At first glance, GST valuation looks pretty straightforward — take the transaction value, apply GST, and you’re done. But certain industries simply don’t fit into this basic template. Two of them are:

- Second-hand goods dealers

- Businesses issuing vouchers, gift cards, coupons, prepaid instruments

These supplies work differently, and the “normal transaction value” formula under Section 15 doesn’t give a fair result. For example:

- A used car dealer buys an old car for ₹3,00,000 and sells it for ₹3,20,000. Should GST apply on the entire ₹3,20,000?

- A gift card issued for ₹1,000—what is the value of supply at the time of issue?

- What about cashback vouchers?

- What about multi-purpose vs single-purpose vouchers?

These situations don’t align with the standard pricing structure of regular goods and services. That’s why GST created Rule 32(5) and Rule 32(6) — simplified valuation rules specifically for second-hand goods and voucher supplies.

1. Why Special Valuation Rules for Second-Hand Goods?

Second-hand goods dealers operate on margin, not product value. They buy a used item and sell it with a small profit.

If GST were charged on the full sale price, it would:

- artificially increase tax burden

- cause double taxation (since GST was already paid when the item was new)

- make second-hand sector unviable

So GST introduced the margin scheme under Rule 32(5).

2. Rule 32(5) — Margin Scheme for Second-Hand Goods

Rule 32(5) is designed to simplify valuation for:

- Used car dealers

- Second-hand electronics sellers

- Furniture resellers

- Scrap dealers

- Dealers of refurbished goods

Under this rule:

👉 GST is charged only on the MARGIN, not on the full sale price.

The formula is extremely simple:

“Value of Supply = Selling Price – Purchase Price ”

If the margin is negative, GST = ZERO.

Let’s take this slowly and visualize it.

2.1 Example 1 — Basic Margin Calculation

A used laptop dealer buys a second-hand laptop for ₹20,000. He refurbishes it slightly and sells it for ₹25,000.

- Margin = 25,000 – 20,000 = ₹5,000

- Value of supply = ₹5,000

GST = 5,000 × 18%

Only the margin is taxed.

2.2 Example 2 — Loss Sale (No GST)

- Purchase price = ₹50,000

- Selling price = ₹45,000

Margin = – ₹5,000 → Negative

Rule 32(5) says:

- If margin is negative, value = 0

- GST = Zero

This prevents unnecessary burden.

2.3 Example 3 — Second-Hand Car Sale (CA Exam Style)

A dealer buys a used car for:

- Purchase price = ₹5,00,000

Sells it for:

- Selling price = ₹5,70,000

Margin = 70,000 GST @ 18% = 12,600

- Value = 70,000

- GST applies only on the margin.

3. Important Conditions for Using Margin Scheme

A dealer must satisfy these conditions:

Condition 1: No ITC allowed on purchase

Dealers cannot claim ITC on the purchase of second-hand goods.

Why? Because margin scheme already gives benefit—charging GST only on margin.

Condition 2: Goods must be "used" and "as is"

This rule applies only when goods are supplied as such or after minor processing that does not change the nature of goods.

For example:

Permitted:

- Minor cleaning

- Minor repairs

- Cosmetic changes

- Polishing

- Repainting

Not permitted:

- Converting used car into ambulance

- Converting e-waste into new product

- Major value-adding transformation

If substantial processing changes nature → margin scheme cannot be used.

Condition 3: Goods must be purchased from unregistered persons OR without ITC

Because ITC disqualifies from the margin scheme.

4. Special Rule for Used Cars (Notification-Based)

GST Council further reduced tax burden for used cars with concessional rates:

- 12% for small cars

- 18% for larger cars

- Margin scheme applicable

But since your blog focuses on valuation, we stick to Rule 32(5).

