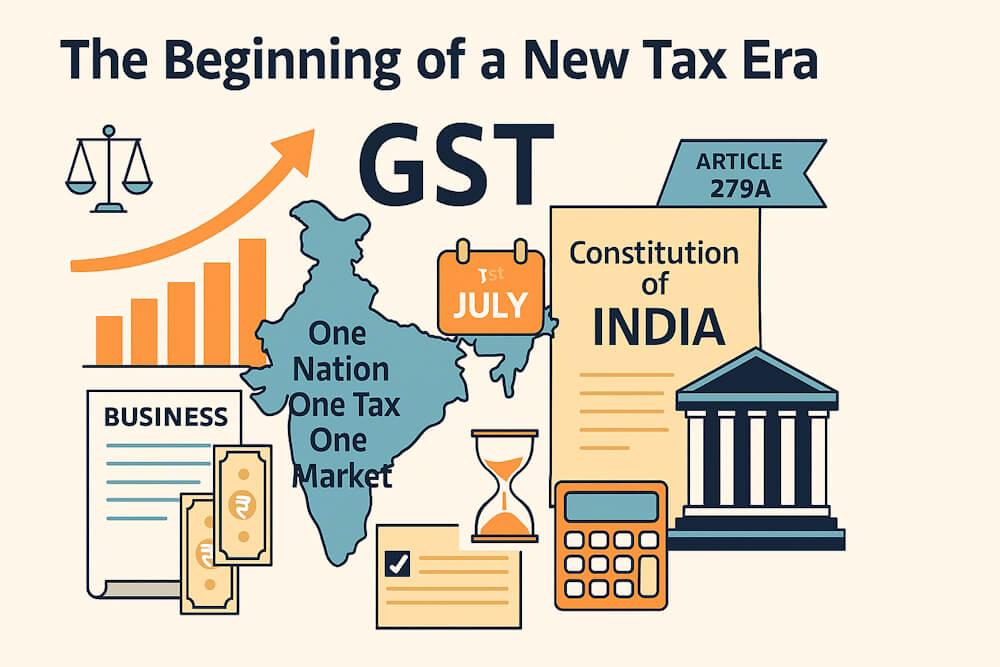

1. The Beginning of a New Tax Era

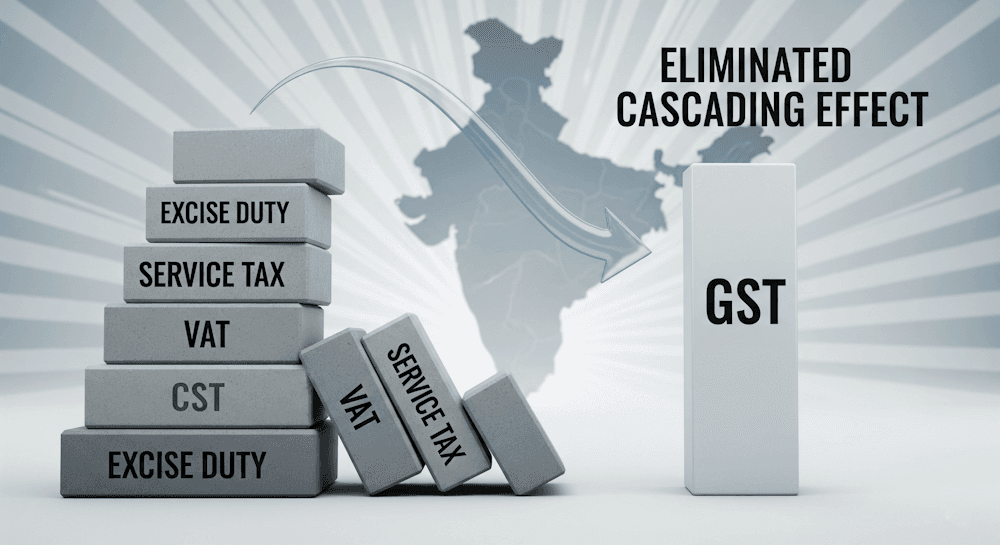

Before 2017, India’s taxation system was a bit messy. Every state had its own tax rules, rates, and procedures. Businesses had to pay multiple taxes like excise duty, VAT, service tax, and entry tax — each collected by a different authority. It often led to double taxation and confusion.

That’s when the Indian government decided to simplify things and bring in a unified system — Goods and Services Tax (GST). GST came into effect on 1st July 2017, marking one of the biggest tax reforms in India’s history.

It replaced a long list of indirect taxes and brought everything under one roof. The goal was simple — “One Nation, One Tax, One Market.”

2. Why Was GST Needed?

If you talk to any business owner before GST, they’ll tell you how complicated taxation used to be. Imagine a product manufactured in one state, sold in another, and used in a third. It would attract multiple layers of taxes — excise at production, VAT at sale, and entry tax at transport.

This system caused:

- Cascading of taxes (tax on tax)

- Complex compliance

- Lack of transparency

- Price differences across states

GST was introduced to remove all that clutter. It ensures that tax is levied only on the final consumption, not at every stage of production and distribution.

