The classification of entities plays a very important role in deciding which Accounting Standards apply and what exemptions are available. To remove confusion and bring uniformity, the Institute of Chartered Accountants of India (ICAI) revised the criteria for classification of Non-Company entities in August 2024.

This revision is extremely important for CA exams, commerce students, accountants, and business owners, as it directly affects compliance with Accounting Standards.

In this blog, we will clearly explain:

- The new ICAI 2024 classification

- Meaning of MSME and Large Entity

- Conditions for MSME status

- Applicability date

- Practical implications

Why Was the Classification Revised?

Earlier, non-company entities were classified into multiple levels, which often created confusion. Different turnover limits and borrowing limits made compliance difficult.

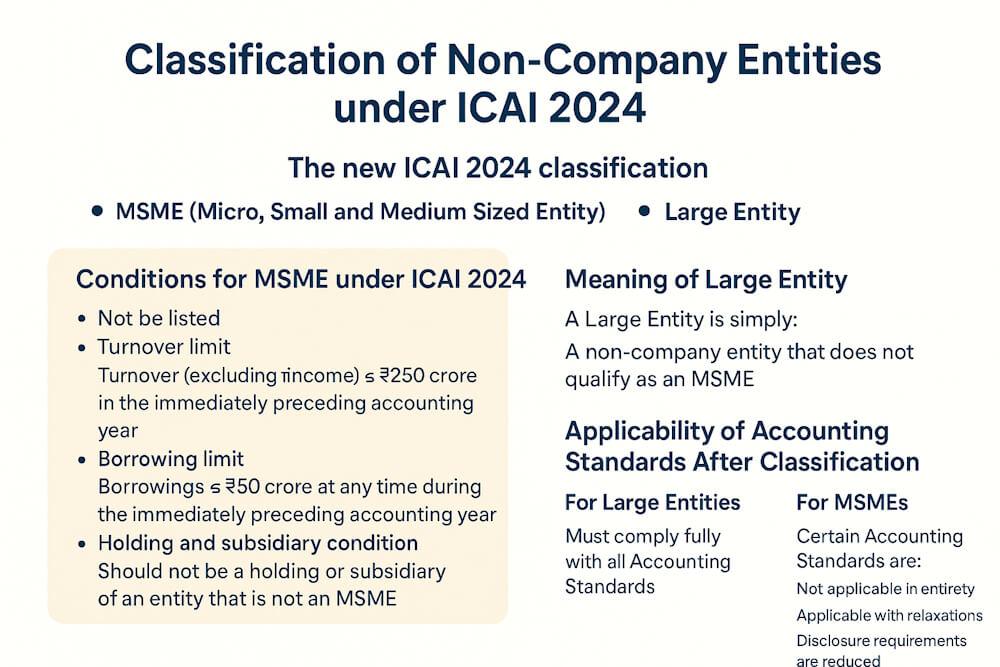

To simplify this, ICAI introduced a two-category system:

- MSME (Micro, Small and Medium Sized Entities)

- Large Entities

This revision helps in:

- Easier identification of entity category

- Clear applicability of Accounting Standards

- Reduced compliance burden for smaller entities

Applicability Date of Revised Classification

The revised classification applies to:

“Accounting periods commencing on or after 1st April 2024”

This means it is fully applicable for exams and financial years 2024–25 onwards.

Classification of Non-Company Entities under ICAI 2024

Under the revised scheme, non-company entities are classified into only two categories:

1. MSME (Micro, Small and Medium Sized Entity)

2. Large Entity

Let us understand both in detail.

Meaning of MSME under ICAI 2024

A non-company entity will be classified as an MSME only if all the following conditions are satisfied.

Conditions for MSME Classification

A non-company entity must:

- Not be listed - Its equity or debt securities should not be listed or in the process of listing in India or outside India.

- Not be a bank, financial institution, or insurance company

- Turnover limit - Turnover (excluding other income) should not exceed ₹250 crore in the immediately preceding accounting year.

- Borrowing limit - Borrowings should not exceed ₹50 crore at any time during the immediately preceding accounting year.

- Holding and subsidiary condition - It should not be a holding or subsidiary of an entity that is not an MSME.

Only when all five conditions are fulfilled, the entity qualifies as an MSME.

Meaning of Large Entity

A Large Entity is simply:

“A non-company entity that does not qualify as an MSME.”

Even if one condition of MSME is not satisfied, the entity becomes a Large Entity.

How Is MSME Status Determined?

MSME status is determined:

- At the end of the relevant accounting period

- Based on figures of the immediately preceding accounting year

This avoids frequent changes during the year.

Applicability of Accounting Standards After Classification

For Large Entities

- Must comply fully with all Accounting Standards

- No exemptions or relaxations available

For MSMEs

- Certain Accounting Standards are: Not applicable in entirety and Applicable with relaxations.

- Disclosure requirements are reduced

This significantly reduces compliance burden for MSMEs.

Important Rules Related to Change in MSME Status

1. Loss of MSME Status

If an entity was an MSME earlier but no longer qualifies:

- Full Accounting Standards apply from the current year

- Previous year figures need not be revised

- Proper disclosure must be made in notes

2. Newly Qualifying MSME

If an entity becomes an MSME for the first time:

- It cannot immediately claim exemptions

- It must remain an MSME for two consecutive years

- Until then, full Accounting Standards apply

3. Partial Exemptions

An MSME:

- May choose to avail exemption for some standards

- Must disclose clearly which exemptions are taken

- Partial exemptions should not mislead users

Why This Topic Is Very Important for Exams

This topic is frequently tested in:

- MCQs

- Case studies

- Practical questions

Questions are often based on:

- Turnover and borrowing limits

- Newly qualifying MSME

- Change in classification

- Disclosure requirements

Practical Example

If a partnership firm:

- Turnover = ₹240 crore

- Borrowings = ₹45 crore

- Unlisted and not a bank

➡ It qualifies as an MSME.

If borrowings increase to ₹55 crore: ➡ It becomes a Large Entity, even if turnover is within limits.

What’s Next?

Now that you understand MSME and Large Entity classification, the next logical topic is:

This will explain which Accounting Standards apply and what exemptions MSMEs get, in detail.

FAQs

1. What is the revised MSME classification under ICAI 2024?

Under ICAI 2024, non-company entities are classified into two categories: MSME and Large Entity, based on listing status, turnover, borrowings, and holding–subsidiary conditions.

2. From when is the revised MSME classification applicable?

The revised classification is applicable for accounting periods commencing on or after 1 April 2024.

3. What is the turnover limit for MSME under ICAI 2024?

The turnover (excluding other income) should not exceed ₹250 crore in the immediately preceding accounting year.

4. What is the borrowing limit for MSME classification?

Borrowings should not exceed ₹50 crore at any time during the immediately preceding accounting year.

5. Who is classified as a Large Entity?

Any non-company entity that does not satisfy all MSME conditions is classified as a Large Entity.

6. Can a newly qualifying MSME claim exemptions immediately?

No. A newly qualifying MSME must remain an MSME for two consecutive years before availing exemptions under Accounting Standards.

7. Do MSMEs get exemptions from all Accounting Standards?

No. MSMEs get exemptions or relaxations only from certain Accounting Standards, not from all standards.