When it comes to GST, one thing that decides everything—from how much tax you pay to how you file your returns—is the value of supply. Most people understand GST rates, but very few truly understand how the value on which you calculate GST is determined. And honestly, this is where most mistakes happen. Businesses either overpay or underpay GST just because they misunderstood what “value of supply” actually means.

So in this blog, we’ll walk through Section 15 of the CGST Act, which explains the valuation of goods and services. We’ll unpack it in simple language, discuss what must be included or excluded, and break down several real examples.

By the end of this, you’ll have complete clarity on how GST value is computed in practical business scenarios—whether you’re raising invoices, offering discounts, receiving subsidies, or charging additional items like freight or packing.

1. Why Is “Value of Supply” Important?

GST is an ad-valorem tax, meaning it is calculated as a percentage of value.

So before you can apply the rate (say 18% or 5%), you must first determine the taxable value.

For example:

- If value = ₹10,000

- GST @ 18% = ₹1,800

But if the value is wrongly taken as ₹9,000 or ₹12,000, your tax calculation will be completely off.

And Section 15 tells you exactly what that value should be.

2. Section 15(1): The Default Rule – Transaction Value

If you remember just one rule from this article, let it be this:

- If buyer and seller are not related, and price is the only consideration, then the value = transaction value.

Transaction value simply means:

“The price actually paid or payable for the supply.”

This is the rule that applies in most everyday business transactions.

Example -

X Ltd. sells 1 MT of cement to a regular customer Y at ₹6,700, even though the general wholesale price is ₹7,000.

- Value of supply = ₹6,700, Not ₹7,000.

Because:

- Buyer and seller are unrelated

- Price is the sole consideration

- Whatever price they agreed upon becomes the transaction value

GST law does not force you to adopt market price.

3. Who Are “Related Persons” Under GST?

Section 15 has a detailed explanation of who is considered a related person. These situations include:

- Directors/officers of each other’s business

- Legal partners

- Employer-employee

- One controls the other

- Both controlled by a third person

- They jointly control another person

- Family relationships

- Sole agent / sole distributor / sole concessionaire

If the transaction is between related persons → transaction value won’t work, and valuation rules apply.

Examples -

Example 1: Ms. Priya holds 30% in ABC Ltd. and 35% in XYZ Ltd. → ABC and XYZ are related.

Example 2: Q Ltd. controls corporate policy and operations of R Ltd. → They are related.

Example 3: Brita Ltd. and Grita Ltd. together control Margarita Ltd. → Brita and Grita are related to each other.

In all these cases, even if a price is charged, it cannot be accepted as transaction value.

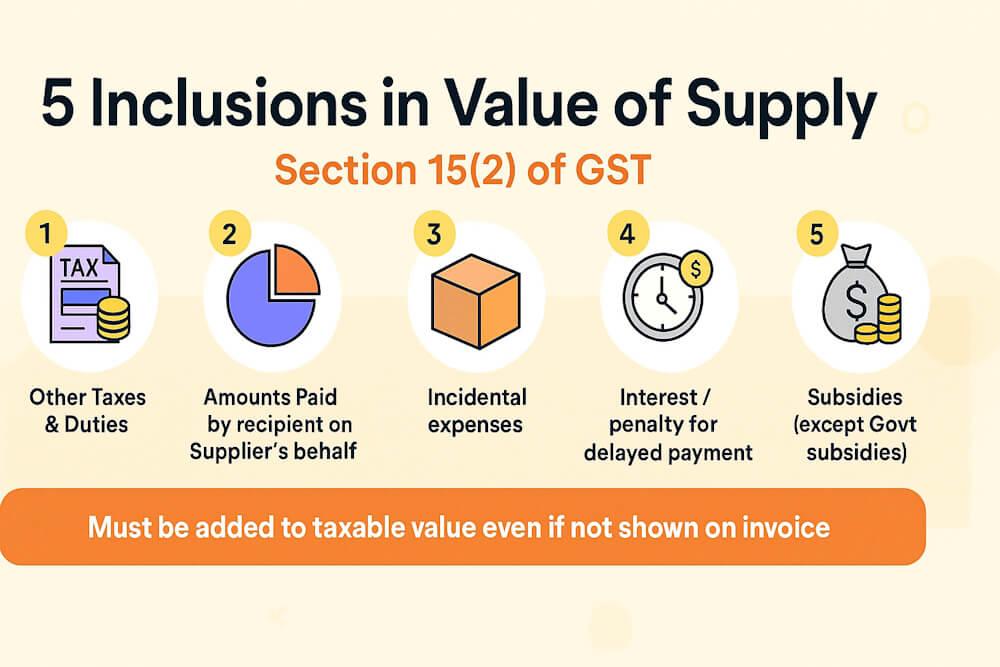

4. Section 15(2): What MUST Be Included in the Value of Supply

This is where things get serious. Even if the invoice price is something, the law requires you to add certain amounts to compute the taxable value.

Let’s break them down.

4.1 Other Taxes, Fees, and Charges

Any taxes other than GST (CGST, SGST, IGST, Compensation Cess) must be added if charged separately.

For example:

- Excise duty

- Municipal taxes

- Entry fee

- Road tax

Example

Price of goods = ₹60,000, Excise duty = ₹6,000

- Total value must include excise duty.

So value = 60,000 + 6,000 = ₹66,000 (before adding other elements)

4.2 Amounts Paid by Recipient ON BEHALF of Supplier

This is one of the most misunderstood rules.

