One of the most confusing questions in indirect taxation has always been this:

“Is it a supply of goods or a supply of services?”

Before GST, this confusion led to endless disputes — for instance, is software a product or a service? Is construction work a sale or a service?

Different taxes (VAT, Excise, Service Tax) applied differently, causing overlapping taxation.

To solve this, the Goods and Services Tax (GST) system introduced Schedule II of the CGST Act — a clear list explaining how certain transactions should be treated:

👉 whether they count as supply of goods or supply of services.

This schedule provides clarity, consistency, and helps apply the correct tax rate, place of supply, and valuation rules.

Let’s break it down in a simple, human way with real-life examples.

What Is Schedule II Under GST?

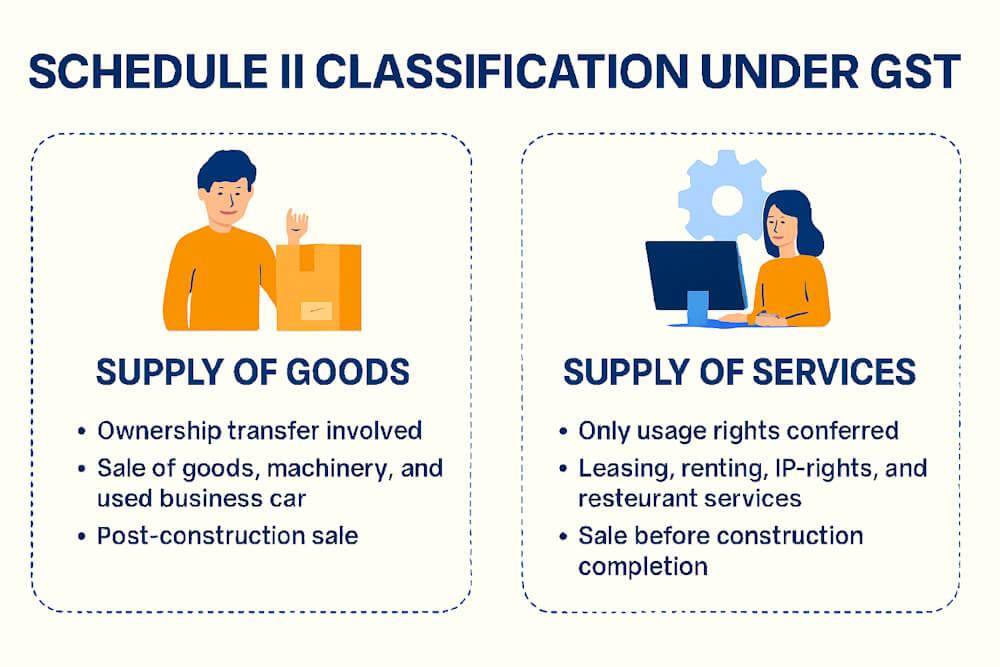

Schedule II doesn’t define what a supply is — instead, it classifies different kinds of supplies into two buckets:

- Supply of goods

- Supply of services

So, once you know a transaction is a supply (as per Section 7 of the CGST Act), Schedule II tells you how to treat it.

This is important because:

- Different GST rates apply to goods vs services

- Time of supply rules differ

- Input tax credit conditions vary

The Logic Behind Schedule II

The goal of Schedule II is to create uniform treatment across India. For example:

- Renting machinery is a service, not a transfer of goods.

- Construction of a building before completion is a service, not a sale of property.

- Transferring ownership of goods permanently is a supply of goods.

It helps avoid double taxation and gives businesses clarity on how to classify transactions.

Supply of Goods (Under Schedule II)

Schedule II lists situations that are specifically treated as supply of goods under GST. Let’s look at each one with examples 👇

(a) Transfer of Title in Goods

If ownership of goods is transferred from one person to another, it’s clearly a supply of goods.

💬 Example: A company sells 100 laptops to a retailer for ₹5,00,000. Ownership passes to the buyer — so this is supply of goods.

(b) Transfer of Goods Without Transfer of Title

If goods are handed over but ownership remains with the original owner, it’s still a transaction, but not sale — it’s treated as supply of services (explained later).

💬 Example: A company leases equipment to another firm for two years. Ownership doesn’t transfer — so it’s a service, not goods.

(c) Transfer of Business Assets

When a business transfers or disposes of assets on which ITC was claimed, it’s considered a supply of goods.

💬 Example: A firm sells its old machinery that was used for production. Since the machinery was part of business assets, its sale is a supply of goods.

(d) Goods that were part of business assets but are no longer used for business purposes

When something used for business is taken for personal use or given away, it’s treated as supply.

💬 Example: A company director takes a company car (on which ITC was claimed) for personal use. That’s a supply of goods, even without payment (deemed supply).

(e) Supply of Goods by an Unincorporated Association to Its Members

When an unregistered club, society, or association provides goods to its members for consideration, it’s a supply of goods.

💬 Example: A cooperative society distributes packaged groceries to its members at cost. It’s treated as supply of goods under Schedule II.