5. Practical Examples Mixing All Conditions

Example — Second-Hand Furniture Dealer

- Purchase = ₹30,000

- Minor polishing cost = ₹3,000

- Selling price = ₹40,000

Purchase price counted = ₹30,000 (polishing ignored since it’s minor)

Margin = 40,000 – 30,000 = 10,000

GST = 10,000 × 18%

Example — Scrap Dealer

- Scrap purchased = ₹1,50,000

- Sold = ₹1,80,000

Margin = 30,000, GST = 30,000 × applicable rate

6. Negative Margin — No Carry Forward

If margin is negative:

- You cannot set it off against another sale

- You cannot adjust it in future months

- It simply becomes zero

Example:

- Sale 1 margin = –₹5,000 (ignored)

- Sale 2 margin = ₹12,000

GST = on ₹12,000 only, Not on (12,000 – 5,000)

7. Rule 32(6) — Valuation of Vouchers, Tokens, Coupons & Gift Cards

This rule deals with supplies where the value is not immediately clear.

Vouchers include:

- Gift cards

- Prepaid coupons

- Shopping vouchers

- Discount vouchers

- Free ride cards

- Wallet recharge vouchers

- Prepaid meal cards

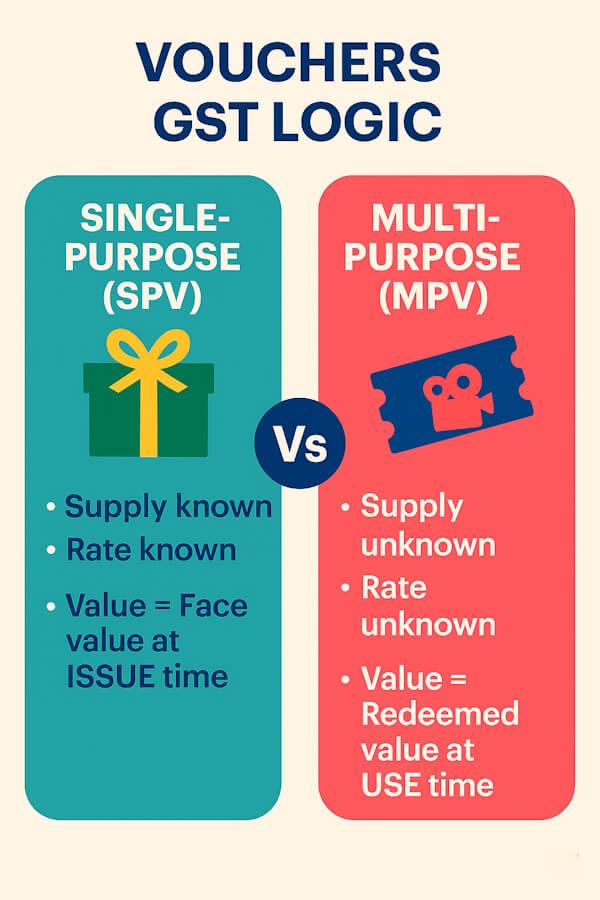

The law distinguishes two types:

- Single-purpose vouchers (SPV)

- Multi-purpose vouchers (MPV)

Let’s simplify.

7.1 Single-Purpose Vouchers (SPV)

A voucher where:

- The supply is known at the time of issue

- The GST rate is determinable

- Place of supply is known

Meaning: You know exactly what will be supplied.

Example of SPV:

- ₹500 Hair spa voucher (service known)

- One passenger bus ticket voucher

- Movie ticket voucher

- One-month gym pass

For SPV:

“Value of supply = Face value / Consideration received at the time of ISSUE”

GST is paid when voucher is issued.

Example — Hair Spa Voucher

A salon issues a hair spa voucher for ₹1,000.

- Value = ₹1,000

- GST charged at time of issuing voucher.

7.2 Multi-Purpose Vouchers (MPV)

A voucher where:

- Supply is NOT known at issue

- Rate is NOT known

- Item/service can vary

Example:

- Amazon gift card

- Shopping mall gift card

- Online wallet top-up

- Generic ₹1000 gift card usable for any item

For MPV:

👉 GST is charged only when the voucher is redeemed, NOT when issued.

7.3 Rule 32(6): Valuation at Redemption

The rule says:

“Value of supply = Money value of goods/services redeemed (or equivalent amount of voucher)”

Example:

A ₹2,000 gift card is used to purchase shoes worth ₹2,200.

Value = ₹2,200 (That is the taxable value)

8. Examples (Voucher Valuation)

Example 1 — SPV

- Voucher: “Gold facial service – ₹1,500”.