If the supplier is liable to pay something but the recipient pays it, that amount must be included in the value.

Example -

Grand Biz is organizing a dealers’ meet for ABC Co. Grand Biz must pay vendors for water, soft drinks, projector, flowers, catering, etc.

But ABC directly pays the soft drink supplier.

Although Grand Biz didn’t charge it in invoice, the amount must be added to value because:

- Liability was of Grand Biz

- ABC paid it to a third party

- Payment relates to the supply

4.3 Incidental Expenses

If the supplier charges any of the following, they must be included:

- Packing

- Commission

- Weighment

- Loading

- Installation

- Testing

- Inspection

- Designing charges

- Any amount charged for anything done before or at the time of supply

Illustration 1

- Packing charges = ₹2,000

- Freight arranged by supplier = ₹1,600

→ Both must be included.

4.4 Interest, Late Fee, or Penalty

If the buyer delays payment, and interest/penalty is charged, it must be added to the value of supply.

Example

- Base price = ₹2,000

- Free credit period = 1 month

- Payment made after 2 months

- Interest @12% p.a. = 1% per month

Interest for 1 extra month = ₹20

So value = ₹2,020 (GST will apply on this)

4.5 Subsidies Directly Linked to Price

Only non-government subsidies are added to value. Government subsidies are excluded.

Example -

- Notebook selling price = ₹50

- NGO gives subsidy = ₹30

- Student pays = ₹20

Value of supply = ₹50

Because subsidy is price-linked, and NOT from the government.

But if the subsidy was from the Central or State Government → value would be ₹20.

5. Section 15(3): Discounts and Their Treatment Under GST

Discounts can be tricky because some are allowed as deductions, and some are not.

Let’s simplify.

5.1 Discounts Allowed BEFORE or AT the Time of Supply

These discounts are deductible only if shown in the invoice.

Example -

List price of biscuits carton: ₹200 Discount: 30% Final: ₹140

GST will be charged on ₹140.

5.2 Post-Supply Discounts Allowed ONLY If:

- They were agreed upon at or before the time of supply

- They are linked to specific invoices

- The recipient reverses proportionate ITC

- Supplier issues a tax credit note

Example -

Discount depends on achieving ≥1000 cookers sales in the festive month.

Since the agreement existed before supply, and discount is calculable invoice-wise → IT IS ALLOWED.

5.3 Discounts NOT Allowed (Secondary Discounts)

These are discounts that:

- Were not agreed beforehand

- Are given later as goodwill or price reduction

- Cannot be linked to invoices

- Are not eligible for ITC reversal

Example -

- A sells 10,000 biscuit packets at ₹10 each.

- Later reduces value to ₹9 and issues a credit note.

This discount cannot be deducted from value for GST.

Supplier must issue a commercial credit note without GST impact.

6. Putting It All Together – Full Calculation Example

Let’s revisit Illustration 1 from the article and compute taxable value step by step.

Scenario

BW Ltd. sells goods with the following details:

- Price of goods: ₹60,000

- Excise duty: ₹6,000

- Packing charges: ₹2,000

- Freight (supplier arranged): ₹1,600

- Discount @2% shown in invoice

Computation

| Particulars | Amount |

| Base Price | 60,000 |

| Add: Excise duty | 6,000 |

| Add: Packing charges | 2,000 |

| Add: Freight | 1,600 |

| Less: Discount @2% of 60,000 | (1,200) |

| Value of Supply | ₹68,400 |

This is the amount on which GST will be charged.

7. When Section 15(1) Does NOT Apply

Section 15(1) (transaction value) cannot be used when:

- Supplier and recipient are related persons

- Price is not the sole consideration

- Supply is of notified categories (like foreign currency exchange, air travel agent service, life insurance, second-hand goods, online gaming, casino, vouchers, etc.)

In such cases, valuation is done using Rules 27–31.

These include:

- Open market value

- Value of like kind and quality

- Cost + 10% method

- Residual method

We’ll cover these rules in detail in Blog 2.

8. Why Does GST Care So Much About “Value”?

GST law ensures:

- Fair taxation

- No undervaluation

- No manipulation between related parties

- No loss of revenue

- Transparency in pricing

Section 15 is designed to prevent practices like:

- Showing low invoice value but charging high in cash

- Shifting value to avoid GST

- Providing free items without valuing them

- Manipulating prices in related-party transactions

9. Common Mistakes People Make in Valuation

Here are typical errors businesses make:

- Not adding packing/installation/transport charges

- Not including interest charged for delayed payment

- Deducting discounts that are NOT allowed

- Not adding subsidies from private bodies

- Misunderstanding related party valuation

- Ignoring additional charges paid by customer directly to third party

- Using market value instead of transaction value

Avoiding these ensures clean GST compliance.

10. Simple Summary of Section 15 (Cheat Sheet)

Value = Transaction value, provided:

- Parties are not related

- Price is the only consideration

Add:

- Other taxes (not GST)

- Third-party payments

- Incidental expenses

- Pre-delivery charges

- Interest/penalty

- Non-government subsidies

Minus:

- Allowable discounts (if conditions satisfied)

If these conditions fail → valuation shifts to Rules 27–31.

Final Thoughts

Understanding the value of supply is essential for any business operating under GST. It ensures:

- Correct invoicing

- Correct GST payment

- Avoidance of notices and penalties

- Smooth audits

- Better compliance

Section 15 is not difficult once you break it down into simple components. The key is remembering what gets included, what gets excluded, and in which situations you must use valuation rules.