Accounting Standards are often misunderstood as rules meant only for companies. In reality, non-company entities such as partnership firms, LLPs, trusts, and societies are also required to follow Accounting Standards, depending on their classification and nature of activities.

With the revised ICAI framework (effective from 1 April 2024), the applicability of Accounting Standards to non-company entities has become much clearer.

This blog explains:

- Which non-company entities must follow Accounting Standards

- How MSME and Large Entity classification affects applicability

- Which standards apply fully and which have exemptions

- Practical implications for exams and practice

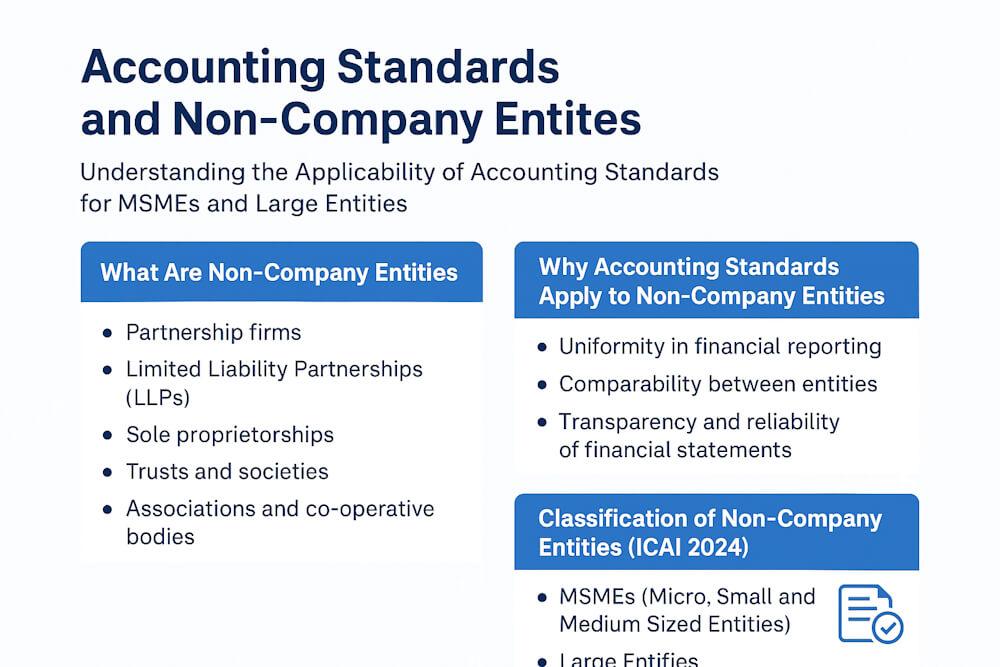

What Are Non-Company Entities?

Non-company entities include:

- Partnership firms

- Limited Liability Partnerships (LLPs)

- Sole proprietorships

- Trusts and societies

- Associations and co-operative bodies

These entities are not registered under the Companies Act, but many of them carry out significant business activities.

Why Accounting Standards Apply to Non-Company Entities

Accounting Standards aim to ensure:

- Uniformity in financial reporting

- Comparability between entities

- Transparency and reliability of financial statements

If non-company entities were excluded, large partnerships or LLPs could avoid proper reporting despite having huge turnover. Hence, Accounting Standards apply based on economic activity, not legal form.

Classification of Non-Company Entities (ICAI 2024)

As per the revised ICAI criteria, non-company entities are classified into:

- MSMEs (Micro, Small and Medium Sized Entities)

- Large Entities

This classification determines the extent of compliance with Accounting Standards.

Applicability of Accounting Standards to Large Non-Company Entities

Full Compliance Required

Large non-company entities must:

- Follow all Accounting Standards in their entirety

- Make full disclosures as required under each standard

- Apply recognition, measurement, presentation, and disclosure requirements fully

There are no exemptions or relaxations available to Large Entities.