Supply of Services (Under Schedule II)

Now let’s see what’s specifically treated as supply of services under GST. Most business transactions today fall under this category.

(a) Transfer of Rights Without Transfer of Title

If you transfer the right to use something without giving ownership, it’s treated as a service.

💬 Example: A construction company rents out its crane to another builder for 3 months. Ownership remains unchanged — it’s a supply of service.

(b) Lease, Tenancy, Easement, or License to Occupy Land

All these are clearly treated as services, not as transfer of goods.

💬 Example: A company rents an office space for ₹50,000 per month.

👉 It’s a service (renting of immovable property).

(c) Lease or Letting Out of a Building (Commercial Use)

Renting a commercial property is always treated as a supply of service.

💬 Example: A landlord rents a shop to a business for ₹20,000 per month.

👉 Supply of services — GST applies on rent.

💬 Example: Renting a residential property for personal use, however, is exempt from GST.

(d) Treatment or Process on Goods Owned by Another Person

If you perform work or processing on someone else’s goods, it’s treated as a supply of service.

💬 Example: A fabric processor dyes cloth for a garment manufacturer.

👉 The job work is a service, not a sale.

(e) Transfer of Business Assets (When Used Privately)

If business goods are used privately or for non-business purposes, it’s treated as a service.

💬 Example: A bakery owner uses business ovens for a personal family event.

👉 That use is treated as a supply of service.

(f) Construction of Complex, Building, or Civil Structure

Construction of a building, complex, or similar structure intended for sale before completion is treated as a supply of service.

💬 Example: A builder constructs an apartment complex and sells units before getting a completion certificate.

👉 It’s a service — GST applies. Once the completion certificate is issued, sale becomes sale of immovable property (outside GST).

(g) Temporary Transfer or Permitting Use of Intellectual Property (IP)

If you allow others to use your intellectual property (like patents, designs, trademarks), it’s a service.

💬 Example: A music company licenses its song catalog to a film studio.

👉 Supply of services (temporary transfer of IP rights).

(h) Information Technology and Software Licensing

Licensing software for use is treated as a service, not as sale of goods.

💬 Example: A business pays ₹50,000 per year for a cloud-based software license.

👉 Supply of service.

But if the same software is sold as a CD with permanent ownership, it’s supply of goods.

(i) Works Contracts

Any contract for construction, installation, repair, or maintenance that involves both goods and services is classified as a supply of service under GST.

💬 Example: A company hires a contractor to install machinery at its factory — including labor and parts.

👉 Works contract = supply of service.

(j) Restaurant and Catering Services

Even though food is a good, restaurant services are treated as supply of services under GST.

💬 Example: Dining at a restaurant — you pay one combined price for food and service.

👉 It’s treated as a service, not a sale of goods.

(k) Renting of Movable Property

Leasing or renting out movable property (like vehicles, equipment, or machines) is a service.

💬 Example: A company rents its construction equipment to another firm for ₹1,00,000 per month.

👉 Supply of services.

(l) Agreeing to perform or avoid an action in return for payment

If someone agrees to do something, or not to do something, for consideration — it’s a service.

💬 Example: A competitor pays another company to delay product launch.

👉 It’s a service under Schedule II.

(m) Composite Supply — Food and Beverages

Supplying food or drink as part of catering, restaurant, or event service is always treated as supply of services, even though it includes goods.

💬 Example: A wedding catering company provides food and wait staff.

👉 Entire transaction = supply of services.

Summary Table: Supply of Goods vs Supply of Services

| Basis | Supply of Goods | Supply of Services |

| Ownership | Transfer of title or ownership | No transfer of title |

| Examples | Sale of goods, sale of machinery | Renting, leasing, IP licensing |

| Construction | Sale after completion certificate | Sale before completion = service |

| Software | CD sold outright | Online access/subscription |

| Food Supply | Sale of packed food | Restaurant dining/catering |

| Works Contract | Not applicable | Always treated as service |

Why the Classification Matters

This classification affects:

- Applicable GST rate (goods and services often have different slabs)

- Place of supply rules (important for interstate vs intrastate tax)

- Time of supply (when the tax liability arises)

- Input Tax Credit eligibility

So, correctly identifying whether a transaction is a supply of goods or services prevents compliance errors and disputes.

Common Confusions Cleared Up

| Situation | Treated As | Reason |

| Leasing machinery | Service | Ownership not transferred |

| Renting shop | Service | Renting is a service |

| Selling used business car | Goods | Ownership transferred |

| Software via download | Service | No physical product, just usage rights |

| Restaurant service | Service | Composite supply, food + service |

| Construction before completion | Service | Sale before completion certificate |

Final Thoughts

Schedule II is one of the most practical parts of GST law.

It clearly defines which transactions count as supply of goods and which as supply of services, leaving little room for confusion.

In simple terms:

“If ownership changes permanently — it’s goods.If you only give usage rights, time, or value temporarily — it’s services.”

By understanding Schedule II, businesses can correctly classify their transactions, apply the right GST rates, and stay fully compliant.