If you’ve ever dealt with GST filings, you already know that the reverse charge mechanism (RCM) can feel a bit confusing at times — especially when it comes to services. Unlike the normal “forward charge” where the supplier charges GST, under RCM the recipient becomes liable to pay the tax.

Now the big question that everyone asks is:

👉 “When exactly does GST become payable under reverse charge for services?”

That’s where the concept of Time of Supply under Section 13(3) comes into play. And once you understand the logic properly, you’ll never get confused in RCM compliance again.

This blog simplifies the entire process, explains the rules in plain English, and includes practical ICAI-based examples to make it absolutely clear.

What Is Reverse Charge for Services? (Quick Refresher)

Normally, under GST:

- The supplier of services charges GST,

- Collects it from the recipient, and

- Pays it to the government.

Under RCM, this flips. The recipient of services becomes liable to pay GST directly to the government.

This usually applies when:

- The services are provided by an unregistered supplier to a registered recipient,

- Or for specific notified services like GTA, legal services, sponsorship, etc.

- Or in case of imports of services under Section 5(3) of IGST Act.

Legal Provision – Section 13(3) (Time of Supply for RCM Services)

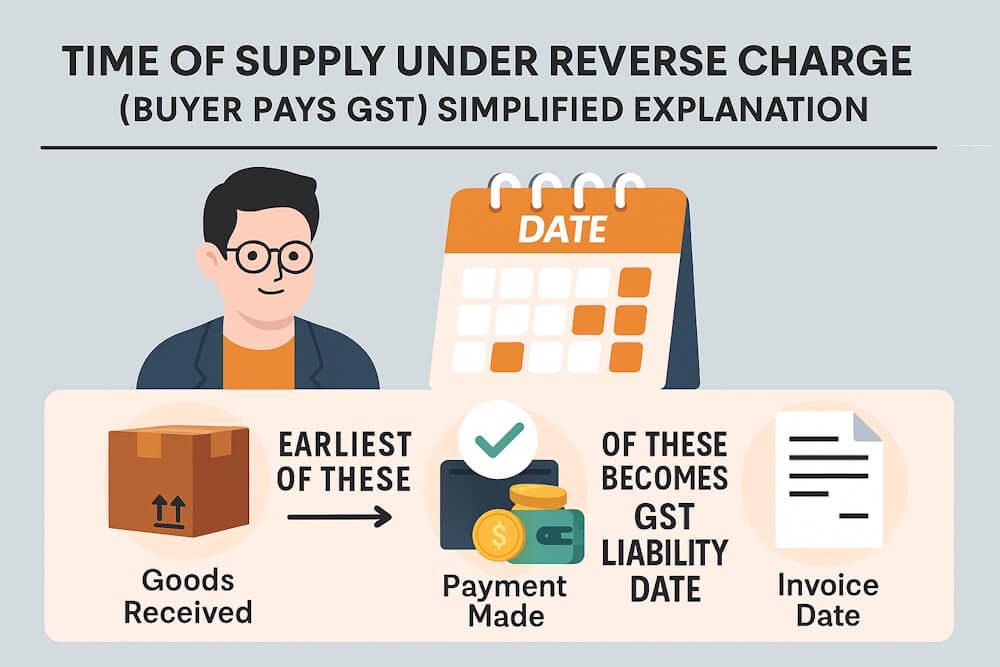

Under Section 13(3), time of supply for services (RCM) is the earliest of the following:

- The date of payment, OR

- 60 days from the date of issue of invoice by the supplier.

If the supplier is an associated enterprise located outside India, the rule changes slightly (we’ll cover that too).

If neither date can be determined, then the time of supply = 👉 Date of entry in the books of the recipient.

Understanding “Date of Payment”

According to Explanation 2 to Section 13:

““Date of payment” = earlier of”

- the date payment is recorded in books, or

- the date payment is debited from the bank account.

So if the payment is entered in your books on 10 July but bank debit happens on 13 July → the date of payment = 10 July.

RCM Time of Supply – How It Actually Works

The simplest way to understand it:

Compare two dates:

- Payment date,

- Invoice date + 60 days

Whichever comes first → that’s your time of supply.

Let’s walk through the examples now.

Example 1 – Payment Made Before 60 Days

- Invoice date: 4 June

- Payment recorded in books: 25 July

- Payment debited in bank: 27 July

60 days from invoice = 3 August → next day = 4 August

Now compare:

- Payment date: 25 July

- 60-day date: 4 August

👉 Time of Supply = 25 July (earlier date)

Example 2 – Payment Made After 60 Days

- Invoice date: 4 June

- Payment recorded: 10 August

- Payment debited: 14 August

60 days from invoice = 3 August → next day = 4 August

Now compare:

- Payment date: 10 August

- 60-day trigger date: 4 August

👉 Time of Supply = 4 August

GST must be paid in August (not when actual payment was made).

