One of the most confusing areas in GST is understanding what exactly must be added to the taxable value of a supply. Businesses often assume that GST is only charged on the amount printed on the invoice. But in reality, Section 15(2) of the CGST Act requires several items—often ignored or misunderstood—to be included in the value.

And this is where many businesses unintentionally create problems for themselves:

- Wrong GST valuation

- Incorrect ITC claim

- Mismatched invoices

- Audit issues

- Demand notices

So in this blog, we’ll break down Section 15(2) in a simple, practical way and understand the five major inclusions with real examples.

If you’ve ever wondered What all should be added to the value of supply?, this article will give you total clarity.

1. A Quick Recap – Why Inclusions Matter in GST

GST is a percentage-based tax. So the base value on which GST is calculated becomes extremely important.

For example:

- If value = ₹1,00,000 → GST @18% = ₹18,000

- If value = ₹1,10,000 → GST @18% = ₹19,800

The smallest change in taxable value affects the final tax amount.

Section 15(2) tells us exactly what MUST be included even if the invoice doesn’t mention it or even if the supplier doesn’t want to include it.

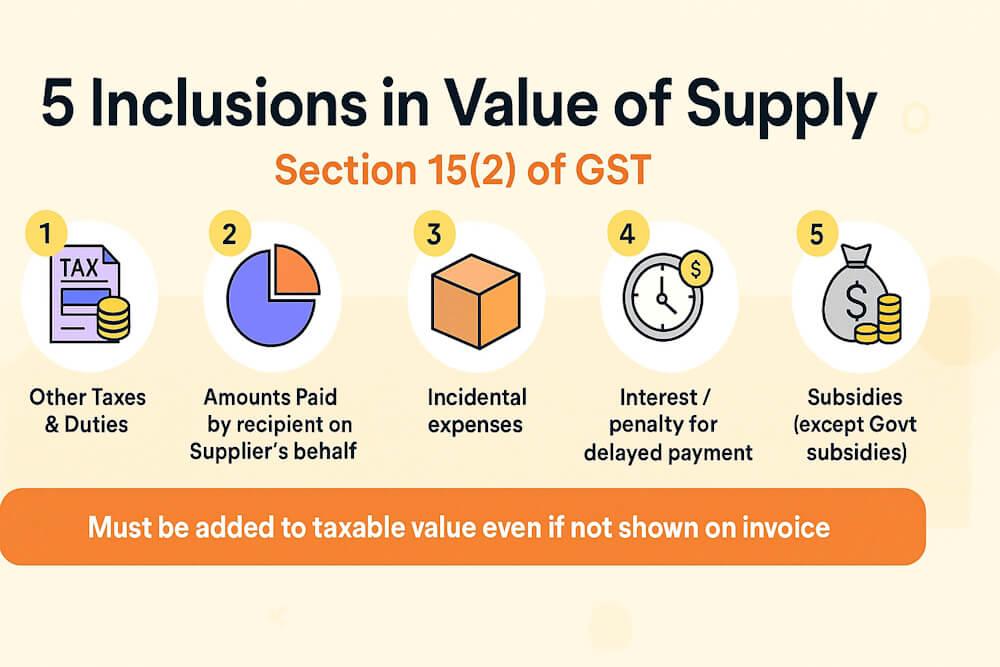

2. Section 15(2) – The Five Mandatory Inclusions

There are 5 categories of additions that must be made to the value of supply:

- Taxes (other than GST)

- Amounts paid on behalf of the supplier

- Incidental expenses

- Interest or penalty for delayed payment

- Subsidies (other than government subsidies)

Let’s discuss these with simple explanations and examples.

3. Inclusion 1: Other Taxes, Duties, Fees & Charges

Section 15(2)(a) says:

“Any taxes, duties, cesses, fees and charges levied under any law other than GST must be included if charged separately by the supplier.”

Examples of such charges:

- Excise duty (still relevant for pre-GST manufactured goods)

- Municipal taxes

- Road tax

- Vehicle registration fee

- Royalty

- Entry tax

- Octroi (still in certain local laws)

Even if GST is separate, these taxes must be added before computing GST.

Illustration 1

BW Ltd. sells goods with the following details:

- Basic price: ₹60,000

- Excise duty: ₹6,000

- Packing charges: ₹2,000

- Freight charges (arranged by supplier): ₹1,600

- Discount 2% shown on invoice

Let’s focus on “excise duty” here.

Excise duty = ₹6,000 must be added to the value.

Why?

Because excise duty is a tax under another law (not GST), and Section 15(2)(a) says it must be included.

So even before considering packing, freight, or discounts, your value automatically increases by ₹6,000.

Why This Rule Exists

Earlier, people used to keep base price low and shift value into local taxes to reduce VAT/CST.

GST plugs that loophole.

4. Inclusion 2: Amounts Paid by Recipient on Behalf of Supplier

This is one of the most misunderstood areas.

Section 15(2)(b) says:

“If the supplier is liable to pay something, but the recipient pays it directly to a third party, that amount must be added to the value of supply.”

This applies when:

- The supplier owes money to someone

- But customer pays instead

- It is in relation to the supply

Even if the supplier doesn’t show this amount on invoice, the law still adds it to value.

Example -

ABC Co. hires Grand Biz Event Organizers to conduct a dealers’ meet.

