1. Meaning of Accounting

Accounting is the art of recording, classifying, and summarising in a significant manner and in terms of money, transactions, and events which are, in part at least, of a financial character, and integrating the result thereof.

1.1 Procedural Aspects of Accounting

On the basis of the above definitions, the procedure of accounting can be basically divided into two parts:

- Generating financial information, and

- Using the financial information

1.1.1 Generating Financial Information

- Recording This is the basic function of accounting. All business transactions of a financial character, as evidenced by some documents such as sales bill, passbook, salary slip, etc., are recorded in the books of account. Recording is done in a book called the “Journal.” This book may be further divided into several subsidiary books according to the nature and size of the business.

- Classification Classification is concerned with the systematic analysis of recorded data, with a view to grouping transactions or entries of one nature at one place, so as to put information in a compact and useful form. The book containing classified information is called the “Ledger.” This book contains, on different pages, individual account heads under which all financial transactions of similar nature are collected.

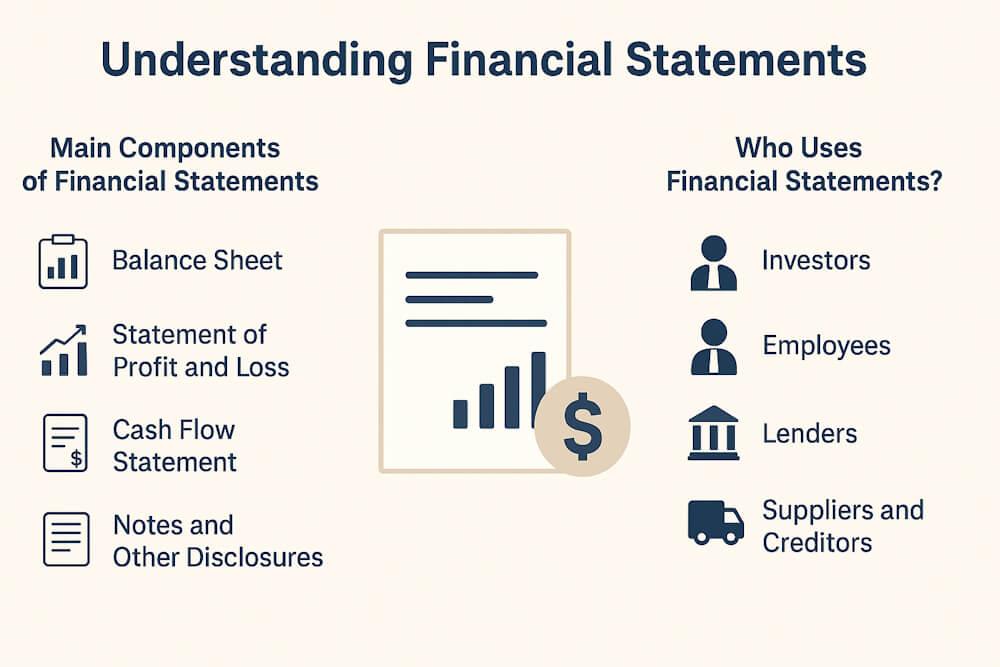

- Summarising It is concerned with the preparation and presentation of the classified data in a manner useful to both internal and external users of financial statements. This process leads to the preparation of the following financial statements: (a). Trial Balance(b). Profit and Loss Account (c). Balance Sheet (d). Cash Flow Statement

- Analysing The term “Analysis” means the methodical classification of the data given in the financial statements. The figures in the financial statement will not help anyone unless they are in a simplified form.

- Interpreting This is the final function of accounting. It is concerned with explaining the meaning and significance of the relationship as established by the analysis of accounting data. The recorded financial data is analysed and interpreted in a manner that will enable the end-user to make a meaningful judgement about the financial condition and profitability of the business operations. The financial statement should explain not only what had happened but also why it happened and what is likely to happen under specified conditions.

- Communication It is concerned with the transmission of summarised, analysed and interpreted information to the end-users to enable them to make rational decisions. This is done through preparation and distribution of accounting reports, which include, besides the usual profit and loss account and balance sheet, additional information in the form of accounting ratios, graphs, diagrams, fund flow statements, etc.

Note: The first two procedural stages of the process of generating financial information, along with the preparation of the trial balance, are covered under book-keeping. The preparation of financial statements and their analysis, interpretation, and communication to the various users are considered as accounting stages.

2. Objectives of Accounting

The objectives of accounting can be given as follows:

- Systematic recording of transactions Basic objective of accounting is to systematically record the financial aspects of business transactions i.e., book-keeping. These recorded transactions are later classified and summarised logically for the preparation of financial statements and for their analysis and interpretation.

