The Goods and Services Tax (GST) system in India is designed to bring almost every commercial transaction under one tax — whether it involves goods, services, or both.

But not everything is taxable under GST. Certain transactions are specifically kept outside the scope of GST — they’re called “neither supply of goods nor supply of services.”

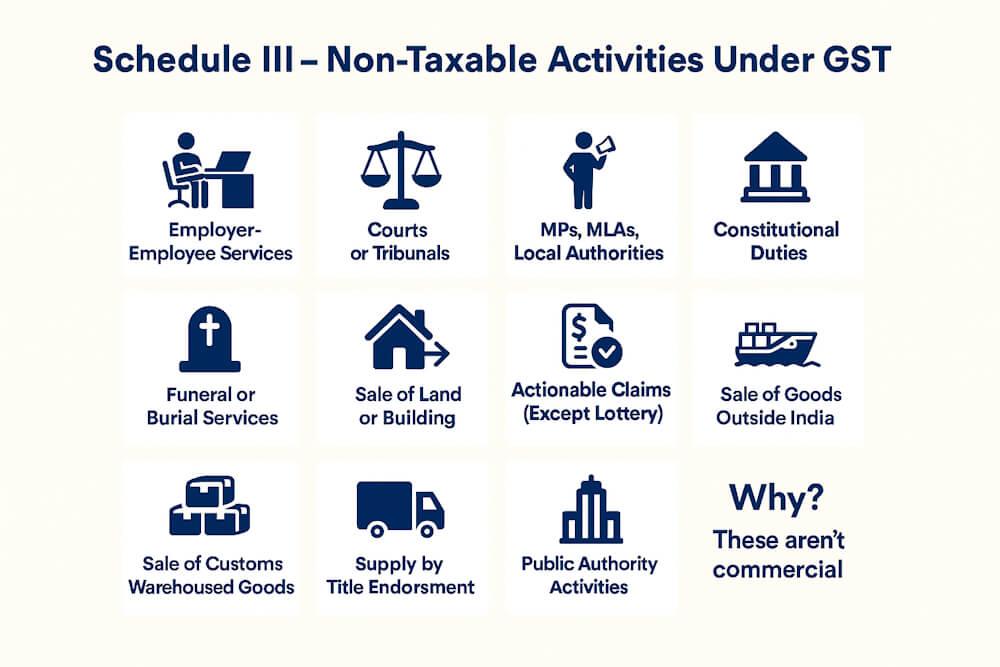

These are listed in Schedule III of the CGST Act, 2017. They are non-taxable activities, meaning even though they may involve money, transfer, or benefit, GST doesn’t apply to them at all.

Let’s understand what these transactions are, why they’re excluded, and see some easy examples from everyday life.

Why Schedule III Exists

Before GST, multiple indirect taxes often overlapped — some activities were taxed twice or misclassified. To make GST fair and simple, lawmakers clearly separated:

- Taxable activities → supply of goods or services (Schedules I & II), and

- Non-taxable activities → neither goods nor services (Schedule III).

So, Schedule III acts as a “GST boundary line.” It tells us which transactions should be completely excluded from GST, ensuring no double taxation and no confusion.

Schedule III – The Official List (Simplified)

Schedule III of the CGST Act lists several transactions that are neither supply of goods nor supply of services. Here’s the complete list in plain, simple language — along with real-world examples.

1. Services by an Employee to the Employer in the Course of Employment

This is one of the most basic exclusions. Anything an employee provides to their employer as part of employment duties is outside GST.

💬 Examples:

- Salary, bonuses, and commissions paid to employees.

- Allowances, incentives, or overtime pay.

- Perks like company cars, phones, or laptops given for work use.

👉 These are employment relationships, not business-to-business supplies, so GST doesn’t apply.

Note: However, if an employer gives gifts to employees worth more than ₹50,000 per year, that extra value is taxable under Schedule I (deemed supply).

2. Services by Any Court or Tribunal

Judicial bodies that administer justice or perform legal functions are outside the GST net.

💬 Examples:

- High Courts, District Courts, or Consumer Forums providing judgments.

- Tribunals or commissions carrying out hearings or legal reviews.

👉 Since these are sovereign functions, not commercial activities, GST doesn’t apply.

3. Functions Performed by MPs, MLAs, and Local Authorities

Services rendered by individuals who perform constitutional or statutory duties — like elected representatives — are also excluded.

💬 Examples:

- Functions performed by Members of Parliament, State Legislatures, or Panchayats.

- Duties by Municipalities or local authorities under state law.

👉 These are governmental functions, not business activities.

4. Duties Performed by Persons Holding Constitutional Posts

People who hold positions under the Constitution — such as the President, Governors, or Judges — are excluded when performing their official duties.

💬 Examples:

- The President addressing Parliament.

- A Governor giving assent to a Bill.

- A Supreme Court Judge delivering a verdict.

👉 These are official functions of the State, not taxable supplies.