Applicability of Accounting Standards to MSMEs

MSMEs are given certain exemptions and relaxations to reduce compliance burden.

These exemptions fall under three broad categories:

- Accounting Standards not applicable at all

- Accounting Standards not applicable in entirety

- Accounting Standards applicable with relaxations

Accounting Standards Not Applicable to MSMEs

The following Accounting Standards are not applicable in their entirety to MSMEs:

- AS 3 – Cash Flow Statements

- AS 17 – Segment Reporting

- AS 20 – Earnings Per Share

- AS 24 – Discontinuing Operations

This means MSMEs are not required to comply with these standards at all.

Accounting Standards Partially Not Applicable to Certain MSMEs

Some Accounting Standards are not applicable to small MSMEs that satisfy additional conditions relating to turnover and borrowings.

These include:

- AS 18 – Related Party Disclosures

- AS 28 – Impairment of Assets

These standards are not applicable in entirety to MSMEs whose:

- Turnover does not exceed ₹50 crore

- Borrowings do not exceed ₹10 crore

- Not holding or subsidiary of another entity

Accounting Standards Applicable with Relaxations

For certain standards, MSMEs must comply but are given relaxations in disclosure or measurement.

Examples include:

- AS 10 – Property, Plant and Equipment

- AS 11 – Effects of Changes in Foreign Exchange Rates

- AS 15 – Employee Benefits

- AS 19 – Leases

- AS 22 – Accounting for Taxes on Income

- AS 26 – Intangible Assets

- AS 28 – Impairment of Assets

- AS 29 – Provisions, Contingent Liabilities and Contingent Assets

These relaxations mainly reduce:

- Detailed disclosures

- Complex valuation techniques

Special Case: Consolidated and Interim Financial Statements

Certain Accounting Standards:

- AS 21 – Consolidated Financial Statements

- AS 23 – Accounting for Investments in Associates

- AS 27 – Joint Ventures (Consolidation part)

- AS 25 – Interim Financial Reporting

do not force non-company entities to prepare consolidated or interim financial statements. These standards apply only if the entity:

- Is required by law, or

- Voluntarily chooses to prepare such statements

Disclosure Requirements for MSMEs

If an MSME avails exemptions:

- It must disclose that it is an MSME

- It must mention compliance with applicable Accounting Standards

- It must specify which exemptions or relaxations are taken

This ensures transparency.

Why This Topic Is Very Important for Exams

Questions from this topic often test:

- MSME vs Large Entity classification

- Which AS apply or do not apply

- Disclosure requirements

- Case studies involving turnover and borrowings

A clear understanding helps avoid mistakes.

What’s Next?

Now that you understand how Accounting Standards apply to non-company entities, the next important topic is:

This will explain each exemption standard by standard, in detail.

FAQs

1. What are non-company entities under Accounting Standards?

Non-company entities include partnership firms, LLPs, trusts, societies and other organisations not registered under the Companies Act.

2. Do Accounting Standards apply to non-company entities?

Yes. Accounting Standards apply to non-company entities based on their business activities and classification as MSME or Large Entity.

3. Do Large non-company entities get any exemptions?

No. Large non-company entities must comply fully with all Accounting Standards without any exemptions.

4. Are MSMEs exempted from all Accounting Standards?

No. MSMEs are exempted only from certain standards or certain requirements within standards, not from all Accounting Standards.

5. Is AS 3 Cash Flow Statement mandatory for MSMEs?

No. AS 3 Cash Flow Statements is not applicable in its entirety to MSMEs.

6. Are non-company entities required to prepare consolidated financial statements?

No. Non-company entities are required to prepare consolidated financial statements only if they are legally required or choose to do so voluntarily.

7. What disclosures are required when MSMEs avail exemptions?

MSMEs must disclose their MSME status, compliance with applicable Accounting Standards, and details of exemptions or relaxations availed.