- Ascertainment of results of above recorded transactions Accountant prepares profit and loss account to know the results of business operations for a particular period. If revenue exceeds expenses, then it is said that the business is running profitably, but if expenses exceed revenue, then it can be said that the business is running under a loss. The profit and loss account helps management and different stakeholders in making rational decisions.

- Ascertainment of the financial position of the business The businessman is not only interested in knowing the results of the business in terms of profits or loss for a particular period but is also anxious to know what he owes (liabilities) and what he owns (assets) on a certain date. To know this, the accountant prepares a financial position statement, popularly known as the Balance Sheet.

- Providing information to the users for rational decision-making Accounting, as a 'language of business', communicates the financial results of an enterprise to various stakeholders via financial statements. It helps meet the information needs of decision-makers and assists them in making rational decisions.

- To know the solvency position By preparing the balance sheet, management can evaluate both short-term liquidity and long-term solvency positions to determine the ability to meet liabilities when due.

3. Book-Keeping

Book-keeping is an activity concerned with the recording of financial data relating to business operations in a significant and orderly manner. It covers the procedural aspects of accounting work and embraces the record-keeping function.

Book-keeping procedures are governed by the end product—the financial statements. These include the Profit and Loss Account and Balance Sheet, along with schedules and notes.

It also involves the classification of transactions and events, determined by the requirements of financial statements. A book-keeper may handle all records of a business or a segment, such as customer accounts. A major part of a book-keeper’s work is clerical, increasingly done with mechanical and electronic devices.

Accounting is based on a careful and efficient book-keeping system.

4. Distinction Between Book-keeping and Accounting

| S. No. | Book-keeping | Accounting |

| 1 | Concerned with recording of transactions. | Concerned with summarising. |

| 2 | It is the base for accounting. | Considered as the language of business. |

| 3 | Financial statements do not form part of it. | Financial statements are prepared. |

| 4 | Managerial decisions cannot be based on it. | Management decisions are based on it. |

| 5 | No sub-fields exist. | Has sub-fields like financial and management accounting. |

| 6 | Cannot ascertain financial position. | Helps ascertain financial position. |

5. Sub-fields of Accounting

(i) Financial Accounting

Deals with preparation and interpretation of financial statements. It records past transactions and prepares profit and loss account and balance sheet.

(ii) Management Accounting

Concerned with internal reporting to managers for decision-making, planning, and control. Includes cost accounting.

(iii) Cost Accounting

According to the Institute of Cost and Management Accountants (England), it is: “The process of accounting for cost which begins with recording income and expenditure and ends with the preparation of periodical statements for cost ascertainment and control.”

(iv) Social Responsibility Accounting

Accounts for social costs and benefits related to business operations.

(v) Human Resource Accounting

Attempts to identify, quantify, and report investments in human resources not covered under conventional accounting.

6. Users of Accounting Information

(a) Internal Users:

- Management and Owners

(b) External Users:

- Investors Assess business performance to decide on investment.

- Employees Interested in business growth and job security.

- Lenders Want assurance about timely repayment of loans.

- Suppliers and Creditors Need to evaluate the firm’s payment ability and stability.

- Customers Depend on consistent supply and business continuity.

- Government and Agencies Regulate, tax, and allocate resources to businesses.

- Public Interested in how businesses affect the local economy.

Self-Examination Questions

- Which of the following is not a subfield of accounting? (a) Management accounting (b) Cost accounting (c) Financial accounting (d) Book-keeping Ans: (d)

- Purposes of an accounting system include all the following except – (a) Interpret and record the effects of business transactions (b) Classify the effects of transactions to facilitate reports (c) Summarize and communicate info to decision-makers (d) Dictate the specific types of business transactions Ans: (d)

- Book-keeping is mainly concerned with – (a) Recording of financial data (b) Designing systems for summarising data (c) Interpreting the data (d) None of the above Ans: (a)

- All of the following are functions of Accounting except – (a) Decision-making (b) Measurement (c) Forecasting (d) Ledger posting Ans: (d)

- Financial statements are part of – (a) Accounting (b) Book-keeping (c) All of the above (d) None of the above Ans: (a)

- Financial position of the business is ascertained on the basis of – (a) Book-keeping records (b) Trial Balance (c) Accounting reports (d) None of the above Ans: (c)

- Users of accounting information include – (a) Creditors (b) Lenders (c) Customers (d) All of the above Ans: (d)

- Financial statements do not consider – (a) Assets expressed in monetary terms (b) Liabilities expressed in monetary terms (c) Only assets in non-monetary terms (d) Assets and liabilities in non-monetary terms Ans: (d)

- On January 1, Sohan paid rent of ₹5,000. This can be classified as – (a) An event (b) A transaction (c) Both transaction and event (d) Neither Ans: (b)

- On March 31st, 2011, after sale of goods worth ₹2,000, closing stock is ₹10,000. This is – (a) An event (b) A transaction (c) Both (d) Neither Ans: (a)