Grand Biz agrees to provide:

- Arrangement of mineral water

- Soft drinks

- Projector

- Stereo equipment

- Flowers

- Caterers

- Flex banners

However, ABC Co. directly pays the soft drink supplier for “Coke & Dew” during the event.

Now, although Grand Biz did not charge this amount in its invoice, law says:

👉 This amount must be added to the value of supply Because:

- Grand Biz was responsible for providing soft drinks

- ABC Co. paid the soft drink vendor

- It was on behalf of Grand Biz

So this amount becomes part of valuation.

Why This Rule Exists

Without this rule, people could show artificially low invoice values and make customers pay third parties to avoid GST. Section 15 stops this manipulation.

5. Inclusion 3: Incidental Expenses (Packing, Loading, etc.)

Section 15(2)(c) covers all incidental expenses charged by the supplier before or at the time of supply.

These include:

- Packing charges

- Loading and unloading charges

- Weighment charges

- Installation charges

- Servicing charges

- Commission

- Design and development charges

- Testing or inspection charges

- Anything done before supply

- Anything done at the time of supply

If the supplier charges any such amount, it MUST be included in taxable value.

Illustration 1 – Packing & Freight

BW Ltd. charges the following:

- Packing charges: ₹2,000

- Freight arranged by supplier: ₹1,600

Both must be added to the taxable value.

- Even if freight is charged at actuals or at a concessional rate — it does not matter.

- Packing is ALWAYS part of taxable value (even special packing).

Additional Example (Common in Businesses)

If a manufacturer charges:

- Wooden boxes

- Steel strip packing

- Bubble-wrap charges

- Labour charges for packing

They all must be included because these are necessary for supply.

6. Inclusion 4: Interest, Late Fees & Penalty for Delayed Payment

Section 15(2)(d) says:

“Any interest, late fee, or penalty charged because the recipient delays payment must be added to the value of supply.”

This is taxable even though it’s collected after supply.

Example -Interest Example – ₹2,020

A supplier sells goods for ₹2,000 with 30 days' free credit.

Buyer pays after 2 months. Interest is 12% per annum = 1% per month.

Interest for delay of 1 month = ₹20

So taxable value = ₹2,020

GST applies on ₹2,020, not ₹2,000.

Important Clarifications

- Interest is always in addition to the value.

- Interest may be calculated monthly/weekly/annually—doesn’t matter.

- Even penalty for delayed payment becomes part of taxable value.

7. Inclusion 5: Subsidies (Except Government Subsidies)

Section 15(2)(e) says:

“Subsidies directly linked to price must be included, except when they are given by the Central or State Government.”

So:

- Govt subsidy → Excluded

- Private subsidy → Included

Example -

A notebook is priced at ₹50.

An NGO gives a subsidy of ₹30. Student pays ₹20.

Value of supply = ₹50 (full price) Because:

- Subsidy is not from government

- It is directly linked to price

If the subsidy was from the government → Value = amount received from buyer = ₹20.

Real-World Example

- Cooperative societies subsidizing milk

- Trusts subsidizing educational fees

- NGOs subsidizing textbooks

All these subsidies are included in value unless coming from government.

8. Full Practical Illustration (Combined Example)

Let’s combine all inclusions using Illustration 1.

Details:

- Basic price: ₹60,000

- Excise duty: ₹6,000

- Packing charges: ₹2,000

- Freight (supplier arranged): ₹1,600

- Discount 2% shown in invoice

Step-by-Step Computation:

| Particulars | Amount |

| Base price | 60,000 |

| Add: Excise duty | 6,000 |

| Add: Packing charges | 2,000 |

| Add: Freight charges | 1,600 |

| Subtotal | 69,600 |

| Less: Discount @2% of 60,000 | (1,200) |

| Value of Supply | ₹68,400 |

GST is calculated on ₹68,400.

9. Why Do These Inclusions Exist?

If GST were only on the invoice amount, businesses might:

- Split prices into multiple components

- Show artificially low prices

- Charge customers directly for extra items

- Avoid showing subsidies

- Delay interest billing

- Reduce visible invoice value

Section 15(2) ensures:

- Transparency

- Fair pricing

- No revenue leakage

- No manipulation

- Clear valuation rules

- Uniform treatment across industries

10. Common Mistakes Businesses Make

Most valuation disputes arise because businesses forget adding:

- Packing charges

- Loading/unloading

- Transport arranged by supplier

- Penalty/interest for delayed payment

- Subsidies from NGOs

- Payments made by customer to a third party

- Design/printing/tooling charges

If any of these relate to the supply and are charged by the supplier, they MUST be included.

11. Quick Summary (Cheat Sheet for Section 15(2))

Value of supply = Invoice amount PLUS the following:

- Other taxes & duties (non-GST)

- Amounts buyer pays on supplier’s behalf

- Incidental expenses

(including packing, loading, design, installation)

- Interest / penalty / late fee

(for delayed payment)

- Subsidies (except government subsidies)

If any of these exist, they must be added before calculating GST.

Final Thoughts

Section 15(2) is one of the most practical sections for day-to-day GST operations. Incorrect valuation due to missing inclusions can easily attract notices, especially during departmental audits.

Once you understand these five inclusions, your GST valuation becomes error-free, compliant, and audit-ready.

This blog explained each inclusion with simple language and real ICAI examples so you never miss an addition again.