When we talk about GST (Goods and Services Tax), one of the most fundamental questions every taxpayer faces is this — “When does the liability to pay GST actually arise?” Is it when the sale is made, when the invoice is issued, or when the payment hits the bank?

This exact question is answered by one crucial concept in GST law known as the Time of Supply. It determines the precise point in time when GST becomes payable on goods or services. Without understanding this concept properly, businesses often end up paying tax either too early or too late — both of which can cause compliance headaches.

Let’s dive deep into this topic in simple words, step by step.

What is Time of Supply under GST?

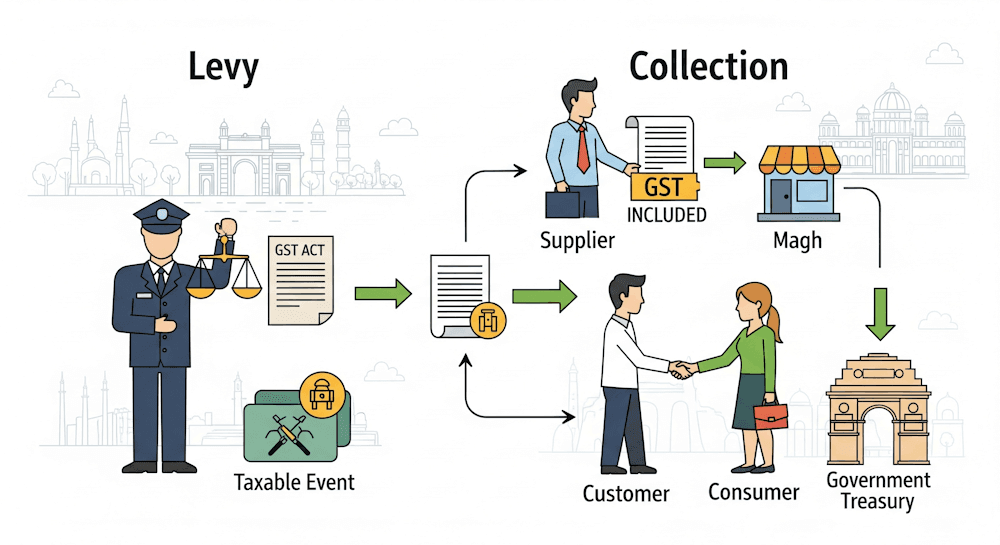

Under the GST regime, tax is payable at the “time of supply” — that is, the moment when a taxable event occurs.

Every supply of goods or services involves a series of activities — like purchase order, dispatch, delivery, invoicing, and payment. But GST law asks a simple but powerful question:

👉 At which of these points does tax liability actually arise?

The answer lies in Sections 12 and 13 of the CGST Act, 2017:

- Section 12 deals with the time of supply for goods, and

- Section 13 deals with the time of supply for services.

In addition, Section 14 covers cases where there’s a change in the rate of GST.

Simply put, the time of supply acts as a trigger point for determining when GST becomes due — and once that point arrives, tax must be paid by the due date linked to that supply period.

Why Time of Supply is Important

Understanding the time of supply is essential because:

- It decides when GST liability arises — not when payment is made.

- It helps in filing GST returns accurately, without missing or pre-paying tax.

- It determines the correct tax period for recording a transaction.

- It avoids disputes or penalties in case of delayed invoicing or early payments.

Example: If the time of supply for a transaction is 25th May, and the supplier files returns monthly, the tax must be paid by 20th June, the due date for May’s return.

How GST Defines the Moment of Tax Liability

The concept becomes clearer if we remember that GST applies to “supply.” However, a supply may spread across multiple events — such as:

- The date of invoice,

- The date of payment,

- The date of delivery or provision, and

- The date of receipt in books.

So, the law provides clear rules to pinpoint the exact timing of tax liability for both goods and services.

And interestingly, these timings differ slightly because of the nature of goods (physical movement) and services (performance-based).

Time of Supply for Goods – Section 12 Overview

When goods are supplied, Section 12 says the time of supply is the earlier of:

- The date of issue of invoice (or the last date it should have been issued under Section 31), or

- The date of receipt of payment.

However, after a key government notification (No. 66/2017 – Central Tax dated 15.11.2017), taxpayers supplying goods (except composition dealers and certain actionable claims) don’t need to pay GST on advances received.

GST becomes payable only at the time of issuing the invoice.

Example 1 – Partial Supply

Scenario: A Ltd. signs an agreement to supply 100 kg of raw material to B Ltd., but only 80 kg is delivered.