3. The Constitutional Background

The power to levy taxes in India comes directly from the Constitution of India. Before GST, the power to levy taxes was divided between the Centre and the States — each could tax certain goods or services under specific constitutional entries.

To make GST possible, this structure had to change. So, the 101st Constitutional Amendment Act, 2016 was passed by Parliament and came into force on 16th September 2016.

This amendment gave both the Centre and the States the power to levy and collect taxes on the supply of goods or services, not just on manufacture or sale. This was a huge shift in how taxation worked in India.

4. Key Constitutional Changes Made by the 101st Amendment

Let’s break down what exactly the 101st Amendment did:

1. Inserted Article 246A

This article gives concurrent powers to both the Centre and States to make laws with respect to GST.

- The Centre can levy tax on inter-State supplies (IGST).

- States can levy tax on intra-State supplies (CGST + SGST).

2. Inserted Article 269A

It deals with the levy and collection of IGST (Integrated GST) on inter-State trade and imports. The collected tax is shared between the Centre and the States.

3. Introduced Article 279A

This article created the GST Council, a powerful decision-making body that decides everything from tax rates to exemptions and policies.

4. Amended the Seventh Schedule

The amendment removed various entries that allowed the Centre and States to impose separate indirect taxes, ensuring no overlap with GST.

5. Added Article 366(12A)

It defines GST as a tax on the supply of goods, services, or both, except on the supply of alcoholic liquor for human consumption.

6. Omitted Entry 92 and 92C

Earlier, these entries empowered the Centre to levy tax on the sale of goods (Entry 92) and services (Entry 92C). After GST, both were replaced to align with the new system.

5. The Structure of GST in India

GST is designed as a dual tax structure, which means both the Central Government and the State Governments levy tax on the same transaction.

There are four types of GST in India:

- CGST (Central GST) – Levied by the Central Government on intra-State supplies.

- SGST (State GST) – Levied by the State Government on intra-State supplies.

- UTGST (Union Territory GST) – Levied by Union Territories like Andaman and Nicobar Islands, Chandigarh, Dadra and Nagar Haveli and Daman and Diu, Lakshadweep and Ladakh. UTs with legislatures (Delhi and Puducherry) have their own State GST Acts, so SGST applies there instead of UTGST.

- IGST (Integrated GST) – Levied by the Central Government on inter-State supplies and imports.

Example: If goods are sold within Maharashtra, both CGST and SGST apply. If goods are sold from Maharashtra to Gujarat, IGST applies.

6. What GST Replaced

GST subsumed (replaced) a large number of central and state taxes, including:

Central Taxes:

- Central Excise Duty

- Service Tax

- Countervailing Duty (CVD)

- Special Additional Duty (SAD)

- Excise Duty on medicinal and toiletry preparations

State Taxes:

- Value Added Tax (VAT)

- Central Sales Tax (CST)

- Purchase Tax

- Luxury Tax

- Entry Tax (Octroi)

- Entertainment Tax (except on local bodies)

- Taxes on advertisements and lotteries

By merging all these, GST made tax administration smoother, transparent, and uniform across India.

7. GST Council – The Nerve Center (the most important and controlling part) of GST

The GST Council, created under Article 279A, is perhaps the most important part of this entire system.

It consists of:

- The Union Finance Minister (Chairperson)

- The Union Minister of State for Finance

- The Finance Ministers of all States

The Council decides:

- GST rates on goods and services

- Exemptions and threshold limits

- Rules for place of supply

- Special provisions for States and Union Territories

- Any amendments or recommendations for smooth implementation

The beauty of the GST Council is that it ensures cooperative federalism (Teamwork between Centre and States in governance) — both Centre and States work together in decision-making. Every decision is taken through consensus (Agreement reached by everyone through discussion), not force.

8. Benefits of GST to the Economy

The introduction of GST has brought several positive changes to India’s economy:

- Simplified Taxation: Multiple taxes were merged into one single system.

- Reduced Cascading Effect: Input tax credit ensures no double taxation.

- Ease of Doing Business: Businesses can now operate across states without dealing with multiple tax authorities.

- Boost to GDP: A more efficient tax system promotes investment and trade.

- Transparency: With online filings, e-invoicing, and data tracking, the chances of tax evasion have reduced.

- Digital Transformation: GST pushed India’s tax system into the digital era, making compliance easier and more transparent.

9. Challenges in Implementation

Of course, every reform has its challenges. GST too faced some teething problems, such as:

- Initial confusion among small businesses

- Technical glitches in the GSTN portal

- Frequent rate changes in the first few years

- Complexity in return filings

However, over the years, many of these issues have been ironed out (Solved, resolved, or made smoother and more efficient). The system continues to evolve (to grow or develop gradually into something better or more advanced) with simplified returns, e-invoicing, and automation.

10. Final Thoughts

GST is not just a tax reform; it’s an economic transformation. By unifying (Bringing together) India into a single market, it has simplified trade, reduced tax barriers, and made compliance more efficient.

The 101st Constitutional Amendment gave India the legal framework to implement this bold step. It empowered both the Centre and States to tax goods and services in a balanced manner while ensuring that taxpayers face less complexity.

Today, GST stands as a symbol of India’s commitment to modernization and economic unity — a system that continues to grow stronger with time.