₹9,000

GST applies on ₹9,000 only.

This is the simplest case.

2.2 Post-Supply Discounts (Allowed Only If Conditions Met)

These discounts are allowed as deduction only if:

- Discount is established in terms of an agreement entered at or before the time of supply

- Such discount is linked to relevant invoices

- The recipient reverses ITC proportionately

If any condition breaks → discount is NOT allowed.

Example

A dealer offers a quarterly turnover discount, but the scheme was informed to the customer beforehand.

- Total purchases: ₹5,00,000

- Discount announced earlier: 2%

- Discount credited later through Credit Note: ₹10,000

If customer reverses ITC on discount portion → taxable value reduces.

If ITC is not reversed → discount not allowed → GST payable on full ₹5,00,000.

2.3 Secondary Discounts (NOT Allowed)

These are discounts offered after the supply without any prior agreement.

Example (Secondary Discount scenario)

A supplier sells goods at ₹1,00,000. Later sends a Commercial Credit Note:

- “To help you clear old stocks, we give ₹5,000 discount.”

No GST credit note is issued, no prior agreement.

Outcome:

- Taxable value remains ₹1,00,000

- Discount not allowed

- Supplier cannot reduce output tax

- Recipient cannot reverse ITC

This is very common and often shown in ICAI problems.

3. GST Treatment of Subsidies (Section 15(2)(e))

Subsidies are one of the trickiest parts of GST valuation.

There are 2 types:

- Government Subsidies

- Non-Government Subsidies

The rule is:

Government subsidies are excluded from taxable value. Any other subsidy is included.

Let’s break it down.

3.1 Government Subsidies Are Excluded

If the Central or State Government gives subsidy, GST value does NOT include it.

Example (Simple)

Price of machinery = ₹1,00,000 Govt subsidy = ₹20,000 Customer pays = ₹80,000

Taxable value = ₹1,00,000 Subsidy ignored.

3.2 Non-Government Subsidies Must Be Added

These come from private companies, NGOs, industry bodies, etc.

Example

- Product Price: ₹10,000

- Subsidy from a private company: ₹2,000

- Customer pays: ₹8,000

Taxable value = ₹10,000 + 2,000 (subsidy) = ₹12,000

GST applies on ₹12,000.

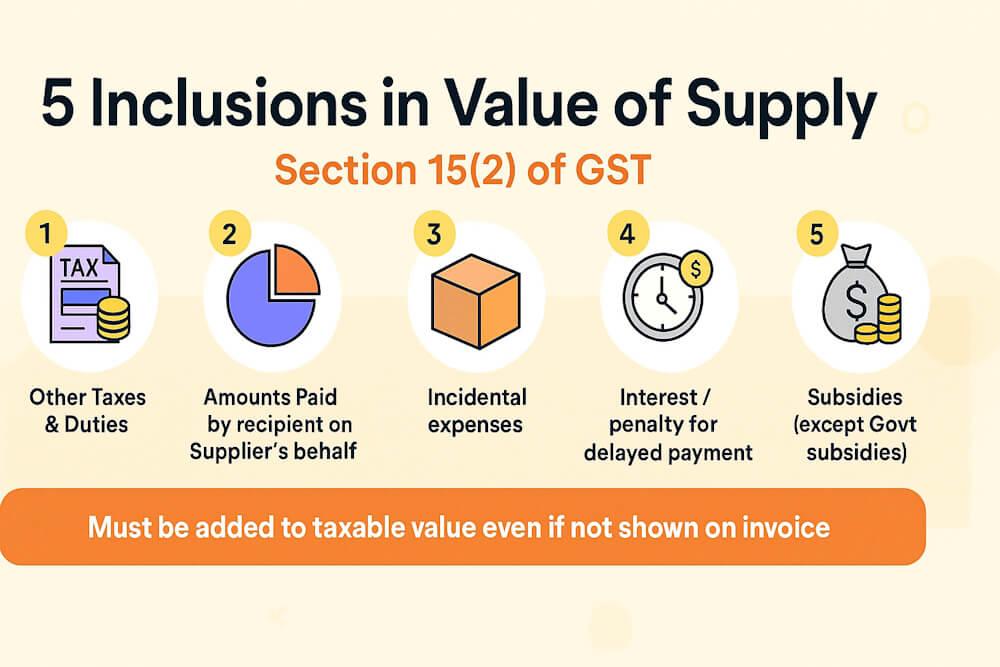

4. Additional Charges Under GST (Section 15(2))

Section 15(2) lists the items that must be added to value of supply.

