When we think of GST on services, most people imagine a simple “invoice → payment → GST paid” flow. But in real life, not all services work this way. Some services are ongoing, sometimes stretched for months or even years — think telecom services, maintenance contracts, construction projects, or big government infrastructure work.

These are called continuous supply of services, and GST treats them a little differently, mainly because it’s hard to say exactly when the service begins or ends. And when you add complex government models like HAM (Hybrid Annuity Model) into the picture, the concept becomes even more interesting.

This blog breaks down everything in a simple, human way:

- What continuous services mean under GST

- How the time of supply is determined

- Practical examples

- And most importantly, a clear explanation of the latest HAM Model.

Let’s start gently and build up.

What Is Continuous Supply of Services Under GST?

Under Section 2(32) of the CGST Act:

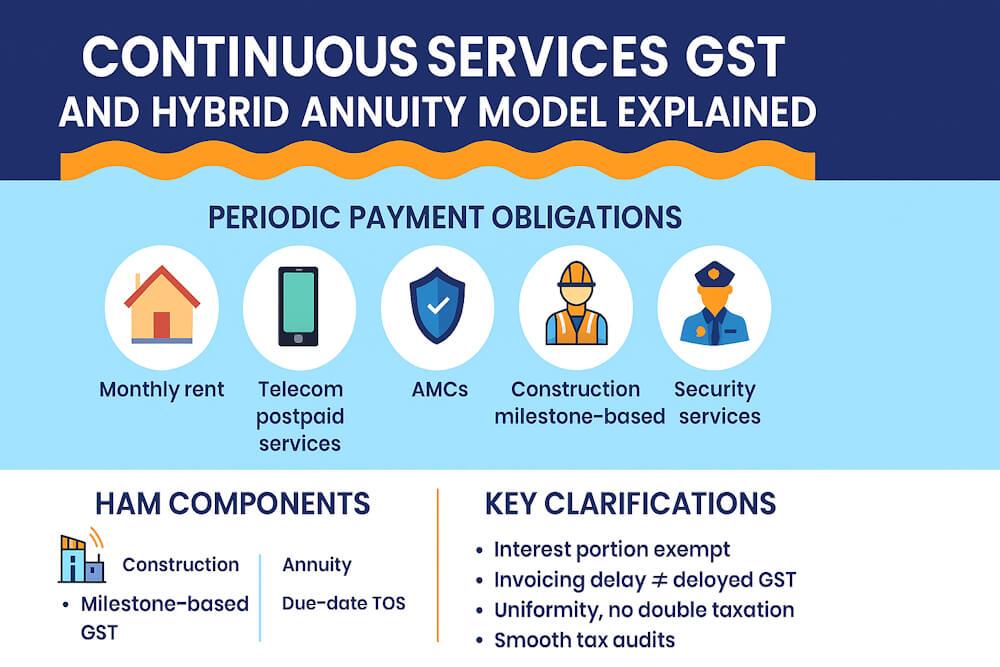

“A “continuous supply of services” means a supply provided continuously or recurrently under a contract for a period exceeding 3 months, with periodic payment obligations.”

Simple examples:

- Monthly rent

- Telecom postpaid services

- Annual maintenance contract (AMC)

- Security services

- Construction services billed milestone-wise

Because these services extend over time, GST needs a consistent way to decide when the tax becomes due.

Time of Supply for Continuous Services – Section 13 + Section 31

Section 13 (time of supply) and Section 31(5) (invoice rules) together determine the time of supply.

Section 31(5) – Invoice Rules for Continuous Services

For continuous supply of services, invoice must be issued:

Case 1 – If the contract specifies a due date for payment

Invoice must be issued on or before the due date.

Case 2 – If there is NO due date for payment

Invoice must be issued before or at the time of receipt of payment.

Case 3 – If payment is linked to completion of an event (milestone-based)

Invoice must be issued on completion of the event.

These invoice rules are important because they directly influence the time of supply.

Time of Supply – Section 13(2) Applied to Continuous Services

The time of supply = earlier of the following:

- Invoice date, or

- Payment date (entry in books or bank credit — whichever is earlier)

BUT… only if the invoice is issued within the timeline prescribed in Section 31(5).

If the invoice is issued late,

👉 Time of supply = date of service completion or completion of milestone.

This is where many businesses slip — delayed invoicing can shift their GST liability backwards.

Examples to Make It Crystal Clear

Example 1 – Contract with Fixed Monthly Due Date

- AMC contract for 1 year

- Payment due date each month: 10th of the month

- Invoice issued: 10th of every month

- Payment received: 20th of month

👉 Time of Supply = 10th (invoice date/due date) Even though the payment came later.

Example 2 – Payment Without Fixed Due Date

A consultant provides services throughout the month. No fixed due date mentioned in contract.

Payment received on 18th July, recorded on same date.

👉 Time of Supply = 18th July, Because there’s no due date, TOS shifts to payment.

