Accounting Standards may sound like a dry accounting topic, but in reality, they decide how companies, firms, LLPs, and even partnerships report their profits, losses, assets, and liabilities. Whether you are a CA student, commerce graduate, finance professional, or business owner, understanding when, how, and to whom Accounting Standards apply is extremely important.

This study series is based on Applicability of Accounting Standards, and it explains everything in a simple, practical, and exam-oriented way. Instead of forcing you to read one long boring chapter, we have divided the topic into easy-to-understand blogs, each focusing on one specific part.

If you follow this series in order, you will get a complete and crystal-clear understanding of how Accounting Standards work in India for companies, LLPs, MSMEs, and other entities.

Why Applicability of Accounting Standards is Important

Many students think Accounting Standards only apply to big companies, but that is not true. Even small businesses, partnership firms, LLPs, and charitable organisations may be required to follow Accounting Standards depending on their activities, turnover, and borrowings.

This article explains:

- Who must follow Accounting Standards

- Which standards are mandatory

- What happens if a company does not follow them

- What exemptions MSMEs get

- How Companies Act and Income Tax Act interact with Accounting Standards

Once you understand this topic, questions related to SMEs, MSMEs, SMCs, Large Entities, and disclosure rules become much easier.

Chapter-Wise Study Series

Below is the complete learning roadmap for Applicability of Accounting Standards. You can read each blog one by one and build your knowledge step by step.

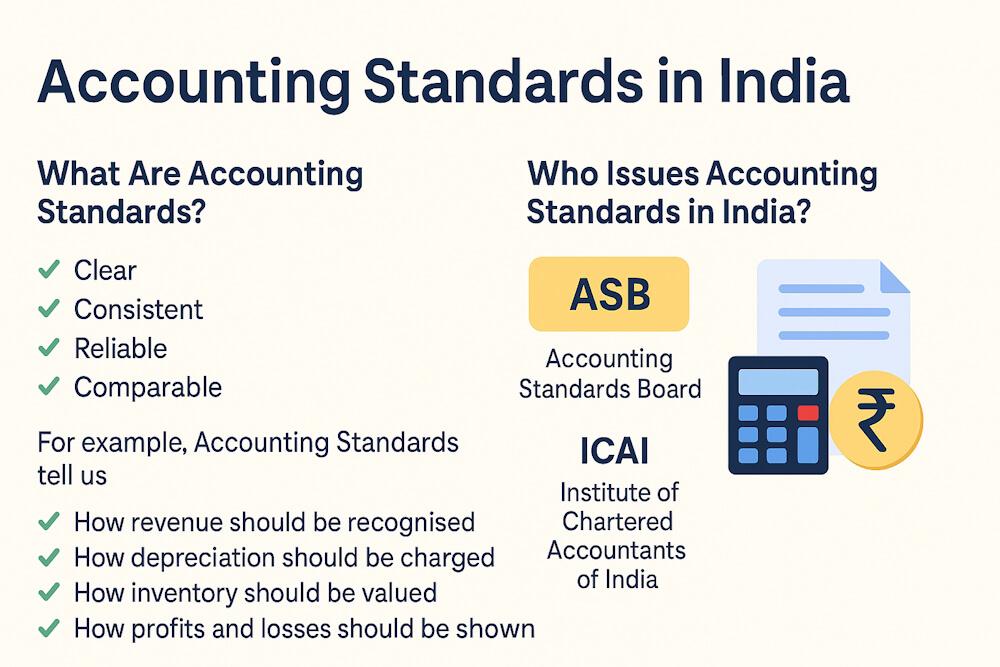

Chapter 1 – Status & Legal Authority of Accounting Standards

This part explains who makes Accounting Standards and why they are legally binding in India. You will learn about:

- ICAI and Accounting Standards Board (ASB)

- Role of Ministry of Corporate Affairs (MCA)