Let’s make it simple:

Things that must be added:

- Taxes (other than GST)

- Packing charges

- Loading / unloading charges

- Freight charged by supplier

- Warranty charges

- Interest for delayed payment

- Penalties

- Any amount the supplier is liable to pay but paid instead by recipient

Let’s understand these one by one with exam-style illustrations.

5. Examples for All Components

Now let’s bring everything together with fully practical examples.

Example 1 — Discount on Invoice + Freight

- List Price: ₹50,000

- Less: On-invoice discount: 5% = ₹2,500

- Packing: ₹1,000

- Freight: ₹2,000

Valuation:

- Base = 50,000 – 2,500 = 47,500

- Add packing = 48,500

- Add freight = 50,500

Taxable Value = ₹50,500

Example 2 — Post-Supply Discount Eligible

- Goods sold at: ₹2,00,000

- Pre-agreed discount scheme: 3% on achieving quarterly target

- Buyer achieved target → discount issued through GST Credit Note

Discount = ₹6,000, Customer reverses ITC = Yes

Taxable Value: ₹1,94,000

Example 3 — Post-Supply Discount NOT Eligible (Secondary Discount)

- Goods sold at: ₹3,00,000

- Later discount (not pre-agreed): ₹10,000

- No ITC reversal

→ Discount NOT allowed.

Taxable value = ₹3,00,000

Example 4 — Non-Government Subsidy

- Price = ₹20,000

- Industry association subsidy = ₹4,000

- Buyer pays = ₹16,000

Taxable Value = ₹24,000

Example 5 — Government Subsidy

- Price = ₹20,000

- Govt subsidy = ₹5,000

- Buyer pays = ₹15,000

Taxable Value = ₹20,000 (subsidy ignored)

Example 6 — Interest for Delayed Payment

- Price = ₹1,00,000

- Customer delays payment by 60 days

- Interest charged = @2% per month → ₹4,000

Taxable Value = ₹1,04,000 (GST applies even on interest)

Example 7 — Recipient Pays Supplier’s Liability

Supplier is supposed to pay UM gas refilling charges of ₹2,000 but customer pays it directly.

Under Section 15(2)(b), add this to value.

Taxable Value = Invoice Value + 2,000

Example 8 — Additional Warranty

- Basic price = ₹30,000

- Supplier charges additional warranty = ₹3,000

Taxable value = ₹33,000

6. Quick Diagrams for Easy Memory

6.1 Discount Rules

6.2 Subsidy Rules

6.3 Additional Charges

7. Common Mistakes

- Treating secondary discount as allowed

- Not adding NGO/Company subsidy

- Forgetting to add packing & freight

- Not adding interest/penalty

- Treating government subsidy as part of value

- Forgetting that post-supply discount needs ITC reversal

These mistakes cost 4–10 marks easily because GST valuation questions usually appear in practical case-based format.

8. Quick Summary (Cheat Sheet)

Here’s your single-page cheat sheet:

DISCOUNTS:

On-invoice → allowedPre-agreed post-supply → allowed if ITC reversedSecondary discount → NOT allowed

SUBSIDIES:

- Govt subsidy → excluded

- Non-Govt subsidy → included

ADDITIONAL CHARGES (Add to value):

- Packing

- Freight

- Loading

- Penalties

- Interest

- Warranty

- Taxes other than GST

- Amount supplier should pay but paid by recipient

Final Thoughts

GST valuation becomes tricky only when the supply isn’t “clean”. But the moment you understand how discounts, subsidies, and additional charges behave, everything falls into place. And honestly, these concepts are extremely scoring in real life because they are rule-based. If students remember the logic + the allowed/not allowed conditions, they can easily solve any valuation question.

For businesses, these rules prevent manipulation. A secondary discount shouldn't reduce GST because it wasn’t part of the original deal. A private subsidy shouldn't hide real value. And costs that the buyer pays on behalf of the supplier must form part of the supply’s value — because GST wants transparency.

Once you get used to these principles, GST valuation becomes almost intuitive.