Example 3 – Event-Based Milestone

Construction contract:

- Base slab completed → payment due

- Work completed: 25th September

- Invoice issued: 30th September

- Payment received: 5th October

👉 Time of Supply = 25th September because event completion triggers invoice timing.

Example 4 – Invoice Issued Late

- Service completed: 10th June

- Invoice issued: 25th July (after 30 days)

- Payment received: 15th August

Since invoice is delayed beyond the allowed 30 days:

👉 Time of Supply = 10th June (date of service)

This is where businesses often face interest demands.

What About Advances?

For services, GST is payable on advance payments. So, if a client gives an advance for a continuous service:

👉 Time of Supply = date of advance payment

This applies regardless of due dates or milestones.

Now, Let’s Talk About HAM Model (Hybrid Annuity Model)

— The Part Everyone Finds Confusing

HAM is used heavily in:

- Road construction

- Public infrastructure

- PPP (public–private partnership) projects

- Long-term developmental projects

HAM has a mixed payment structure:

- The government pays 40% during construction, and

- Remaining 60% is paid as annuity over several years.

GST complications arise because:

- The construction happens NOW

- The payments are spread out over YEARS

- Actual use of road/infrastructure starts earlier

- There is no simple “invoice → payment” cycle

To resolve all confusion, the government released:

CBIC Circular No. 221/15/2024-GST (Dated 26 September 2024)

Clarifying the Time of Supply & GST liability for HAM projects

Let’s break it down in plain, uncomplicated language.

HAM Model Circular – Key Clarifications

1. Construction Service Portion (40% upfront)

GST on the construction portion (during construction phase) must be paid when the milestone is completed as per Section 13 and Section 31(5).

👉 Time of Supply = event completion (i.e., completion certificate or measurement book entry)

2. Annuity Payments (Remaining 60%)

Annuity payments made over years are treated as consideration for service (like O&M or deferred payment).

The time of supply for annuity payments = 👉 Each time annuity becomes due

Not on the original construction date.

3. No GST on "interest" part of annuity

The circular clarified that only the service portion of annuity is taxable. The "interest" portion is exempt, aligning with earlier notifications.

4. Invoice Timing Matters

- For construction phase: invoice at each construction event.

- For annuity phase: invoice at each due date of annuity.

If the contractor delays the invoice:

👉 GST liability still arises on the due date.

5. No GST on pure financing components

If part of the annuity represents financing charges (interest), GST doesn’t apply to that segment.

HAM Time of Supply – Simple Flowchart

| Phase | Event Trigger | Time of Supply |

| Construction Phase | Completion of milestone | Date of milestone completion |

| Annuity Phase | Due date of each annuity installment | Date annuity becomes due |

| Advance (if any) | Advance payment | Date advance received |

| Delayed invoice | Invoice issued late | Due date/milestone date (whichever relevant) |

Realistic Examples (Based on Circular)

Example 1 – Construction Milestone

A road contractor finishes:

- Foundation on 15 March

- Government records MB entry on 20 March

- Invoice issued on 5 April

- Payment on 15 April

👉 Time of Supply = 20 March (event completion) GST payable in March return.

Example 2 – First Annuity Payment

Annuity installment due on: 10 July Invoice issued: 12 July Payment received: 20 July

👉 Time of Supply = 10 July (due date) Invoice delay doesn’t change liability.

Example 3 – Interest Component

Annuity breakup:

- Service portion: ₹40 lakh

- Interest portion: ₹10 lakh

GST applies only on ₹40 lakh.

Why HAM Model Needed a Circular?

Because different states and contractors followed different interpretations:

- Some paid GST on entire annuity (wrong)

- Some delayed GST until payment was received (wrong)

- Some treated annuity as exempt (partially wrong)

- Some paid GST only at the end of construction (wrong)

This circular ensures:

- Uniformity

- No double taxation

- Clear time of supply

- Smooth tax audits

Key Takeaways

- Continuous services follow due dates, events, or payment triggers = Invoice timing decides everything.

- For services, GST is always due on advance payments.

- HAM Model has two distinct components = (a) Construction (milestone-based TOS) and (b) Annuity (due-date TOS)

- Interest portion of annuity is exempt from GST.

- Delay in invoicing does NOT delay GST liability.

- Government’s 2024 Circular resolves all grey areas

Especially useful for EPC contractors, infrastructure companies, PPP projects, and engineering firms.

Final Thoughts

Continuous services and the HAM model show how real-world GST isn’t one-size-fits-all. These services run across months or years, and their payment cycles don’t match the actual work. GST handles this by tying the tax payment to:

- Due dates

- Event completion

- Payment timing

Once you understand these “trigger points,” GST on long-term services becomes predictable and easy to manage.

The HAM model now has crystal-clear rules thanks to the latest circular — and knowing these rules avoids disputes, late fees, interest, and audit complications.