Normally, when you buy something, the seller is the one who takes care of GST. They add it to your bill, you pay, and later they pass it on to the government. Simple. That’s how it works 99% of the time. But then GST throws in this twist called Reverse Charge Mechanism (RCM). Suddenly the roles flip. Instead of the seller paying GST to the government, the buyer has to do it. Weird? Yeah, a little. Let’s talk it through.

Normal GST vs. Reverse Charge

Let’s look at it with a laptop example, because numbers make it easier.

In the normal case, you walk into a store and buy a laptop for ₹50,000. Now GST at 18% adds another ₹9,000. So your final bill is ₹59,000. You hand that money over to the shopkeeper, and later he files his GST return and passes the ₹9,000 to the government. Simple.

Now flip it around under reverse charge. Same ₹50,000 laptop, same 18% GST. But here’s the twist—the supplier either isn’t registered or can’t collect GST (like a small vendor or maybe a foreign consultant if it were services). In that situation, you don’t pay GST to the seller at all. You still pay him the ₹50,000 for the laptop, but the tax part—₹9,000—you pay straight to the government yourself.

So the seller gets his full price, but you, the buyer, carry the tax burden. That’s why they call it “reverse.”

Why even bring in reverse charge?

You might ask, “Why complicate life like this?” Fair point. But here’s why the government did it:

- To close gaps – Some suppliers aren’t registered under GST. Without RCM, tax would be missed.

- Imports – Foreign suppliers don’t register here. Without RCM, they’d get away with zero GST.

- High-risk services – Some sectors (like transport, legal services) are notorious for escaping taxes. Shifting the responsibility to the buyer means the government is safer.

So RCM is basically a safety net. It makes sure the taxman doesn’t lose out, no matter who the seller is.

When do you run into RCM?

Alright, here are the big situations:

1. Buying from an unregistered supplier

If you’re a GST-registered business and you buy goods or services from someone who isn’t registered, you end up paying GST directly.

👉 Example: Your company buys office chairs from a small vendor who’s not under GST. You pay him the price of the chairs, and you separately pay GST on those chairs to the government.

2. Import of services

This is super common. Say you hire a U.S.-based freelancer for web design. He’s not registered in India, so he won’t charge GST. But under RCM, you pay GST on that service in India.

3. Government-notified cases

There’s also a list of goods and services where the law says: “RCM applies, no matter what.” Some common ones are:

- Transport of goods by a Goods Transport Agency (GTA).

- Legal services from a lawyer or law firm.

- Services from a company director to the company itself.

- Some niche goods like bidi wrapper leaves, cashew nuts, silk yarn.