- How Companies Act 2013 gives legal force to Accounting Standards

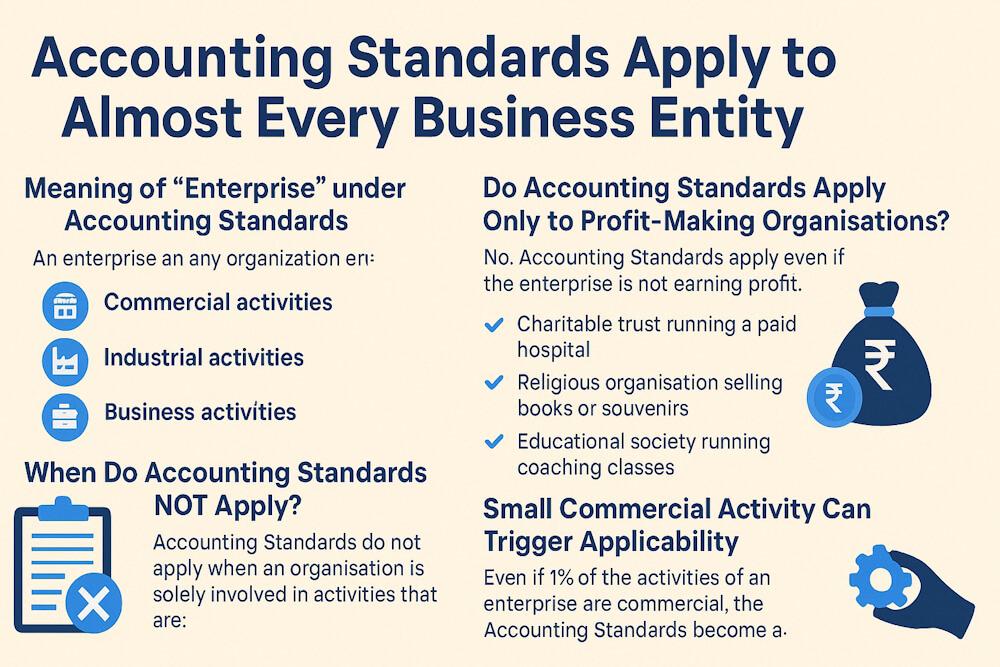

Chapter 2 – Which Enterprises Must Follow Accounting Standards?

Not every organisation is treated the same. This chapter explains:

- Which businesses are covered

- Whether charitable and non-profit organisations need to follow AS

- How even a small commercial activity makes AS applicable

“Read here: Which Enterprises Must Follow Accounting Standards?”

Chapter 3 – Accounting Standards vs Income Tax Act & ICDS

Many students get confused between Accounting Standards and Income Tax rules. This blog clears:

- Why accounting profit is different from taxable profit

- What Income Computation and Disclosure Standards (ICDS) are

- Why depreciation and revenue recognition differ

Chapter 4 – MSME & Large Entity Classification (2024 Rules)

ICAI changed the rules in 2024. This blog explains:

- What is MSME for Accounting Standards

- Turnover and borrowing limits

- Listed vs unlisted entities

- Holding and subsidiary restrictions

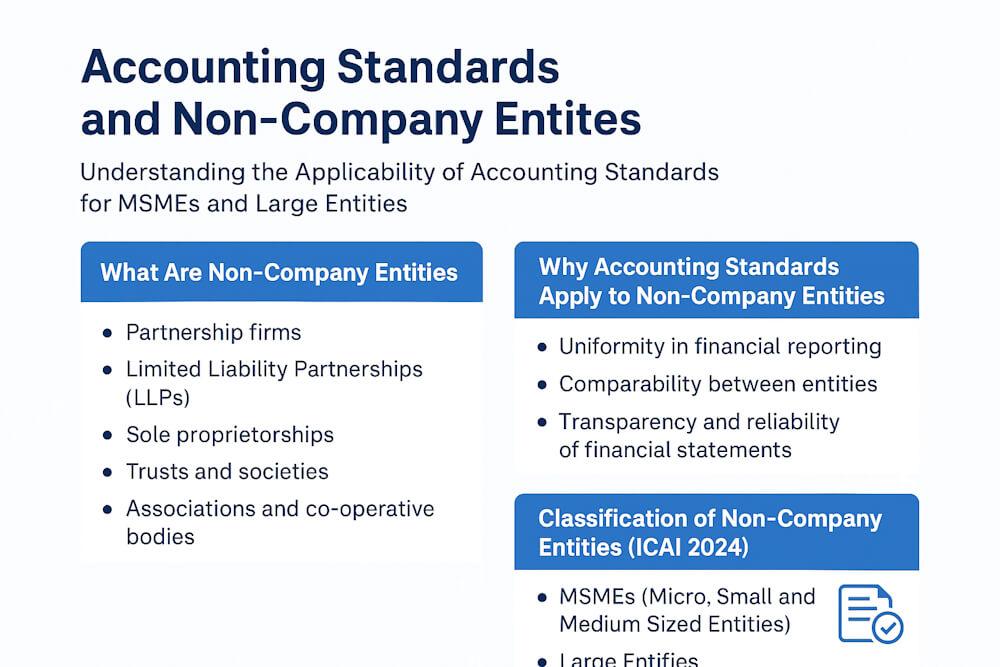

Chapter 5 – Applicability of Accounting Standards to Non-Company Entities

This chapter is very important for:

- Partnership firms

- LLPs

- Trusts and societies You will learn how Accounting Standards apply to non-company entities.

Chapter 6 – MSME Exemptions under Accounting Standards

MSMEs get many relaxations. This detailed blog explains:

- Which AS are not applicable

- Which disclosures can be skipped

- Special treatment under AS 10, AS 15, AS 19, AS 22, AS 28, etc.

Chapter 7 – Applicability of Accounting Standards to Companies & SMCs

Here you will understand:

- What is an SMC (Small & Medium Company)

- Difference between SMC and Non-SMC

- Which AS are relaxed for SMCs

Chapter 8 – MSME Disclosure Rules & Two-Year Condition

MSMEs must disclose certain things when they take exemptions. This chapter explains:

- What to write in notes to accounts

- What happens when MSME status changes

- The two-year rule for new MSMEs

“Read here: MSME Disclosure Requirements & Two-Year Rule”

How to Use This Series

If you are preparing for CA, B.Com, M.Com, or MBA, start from move step by step. If you are a business owner or accountant, you can directly go to MSME, Company, or Non-Company sections.

By the time you finish this series, you will have zero confusion about:

- Who must follow Accounting Standards

- Which standards apply

- What exemptions are allowed

- What disclosures are required