Accounting Policies are the specific principles, conventions, rules, and practices that an entity applies while preparing its financial statements.

The selection of accounting policies is an important task for any company — whether it's for handling transactions, managing sales, or maintaining profitability. These policies can change over time to align with the company’s evolving needs.

Overview of Accounting Policies

Every company follows certain rules and regulations behind every financial decision it makes. Accounting policies are the foundation of those decisions.

These specific policies reveal how management operates — whether it's conservative, consistent, or aggressive.

Just like a firm follows a set strategy to earn profits, accounting provides the structure to track performance, and accounting policies support that upward journey.

Meaning of Accounting Policies

Accounting policies include the methods, procedures, and measuring systems used to present information in a company's financial statements.

For example, a company prepares a quarterly earnings report that includes:

- Earnings per share

- Earnings from daily operations

- Net sales

- Net income

This report is then presented to investors. Based on that, investors assess the company's performance and make investment decisions.

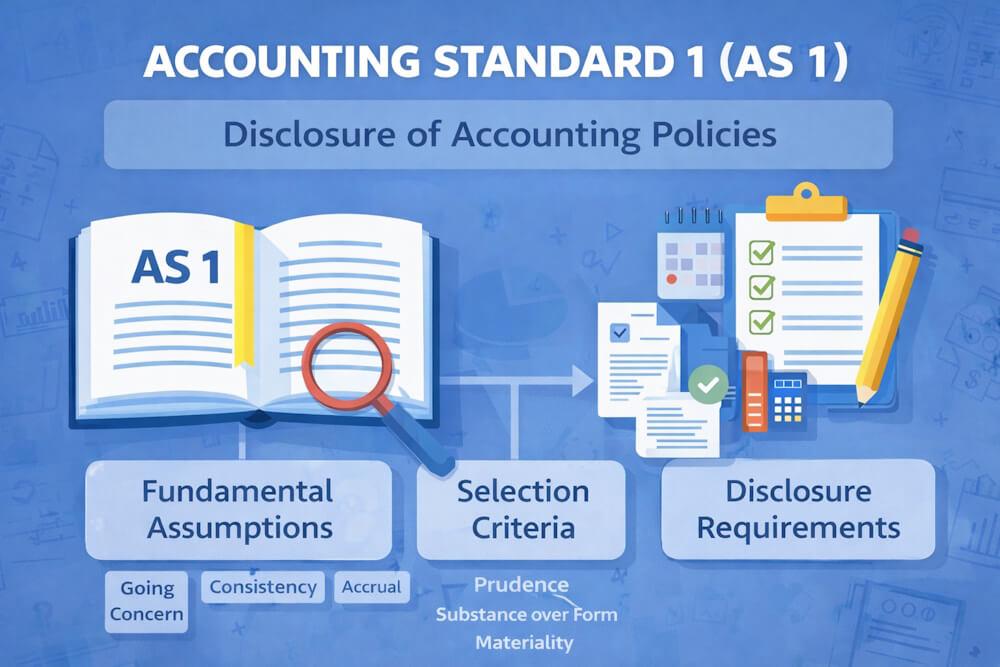

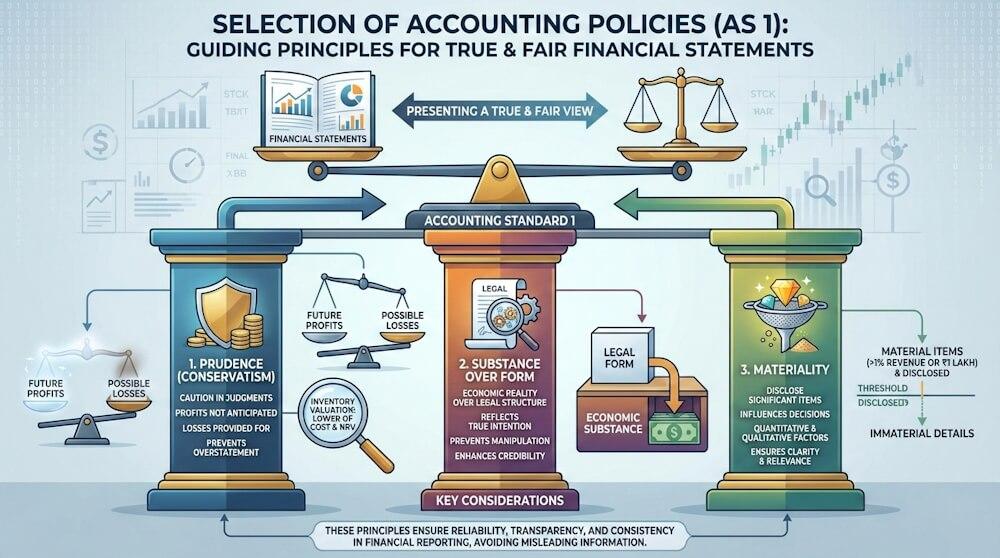

Selection of Accounting Policies

Companies consider some key factors when selecting their accounting policies. These are designed to promote accuracy, clarity, and legitimacy.

Precise and Accurate Presentation

The chosen accounting policies should clearly communicate financial information.

Instead of making excessive adjustments or confusing changes, the policies should reflect genuine, simple data.

Example:

If a company owns assets, those assets initially go into the expense list. Later, their future potential is assessed.

Using the accuracy principle, the firm might create an inventory that includes:

- Expenses incurred on that asset

- Services consumed by the asset during a specific period

“Limitation: It’s often difficult to precisely measure an asset’s remaining usability or potential value.”

Restrictions on Selecting Accounting Principles

Even though multiple policies are available, companies can’t randomly pick or discard them as they please.

There are certain rules to follow:

- A firm typically maintains a permanent set of accounting policies

- A secondary set may be developed to meet additional or temporary needs

Even if a company maintains separate reports for financial accounting and income tax, the practices must remain legal and transparent.

Government authorities expect reports to be:

- Clear and understandable

- Open to examination

- Free from concealment (e.g., past liabilities or unpaid dues)

Conclusion

Accounting policies are not just guidelines — they are strict rules that every company must adhere to.

In the end, these policies benefit everyone: the business, its investors, and its regulators.

“Imagine investing in a company and it disappears in days. You wouldn’t feel secure, right?”

That’s why companies need to maintain transparency. If you're investing in a business, make sure both sides follow ethical standards.

Accounting policies give structure and credibility to a business. They define how responsibly a company is managed. So, apply the right policies and make sure they are accessible to concerned authorities. It builds trust — and helps your business grow.

Solved Questions for You

What is the importance of Accounting Policies Disclosure?

Answer:

If government authorities find a mismatch between the accounting policies a company follows and the ones it discloses, it could lead to serious consequences.

This might even result in business license cancellation — without any prior warning — since it would be treated as a violation or misrepresentation.

That’s why it is essential to disclose your accounting policies as soon as they are finalized.

What is meant by Generally Accepted Accounting Principles (GAAP)?

Answer:

GAAP stands for Generally Accepted Accounting Principles — a set of commonly accepted rules that companies follow while preparing their financial statements.

It acts as a standard framework to clear accounting-related confusion and ensures consistency in reporting across different companies.