Example 3 – Payment Before Booking Expense

- Invoice issued: 5 January

- Goods/services received: 10 January

- Payment recorded: 1 January

- Payment debited: 5 January

Even though the service was received later, under RCM for services:

👉 Earliest event is 1 January (payment in books)

Time of Supply = 1 January

What If Neither Payment nor Invoice Date Is Traceable?

(Residual Rule)

Let’s say the invoice is misplaced, the payment wasn’t recorded, or the supplier is unorganized and didn’t issue a proper document.

In such cases, Section 13(3) says:

Time of Supply = date of entry in books of accounts (as a fallback rule)

Meaning, the day you recognize the expense becomes the time of supply.

Special Rule – Associated Enterprises (Import of Services)

When services are received from an associated enterprise located outside India, the time of supply is:

Earlier of:

- date of entry in books, or

- date of payment.

There is no 60-day condition in these cases.

Example 4 – Import of Service from Foreign Parent Company

Indian Co. receives consultancy services from its US parent company.

- Service received: 10 July

- Payment made: 20 August

- Entry in books: 25 July

Under the special rule:

Time of Supply = 25 July (date of entry)

Even though payment is later, GST liability arises when the expense is recognized.

Why These Rules Exist? (Common-Sense Explanation)

The reason GST law uses the earliest of payment or 60 days is simple:

- Many services are intangible and can be consumed instantly.

- Payment can be delayed or invoices can be irregular.

- Without a strict trigger, taxpayers could indefinitely delay GST.

So the 60-day rule ensures that GST is collected in a reasonable timeframe, even if payment is not made.

RCM on Services vs RCM on Goods – Quick Comparison

| Feature | RCM on Goods | RCM on Services |

| Time window | 30 days after invoice | 60 days after invoice |

| Governing section | Section 12(3) | Section 13(3) |

| Payment trigger | Earlier of receipt/payment/30 days | Earlier of payment/60 days |

| Advances | May affect timing | Always affect timing |

| Imported services rule | Normal RCM | Associated enterprise rule applies |

Continuous Supply of Services – Does RCM Apply?

If the service is continuous in nature (AMC, legal retainer, consultancy, etc.), the RCM provisions still apply normally. Meaning, you still compare:

- payment date, and

- invoice date + 60 days

Even if the service spans months, RCM time-of-supply logic doesn’t change.

Practical Real-Life Scenarios

Scenario 1 – Legal Services from Advocate

- Advocate issues invoice: 1 April

- Company books the expense: 3 April

- Payment made: 28 June

- 60 days from invoice = 31 May

TOS = 31 May GST payable for May month.

Scenario 2 – Security Service via Unregistered Vendor

- Invoice issued: 10 Jan

- Payment recorded: 5 Feb

- Payment debited: 6 Feb

60 days from invoice = 10 March → TOS = 5 Feb

Scenario 3 – Sponsorship Service from Agency

- Invoice: 20 August

- Payment recorded: No (forgot)

- Payment debited: No (not paid yet)

60 days from invoice = 19 October → TOS = 20 October

Even if you haven’t paid a rupee, GST is still due.

Interest or Penalty Charged on Delayed Payment – Section 13(6)

If the supplier charges interest, penalty, or late fee, GST on that additional amount becomes payable when you pay it.

This works the same under RCM and forward charge.

Common Mistakes Businesses Make in RCM for Services

- Waiting for payment date to trigger GST = GST may trigger 60 days after invoice, even without payment

- Not recording expenses properly = Date of book entry can become Time of Supply

- Forgetting RCM for imported services = “Associated enterprise” rule applies even without invoice

- Assuming service and goods RCM rules are same = Goods follow 30 days, services follow 60 days

Summary Table – Time of Supply for Services (RCM)

| Event | Relevant Date | GST Trigger? |

| Payment recorded in books | Earlier of books/bank | Yes |

| Payment debited in bank | Earlier of books/bank | Yes |

| 60 days after invoice | Day after 60 days | Yes |

| Associated enterprise (foreign) | Entry in books OR payment (whichever earlier) | Yes |

| No info available | Date of book entry | Yes |

Final Thoughts

GST under RCM on services looks complicated initially, but once you understand the simple rule — whichever happens first: payment or 60 days from invoice — it becomes almost mechanical.

The whole idea is to ensure GST is paid on time, even if payments are delayed. And for imported or associated enterprise transactions, the law ensures tax isn’t postponed just because payment happens later.

If you keep track of invoice dates and payment dates closely, RCM compliance becomes very smooth, and you’ll never end up paying interest unnecessarily.