5. Services of Funeral, Burial, Cremation, or Mortuary

Services connected with the death of a person are fully exempt from GST.

💬 Examples:

- Services by cremation grounds, burial sites, or funeral homes.

- Mortuary services and arrangements for last rites.

👉 Since these are essential and compassionate services, they are kept completely outside taxation.

6. Sale of Land and, Subject to Clause (b) of Paragraph 5 of Schedule II, Sale of Building

The sale of land and sale of a completed building are not treated as supply.

💬 Examples:

- Selling a plot of land for development → not taxable.

- Selling a ready-to-move apartment after getting the completion certificate → not taxable.

But: Construction or sale before completion is treated as a supply of service under Schedule II and is taxable.

7. (a) Actionable Claims Other Than Lottery, Betting, and Gambling

An actionable claim is a legal right to recover a debt or claim. Most actionable claims are excluded from GST — except lottery, betting, and gambling, which remain taxable.

💬 Examples (non-taxable):

- Claiming money under insurance.

- Claiming dues from a customer or debtor.

💬 Examples (taxable):

- Lottery tickets, horse race betting, and casino winnings.

8. Supply of Goods from a Place Outside India to Another Place Outside India (Without Entering India)

When goods move between two foreign locations without entering Indian territory, GST doesn’t apply. This is often referred to as “high-seas sales” or “merchanting trade.”

💬 Example: An Indian exporter arranges the sale of goods from a supplier in China directly to a buyer in Germany. The goods never enter India — so it’s not a supply under GST.

9. Supply of Warehoused Goods Before Clearance for Home Consumption

When goods are stored in a customs warehouse and are sold before being cleared for home consumption, the transaction is outside the scope of GST.

💬 Example: An importer sells goods while they are still in a bonded warehouse — before they are officially imported.

👉 Such transfer is not taxable under GST.

10. Supply of Goods by Endorsement of Documents of Title (Before Clearance for Home Use)

If goods are sold by simply transferring title (ownership documents) before being imported into India, it’s not a supply under GST.

💬 Example: Company A imports goods from the U.S. and, before clearing customs, endorses the bill of lading to Company B.

👉 This transfer of ownership outside customs clearance is excluded from GST.

11. Activities or Transactions Undertaken by Central, State, or Local Governments as Public Authorities

This clause covers all sovereign or statutory functions performed by government bodies.

💬 Examples:

- Issuance of passports, driving licenses, or birth certificates.

- Collection of property tax or fines.

- Police services, judicial functions, or law enforcement.

👉 These are considered governmental duties, not commercial supplies.

Note: If the government performs a commercial activity (like renting out property or providing consultancy services), that part may still be taxable under GST.

12. Certain Specific Additions (Amendments Introduced Later)

Over the years, a few more activities have been added to Schedule III to clarify tax treatment. Here are some of the key inclusions:

- Supply of goods from customs bonded warehouses — still excluded until cleared for home use.

- Insurance-related transfers (co-insurance, reinsurance, and NCB adjustments) — excluded from GST to avoid double taxation.

- Financial transactions like securities lending — excluded as they involve securities, which are outside GST.

These updates help keep GST aligned with complex modern business practices.

Why These Are Outside GST

The logic behind Schedule III is straightforward:

- These activities are not commercial in nature.

- They are sovereign or personal functions.

- Many are already taxed under other laws (like stamp duty, property tax, or customs).

So, including them in GST would only create duplication and confusion.

Schedule III in Real-Life Scenarios

| Scenario | GST Applicability | Reason |

| Salary paid by employer | ❌ No GST | Employment relationship |

| Sale of land | ❌ No GST | Immovable property excluded |

| Sale of under-construction flat | ✅ Yes | Service under Schedule II |

| Funeral or burial services | ❌ No GST | Compassionate service |

| Sale of lottery tickets | ✅ Yes | Taxable actionable claim |

| Government collecting property tax | ❌ No GST | Sovereign function |

| Renting government property to private company | ✅ Yes | Commercial supply |

| High-seas sales (foreign to foreign) | ❌ No GST | Goods never entered India |

Quick Checklist: How to Identify Non-Taxable Transactions

Before you add anything to your GST return, ask:

- ✅ Is it a government or employment activity?

- ✅ Does it involve land, building (after completion), or securities?

- ✅ Did goods or services actually enter India?

- ✅ Is it a compassionate or statutory service?

If most answers are “yes,” you’re probably dealing with a Schedule III activity, not a taxable supply.

Final Thoughts

Schedule III of the CGST Act acts like a “filter” — separating purely commercial supplies from those that are sovereign, personal, or outside trade.

These exclusions make the GST system fairer and prevent unnecessary tax on activities like:

- Paying salaries

- Selling land or completed buildings

- Performing government duties

- Handling customs warehoused goods

In simple words:

“If it’s not part of trade or business, or if it’s a sovereign or personal function — it’s not supply under GST.”

Understanding Schedule III helps businesses avoid over-reporting and keeps GST filings clean, accurate, and compliant.