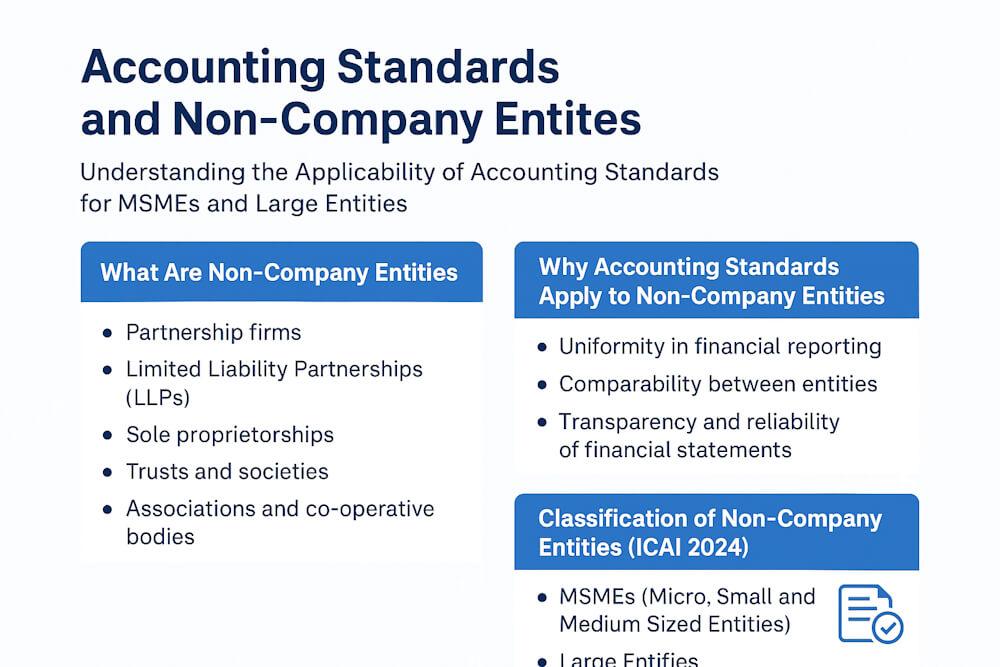

Many students think Accounting Standards apply only to large companies. In reality, Accounting Standards apply to almost every business entity that carries out commercial activities—whether it is a company, partnership firm, LLP, or even a charitable organisation engaged in business.

This blog explains which enterprises must follow Accounting Standards, when they become applicable, and how even a small commercial activity can bring an entity under their scope.

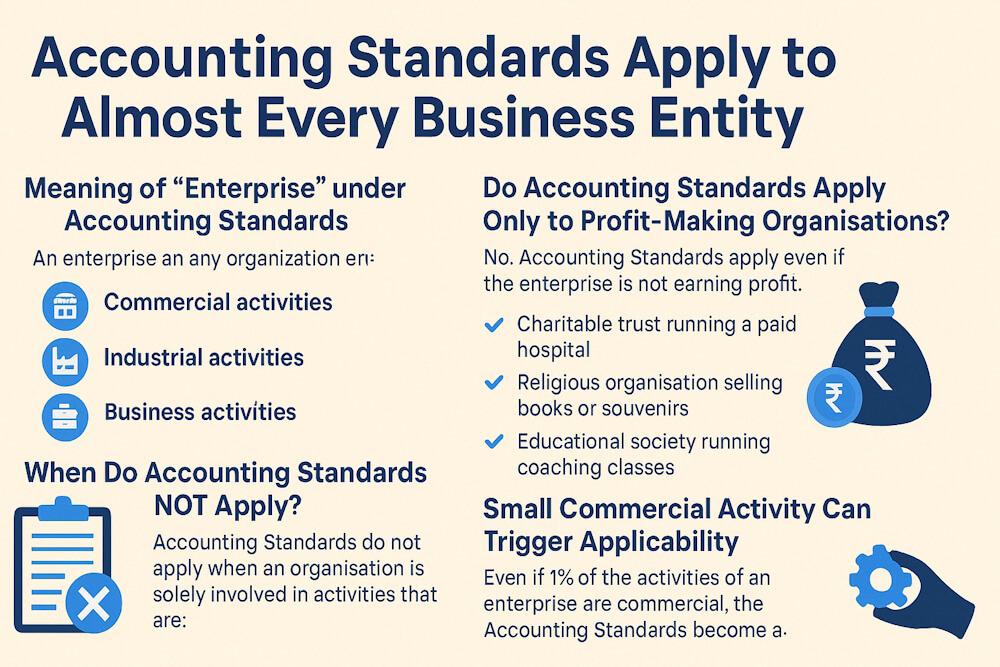

Meaning of “Enterprise” under Accounting Standards

For the purpose of Accounting Standards, an enterprise means any organisation engaged in:

- Commercial activities

- Industrial activities

- Business activities

It does not matter whether the organisation is:

- A company

- A partnership firm

- An LLP

- A trust

- A society

- A cooperative

If it carries out business or commercial activities, Accounting Standards apply to it.

Do Accounting Standards Apply Only to Profit-Making Organisations?

No. This is a very common misunderstanding.

Accounting Standards apply even if the enterprise is not earning profit. Even charitable, educational, or religious institutions must follow Accounting Standards if they carry out any commercial or business activity.

For example:

- A charitable trust running a paid hospital

- A religious organisation selling books or souvenirs

- An educational society running coaching classes

Since money is earned from such activities, Accounting Standards apply.

