1. Introduction

In today’s business world, training programs, workshops, employee development sessions, and performance appraisals are essential for improving workforce quality. But under GST, these services can get confusing — especially when the trainer is in one State, the company in another, and the training conducted somewhere else.

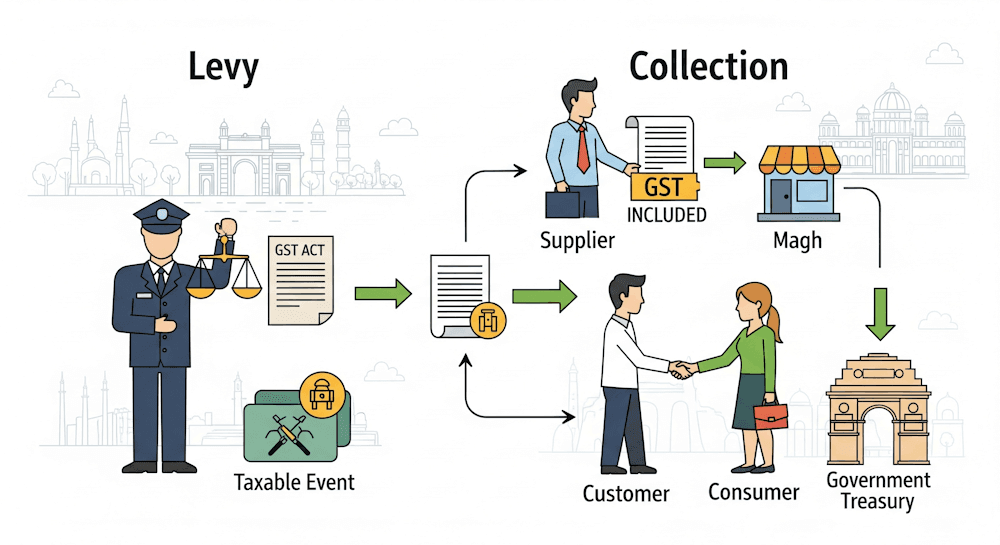

To remove this confusion, the Integrated Goods and Services Tax (IGST) Act, 2017 has a special provision:

👉 Section 12(5)

This section explains how to determine the place of supply (PoS) for training and performance appraisal services, when both the supplier and recipient are located in India.

Let’s break this down in a simple, conversational way, with examples and the latest GST updates.

2. What Section 12(5) Says

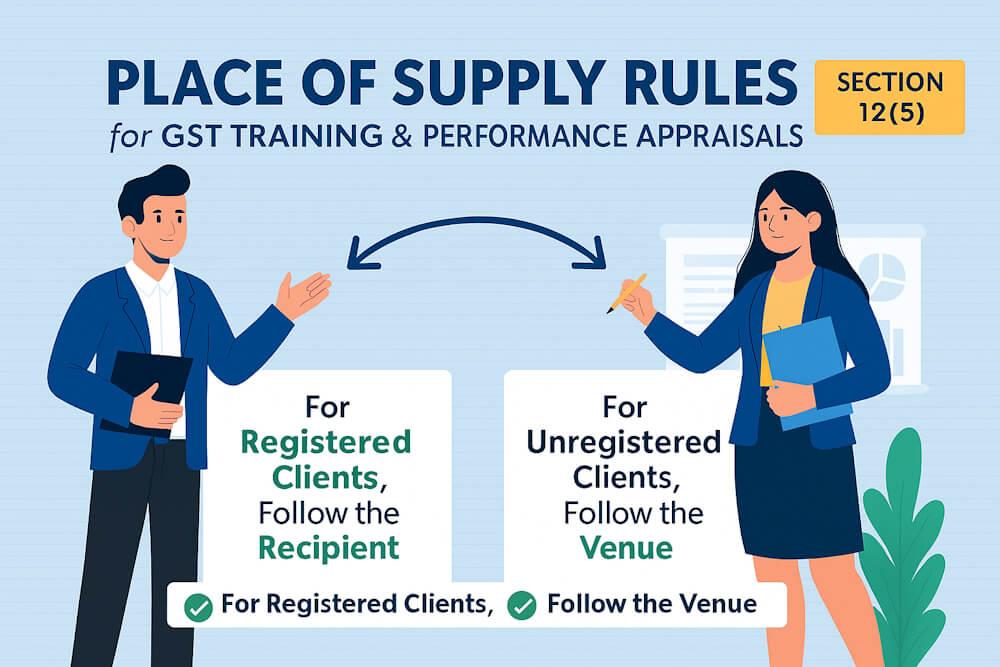

Section 12(5) clearly states the PoS based on whether the recipient is registered or unregistered.

(A) If the recipient is a registered person:

Place of Supply = Location of the recipient

(B) If the recipient is an unregistered person:

Place of Supply = Place where the services are actually performed

That means GST treatment changes depending on the type of recipient.

3. Why This Rule Exists

Training services sometimes require physical presence, while performance appraisals may be done remotely. Without a proper rule, confusion arises about which State gets the GST revenue.

Section 12(5) ensures that tax flows to the correct State, based on:

- Who the recipient is (registered/unregistered)

- Where the service is performed

This aligns GST with its principle of destination-based taxation.

4. Understanding the Two Categories

The rule is simple but powerful. Let’s understand each part clearly.

CASE 1: Recipient is a Registered Person

Place of Supply = Location of the recipient

This applies to all B2B training or appraisal services provided to GST-registered businesses.

Why?

Because registered businesses consume the training internally, regardless of where the session is actually held.

CASE 2: Recipient is NOT Registered

Place of Supply = Where the training session is physically performed

This applies mostly to:

- Students

- Individuals

- Freelancers

- Job seekers

- Employees attending open seminars not arranged by employer

Here, physical presence matters.