Analysis: The time of supply applies only to the 80 kg actually invoiced and delivered. The remaining 20 kg isn’t yet a supply — no GST liability arises until it’s invoiced.

Example 2 – Invoice and Payment on Same Day

B Ltd. sells goods to C Ltd. on 10th June, issues the invoice the same day, and receives payment on 20th June.

Time of supply: 10th June (invoice date).

Example 3 – Payment Received Before Invoice

B Ltd. sells goods to C Ltd. on 10th June, but receives payment on 5th June and issues the invoice on 10th June.

Time of supply: Still 10th June, because tax is based on the invoice date for goods (per the notification).

Example 4 – Late Invoice Issue

Invoice should’ve been issued on 10th June but was actually issued on 12th June. Time of supply: 10th June (the last date the invoice ought to have been issued).

Example 5 – Continuous Supply of Goods

If goods are supplied monthly (say, as part of an annual contract) and the supplier issues invoices every month, then the time of supply is the invoice date each month — for example, the 10th day of every month, if that’s when invoicing occurs.

Example 6 – Goods Sent on Approval Basis

B Ltd. sends goods to C Ltd. on 10th January for approval. The goods are approved on 15th August. As per Section 31(7): The invoice must be issued before or at the time of supply or within 6 months from removal, whichever is earlier. Hence, the time of supply is 10th July (the date by which 6 months are completed).

Reverse Charge on Goods – When Buyer Pays GST

Under Section 12(3), when GST is payable on a reverse charge basis, the time of supply is the earliest of:

- The date of receipt of goods,

- The date of payment, or

- 30 days after the supplier’s invoice.

If none of these dates are clear, it defaults to the date of entry in the buyer’s books.

Example 7 – Reverse Charge Scenario 1

- Invoice issued: 4th June

- Goods received: 12th June

- Payment recorded: 30th June (debited from bank on 2nd July)

Time of supply: 12th June — the earliest date among all three.

Example 8 – Reverse Charge Scenario 2

- Invoice issued: 4th June

- Goods received: 6th July

- Payment recorded: 21st July (debited 31st July)

Time of supply: 5th July — the day after 30 days from invoice date.

Example 9 – Reverse Charge Scenario 3

- Invoice issued: 4th June

- Goods received: 27th June

- Payment recorded: 10th June (debited 2nd July)

Time of supply: 10th June — earliest date among the three.

Vouchers and Residual Cases

Section 12(4) talks about vouchers used for goods or services:

- If the supply is identifiable when the voucher is issued → time of supply is date of issue.

- If not identifiable → date of redemption.

Example 10 – Voucher for Unidentified Supply

A Ltd. sells food coupons to B Ltd. (employees can buy any food item). Since the supply isn’t known at issue time, the time of supply is when the coupon is redeemed.

Example 11 – Voucher for Identified Supply

A pizza shop offers a ₹20 voucher redeemable for a small pizza only. Here, the supply is known at issue time, so time of supply = date of issue.

Residual Case

If time of supply can’t be determined by regular rules, then:

- If a return is to be filed → it’s the due date of return.

- Otherwise → the date tax is paid.

Addition to Value – Interest or Late Fee

If payment for goods or services is delayed, and interest or penalty is charged, Section 12(6) says GST on that extra amount is payable when the supplier receives it.

Example 12 – Interest on Late Payment

A Ltd. sold goods on 6th June, with a clause: 2% monthly interest if payment is delayed beyond 15 days.

Payment (with interest) received on 6th July.

- GST on goods → 6th June (invoice date).

- GST on interest → 6th July (date of receipt of interest).

In Short – How Time of Supply Works

| Type of Supply | Trigger Point for GST Liability |

| Goods (Forward Charge) | Date of invoice / last date to issue invoice |

| Goods (Reverse Charge) | Earliest of receipt, payment, or 30 days after invoice |

| Vouchers | Date of issue (if identifiable) or redemption |

| Delayed Payment (Interest) | Date of receiving the interest/fee |

| Residual Cases | Return due date or tax payment date |

Why Businesses Should Care

Getting the time of supply wrong can lead to:

- Paying GST too early → blocking cash flow, or

- Paying too late → interest and penalties.

Hence, businesses should:

- Align their invoicing and accounting systems with the GST timelines,

- Regularly verify transaction dates,

- Maintain clear documentation of invoice and payment records.

Final Thoughts

The Time of Supply under GST may look technical at first, but it’s the backbone of correct tax compliance. Once you understand when GST liability arises — whether on goods, services, or vouchers — everything else (returns, ITC, payments) falls neatly into place.

For businesses, mastering this concept means smoother audits, fewer disputes, and total peace of mind when filing GST returns.