When Do Accounting Standards NOT Apply?

Accounting Standards do not apply when an organisation is solely involved in activities that are:

- Not commercial

- Not industrial

- Not business related

Example: An organisation only collecting donations and distributing them for flood relief is not doing business. Therefore, Accounting Standards will not apply.

However, if even a small portion of its activity becomes commercial, Accounting Standards apply to all activities of that organisation.

Small Commercial Activity Can Trigger Applicability

Even if 1% of the activities of an enterprise are commercial, the Accounting Standards become applicable to the entire enterprise.

For example: A charitable trust earns most income from donations but runs a paid canteen. Since the canteen is a business activity, the trust must follow Accounting Standards for all its financial reporting.

Three Key Questions to Check Applicability

Before applying any Accounting Standard, these three questions must be asked:

1. Does it apply to the enterprise?

Is the organisation engaged in business or commercial activity?

2. Does it apply to the financial statement?

Is the standard relevant to the type of statement (P&L, Balance Sheet, etc.)?

3. Does it apply to the financial item?

Is the item material and covered by the standard?

Only when all three are satisfied, the standard becomes applicable.

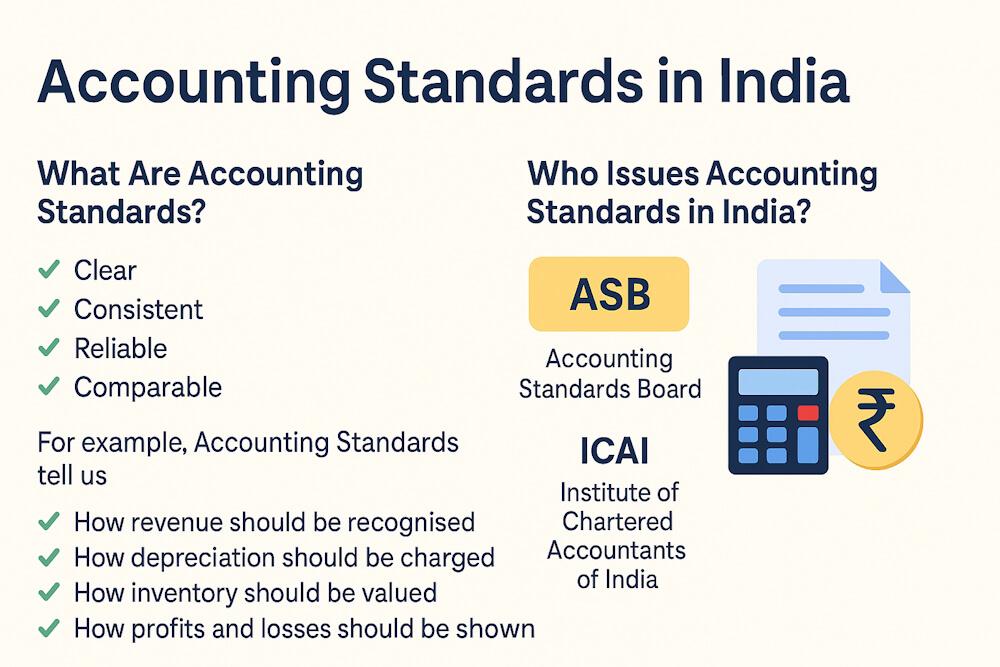

Materiality: A Very Important Concept

Accounting Standards apply only to material items.

A financial item is material if its omission or misstatement can affect the decision of users of financial statements.

Example: A ₹50,000 penalty paid by a company earning crores may look small, but it shows that the company violated a law. So it is material and must be disclosed separately.

Who Decides Whether an Item Is Material?

Materiality is judged:

- Case by case

- Based on importance

- Not only on amount

If the information is important for users, it is material.

Responsibility for Compliance

The responsibility of following Accounting Standards lies with:

- Management of the enterprise

The responsibility of checking compliance lies with:

- Auditor

If Accounting Standards are not followed, the auditor must report it.

Why This Topic Is Very Important

This topic helps you:

- Identify whether Accounting Standards apply

- Solve case study questions

- Understand MSME, LLP, trust, and firm rules

- Avoid mistakes in exams and real life

What’s Next?

Now that you know which enterprises must follow Accounting Standards, the next step is to understand:

FAQs

1. Do Accounting Standards apply only to companies?

No. Accounting Standards apply to all enterprises engaged in business or commercial activities, including companies, partnership firms, LLPs, trusts, and societies.

2. Do non-profit organisations need to follow Accounting Standards?

Yes, if they carry out any commercial or business activity, even partially, they must follow Accounting Standards.

3. When are Accounting Standards not applicable?

Accounting Standards are not applicable when an organisation is engaged only in non-commercial activities such as collecting and distributing donations for charity.

4. What happens if only a small part of an organisation’s activity is commercial?

Even if a small part of the activity is commercial, Accounting Standards apply to the entire organisation.

5. What does “materiality” mean in Accounting Standards?

Materiality means that any financial item that can influence users’ decisions must be properly disclosed, regardless of its amount.

6. Who is responsible for following Accounting Standards?

The management of the enterprise is responsible for following Accounting Standards, while the auditor checks and reports compliance.

7. Why is enterprise applicability important in exams?

It helps in solving case studies, identifying whether Accounting Standards apply, and avoiding incorrect assumptions about small or non-profit entities.