The story of GST in India is honestly a long one. It didn’t just appear suddenly in 2017; the idea had been moving around for years before it finally happened.

It actually started way back in 2000. The Prime Minister at that time threw the idea on the table — why not have a single tax system for goods and services? A committee was put together to figure out a model. Nothing major happened right away, but the thought had been planted.

Early Push (2003–2004)

A few years later, in 2003, the Central Government made a task force under the Fiscal Responsibility and Budget Management Act. And by 2004, that group didn’t mince words — they said India really needed a fully integrated GST at the national level.

The Big Budget Talk (2006)

The first real announcement came in 2006, when Finance Minister P. Chidambaram, during his Union Budget speech, said GST would start from 1st April 2010.

Sounds good, right? But reality was different. The deadlines slipped. More delays kept piling up. Political disagreements, technical headaches… it just didn’t take off.

The Restart (2014)

The whole idea got fresh energy when the NDA government came in. On 19th December 2014, they introduced the Constitution (122nd Amendment) Bill, 2014 in Parliament.

- The Lok Sabha cleared it on 6th May 2015.

- The Rajya Sabha followed much later, on 3rd August 2016.

This was a huge breakthrough after years of uncertainty.

President’s Approval (2016)

Then came the crucial step — more than half the states agreed to the Bill, and it was sent to the President. On 8th September 2016, the President gave his assent, and it officially became the Constitution (101st Amendment) Act, 2016. That set the legal stage for GST.

GST Bills in 2017

Once the constitutional part was sorted, the government needed to pass detailed laws. On 27th March 2017, four important GST bills were tabled in the Lok Sabha:

- Central GST Bill (CGST)

- Integrated GST Bill (IGST)

- Union Territory GST Bill (UTGST)

- GST (Compensation to States) Bill

The Lok Sabha passed them on 29th March, and by 12th April 2017, with the President’s assent, the Acts were ready to go.

What Leaders Said

When GST was ready to roll out, leaders described it as a historic reform.

- Narendra Modi said it was “a win for India’s democratic ethos and a victory for everyone; GST will improve the way of doing business.”

- Arun Jaitley said, “It is not the end but the beginning of the journey.”

States Coming Onboard

After the central bills, states had to pass their own GST laws too. Telangana, Rajasthan, Chhattisgarh, Punjab, Goa, and Bihar were quick to act. By 30th June 2017, every state and Union Territory had passed their GST laws — except Jammu & Kashmir, which joined on 8th July 2017.

GST Finally Arrives (1st July 2017)

Then came the big moment. On the night of 1st July 2017, GST officially kicked in. It was called one of the biggest tax reforms since independence, creating “one nation, one tax.”

Why GST Was a Game-Changer

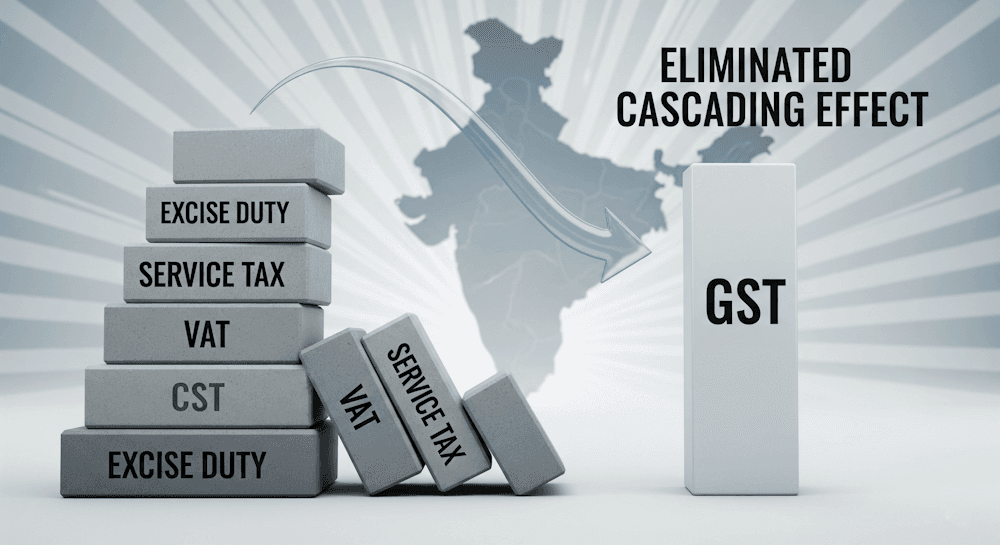

- Simplified system: Earlier there were too many indirect taxes — excise duty, service tax, VAT, CST, luxury tax, entertainment tax, entry tax. GST merged them into one.

- VAT vs GST: VAT only covered goods. GST goes a step further, covering both goods and services.

- Not just India: France was the first to adopt VAT/GST way back in 1954, and now more than 160 countries follow some version of it.

- India’s dual model: Unlike many countries that have a single GST system, India went with a dual GST model, meaning both the Centre (CGST) and States (SGST/UTGST) share the tax.

Wrapping It Up

Now, GST isn’t just another tax change. It’s one of the biggest shifts in India’s economic story. By cutting through layers of different indirect taxes, it gave the country a cleaner system, a more unified market, and put us a step closer to how most of the world handles taxation.