- Since the exact service is known → SPV.

GST is paid at issue.

Value = ₹1,500

Example 2 — MPV

Voucher: Amazon gift card of ₹2,000.

Redeemed for:

- T-shirt = ₹1,400

- Shoes = ₹900

Value = 1,400 + 900 = ₹2,300

GST charged at redemption.

Example 3 — Prepaid Meal Card

A cafeteria issues a ₹3,000 prepaid meal card usable for ANY food item.

→ MPV.

GST at redemption based on items consumed.

9. Why GST Distinguishes SPV Vs MPV?

Because GST needs:

- Supply classification

- Rate

- Place of supply

These are not known when issuing MPVs.

10. Invoice Treatment for Vouchers

SPV: Invoice at time of issue.

MPV: Invoice at time of redemption.

11. Summary Diagram — Vouchers Under GST

Vouchers Under GST

12. Putting It All Together — Comparison Table

| Rule | Category | When GST Applies | Value of Supply |

| 32(5) | Second-Hand Goods | At sale | Margin only (SP – PP) |

| 32(6) | Vouchers | SPV → issue; MPV → redemption | SPV → face value; MPV → redeemed value |

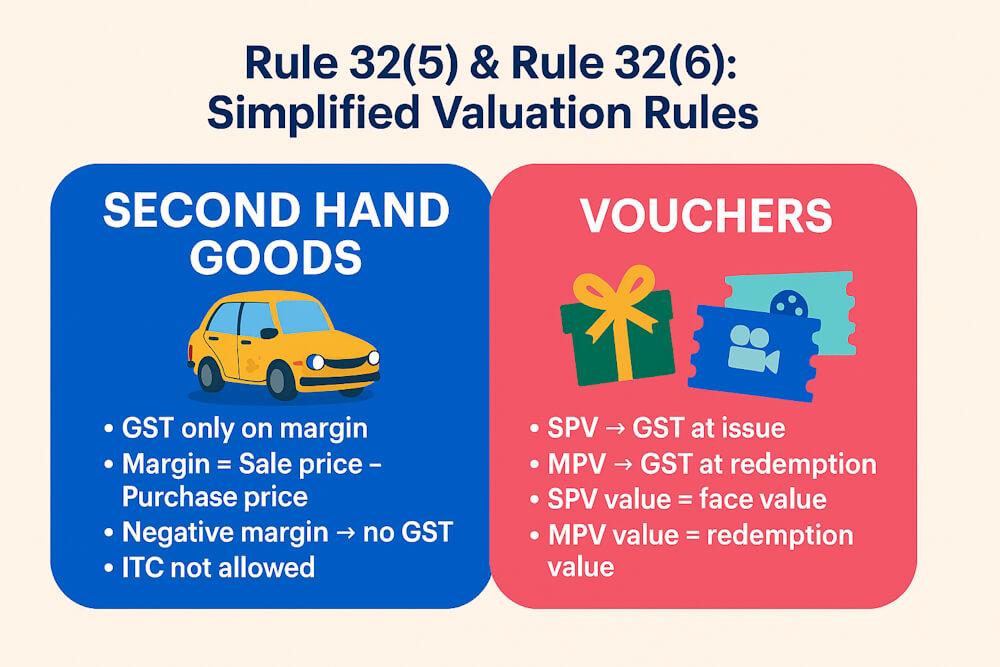

Final Summary (Cheat Sheet Style)

RULE 32(5) — SECOND-HAND GOODS

- GST only on margin

- Margin = Sale price – Purchase price

- Negative margin → no GST

- ITC not allowed

- Goods must be used and sold as is

RULE 32(6) — VOUCHERS

- SPV → GST at issue

- MPV → GST at redemption

- SPV value = face value

- MPV value = redemption value

Final Thoughts

Rule 32(5) and Rule 32(6) are two of the most practical and business-friendly valuation rules in GST. They make life easier for used goods dealers, refurbishers, voucher issuers, malls, gift card platforms, and modern e-commerce companies. The margin scheme prevents double taxation, while the voucher rules ensure GST is applied at the right time with full transparency.

Once these concepts are understood, you will never get confused in CA-exam questions or in real-world GST scenarios.