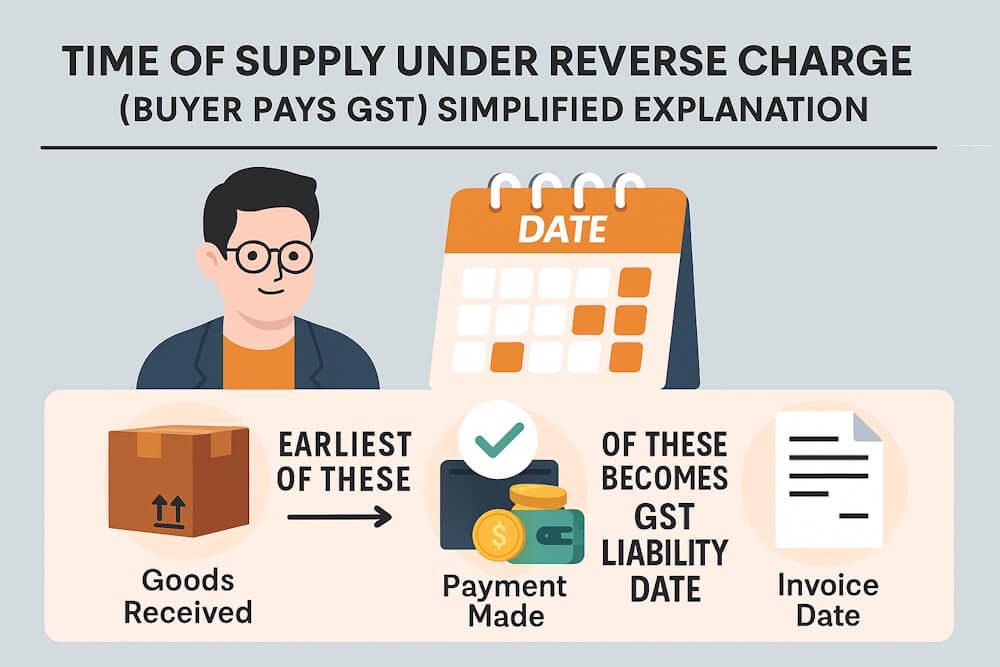

How the payment actually works

Let me walk you through a simple flow.

- You pay the supplier the value of goods or services.

- You separately calculate GST and pay it to the government while filing returns.

- Later, you can usually claim that GST back as Input Tax Credit (ITC), provided the goods/services are used for business.

👉 Example: You hire a transport company for ₹10,000. GST @5% = ₹500. You pay the transporter ₹10,000. Then you pay ₹500 straight to the government as GST. And later, you use that ₹500 as ITC to reduce your own GST liability.

So it’s not always an “extra” cost—it’s more like paying upfront and adjusting later.

What About Input Tax Credit?

Now this is where people usually freak out. They go, “Wait, if I’m the one paying GST under reverse charge, doesn’t that mean I just lose that money?” The short answer—no, not always.

Here’s how it actually works. If whatever you paid GST on is being used for your business, then you can usually claim it back as Input Tax Credit (ITC). Which basically means, yeah you shell out the cash upfront, but when you’re doing your GST calculations at the end of the month, you knock that amount off your total tax bill.

Think of it like this:

Let’s say your company had to pay ₹5,000 GST under RCM for legal services. In the same month, you collected ₹20,000 GST from customers on your own sales. When you file your returns, you don’t really have to pay the full ₹20,000 to the government. You subtract that ₹5,000 already paid, so you just pay ₹15,000 net.

So yeah, it’s not a total loss. It’s more like paying first and adjusting later. Not as scary once you see how the math works out.

Real-world examples of RCM

- Lawyer services: A company hires a lawyer. The lawyer doesn’t charge GST. The company pays GST directly.

- GTA services: Businesses using transporters often fall into RCM.

- Director services: If a director provides consultancy to his company, the company pays GST under RCM.

- Imports: Hiring a foreign consultant, designer, or marketing firm—all covered by RCM.

Some common confusions

- Do individuals need to care? Nope. If you’re just buying a fridge for your house, this isn’t your problem. RCM is mainly for businesses.

- Can every RCM GST be claimed as ITC? No. If you’re buying something for personal use or for making exempt supplies, you can’t claim ITC.

- Does RCM apply on everything from unregistered dealers? It used to in early GST days, but now only in certain cases.

Why businesses should pay attention

Here’s the thing. Missing RCM compliance can backfire badly. If a company forgets to pay GST under reverse charge, the government can slap penalties, charge interest, and even block ITC.

That’s why businesses set up internal checks. They ask questions like:

- Did we buy from any unregistered supplier?

- Did we hire any foreign consultant?

- Did we pay for legal or GTA services?

If the answer is yes, they pay RCM right away to avoid future mess.

Big picture

Reverse charge may look like a headache, but it makes sense once you see the logic. It closes loopholes. It ensures every transaction that should be taxed actually gets taxed. It’s not about punishing businesses—it’s about making sure tax flows smoothly to the government.

For businesses, RCM is something you just have to build into your system. It’s not optional. The good news? Since ITC is available in most cases, you don’t actually lose money. It’s just a bit of extra paperwork.

Wrapping up (kinda messy, but that’s fine)

So yeah, reverse charge is basically GST upside down. Normally the seller pays, here the buyer does. It applies in some specific cases—unregistered suppliers, imports, legal services, transport, director services, and a few others.

If you’re running a business, you’ve got to know where RCM applies, or you risk penalties. If you’re just a consumer, you honestly don’t need to worry—you’ll never see “reverse charge” on your grocery bill.

End of the day, it’s just the government making sure tax is collected one way or another. Doesn’t matter if it comes from the seller or the buyer—as long as it gets paid.