5. Examples + Practical Scenarios

Let’s understand this rule with multiple examples.

Example 1 – Training for a Registered Company (B2B)

ABC Learning Institute (Pune) provides corporate training to TechGlobal Pvt. Ltd., registered in Hyderabad. The training is conducted in Mumbai.

Here:

- Supplier: Pune

- Training venue: Mumbai

- Recipient: Hyderabad (Registered)

📌 Place of Supply = Hyderabad

📌 Tax Type = IGST (Pune → Hyderabad)

Even though training happened in Mumbai, GST law says PoS = recipient’s registered location.

Example 2 – Performance Appraisal for Employees of a Registered Firm

A consultancy in Bengaluru conducts performance appraisal interviews for an IT company registered in Chennai. Appraisal interviews are held online over video calls.

- Recipient is registered

- PoS = Chennai (location of registered recipient)

This shows that actual performance location does not matter when recipient is registered.

Example 3 – Training for Unregistered Individuals (B2C)

A coaching institute in Kolkata conducts a physical workshop in Delhi for unregistered participants.

- Recipient unregistered → physical performance matters

- PoS = Delhi (training performed in Delhi)

- Tax = CGST + SGST (Delhi)

Example 4 – Online Skill Training for Unregistered Students

A digital academy in Jaipur conducts online training for individual students across India.

But wait — where is the training performed?

👉 For virtual/online training, GST treats the performance location as supplier’s location, unless a special rule applies.

- PoS = Supplier’s location (Jaipur)

- Tax = CGST + SGST (Rajasthan)

Even though students are from other States, PoS stays with supplier because training isn't physically performed anywhere else.

Example 5 – Performance Appraisal for Unregistered Individuals

A career counselor conducts a personality and performance assessment workshop in Gurugram for unregistered candidates.

- PoS = Gurugram (location of actual performance)

- Tax = CGST + SGST (Haryana)

Example 6 – On-Site Corporate Training for Registered Recipient

A corporate trainer from Ahmedabad trains employees of a registered company in Kerala.

- Recipient is registered → PoS = Kerala (recipient’s location)

- Tax Type = IGST (Ahmedabad → Kerala)

Even though training happens in Kerala, PoS is Kerala because the company is registered there.

6. Important Concept: “Place Where Services Are Actually Performed”

For unregistered individuals, it matters where the trainer physically conducts the session.

This includes:

- On-site workshops

- Classroom training

- Seminars

- Physical skill-development sessions

But NOT:

- Webinars

- Video-call appraisals

- Online learning

In digital mode, PoS = supplier’s location (since no physical performance happens elsewhere).

7. Relationship with Other Sections

Section 12(5) is a specific rule that overrides the general rule in Section 12(2).

| Service Type | Relevant Section | PoS Logic |

| General services | 12(2) | Recipient’s location |

| Immovable property | 12(3) | Property location |

| Personal/physical services | 12(4) | Performance location |

| Training & appraisal | 12(5) | Registered → recipient location Unregistered → actual performance location |

8. Practical Challenges in Real Business

What if training occurs in multiple States?

The supplier must:

- split invoice values per State

- apply correct tax (IGST or CGST+SGST) for each location

What if training is hybrid (online + offline)?

Each portion must follow its own PoS logic.

What if recipient’s branch consumes the service, not the head office?

GST considers recipient’s GSTIN, not employee location.

9. Latest 2024–25 CBIC Clarifications

| Circular / Notification | Date | Key Details |

| Circular 209/3/2024-GST | July 2024 | Confirms PoS for training is based on recipient type (registered/unregistered). |

| Notification 09/2024-IGST | Oct 2024 | For unregistered recipients, PoS = actual training venue; billing address irrelevant. |

| CBIC Advisory (Jan 2025) | — | For online-only training → PoS = supplier’s location. |

| E-invoice Update (2024) | — | PoS field must mention correct State code, based on 12(5). |

10. Common Mistakes to Avoid

- Treating registered recipient as unregistered → wrong PoS

- Using training venue as PoS for B2B transactions

- Charging IGST incorrectly when training done locally

- Missing proper address / GSTIN of corporate recipient

- Wrong State code in e-invoice for training sessions

11. Documentation Requirements

- Training agreement / purchase order

- GSTIN of corporate client

- Attendance sheet or training venue proof (for B2C)

- Correct State code on invoice

- Report submission showing recipient name and consumption

12. Case Study Summary

Case Study A – Corporate Training

Supplier: Delhi

Recipient: Bangalore (registered)

Training venue: Mumbai

- PoS = Bangalore

- IGST charged

Case Study B – B2C Retail Workshop

Supplier: Chennai

Training venue: Hyderabad

Participants: Unregistered

- PoS = Hyderabad

- CGST + SGST

13. Quick Summary Table

| Recipient Type | Training Mode | Place of Supply | Tax Type |

| Registered | Any mode | Recipient’s location | IGST / CGST+SGST |

| Unregistered | Physical | Where performed | CGST + SGST |

| Unregistered | Online | Supplier’s location | CGST + SGST |

| Multi-State training | Physical | Split per location | Mixed |

14. Key Takeaways

- Section 12(5) is the specific rule for training and performance appraisal.

- For registered clients, always use recipient’s location.

- For unregistered clients, use where training happens.

- Online training → PoS = supplier’s location.

- Always use correct State code when filing GST returns.

15. Final Thoughts

Training and performance appraisal services are integral to organizational growth. But under GST, the place of supply plays a crucial role in determining which tax applies.

Section 12(5) keeps things fair and clear by distinguishing between registered and unregistered recipients.

So remember:

“For registered clients, follow the recipient. For unregistered clients, follow the venue.”

This simple rule ensures your GST compliance stays accurate, audit-proof, and stress-free.